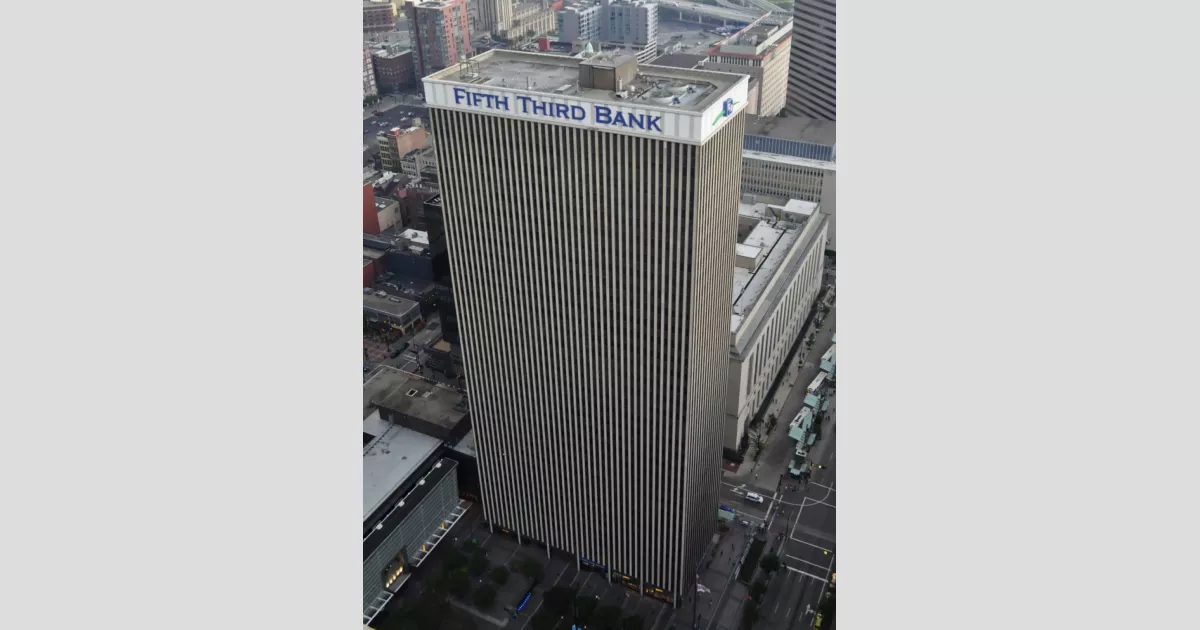

Fifth Third Bank, headquartered in Cincinnati, Ohio, is a major consumer bank in the American Midwest. As the primary subsidiary of Fifth Third Bancorp, a bank holding company, Fifth Third holds a significant presence in the region's financial landscape.

June 1, 1908: Formation of Fifth–Third National Bank of Cincinnati

On June 1, 1908, Third National Bank and Fifth National Bank merged to form the Fifth–Third National Bank of Cincinnati.

1909: Merger of Third National Bank and Fifth National Bank

In 1909, Third National Bank and Fifth National Bank merged, leading to the creation of Fifth Third Bank.

March 24, 1969: Name change to Fifth Third Bank

On March 24, 1969, the bank's name was officially changed to Fifth Third Bank.

November 2008: US Treasury Invests in Fifth Third Through TARP

In November 2008, the United States Department of the Treasury invested $3.4 billion in Fifth Third as part of the Troubled Asset Relief Program (TARP).

2009: Spin-off of Fifth Third Processing Services

During the 2009 recession, Fifth Third spun off its processing arm, Fifth Third Processing Services, forming a new company called Vantiv.

February 2011: Fifth Third Repurchases Treasury Investment

In February 2011, Fifth Third repurchased the $3.4 billion investment the Treasury made in the company through TARP.

September 2015: Settlement with Department of Justice and CFPB

In September 2015, the US Department of Justice and the CFPB announced an $18 million settlement with Fifth Third to resolve allegations of discriminatory lending practices against African-American and Hispanic borrowers.

December 2016: Small Business Owners Sue Fifth Third for Telemarketing Law Violations

In December 2016, small business owners filed a lawsuit against Fifth Third, Vantiv, and National Processing Company for violating telemarketing laws.

May 2018: Acquisition of MB Financial

In May 2018, Fifth Third expanded its presence in the greater Chicago area by acquiring MB Financial for $4.7 billion.

March 9, 2020: Consumer Financial Protection Bureau (CFPB) Charges Fifth Third with Illegal Cross-Selling

On March 9, 2020, the CFPB charged Fifth Third with illegal cross-selling practices.

August 2020: Partnership with Trust & Will

In August 2020, Fifth Third partnered with Trust & Will.

October 13, 2020: Fifth Third Files Motion to Dismiss in Class Action Lawsuit

On October 13, 2020, Fifth Third filed a motion to dismiss a class-action lawsuit filed by former MB Financial shareholders alleging that cross-selling practices artificially inflated Fifth Third's stock price during the acquisition.

March 19, 2021: Court Denies Fifth Third's Motion to Dismiss

On March 19, 2021, the court denied Fifth Third's motion to dismiss the class action lawsuit filed by former MB Financial shareholders.

June 16, 2021: Amendment to CFPB Complaint

On June 16, 2021, the CFPB amended its complaint against Fifth Third regarding illegal cross-selling.

January 2022: Acquisition of Dividend Finance

In January 2022, Fifth Third acquired Dividend Finance, a San Francisco-based residential solar power lender.

August 4, 2022: Settlement of Telemarketing Lawsuit

On August 4, 2022, Fifth Third, along with Vantiv and National Processing Company, finalized a $50 million settlement in a lawsuit filed by small business owners alleging violations of telemarketing laws.

April 27, 2023: Jury Rules in Favor of Fifth Third in Early Access Loan Lawsuit

On April 27, 2023, a jury ruled in favor of Fifth Third in a lawsuit regarding its Early Access loan program. While the jury found that Fifth Third breached its loan agreement, they also determined that customers were fully aware of the fee structure and did not award any damages.

September 14, 2023: Settlement of Class Action Lawsuit

On September 14, 2023, Fifth Third settled the class action lawsuit filed by former MB Financial shareholders for $5.5 million.

2023: Mortgage Origination Value

In 2023, Fifth Third originated $12.3 billion in mortgages.

Mentioned in this timeline

San Francisco is a major commercial financial and cultural hub...

Chicago is the most populous city in Illinois and the...

Justice in its broadest sense is the concept of treating...

A bank is a financial intermediary that accepts deposits from...

September is the ninth month of the year in the...

Stocks represent fractional ownership of a corporation granting shareholders a...

Trending

53 minutes ago North Carolina Early Voting Surges Before 2024 Primary Elections, Featuring Thom Tillis

54 minutes ago Jurickson Profar Suspended 162 Games by MLB for Second PED Violation.

2 hours ago Zach Braff surprised by 'Scrubs' reboot cast's age; show returns with new heart.

2 hours ago Mitch Barnhart, Kentucky's Athletic Director, to Retire After Long Tenure

2 hours ago Jets Secure Breece Hall with Franchise Tag: Future Plans and Contract Details

1 day ago Elisabeth Hasselbeck Returns to 'The View', Receives 'Armor of God' Gift

Popular

Jesse Jackson is an American civil rights activist politician and...

Hillary Diane Rodham Clinton is a prominent American politician lawyer...

Jim Carrey is a Canadian-American actor and comedian celebrated for...

Ken Paxton is an American politician and lawyer serving as...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...

Bill Clinton served as the nd U S President from...