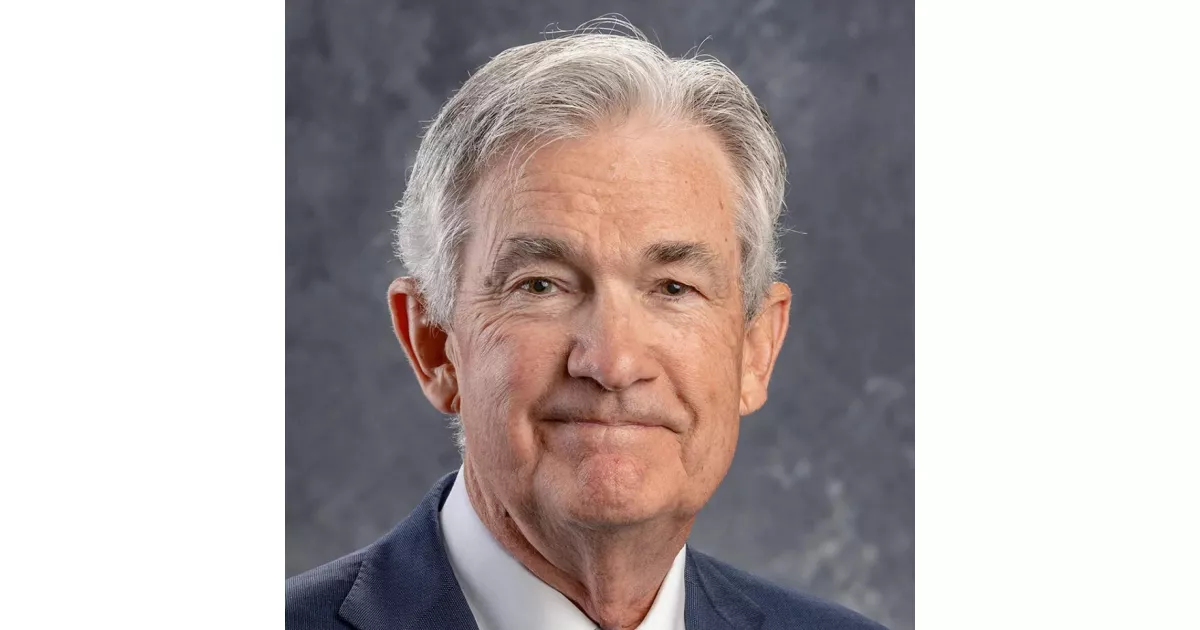

How Jerome Powell built a successful career. Explore key moments that defined the journey.

Jerome Hayden "Jay" Powell is an American investment banker and lawyer. Since 2018, he has served as the 16th chair of the Federal Reserve. This position makes him a key figure in managing the monetary policy of the United States.

1983: Moved to Werbel & McMillen

In 1983, after working at Davis Polk & Wardwell, Powell moved to the law firm of Werbel & McMillen.

1984: Joined Dillon, Read & Co.

In 1984, Powell began working at investment bank Dillon, Read & Co. where he focused on financing, merchant banking, and mergers and acquisitions.

1990: Worked in the United States Department of the Treasury

In 1990, Jerome Powell began working in the United States Department of the Treasury, when Nicholas F. Brady, the former chairman of Dillon, Read & Co., was the United States Secretary of the Treasury.

1990: Became vice president at Dillon, Read & Co.

In 1990, Powell rose to the position of vice president at the investment bank Dillon, Read & Co.

1992: Under Secretary of the Treasury for Domestic Finance

In 1992, Jerome Powell became the Under Secretary of the Treasury for Domestic Finance after being nominated by George H. W. Bush, overseeing the investigation and sanctioning of Salomon Brothers and involved in negotiations that made Warren Buffett chairman.

1993: Began working as managing director for Bankers Trust

In 1993, Jerome Powell began working as a managing director for Bankers Trust.

1993: End of tenure in the United States Department of the Treasury

In 1993, Powell's time in the United States Department of the Treasury came to an end.

1995: Left Bankers Trust

In 1995, Jerome Powell left Bankers Trust after it suffered reputational damage from complex derivative transactions that caused large losses for major corporate clients.

1997: Partner at The Carlyle Group

In 1997, Jerome Powell became a partner at The Carlyle Group, where he founded and led the Industrial Group within the Carlyle U.S. Buyout Fund.

2005: Founded Severn Capital Partners

In 2005, after leaving Carlyle Group, Jerome Powell founded Severn Capital Partners, a private investment firm focused on specialty finance and opportunistic investments in the industrial sector.

2008: Managing partner of the Global Environment Fund

In 2008, Powell became a managing partner of the Global Environment Fund, a private equity and venture capital firm that invests in sustainable energy.

2010: Visiting Scholar at the Bipartisan Policy Center

In 2010, Jerome Powell became a visiting scholar at the Bipartisan Policy Center, a think tank in Washington, D.C., and worked on getting Congress to raise the United States debt ceiling.

December 2011: Nominated to the Federal Reserve Board of Governors

In December 2011, Jerome Powell was nominated to the Federal Reserve Board of Governors by President Barack Obama.

2011: Worked on United States debt-ceiling crisis

In 2011, Jerome Powell worked on getting Congress to raise the United States debt ceiling during the United States debt-ceiling crisis.

May 25, 2012: Took office on the Federal Reserve Board of Governors

On May 25, 2012, Jerome Powell took office on the Federal Reserve Board of Governors, filling the unexpired term of Frederic Mishkin.

September 2012: QE3 initiated

In September 2012, Powell was initially skeptical but eventually voted for round 3 of quantitative easing (QE3).

