Weather derivatives are financial tools used for risk management against adverse weather. They are index-based, using weather data from stations to create indices that trigger payouts. Examples include rainfall indices for hydro-generation and temperature indices for frost damage protection in agriculture. These derivatives allow businesses and individuals to hedge against financial losses caused by unexpected or extreme weather conditions.

July 1996: First weather derivative deal

In July 1996, Aquila Energy structured the first weather derivative deal, a dual-commodity hedge for Consolidated Edison (ConEd). The transaction involved ConEd's purchase of electric power from Aquila for the month of August, with a weather clause stipulating that Aquila would pay ConEd a rebate if August turned out to be cooler than expected, based on Cooling Degree Days (CDDs) measured at New York City's Central Park weather station.

1997: Weather derivatives trading over-the-counter

In 1997, weather derivatives slowly began trading over-the-counter.

1999: CME introduces weather futures contracts

In 1999, the Chicago Mercantile Exchange (CME) introduced the first exchange-traded weather futures contracts and corresponding options. The CME currently lists weather derivative contracts for various cities and also offers products tracking snowfall, rainfall, and hurricane activity.

2014: Online weather derivative exchange creation

In 2014, an online weather derivative exchange named Massive Rainfall was created to bet or hedge on specific weather conditions. However, it seems to serve primarily as an educational tool for practice accounts.

6/9/2008: Weather Derivatives as hot commodities

On June 9, 2008, USA Today Online posted an article entitled "Weather Derivatives becoming hot commodities".

9/2008: Weather Derivatives as hot commodities

In September 2008, USA Today Online posted an article entitled "Weather Derivatives becoming hot commodities".

Trending

1 month ago Moldova's election: A choice between Russia and the EU amid meddling.

27 minutes ago Food influencer Michael 'FoodWithBearHands' Duarte tragically dies in accident, GoFundMe raises over $58,000.

1 hour ago Dakota Meyer, Medal of Honor Recipient, Praises New York's Patriotism on Veterans Day

1 hour ago Marine Recruit Shot During Training Exercise at Parris Island Firing Range

1 hour ago US flights face cancellations and delays despite shutdown's end, travel disruptions continue.

2 hours ago Olive Garden, Cracker Barrel Veterans Day Meals and Closures: Deals and Appreciation

Popular

Nancy Pelosi is a prominent American politician notably serving as...

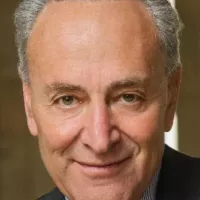

Chuck Schumer is the senior United States Senator from New...

Zohran Kwame Mamdani is an American politician currently serving as...

Nicholas J Fuentes is a far-right political commentator and activist...

William Franklin Graham III commonly known as Franklin Graham is...

Bernie Sanders is a prominent American politician currently serving as...