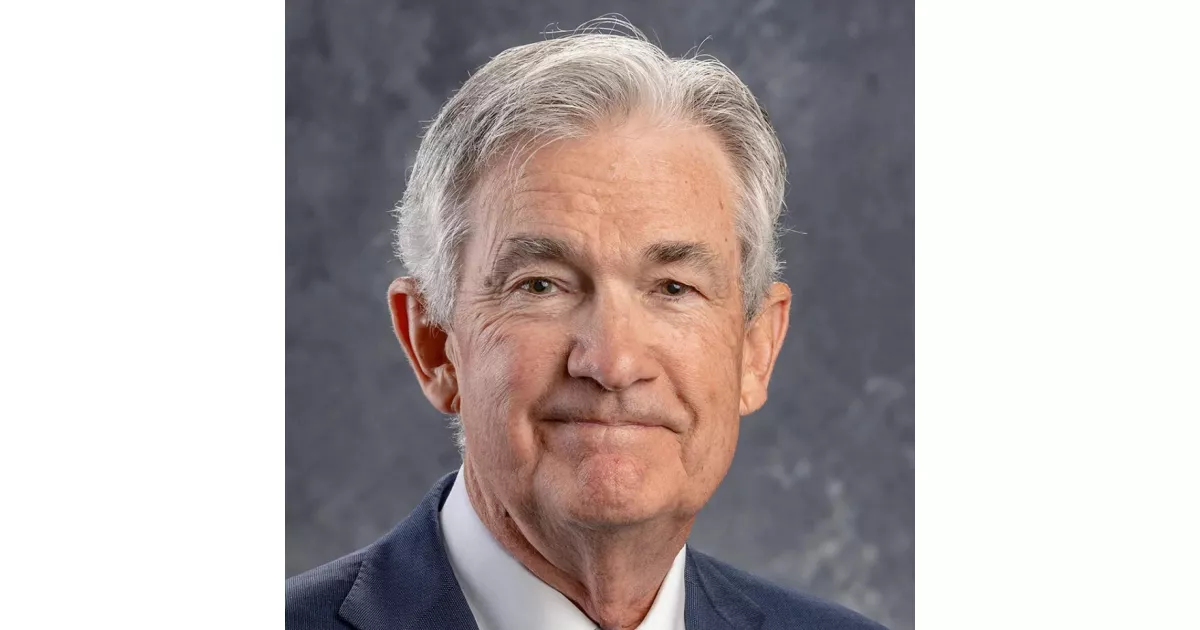

Jerome Hayden "Jay" Powell is an American investment banker and lawyer. Since 2018, he has served as the 16th chair of the Federal Reserve. This position makes him a key figure in managing the monetary policy of the United States.

1971: Graduation from Georgetown Preparatory School

In 1971, Jerome Powell graduated from Georgetown Preparatory School, a Jesuit university-preparatory school.

1983: Moved to Werbel & McMillen

In 1983, after working at Davis Polk & Wardwell, Powell moved to the law firm of Werbel & McMillen.

1984: Joined Dillon, Read & Co.

In 1984, Powell began working at investment bank Dillon, Read & Co. where he focused on financing, merchant banking, and mergers and acquisitions.

1985: Powell married Elissa Leonard

In 1985, Jerome Powell married Elissa Leonard at the Episcopal Washington National Cathedral.

1987: GSFCI began

By December 2020, Powell's monetary policy, measured by the Goldman Sachs US Financial Conditions Index (GSFCI), was the loosest in the history of the GSFCI since it began in 1987.

1988: First time a president nominated a member of the opposition party for such a position

In 1988, it was the first time a president nominated a member of the opposition party for such a position.

1990: Worked in the United States Department of the Treasury

In 1990, Jerome Powell began working in the United States Department of the Treasury, when Nicholas F. Brady, the former chairman of Dillon, Read & Co., was the United States Secretary of the Treasury.

1990: Became vice president at Dillon, Read & Co.

In 1990, Powell rose to the position of vice president at the investment bank Dillon, Read & Co.

1992: Under Secretary of the Treasury for Domestic Finance

In 1992, Jerome Powell became the Under Secretary of the Treasury for Domestic Finance after being nominated by George H. W. Bush, overseeing the investigation and sanctioning of Salomon Brothers and involved in negotiations that made Warren Buffett chairman.

1993: Began working as managing director for Bankers Trust

In 1993, Jerome Powell began working as a managing director for Bankers Trust.

1993: End of tenure in the United States Department of the Treasury

In 1993, Powell's time in the United States Department of the Treasury came to an end.

1995: Left Bankers Trust

In 1995, Jerome Powell left Bankers Trust after it suffered reputational damage from complex derivative transactions that caused large losses for major corporate clients.

