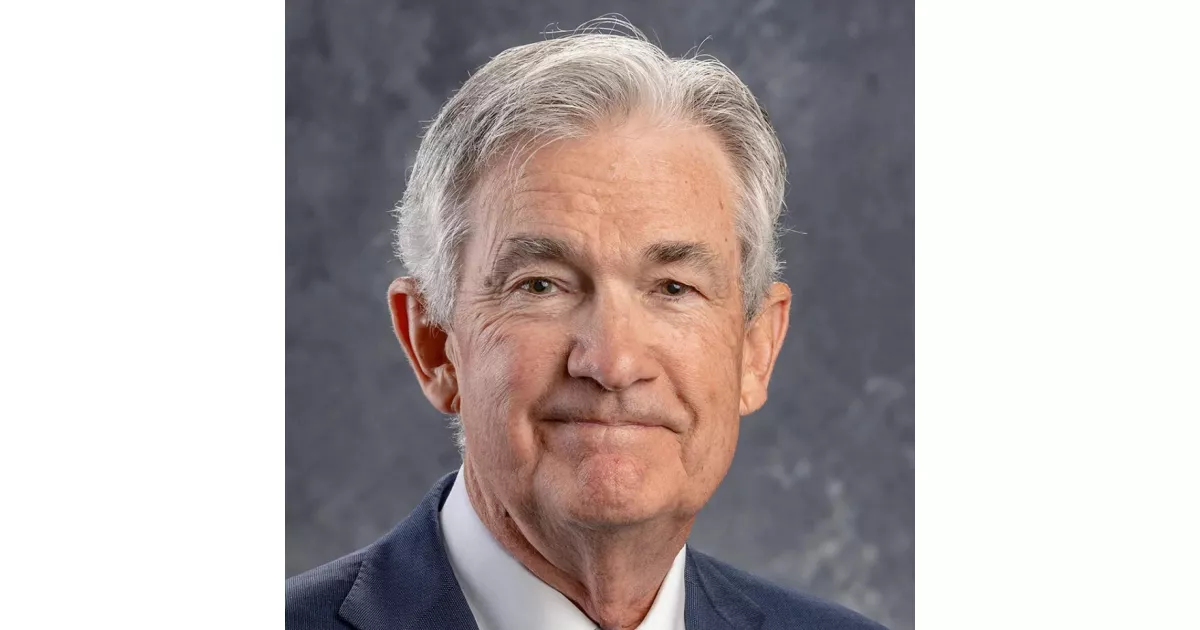

Life is full of challenges, and Jerome Powell faced many. Discover key struggles and how they were overcome.

Jerome Hayden "Jay" Powell is an American investment banker and lawyer. Since 2018, he has served as the 16th chair of the Federal Reserve. This position makes him a key figure in managing the monetary policy of the United States.

July 2018: Trump begins conflict with Powell

In July 2018, U.S. president Donald Trump began a conflict with Jerome Powell, whom he nominated to the position in November 2017.

2018: Continued raising US interest rates

In 2018, Jerome Powell continued to raise US interest rates and announced the Fed would reduce its asset portfolio, which drew public criticism from President Trump.

January 2019: Powell says he would not resign if asked

In January 2019, Jerome Powell stated that he would not resign if asked to do so by Donald Trump, amidst ongoing pressure and criticism.

February 2019: White House Counsel examines request to fire Powell

In February 2019, after Powell announced another interest rate increase the previous month, the Office of White House Counsel examined Trump's request to fire Powell.

2019: Abandoned quantitative tightening

In early 2019, Jerome Powell abandoned quantitative tightening, leading to a recovery in asset prices, though President Trump continued to criticize him.

2019: Fed's acceptance of asset price inflation resulted in wealth inequality

The Fed's acceptance of asset price inflation from 2019 onwards resulted in levels of wealth inequality not seen in the United States since the 1920s.

