The NIFTY 50 is a prominent Indian stock market index consisting of 50 of the largest Indian companies listed on the National Stock Exchange (NSE). It is owned and managed by NSE Indices, a subsidiary of the NSE. Launched on April 22, 1996, with a base value of 1000 and a base date of November 3, 1995, it serves as a key indicator of the Indian stock market's performance and is calculated using a float-weighted average method.

November 1995: Base Date for NIFTY 50

In November 1995, the base date for the NIFTY 50 index was set, with a base value of 1000.

April 1996: NIFTY 50 Index Launch

In April 1996, the NIFTY 50 index was launched, representing the float-weighted average of 50 of the largest Indian companies listed on the National Stock Exchange.

2000: Annual Development of the NIFTY 50

Since 2000, the NIFTY 50 has shown annual development, with historical daily returns data available on the NSE website.

2006: Changes in Index Constituents

Since 2006, there have been changes in the constituents of the NIFTY 50 index.

June 2009: Computation Change to Free-Float Methodology

On June 26, 2009, the NIFTY 50 computation methodology was changed to a free-float methodology.

2016: NIFTY 50 Most Actively Traded Index Option

In 2016, the NIFTY 50 was reported as the world's most actively traded index options contract by the WFE and FIA.

July 2023: Rebranding to GIFT Nifty

On July 3, 2023, SGX Nifty was rebranded to GIFT Nifty, and trading was moved to the NSE International Exchange (NSEIX) in GIFT City, Gandhinagar.

July 2024: Sector Weightage in NIFTY 50

As of July 2024, the NIFTY 50 allocates 32.76% weightage to financial services including banking, 13.76% to information technology, 12.12% to oil and gas, 8.46% to consumer goods, and 8.22% to automotive sectors.

2024: NIFTY 50 Overtakes Nifty Bank

In 2024, the NIFTY 50 overtook Nifty Bank after the latter's weekly expiry contracts were discontinued.

March 2025: NIFTY 50 Constituents

As of March 28, 2025, the NIFTY 50 has a specific set of constituents.

Trending

45 minutes ago Tucker Carlson faced criticism from Ben Shapiro amidst Heritage staff shakeup and antisemitism concerns.

14 days ago Cuomo and Mamdani compete in NYC mayoral race; poll shows trouble for Mamdani.

16 days ago Jennifer Lawrence Shines at London Film Festival Premiere in Vintage Armani Privé

6 months ago Kanye West Abruptly Ends Piers Morgan Interview After Heated Exchange Over Social Media

Isaiah Zay Jones is an American football wide receiver for the Arizona Cardinals During his college career at East Carolina...

Ben Shapiro is a prominent American conservative political commentator media host and attorney He is known for his conservative viewpoints...

Popular

Gavin Newsom is an American politician and businessman currently serving...

Candace Owens is an American political commentator and author known...

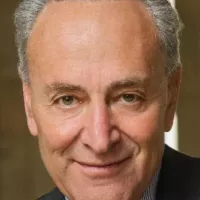

Chuck Schumer is the senior United States Senator from New...

Turning Point USA TPUSA is an American nonprofit organization founded...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...

Charlie Kirk is an American right-wing political activist entrepreneur and...