A mortgage is a loan secured by real property, used to purchase real estate or raise funds for other purposes. The lender is given a lien on the property, allowing them to seize and sell it if the borrower defaults. The term originates from "death pledge," signifying the pledge ends when the loan is repaid or the property is foreclosed. Essentially, a mortgage involves a borrower providing collateral (the property) in exchange for a loan.

1946: Creation of CMHC

In 1946, the Canada Mortgage and Housing Corporation (CMHC) was created by the Canadian federal government to address post-war housing shortages and promote homeownership.

1977: Building Societies' Market Share Declines

In 1977, building societies held 96% of the new mortgage loans market.

1987: Further Decline in Building Societies' Market Share

Between 1977 and 1987, the share of new mortgage loans held by building societies in the UK fell from 96% to 66%, while banks and other institutions rose from 3% to 36%.

2003: Stamp Duty Removed to Facilitate Islamic Mortgages

In 2003, the dual application of stamp duty in Islamic mortgage transactions was removed in the United Kingdom via the Finance Act 2003.

2004: Comparison of Mortgage Systems

In 2004, a UN study compared German, US, and Danish mortgage systems. German Bausparkassen reported 6% interest rates over the last 40 years. US rates, which were in the tens and twenties in the 1980s, had also fallen to about 6%. Denmark also saw interest rates fall to 6% per annum.

2007: Covered Bonds Market Volume

At year-end 2007, within the European Union, covered bonds market volume amounted to about €2 trillion.

2007: Fixed-Rate Mortgages Gain Popularity

From 2007 to the beginning of 2013, fixing the rate of the mortgage for short periods has become popular in the UK.

2007: Subprime Mortgage Crisis

In 2007, the US subprime mortgage crisis occurred, significantly impacting the financial sector.

July 28, 2008: US Treasury to Kick Start Market for Securities

On July 28, 2008, US Treasury Secretary Henry Paulson announced that the Treasury would attempt to kick start a market for these securities in the United States.

October 10, 2008: George Soros Promotes Danish Mortgage Model

On October 10, 2008, George Soros promoted the Danish mortgage market model in The Wall Street Journal.

2008: Regulatory Failings Highlighted

In 2008, the financial crisis exposed regulatory failings in the UK mortgage sector, leading to the establishment of the FCA and PRA in 2013.

2010: Foreclosure Crisis

In 2010, the foreclosure crisis followed the subprime mortgage crisis in the US.

2012: Consideration of CMHC Privatization

In 2012, Finance Minister Jim Flaherty publicly mused about privatizing the Crown corporation, CMHC.

2013: Fixed-Rate Mortgages Still Popular

From 2007 to the beginning of 2013, between 50% and 83% of new mortgages in the UK had initial periods fixed in this way.

2013: Establishment of FCA and PRA

In 2013, the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) were established in the UK to address regulatory failings highlighted by the 2008 financial crisis.

April 2014: OSFI Releases Mortgage Insurance Guidelines

In April 2014, the Office of the Superintendent of Financial Institutions (OSFI) released guidelines for mortgage insurance providers to tighten standards around underwriting and risk management, aiming for a more stable financial system.

May 2018: Stress-Test Rate Peak

In May 2018, the stress-test rate consistently increased until its peak of 5.34%.

July 2019: Stress-Test Rate Decrease

In July 2019, for the first time in three years, the stress-test rate decreased to 5.19%.

December 2019: Review of Mortgage Stress Test Ordered

In December 2019, Canada's finance minister Bill Morneau ordered a review and consideration of changes to the mortgage stress test due to criticisms from the real estate industry.

Mentioned in this timeline

George Soros is a Hungarian-American investor and philanthropist with a...

Canada is a North American country the second largest in...

War is defined as an armed conflict involving the armed...

A bank is a financial intermediary that accepts deposits from...

Trending

11 minutes ago Gregory Bovino Faces DHS Investigation Over Remarks and Operation Metro Surge Actions.

12 minutes ago Scottie Scheffler Favored at 2026 Arnold Palmer Invitational: Expert Predictions and Purse Details

12 minutes ago Seth MacFarlane reveals 'The Orville' Season 4 scripts are complete, teasing a new life.

12 minutes ago Apple's MacBook prices rise with M5 chips, new displays, and AI focus.

12 minutes ago Hegseth and Caine Briefed on Iran War Operations; Pentagon Discussed Iran Conflict.

1 hour ago Tennis star Aryna Sabalenka announces engagement to Georgios Frangulis before Indian Wells tournament.

Popular

Hillary Diane Rodham Clinton is a prominent American politician lawyer...

Ken Paxton is an American politician and lawyer serving as...

Jesse Jackson is an American civil rights activist politician and...

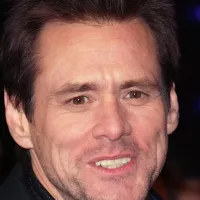

Jim Carrey is a Canadian-American actor and comedian celebrated for...

Bill Clinton served as the nd U S President from...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...