The Small Business Administration (SBA) is a U.S. government agency supporting entrepreneurs and small businesses. Its mission focuses on strengthening the economy by fostering small business establishment and assisting communities in disaster recovery. The SBA's core functions revolve around the '3 Cs': capital, contracts, and counseling. It provides access to funding through loan programs, helps small businesses secure government contracts, and offers business counseling and training resources. The SBA plays a crucial role in promoting small business growth and economic stability.

July 30, 1953: Creation of the SBA

On July 30, 1953, the SBA was created by Republican President Eisenhower with the signing of the Small Business Act. The Small Business Act was originally enacted as the "Small Business Act of 1953" in Title II (67 Stat. 232) of Pub. L. 83–163 (ch. 282, 67 Stat. 230, July 30, 1953).

July 18, 1958: Small Business Act Amendments

On July 18, 1958, The Small Business Act Amendments of 1958 (Pub. L. 85–536, 72 Stat. 384, enacted July 18, 1958) withdrew Title II as part of that act and made it a separate act to be known as the "Small Business Act".

1964: Founding of SCORE

In 1964, SCORE, the nation's largest network of volunteer, expert business mentors, was founded as a resource partner of the U.S. Small Business Administration.

1979: Establishment of the Office of Women-Owned Businesses

In 1979, the Office of Women-Owned Businesses (OWBO) was established by Executive Order 12138, with the mission to empower women entrepreneurs.

1983: Establishment of the Office of Hearings and Appeals

In 1983, the Office of Hearings and Appeals (OHA) was established within the SBA to provide an independent, quasi-judicial appeal process against certain SBA program decisions.

1988: Establishment of Women's Business Center Program

In 1988, The Women's Business Center Program was established under Title II of the Women's Business Ownership Act of 1988. It was first named the Demonstration Training Program when it was created by Congress to provide a long-term solution for training and counseling potential and current women business owners, including those who are Socially and Economically Disadvantaged as defined in 13 CFR 124.103.

1996: House of Representatives Planned Elimination

In 1996, the Republican-controlled House of Representatives planned to eliminate the agency. However, it survived.

2000: Record High Budget

In 2000, the SBA received a record high budget after surviving a planned elimination in 1996.

2001: SBA Loan Failure Rate

The Cato Institute noted that the failure rate of all SBA loans from 2001 to 2010 is 19.4%, contributing to a cost to taxpayers of $6.2 billion in 2011.

2004: Expenditures Frozen

In 2004, during the Bush Administration, certain expenditures of the SBA were frozen, despite congressional resistance to efforts to end the SBA loan program.

2005: Inspector General Report on Procurement Awards

In 2005, SBA Inspector General Report 5-15 stated that large businesses were receiving small business procurement awards, leading to agencies receiving undue credit.

2008: Credit Freeze Impact

In 2008, the credit market froze, leading to enhancements in SBA loans under the Recovery Act and the Small Business Jobs Act. These enhancements provided up to a 90 percent guarantee to strengthen access to capital for small businesses.

October 2009: GAO Report on Lack of Accountability

In October 2009, the Government Accountability Office released Report 10-108, stating that the SBA and contracting agencies were not holding firms accountable for fraud.

2009: Decline in Loans to Black-Owned Businesses

Between 2009 and 2011, there was a 47% decline in 7a Program guaranteed loans to Black-owned businesses.

2009: Strengthening through American Recovery and Reinvestment Act

In 2009, the Obama administration supported SBA budgets and strengthened it through The American Recovery and Reinvestment Act.

2010: Strengthening through Small Business Jobs Act

In 2010, SBA budgets were further strengthened by the Small Business Jobs Act.

2010: Increased Loan Size

In 2010, The Small Business Jobs Act increased the maximum size of 7(a) Loan Guarantee Program loans, indefinitely, from $2 million to $5 million.

2010: Record Lending Volumes

In late 2010, the Small Business Administration experienced record lending volumes, following enhancements to SBA loans under the Recovery Act and the Small Business Jobs Act. These enhancements provided up to a 90 percent guarantee to strengthen access to capital for small businesses.

2010: SBA Loan Failure Rate

The Cato Institute noted that the failure rate of all SBA loans from 2001 to 2010 is 19.4%, contributing to a cost to taxpayers of $6.2 billion in 2011.

2011: Decline in Loans to Black-Owned Businesses

Between 2009 and 2011, there was a 47% decline in 7a Program guaranteed loans to Black-owned businesses.

