A mortgage broker is an intermediary connecting borrowers with suitable mortgage lenders. They've gained prominence due to increased competition in mortgage markets, becoming significant sellers for lenders in developed markets. Brokers identify lenders willing to provide specific loans for individuals. In Canada, they're lender-paid and typically don't charge borrowers with good credit. In the U.S., mortgage brokers are often regulated by state and the CFPB to ensure adherence to financial laws, though the degree of regulation varies by jurisdiction. Their role is to navigate the complex mortgage landscape, matching borrowers with the right lenders while adhering to legal and financial standards.

1979: California Supreme Court Ruling on Fiduciary Duties

In 1979, the Supreme Court of California established fiduciary duties for mortgage brokers, making California an exception to the general lack of such duties in other states as of 2007.

2002: Mortgages under 25 years in length

Between 2002 and 2012, the percentage of mortgages under 25 years in length fell from 95% to 68%.

2004: Mortgage Brokerage Industry Statistics

In 2004, a study indicated that there were approximately 53,000 mortgage brokerage companies in the US, employing around 418,700 individuals and originating 68% of all residential loans.

2007: Fiduciary Duty of Mortgage Brokers in the United States

As of 2007, federal law and most state laws in the United States did not assign a fiduciary duty to mortgage brokers, with California being an exception due to a 1979 ruling.

2008: Commission Realignment in Australia due to Subprime Crisis

In 2008, Australian banks introduced commission re-alignments in reaction to the Subprime mortgage crisis. These commissions can vary significantly between different lenders and loan products.

2008: Mortgage Broker Market Share in Australia

In 2008, approximately 35% of all loans secured by a mortgage in Australia were introduced by mortgage brokers.

2009: Start of the Mortgage Market Review in the UK

In 2009, the Mortgage Market Review (MMR) began as a comprehensive review of the UK mortgage market.

2010: Introduction of the new Good Faith Estimate

In 2010, the government created a new Good Faith Estimate to help consumers compare mortgage fees from brokers and direct lenders, in response to concerns about bait and switch tactics used by some mortgage brokers.

March 2012: Mortgage Broker Market Share in Australia

In March 2012, mortgage brokers introduced 43% of all loans secured by a mortgage in Australia.

2012: Mortgages under 25 years in length

Between 2002 and 2012, the percentage of mortgages under 25 years in length fell from 95% to 68%.

2012: Conclusion of the Mortgage Market Review in the UK

In 2012, the Mortgage Market Review (MMR) concluded its comprehensive review of the UK mortgage market. The review ran from 2009 to 2012.

April 2014: Mortgage Market Review Implemented in the UK

On April 26, 2014, the Mortgage Market Review (MMR) came into force in the UK, leading to stricter affordability requirements and income/expenditure checks, while some mortgage brokers were able to circumvent delays due to their in-house underwriting.

2016: Changes to UK Mortgage Regulations

By 2016, changes to UK mortgage regulations meant that borrowers occupying less than 40% of a property, or relatives of those borrowers, would be considered consumers, bringing transactions under regulation that were previously exempt.

2016: Mortgage Broker Contribution to Australian Economy

In 2016, mortgage brokers contributed $2.9 billion to the Australian economy.

2017: Move towards Mobile and Online Technology in Canada

As of 2017, the Canadian mortgage industry was moving towards mobile and online technology, with CIBC testing a mobile app and companies focusing on consumer awareness against bank products.

2017: Mortgage Broker Contribution to Australian Economy

In 2017, mortgage brokers had contributed to $2.9 billion to the Australian economy.

2019: Mortgage Broker Market Share and Regulatory Challenges

In 2019, mortgage brokers held 59% of the mortgage market share, but faced potential challenges due to recommendations from the Hayne Royal Commission, which suggested lenders cease paying commissions to brokers. The industry successfully lobbied against upfront fee-for-service model during the 2019 Federal Election campaign.

Mentioned in this timeline

The United States of America is a federal republic located...

California is a U S state on the Pacific Coast...

Australia officially the Commonwealth of Australia is a country encompassing...

Canada is a North American country the second largest in...

A supreme court the court of last resort in many...

A bank is a financial institution that plays a crucial...

Trending

1 month ago Moldova's election: A choice between Russia and the EU amid meddling.

34 minutes ago Food influencer Michael 'FoodWithBearHands' Duarte tragically dies in accident, GoFundMe raises over $58,000.

2 hours ago Dakota Meyer, Medal of Honor Recipient, Praises New York's Patriotism on Veterans Day

2 hours ago Marine Recruit Shot During Training Exercise at Parris Island Firing Range

2 hours ago US flights face cancellations and delays despite shutdown's end, travel disruptions continue.

3 hours ago Olive Garden, Cracker Barrel Veterans Day Meals and Closures: Deals and Appreciation

Popular

Nancy Pelosi is a prominent American politician notably serving as...

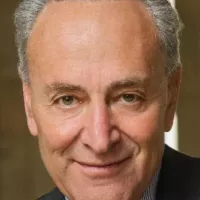

Chuck Schumer is the senior United States Senator from New...

Zohran Kwame Mamdani is an American politician currently serving as...

Nicholas J Fuentes is a far-right political commentator and activist...

William Franklin Graham III commonly known as Franklin Graham is...

Bernie Sanders is a prominent American politician currently serving as...