A tax is a compulsory financial charge levied by a government on individuals or entities to fund public spending and reduce negative externalities. Tax compliance involves policies and behaviors ensuring correct and timely tax payments, including claiming appropriate allowances and reliefs. The earliest known taxation dates back to Ancient Egypt (3000–2800 BC). Taxes can be direct or indirect and paid in currency or labor.

1920: Arthur Pigou suggests tax to deal with externalities

In 1920, Arthur Pigou suggested a tax to deal with externalities.

1920: Pigou writes about Pigovian tax

In 1920, economist Arthur Pigou wrote about the Pigovian tax in his book "The Economics of Welfare".

1982: Rothbard argues taxation is theft

In 1982, Murray Rothbard argued in The Ethics of Liberty that taxation is theft and that tax resistance is therefore legitimate.

1989: Scotland tests new poll tax

In 1989, Scotland was the first to be used to test the new poll tax.

1990: Poll tax introduced in England and Wales

In 1990, England and Wales introduced the poll tax, leading to widespread refusal to pay and civil unrest known as the 'Poll Tax Riots'. The change was from progressive local taxation based on property values to a single-rate form of taxation regardless of ability to pay.

2008: Tax revenue as a share of GDP in resource-rich countries

By 2008, resource-rich countries had the most progress, rising from 10% in the mid-1990s to around 17% for average tax revenue as a share of GDP.

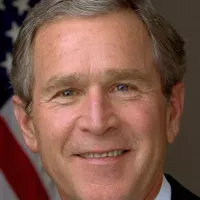

2009: President Bush proposes to terminate or reduce discretionary programs

In 2009, President George W. Bush proposed in his budget "to terminate or reduce 151 discretionary programs" which were inefficient or ineffective.

February 2010: US IRS tax forms and instructions

As of February 1, 2010, the IRS in the United States had about 1,177 forms and instructions, 28.4111 megabytes of Internal Revenue Code which contained 3.8 million words, multiple tax regulations in the Code of Federal Regulations, and supplementary material in the Internal Revenue Bulletin.

2011: Decline in trade taxes

According to the IMF in 2011, the global trend shows that trade taxes have been declining as a proportion of total revenues, with the share of revenue shifting away from border trade taxes towards domestically levied sales taxes on goods and services.

2016: Taxation as a percentage of GDP

In 2016, taxation as a percentage of GDP was 45.9% in Denmark, 45.3% in France, 33.2% in the United Kingdom, 26% in the United States, and an average of 34.3% among all OECD members.

2019: Study on impact of tax cuts

A 2019 study showed that tax cuts for low-income groups had the greatest positive impact on employment growth, while tax cuts for the wealthiest top 10% had a small impact.

Mentioned in this timeline

George W Bush the rd U S President - is...

The United States of America is a federal republic located...

India officially the Republic of India is a South Asian...

France officially the French Republic is primarily located in Western...

Books are a means of storing information as text or...

The Organisation for Economic Co-operation and Development OECD is an...

Trending

26 minutes ago Kyshawn George's Injury Update: Cleared to Play After Toe Issue

4 months ago Trump defends Tucker Carlson's Nick Fuentes interview amid antisemitism concerns.

26 minutes ago Fire at US embassy in Riyadh after drone strike amid Iran-US tensions.

27 minutes ago Julian Reese's Two-Way Contract: Angel Reese's Inspiring Message and Wizards' New Addition

1 hour ago Peyton Stearns, Texas Longhorn, triumphs at ATX Open, securing second WTA title.

2 hours ago Tom Steyer's California plan faces criticism while he spends millions on governor's race.

Popular

Jesse Jackson is an American civil rights activist politician and...

Hillary Diane Rodham Clinton is a prominent American politician lawyer...

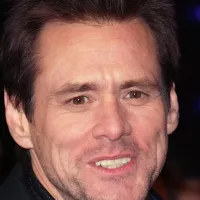

Jim Carrey is a Canadian-American actor and comedian celebrated for...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...

Kashyap Pramod Patel is an American lawyer who became the...

Barack Obama the th U S President - was the...