1996: Alan Greenspan coins the phrase "irrational exuberance"

In 1996, Alan Greenspan used the term "irrational exuberance" to describe market behavior, a phrase that was later echoed in descriptions of Jerome Powell's policies in August 2020.

1997: Partner at The Carlyle Group

In 1997, Jerome Powell became a partner at The Carlyle Group, where he founded and led the Industrial Group within the Carlyle U.S. Buyout Fund.

2005: Founded Severn Capital Partners

In 2005, after leaving Carlyle Group, Jerome Powell founded Severn Capital Partners, a private investment firm focused on specialty finance and opportunistic investments in the industrial sector.

2008: Managing partner of the Global Environment Fund

In 2008, Powell became a managing partner of the Global Environment Fund, a private equity and venture capital firm that invests in sustainable energy.

2010: Visiting Scholar at the Bipartisan Policy Center

In 2010, Jerome Powell became a visiting scholar at the Bipartisan Policy Center, a think tank in Washington, D.C., and worked on getting Congress to raise the United States debt ceiling.

2010: Powell was on the board of governors of Chevy Chase Club

In 2010, Jerome Powell was on the board of governors of Chevy Chase Club, a country club.

December 2011: Nominated to the Federal Reserve Board of Governors

In December 2011, Jerome Powell was nominated to the Federal Reserve Board of Governors by President Barack Obama.

2011: Worked on United States debt-ceiling crisis

In 2011, Jerome Powell worked on getting Congress to raise the United States debt ceiling during the United States debt-ceiling crisis.

May 25, 2012: Took office on the Federal Reserve Board of Governors

On May 25, 2012, Jerome Powell took office on the Federal Reserve Board of Governors, filling the unexpired term of Frederic Mishkin.

September 2012: QE3 initiated

In September 2012, Powell was initially skeptical but eventually voted for round 3 of quantitative easing (QE3).

2012: End of tenure at the Bipartisan Policy Center

In 2012, Jerome Powell's time as visiting scholar at the Bipartisan Policy Center came to an end.

2013: Endorsed financial regulation

In 2013, Jerome Powell endorsed financial regulation to end the problem of institutions that are too big to fail.

April 2017: Assigned to head the bank oversight committee

In April 2017, Jerome Powell was assigned to head the bank oversight committee.

July 2017: Speech on Fannie Mae and Freddie Mac

In a July 2017 speech, Jerome Powell stated that the status quo regarding Fannie Mae and Freddie Mac is unacceptable and unsustainable, expressing concerns about government responsibility for mortgage defaults and rigid lending standards.

October 2017: Speech on financial system safety

In an October 2017 speech, Jerome Powell stated that higher capital and liquidity requirements and stress tests from the Dodd–Frank Wall Street Reform and Consumer Protection Act have made the financial system safer.

November 2, 2017: Nominated as chairman of the Federal Reserve

On November 2, 2017, President Donald Trump nominated Jerome Powell to serve as the chairman of the Federal Reserve, replacing Janet Yellen.

November 2017: Trump nominated Powell

In November 2017, Donald Trump nominated Jerome Powell as chair of the Federal Reserve.

November 2017: Trump Nominates Powell as Fed Chair

In November 2017, Donald Trump nominated Jerome Powell to serve a four-year term as chair of the Federal Reserve.

January 23, 2018: Nomination confirmed by the Senate

On January 23, 2018, Jerome Powell's nomination to be chair of the Federal Reserve was confirmed by the Senate by an 84–13 vote.

February 5, 2018: Assumed office as chair of the Federal Reserve

On February 5, 2018, Jerome Powell assumed office as chair of the Federal Reserve.

February 2018: Powell assumes position as chair of the Federal Reserve

In February 2018, Jerome Powell assumed the position as chair of the Federal Reserve. His tenure began with an effort to argue for the independence of the Federal Reserve and to avoid criticism from Trump.

July 2018: Trump begins conflict with Powell

In July 2018, U.S. president Donald Trump began a conflict with Jerome Powell, whom he nominated to the position in November 2017.

2018: Continued raising US interest rates

In 2018, Jerome Powell continued to raise US interest rates and announced the Fed would reduce its asset portfolio, which drew public criticism from President Trump.

January 2019: Powell says he would not resign if asked

In January 2019, Jerome Powell stated that he would not resign if asked to do so by Donald Trump, amidst ongoing pressure and criticism.

February 2019: White House Counsel examines request to fire Powell

In February 2019, after Powell announced another interest rate increase the previous month, the Office of White House Counsel examined Trump's request to fire Powell.

October 2019: Announced the Fed would return to expanding its balance sheet

In October 2019, Jerome Powell announced the Fed would return to expanding its balance sheet, leading to a global rally in assets, a move some dubbed QE4.

