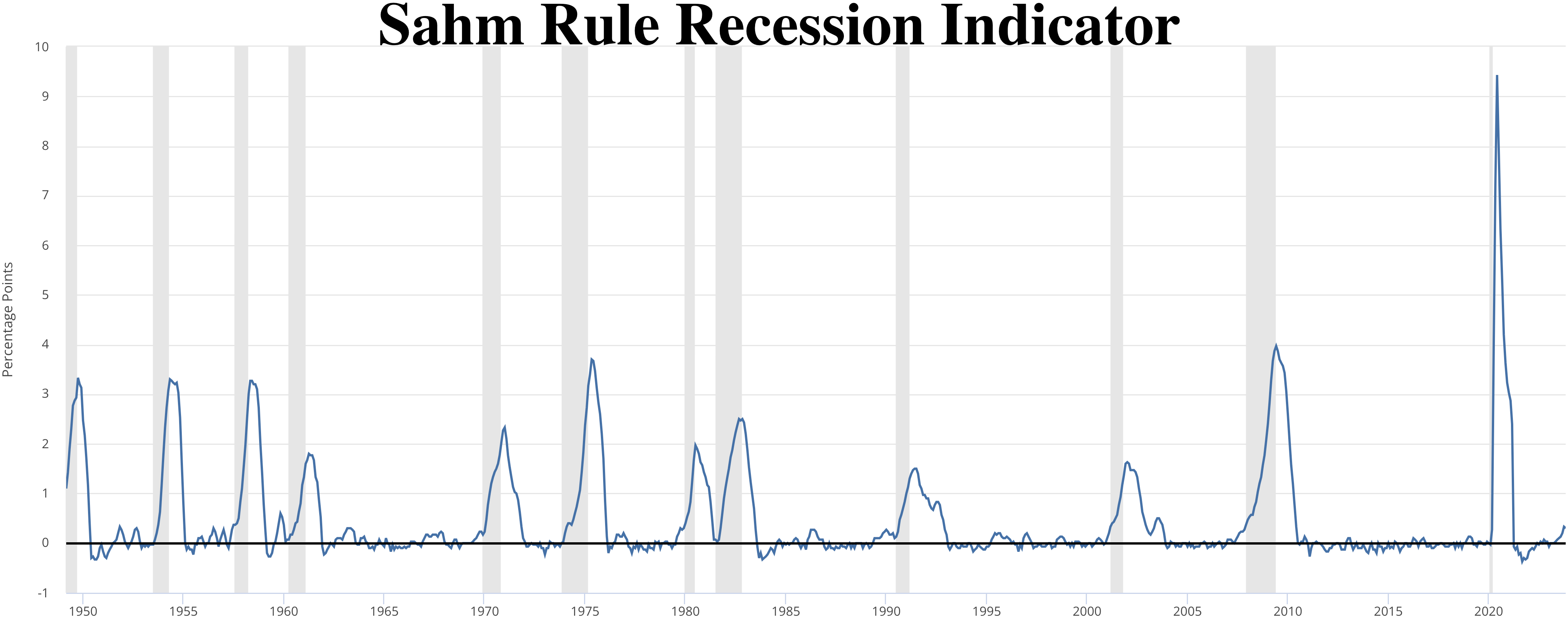

The Sahm Rule, named after economist Claudia Sahm, is a macroeconomic indicator used by the US Federal Reserve to identify recessions. This heuristic tool, relying on monthly unemployment data from the Bureau of Labor Statistics, assists in real-time business cycle analysis.

1950: Start of Recession Tracking

Since 1950, there have been 11 recessions recorded in the U.S. economy.

1959: First False Positive

In 1959, the Sahm rule generated its first false positive signal, indicating a recession a few months before it actually began. However, a recession did follow six months later.

1969: Second False Positive

The Sahm rule encountered its second false positive signal in 1969, again warning of a recession shortly before it started.

June 2003: False Positive Addressed

Dwaine Van Vuuren proposed modifications to the Sahm rule calculation to eliminate the false positive signal observed in June 2003, aiming to achieve 100% accuracy in recession prediction.

October 2019: Sahm Rule Published

The Sahm rule, a recession indicator, was published by the Federal Reserve Economic Data (FRED) system in October 2019. It is designed to identify the early stages of a recession.

July 2024: Sahm Rule Acknowledged

Federal Reserve Chair Jerome Powell acknowledged the Sahm rule, referring to it as a "statistical regularity" during a press conference in July 2024.

Mentioned in this timeline

Jerome Hayden Jay Powell is an American investment banker and...

Trending

Katherine Barrett Wilson is an American progressive activist community organizer and writer As the co-founder and executive director of the...

The iPhone e is an affordable smartphone in Apple's iPhone series part of the eighteenth-generation line-up Announced on February it...

6 months ago Robert De Niro's best and worst performances, Netflix movie review and The Intern

Adam Schefter is a prominent American sports writer and reporter best known for his role as an NFL insider at...

1 month ago Bitwise Launches XRP ETF Amidst Market Activity; XRP Staking Explored.

The Topps Company is an American manufacturer of trading cards and collectibles most notably known for its baseball and other...

Popular

Stranger Things created by the Duffer Brothers is a popular...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...

Kelsey Grammer is an accomplished American actor producer and singer...

Candace Owens is an American conservative political commentator and author...

Turning Point USA TPUSA is an American nonprofit organization founded...

Bernie Sanders is a prominent American politician currently serving as...