Stablecoins are cryptocurrencies designed to maintain a stable value by pegging their value to a reference asset like fiat currency or commodities. Ideally, this peg would mitigate the volatility often seen in other cryptocurrencies. However, many stablecoins have not been proven to maintain sufficient reserves to back their value. This has led to failures where investors have lost the total value of their investment.

2016: Tether's backing by fiat currency

From 2016 to 2018, Tether claimed to be fully backed by fiat currency but only had enough fiat reserves to guarantee their stablecoin for 27.6% of the time.

2017: Unbacked USDT and Bitcoin's Price Rise

In 2017, research by Griffin and Shams attributed the creation of unbacked USDT to the rise in Bitcoin's price.

2018: Tether's backing by fiat currency

From 2016 to 2018, Tether claimed to be fully backed by fiat currency but only had enough fiat reserves to guarantee their stablecoin for 27.6% of the time.

May 2022: TerraUSD (UST) Depegs and Collapses

In May 2022, TerraUSD (UST) lost its peg with the United States dollar, plunging to 10 cents. Terra (LUNA) fell to virtually zero from a high of $119.51. The collapse wiped out $45 billion of market capitalization in a week.

May 2022: Terra "UST" asset plummets in value

In May 2022, the "UST" asset on the Terra blockchain, theoretically supported by "Luna", plummeted in value. It was noted that the system resembled a Ponzi scheme.

June 2022: Tron's USDD Loses Peg to US Dollar

On 13 June 2022, Tron's algorithmic stablecoin, USDD, lost its peg to the US Dollar.

May 2024: US Legislation Progressing

In May 2024, US legislation is progressing to provide increased regulatory clarity for digital assets. However, the Financial Innovation and Technology for the 21st Century Act in its current form excludes certain stablecoins from regulation by the SEC, except for fraud and certain activities by registered firms, and is specifically excluded from regulation by the CFTC.

Mentioned in this timeline

The United States of America is a federal republic located...

Australia officially the Commonwealth of Australia encompasses the Australian mainland...

Bitcoin created in by the unknown Satoshi Nakamoto is the...

A bank is a financial institution that plays a crucial...

Trending

22 minutes ago Atmos Energy: A Promising Gas Distribution Stock in a Flourishing Industry Sector.

Jeff Passan is a prominent American baseball columnist for ESPN known for his insightful analysis and reporting on the sport...

22 days ago Kelly Ripa considers law school, encouraged by family and Mark Consuelos.

3 months ago Porsha Williams confronts heartbreak, while Kenya Moore faces scandal on Real Housewives of Atlanta.

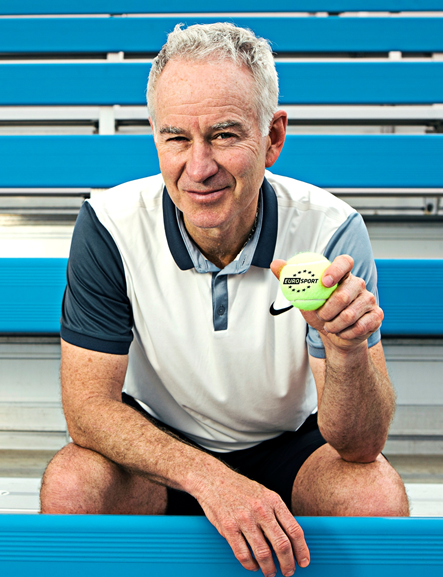

1 month ago John McEnroe's Tennis Mount Rushmore, Djokovic's History, and Djokovic-Murray Partnership

29 days ago Jannik Sinner to face Rublev at Roland Garros; Italian players' matches on TV.

Popular

Jupiter is the fifth and largest planet from the Sun...

A blue moon is defined in several ways most commonly...

Candace Owens is an American conservative and far-right political commentator...

Zohran Kwame Mamdani is a Uganda-born American politician representing New...

Kelley O'Hara is a celebrated American former professional soccer player...

Melania Trump is a Slovenian-American former model and the current...