2019: Powell's net worth estimated

Based on public filings, as of 2019 Jerome Powell's net worth was estimated to be in a range between $20 and $55 million. Powell has served on the boards of charitable and educational institutions including DC Prep, a public charter school, the Bendheim Center for Finance at Princeton University, and The Nature Conservancy.

2019: Abandoned quantitative tightening

In early 2019, Jerome Powell abandoned quantitative tightening, leading to a recovery in asset prices, though President Trump continued to criticize him.

2019: Fed's acceptance of asset price inflation resulted in wealth inequality

The Fed's acceptance of asset price inflation from 2019 onwards resulted in levels of wealth inequality not seen in the United States since the 1920s.

March 2020: Trump claims he could fire Powell

In March 2020, during the onset of the COVID-19 pandemic in the United States, Donald Trump reiterated his claim that he could fire Jerome Powell, although he later tempered his remarks.

June 2020: Jim Grant likens Powell's policy to drug dealing

In June 2020, Jim Grant compared Jerome Powell's monetary policy to drug dealing, referring to him as "the Fed's Dr. Feelgood," due to the expansion of credit through repo contracts which generated significant profits for Wall Street investment banks.

July 2020: Jim Cramer defends Powell's monetary policy

In July 2020, CNBC host Jim Cramer defended Jerome Powell's monetary policy against accusations of inflating stock prices to keep the economy moving, stating he was tired of hearing about a bubble.

August 2020: Bloomberg News calls Powell's policy "exuberantly asymmetric"

In August 2020, Bloomberg News described Jerome Powell's policy as "exuberantly asymmetric," noting that the "Powell Put" had become more extreme than the "Greenspan Put," referring to Alan Greenspan's policy from 1996.

August 2020: Investors Warn of Dangerous Speculative Bubble

In August 2020, investors Leon Cooperman and Seth Klarman cautioned about a potentially dangerous "speculative bubble" in the market, noting that market psychology was becoming "unhinged from market fundamentals."

September 2020: Powell Testifies on Actions Taken to Relieve Wall Street Pain

In September 2020, Jerome Powell testified and stated, "Our actions were in no way an attempt to relieve pain on Wall Street," despite the criticism that his policies disproportionately benefited Wall Street investment banks.

November 19, 2020: Agreed to return unused crisis funds to the United States Treasury

On November 19, 2020, Jerome Powell, after disagreeing with Treasury Secretary Steve Mnuchin, agreed to return unused crisis funds to the United States Treasury and urged Congress to approve more stimulus.

December 2020: Powell wins Forbes Person Of The Year In Crypto

By December 2020, Jerome Powell's monetary policy resulted in the loosest conditions in the history of the Goldman Sachs US Financial Conditions Index, leading to simultaneous asset bubbles and dramatic increases in cryptocurrency prices and resulting in him winning the 2020 Forbes Person Of The Year In Crypto.

December 2020: Powell defends high asset prices by invoking the Fed model

In December 2020, Jerome Powell defended high asset prices using the Fed model, leading to criticism and concerns about a potential financial bubble.

2020: Actions to counter the financial market impact of the COVID-19 pandemic

In early 2020, Jerome Powell launched an unprecedented series of actions to counter the financial market impact of the COVID-19 pandemic, including expanding the Fed's balance sheet and introducing new tools.

January 2021: Wealth inequality could lead to political and social instability in the United States

In January 2021, Edward Luce of the Financial Times warned that the Fed's use of asset purchases, and the resultant widening of wealth inequality, could lead to political and social instability in the United States.

February 2021: Richard Cookson comments on Powell

In February 2021, Richard Cookson from Bloomberg commented on Jerome Powell's policy.

April 2021: Powell Reassures on Housing Bubble Concerns

In April 2021, Jerome Powell addressed concerns about a potential housing bubble, stating that conditions were different from those preceding the Great Recession, as he did not see "bad loans and unsustainable prices".

August 2021: Powell expects the Fed to reduce economic support later in the year

In August 2021, Jerome Powell anticipated the Federal Reserve would reduce economic support later in the year. Powell, who had previously considered inflation to be transitory, stated that this term should be "retired".

August 2021: Progressive Democrats call for Powell's replacement

In August 2021, progressive Democrats, including Alexandria Ocasio-Cortez, urged President Joe Biden to replace Jerome Powell, citing his failure to address the financial risks of climate change.

September 2021: Senator Warren criticizes Powell's financial regulation record

In September 2021, Senator Elizabeth Warren criticized Jerome Powell's financial regulation record and labeled him a "dangerous man to head up the Fed."

