The Social Security Fairness Act repeals the Government Pension Offset (GPO) and Windfall Elimination Provision (WEP) of Social Security in the United States. This legislation, aimed at addressing perceived inequities in how Social Security benefits are calculated for individuals who also receive government pensions, passed both the House and Senate in late 2024. President Biden signed the bill into law on January 5, 2025, marking a significant change in Social Security benefit calculations for affected individuals.

1983: Social Security Amendments of 1983 Passed

In 1983, Congress passed the Social Security Amendments of 1983, establishing the Windfall Elimination Provision due to concerns about the system's financial stability.

December 2023: Amendments Effective

In December 2023, amendments to the Social Security Act were applied to monthly insurance benefits under title II, with the Commissioner of Social Security adjusting primary insurance amounts as necessary.

2023: Social Security Fairness Act of 2023

In 2023, the Act was named the 'Social Security Fairness Act of 2023'.

November 2024: House Passed the Bill

In November 2024, the Social Security Fairness Act passed in the House.

December 2024: Final Passage of the Bill

In December 2024, the Social Security Fairness Act achieved its final passage after multiple introductions in various Congresses.

January 5, 2025: Bill Signed Into Law

On January 5, 2025, President Biden signed the Social Security Fairness Act into law.

Mentioned in this timeline

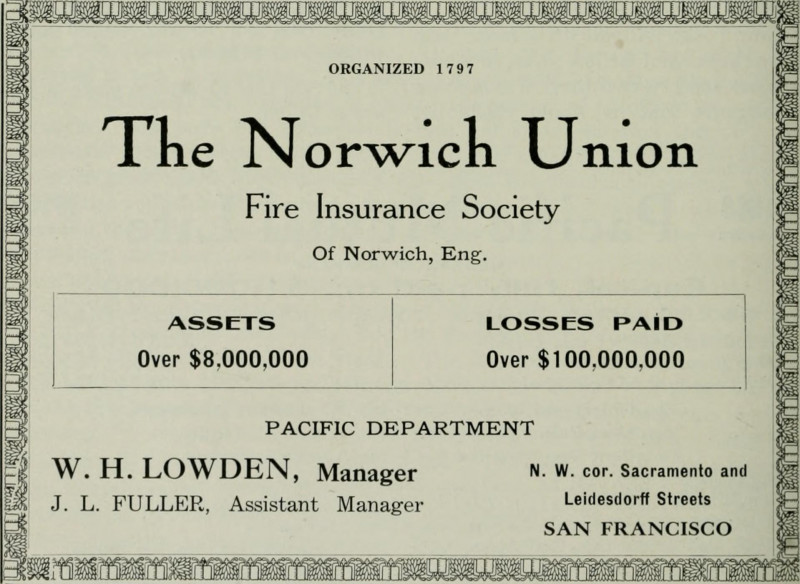

Insurance is a risk management tool providing financial protection against...

Trending

7 months ago Pat Maroon plans Tampa coaching, gives back as Greenville faces 'No Kings' protest.

1 month ago Jalen Williams' Impact: Thunder, Warriors Matchups, Dort's Future, Injury Return

8 months ago Trans Athlete Wins California State Titles Amidst Controversy and Political Tension.

1 month ago Andrew Wiggins shines as Heat realize Warriors' insight; masters portion control.

8 months ago Donte DiVincenzo's impactful performance and confidence boost Timberwolves in Western Conference Finals Game 1.

8 months ago Devin Booker and Molly Murphy spark dating rumors at Stagecoach 2025.

Popular

Carson Beck is an American college football quarterback currently playing...

Curt Cignetti is an American college football coach currently the...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...

WWE Raw a professional wrestling television program by WWE airs...

Stranger Things created by the Duffer Brothers is a popular...

Kristi Noem is an American politician who has served as...