March 2020: Trump claims he could fire Powell

In March 2020, during the onset of the COVID-19 pandemic in the United States, Donald Trump reiterated his claim that he could fire Jerome Powell, although he later tempered his remarks.

August 2020: Investors Warn of Dangerous Speculative Bubble

In August 2020, investors Leon Cooperman and Seth Klarman cautioned about a potentially dangerous "speculative bubble" in the market, noting that market psychology was becoming "unhinged from market fundamentals."

September 2020: Powell Testifies on Actions Taken to Relieve Wall Street Pain

In September 2020, Jerome Powell testified and stated, "Our actions were in no way an attempt to relieve pain on Wall Street," despite the criticism that his policies disproportionately benefited Wall Street investment banks.

January 2021: Wealth inequality could lead to political and social instability in the United States

In January 2021, Edward Luce of the Financial Times warned that the Fed's use of asset purchases, and the resultant widening of wealth inequality, could lead to political and social instability in the United States.

April 2021: Powell Reassures on Housing Bubble Concerns

In April 2021, Jerome Powell addressed concerns about a potential housing bubble, stating that conditions were different from those preceding the Great Recession, as he did not see "bad loans and unsustainable prices".

August 2021: Progressive Democrats call for Powell's replacement

In August 2021, progressive Democrats, including Alexandria Ocasio-Cortez, urged President Joe Biden to replace Jerome Powell, citing his failure to address the financial risks of climate change.

September 2021: Senator Warren criticizes Powell's financial regulation record

In September 2021, Senator Elizabeth Warren criticized Jerome Powell's financial regulation record and labeled him a "dangerous man to head up the Fed."

July 2022: US CPI peaked

In July 2022, US CPI, a measure of inflation, peaked at 9.1% year-over-year.

2022: Powell describes inflation as being a severe threat

In Jerome Powell's confirmation hearing in 2022 he described inflation as being a "severe threat" to the U.S. economic recovery due to "higher costs of essentials like food, housing and transportation."

February 2024: Trump says he would not re-appoint Powell to a third term

In February 2024, Donald Trump stated he would not re-appoint Jerome Powell to a third term as chair if elected president for a second term.

January 2025: Trump claims that Powell and the Federal Reserve failed to lower inflation

In January 2025, Donald Trump began his second term by continuing the conflict, claiming that Jerome Powell and the Federal Reserve failed to lower inflation.

April 2025: Trump criticizes Powell on Truth Social

In April 2025, Donald Trump criticized Jerome Powell on Truth Social, stating that "Powell's termination cannot come fast enough!"

July 16, 2025: Reports of Trump's letter to dismiss Powell

On July 16, 2025, there were reports that Donald Trump penned a letter to dismiss Jerome Powell as Fed Chair, which Trump later denied.

Mentioned in this timeline

Donald John Trump is an American politician media personality and...

Alexandria Ocasio-Cortez AOC is a prominent American politician and activist...

Barack Obama the th U S President - was the...

Elizabeth Warren is a prominent American politician and the senior...

Joe Biden a member of the Democratic Party served as...

CNBC is an American business news channel owned by NBCUniversal...

Trending

2 months ago Report reveals FBI's internal paralysis; Patel and Bongino defend their tenures.

4 months ago IonQ Stock Surges After Quantum Networking Breakthrough: A Quantum Internet Revolution?

Jackie Robinson was an American professional baseball player who broke Major League Baseball's color barrier on April when he started...

Simu Liu is a Canadian actor best known for his role as Shang-Chi in Marvel's Shang-Chi and the Legend of...

Gus Malzahn is an American college football coach currently the offensive coordinator at Florida State Previously he was the head...

8 months ago Keke Palmer stuns in vintage Versace, Chanel, and mirrored gold platform stilettos.

Popular

Thomas Douglas Homan is an American law enforcement officer who...

William Franklin Graham III commonly known as Franklin Graham is...

Melania Trump a Slovenian-American former model has served as First...

Jupiter is the fifth and largest planet from the Sun...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...

Instagram is a photo and video-sharing social networking service owned...