2012: End of tenure at the Bipartisan Policy Center

In 2012, Jerome Powell's time as visiting scholar at the Bipartisan Policy Center came to an end.

2013: Endorsed financial regulation

In 2013, Jerome Powell endorsed financial regulation to end the problem of institutions that are too big to fail.

April 2017: Assigned to head the bank oversight committee

In April 2017, Jerome Powell was assigned to head the bank oversight committee.

July 2017: Speech on Fannie Mae and Freddie Mac

In a July 2017 speech, Jerome Powell stated that the status quo regarding Fannie Mae and Freddie Mac is unacceptable and unsustainable, expressing concerns about government responsibility for mortgage defaults and rigid lending standards.

October 2017: Speech on financial system safety

In an October 2017 speech, Jerome Powell stated that higher capital and liquidity requirements and stress tests from the Dodd–Frank Wall Street Reform and Consumer Protection Act have made the financial system safer.

November 2, 2017: Nominated as chairman of the Federal Reserve

On November 2, 2017, President Donald Trump nominated Jerome Powell to serve as the chairman of the Federal Reserve, replacing Janet Yellen.

November 2017: Trump nominated Powell

In November 2017, Donald Trump nominated Jerome Powell as chair of the Federal Reserve.

November 2017: Trump Nominates Powell as Fed Chair

In November 2017, Donald Trump nominated Jerome Powell to serve a four-year term as chair of the Federal Reserve.

January 23, 2018: Nomination confirmed by the Senate

On January 23, 2018, Jerome Powell's nomination to be chair of the Federal Reserve was confirmed by the Senate by an 84–13 vote.

February 5, 2018: Assumed office as chair of the Federal Reserve

On February 5, 2018, Jerome Powell assumed office as chair of the Federal Reserve.

February 2018: Powell assumes position as chair of the Federal Reserve

In February 2018, Jerome Powell assumed the position as chair of the Federal Reserve. His tenure began with an effort to argue for the independence of the Federal Reserve and to avoid criticism from Trump.

2018: Continued raising US interest rates

In 2018, Jerome Powell continued to raise US interest rates and announced the Fed would reduce its asset portfolio, which drew public criticism from President Trump.

October 2019: Announced the Fed would return to expanding its balance sheet

In October 2019, Jerome Powell announced the Fed would return to expanding its balance sheet, leading to a global rally in assets, a move some dubbed QE4.

2019: Abandoned quantitative tightening

In early 2019, Jerome Powell abandoned quantitative tightening, leading to a recovery in asset prices, though President Trump continued to criticize him.

November 19, 2020: Agreed to return unused crisis funds to the United States Treasury

On November 19, 2020, Jerome Powell, after disagreeing with Treasury Secretary Steve Mnuchin, agreed to return unused crisis funds to the United States Treasury and urged Congress to approve more stimulus.

2020: Actions to counter the financial market impact of the COVID-19 pandemic

In early 2020, Jerome Powell launched an unprecedented series of actions to counter the financial market impact of the COVID-19 pandemic, including expanding the Fed's balance sheet and introducing new tools.

November 22, 2021: Powell Renominated for Second Term by Biden

On November 22, 2021, President Joe Biden renominated Jerome Powell for a second term as chair of the Federal Reserve.

January 11, 2022: Hearings held on Powell's nomination before the Senate Banking Committee

On January 11, 2022, hearings were held on Jerome Powell's nomination before the Senate Banking Committee.

March 16, 2022: Committee Favorably Reports Powell's Nomination to Senate Floor

On March 16, 2022, the Senate Banking Committee favorably reported Jerome Powell's nomination to the Senate floor, with a 22–1 vote. Senator Elizabeth Warren was the lone member to vote against his nomination.

May 12, 2022: U.S. Senate Confirms Powell for Second Term

On May 12, 2022, the U.S. Senate confirmed Jerome Powell's nomination for another term as chair through May 2026, in an 80–19 vote.

May 23, 2022: Powell Sworn in for Second Term as Chair

On May 23, 2022, Jerome Powell was sworn in for his second term as chair of the Federal Reserve.

June 2022: Confirmed by the United States Senate for another term

In June 2022, Jerome Powell was confirmed by the United States Senate in a 67–24 vote for a 4-year term.

2022: Biden reappointed Powell for a second term

In 2022, President Joseph Biden reappointed Jerome Powell for a second term as chair of the Federal Reserve.

Mentioned in this timeline

Donald John Trump is an American politician media personality and...

Alexandria Ocasio-Cortez AOC is a prominent American politician and activist...

Barack Obama the th U S President - was the...

Elizabeth Warren is a prominent American politician and the senior...

Joe Biden a member of the Democratic Party served as...

CNBC is an American business news channel owned by NBCUniversal...

Trending

2 months ago Report reveals FBI's internal paralysis; Patel and Bongino defend their tenures.

4 months ago IonQ Stock Surges After Quantum Networking Breakthrough: A Quantum Internet Revolution?

Jackie Robinson was an American professional baseball player who broke Major League Baseball's color barrier on April when he started...

Simu Liu is a Canadian actor best known for his role as Shang-Chi in Marvel's Shang-Chi and the Legend of...

Gus Malzahn is an American college football coach currently the offensive coordinator at Florida State Previously he was the head...

8 months ago Keke Palmer stuns in vintage Versace, Chanel, and mirrored gold platform stilettos.

Popular

Thomas Douglas Homan is an American law enforcement officer who...

William Franklin Graham III commonly known as Franklin Graham is...

Melania Trump a Slovenian-American former model has served as First...

Jupiter is the fifth and largest planet from the Sun...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...

Instagram is a photo and video-sharing social networking service owned...