Resilience and perseverance in the journey of Bill Ackman. A timeline of obstacles and growth.

Bill Ackman is an American billionaire hedge fund manager, and the founder and CEO of Pershing Square Capital Management. Known as an activist investor, Ackman's net worth is approximately $9.4 billion as of July 2025. He's a prominent figure in the world of finance.

2002: Litigation Entanglement for Gotham Partners

By 2002, Gotham Partners was involved in litigation with external shareholders who had interests in the companies Gotham invested in.

2002: Ackman Challenges MBIA's Bond Rating

In 2002, Ackman researched MBIA to challenge Standard & Poor's AAA rating of its bonds, incurring over $100,000 in legal costs to copy 725,000 pages of statements. Ackman advocated for a division between MBIA's structured finance and municipal bond insurance businesses.

2003: Feud with Carl Icahn Begins

In 2003, a feud started between Ackman and Carl Icahn over an investment deal.

December 2012: Ackman Announces Short Bet Against Herbalife

In December 2012, Bill Ackman announced that Pershing Square had made a $1 billion short bet against Herbalife, a weight-loss and vitamin supplement maker, labeling it a "pyramid scheme".

2012: Shorting Herbalife

From 2012, Ackman held a US$1 billion short against Herbalife, which he described as a pyramid scheme. His efforts were documented in the film "Betting on Zero".

January 2013: Icahn Challenges Ackman's Herbalife Comment

In January 2013, Carl Icahn challenged Ackman's comment regarding Herbalife during a CNBC appearance, leading to a contentious exchange and Icahn announcing a stake in Herbalife to counter Ackman's short position.

August 2013: Ackman Steps Down from J. C. Penney Board

In August 2013, Bill Ackman stepped down from the J. C. Penney board following a disagreement with fellow board members, ending a two-year campaign to transform the department store.

April 2014: FBI Probes Herbalife

In April 2014, Reuters reported that the FBI conducted a probe into Herbalife and reviewed documents obtained from the company's former distributors.

March 12, 2015: FBI and Federal Prosecutors Investigate Ackman's Actions Regarding Herbalife

On March 12, 2015, reports surfaced that federal prosecutors and the FBI were probing whether individuals hired by Ackman made false statements to encourage investigations and lower Herbalife's stock. Ackman affirmed his stance against Herbalife.

2015: Weak Performance of Pershing Square Begins

In 2015, Pershing Square faced a period of weak performance.

March 2017: Ackman Sells Valeant Shares at a Substantial Loss

In March 2017, Ackman sold his remaining 27.2 million share position in Valeant to Jefferies for about $300 million, incurring an estimated $4.6 billion loss on the position. This included direct stock purchases and underlying stock options.

November 2017: Ackman Covers Herbalife Short Position

In November 2017, Ackman stated that he had covered his short-sell position against Herbalife, but would continue to bet against the company using put options.

February 28, 2018: Ackman Exits Herbalife Bet at a Loss

On February 28, 2018, Ackman exited his near billion-dollar bet against Herbalife at a loss.

2018: Ackman's Short Against Herbalife Ends

In 2018, Ackman's US$1 billion short against Herbalife, a company he described as a pyramid scheme, came to an end.

2018: Weak Performance of Pershing Square Continues

In 2018, Pershing Square continued to experience weak performance.

August 1, 2024: IPO Withdrawal and Restructuring Announcement

On August 1, 2024, after failing to secure the targeted $25 billion, Ackman withdrew Pershing Square's IPO and announced plans to relaunch the fund with a new "transaction structure".

Mentioned in this timeline

Elon Musk is a prominent businessman and entrepreneur recognized globally...

WhatsApp is a widely-used instant messaging and VoIP service owned...

Donald John Trump is an American politician media personality and...

Jeffrey Epstein was an American financier and convicted sex offender...

Michael Bloomberg is an American entrepreneur politician and philanthropist He...

Joe Biden a member of the Democratic Party served as...

Trending

2 months ago Bradley Cooper directs Will Arnett and Laura Dern in the dramedy 'Is This Thing On?'

Joss Whedon is a multifaceted American creator known for his work in television film and comics He is best known...

2 months ago Selena Gomez and Benny Blanco Celebrate Exciting News and Grammy Nomination Showered with Congratulations

3 months ago Mindy Kaling's 'GMA' appearance features deals, steals and a book club pick.

6 months ago Kostyuk vs Erjavec: Wimbledon 2025 Prediction, Odds, and Picks for the upcoming match.

8 months ago Homan Urges Self-Deportation as White House Touts Immigration Crackdown in First 100 Days

Popular

Stranger Things created by the Duffer Brothers is a popular...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...

Kelsey Grammer is an accomplished American actor producer and singer...

Candace Owens is an American conservative political commentator and author...

Bernie Sanders is a prominent American politician currently serving as...

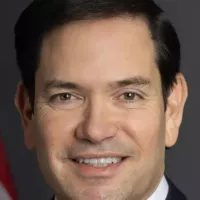

Marco Rubio is an American politician attorney and diplomat He...