November 22, 2021: Powell Renominated for Second Term by Biden

On November 22, 2021, President Joe Biden renominated Jerome Powell for a second term as chair of the Federal Reserve.

January 3, 2022: Powell's initial nomination expired

Jerome Powell's initial nomination expired at the end of the year and was returned to President Biden on January 3, 2022.

January 11, 2022: Hearings held on Powell's nomination before the Senate Banking Committee

On January 11, 2022, hearings were held on Jerome Powell's nomination before the Senate Banking Committee.

January 2022: Nominated for another term

In January 2022, Jerome Powell was nominated for another term.

February 2022: Powell's term as chair expiring

In light of Jerome Powell's term as chair expiring in February 2022, many Democrats began to express opposition to his reappointment.

March 16, 2022: Committee Favorably Reports Powell's Nomination to Senate Floor

On March 16, 2022, the Senate Banking Committee favorably reported Jerome Powell's nomination to the Senate floor, with a 22–1 vote. Senator Elizabeth Warren was the lone member to vote against his nomination.

March 17, 2022: U.S. Federal Reserve began its rate hike cycle

On March 17, 2022, the U.S. Federal Reserve initiated its rate hike cycle, increasing rates by 25 basis points in response to high inflation.

May 12, 2022: U.S. Senate Confirms Powell for Second Term

On May 12, 2022, the U.S. Senate confirmed Jerome Powell's nomination for another term as chair through May 2026, in an 80–19 vote.

May 23, 2022: Powell Sworn in for Second Term as Chair

On May 23, 2022, Jerome Powell was sworn in for his second term as chair of the Federal Reserve.

June 2022: Confirmed by the United States Senate for another term

In June 2022, Jerome Powell was confirmed by the United States Senate in a 67–24 vote for a 4-year term.

July 2022: US CPI peaked

In July 2022, US CPI, a measure of inflation, peaked at 9.1% year-over-year.

2022: Biden reappointed Powell for a second term

In 2022, President Joseph Biden reappointed Jerome Powell for a second term as chair of the Federal Reserve.

2022: Powell describes inflation as being a severe threat

In Jerome Powell's confirmation hearing in 2022 he described inflation as being a "severe threat" to the U.S. economic recovery due to "higher costs of essentials like food, housing and transportation."

July 2023: U.S. Federal Reserve rate hikes continued

Through July 2023, the central bank had hiked rates ten more times since March 17, 2022, cumulatively raising the benchmark rate by 5.25%.

February 2024: Trump says he would not re-appoint Powell to a third term

In February 2024, Donald Trump stated he would not re-appoint Jerome Powell to a third term as chair if elected president for a second term.

January 2025: Trump claims that Powell and the Federal Reserve failed to lower inflation

In January 2025, Donald Trump began his second term by continuing the conflict, claiming that Jerome Powell and the Federal Reserve failed to lower inflation.

April 2025: Trump criticizes Powell on Truth Social

In April 2025, Donald Trump criticized Jerome Powell on Truth Social, stating that "Powell's termination cannot come fast enough!"

July 16, 2025: Reports of Trump's letter to dismiss Powell

On July 16, 2025, there were reports that Donald Trump penned a letter to dismiss Jerome Powell as Fed Chair, which Trump later denied.

January 31, 2026: End of 4-year term

January 31, 2026 is the end date of Jerome Powell's 4-year term.

May 2026: End of second term

Jerome Powell was confirmed for another term as chair through May 2026.

Mentioned in this timeline

Donald John Trump is an American politician media personality and...

Alexandria Ocasio-Cortez AOC is a prominent American politician and activist...

Barack Obama the th U S President - was the...

Elizabeth Warren is a prominent American politician and the senior...

Joe Biden a member of the Democratic Party served as...

CNBC is an American business news channel owned by NBCUniversal...

Trending

8 months ago Keke Palmer stuns in vintage Versace, Chanel, and mirrored gold platform stilettos.

Chase Claypool is a Canadian professional football wide receiver who has played in the NFL since He played college football...

2 months ago GameStop's Valuation, Investor Sentiment, Burry's Email, and Strategic Shifts Analyzed.

2 months ago Strategy's Dollar Reserve for Bitcoin Fails Amidst Sales Concern and Market Slump

2 months ago Alycia Parks vs Tamara Korpatsch in Angers: Preview, Prediction, and Betting Tips

9 months ago Kaja Juvan Advances to Saint Malo Semi-Finals at L’Open 35 Tournament.

Popular

Thomas Douglas Homan is an American law enforcement officer who...

William Franklin Graham III commonly known as Franklin Graham is...

Melania Trump a Slovenian-American former model has served as First...

Jupiter is the fifth and largest planet from the Sun...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...

Instagram is a photo and video-sharing social networking service owned...