2011: Increased Support for Rural Small Businesses

In 2011, President Obama announced that the SBA would double its support of rural small businesses to $350 million in the next 5 years.

2011: Taxpayer Cost Due to SBA Loan Failures

In 2011, the Cato Institute noted that the failure rate of all SBA loans from 2001 to 2010 is 19.4%, contributing to a cost to taxpayers of $6.2 billion.

2011: Fraudulent Scheme Uncovered

In 2011, the SBA, along with the FBI and the IRS, uncovered a scheme to defraud the 8(a) Business Development Program, involving over $20 million in fraudulent bills.

January 2012: SBA Elevated to Cabinet Level

In January 2012, President Obama announced that the SBA would be elevated into the Cabinet, making the administrator of the Small Business Administration a cabinet-level position, a status it last held during the Clinton administration.

2012: WBC Client Demographics

Research conducted by the Association of Women's Business Centers indicates that 64% of WBC clients in 2012 were low-income, 39% were persons of color, and 70% were nascent businesses.

2014: Loans to Black-Owned Businesses

Black loans are 3% of 7a loans for fiscal years 2014-2019.

2016: SCORE Contributes to Small Business Growth

In 2016, SCORE's more than 10,000 volunteer mentors helped their 125,000 clients create 54,072 small businesses, adding 78,691 non-owner jobs to the U.S. economy.

2016: SCORE Workshop Attendance

In 2016, clients attended 119,957 online workshop sessions, while 237,712 local workshop attendees benefited from SCORE's in-person educational programming.

March 2018: Launch of SBA Franchise Directory

In March 2018, the SBA launched the SBA Franchise Directory to connect entrepreneurs with lines of credit and capital for business growth.

November 25, 2019: Publication of Rules and Regulations for Women's Business Center Program

On November 25, 2019, the US Small Business Administration published rules and regulations in the Federal Register to make the Women's Business Center Program more transparent in reporting on progress and financial allotments.

2019: Loans to Black-Owned Businesses

Black loans are 3% of 7a loans for fiscal years 2014-2019.

January 1, 2020: New Rules Applied to Women's Business Center Program

On January 1, 2020, New rules were applied to the Women's Business Center Program under Title 15 of the US Code, 2019 Edition, Chapter 14A, by the US Small Business Administration.

April 17, 2020: Loan Approval to Ruth's Hospitality Group

On April 17, 2020, the SBA approved $20 million in forgivable loans to Ruth's Hospitality Group, a publicly traded company, as part of the Paycheck Protection Program, representing a departure from the SBA's mission.

May 21, 2020: Planned Parenthood Improperly Receives Funding

On May 21, 2020, it was reported that Planned Parenthood improperly received Paycheck Protection Program funding, leading the SBA to demand the return of the funds.

December 2020: Distribution of Coronavirus Emergency Fund

In December 2020, data revealed that more than half of the money from the Treasury Department's coronavirus emergency fund for small businesses went to bigger small businesses representing just 5 percent of the recipients.

July 19, 2023: District Court Ruling on 8(a) Program

On July 19, 2023, a US district court ruled that the SBA's presumption of social disadvantage for certain racial and ethnic groups in the 8(a) Business Development Program is unconstitutional.

Mentioned in this timeline

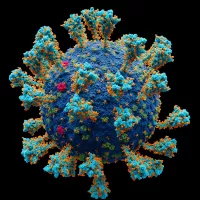

Coronaviruses are a family of RNA viruses affecting mammals and...

Ohio is a Midwestern U S state bordering Lake Erie...

Money serves as a universally accepted medium for exchanging goods...

Trending

24 minutes ago Larson and SVG collision leads to wreck in NASCAR Atlanta race.

24 minutes ago Chastain and Hill Collide on Final Lap at Atlanta's O'Reilly Race

24 minutes ago Hocevar Admits Fault in Logano Incident, Hamlin Involved in Atlanta NASCAR Crash

25 minutes ago Tiger Woods eyes Masters return, not ruling out participation, Scheffler favored in 2026.

25 minutes ago Jayson Tatum's Injury Status Updates, Return Date Still Unknown Amid Celtics Practice

1 hour ago Sebastian Korda Dominates Tommy Paul to Win Delray Beach Open Trophy.

Popular

Jesse Jackson is an American civil rights activist politician and...

Barack Obama the th U S President - was the...

Bernie Sanders is a prominent American politician currently serving as...

Michael Joseph Jackson the King of Pop was a highly...

WWE Raw a professional wrestling television program by WWE airs...

The Winter Olympic Games a major international multi-sport event held...