The BSE SENSEX is a stock market index consisting of 30 financially sound and actively traded companies listed on the Bombay Stock Exchange (BSE). Representing various sectors of the Indian economy, it's a free-float, market-weighted index regarded as a key indicator of the Indian stock market's health. Published since January 1, 1986, the SENSEX has a base value of 100 from April 1, 1979, with a base year of 1978-79. In 2001, BSE launched DOLLEX-30, a dollar-linked version of the SENSEX.

April 1979: Base Value of SENSEX

On April 1, 1979, the base value of the SENSEX was set to 100, with the base year being 1978–79.

April 1979: Long-run rate of return on the S&P BSE SENSEX

Using information from April 1979 onwards, the long-run rate of return on the S&P BSE SENSEX works 18.6% per annum.

January 1986: S&P BSE SENSEX Publication

In January 1986, the S&P BSE SENSEX, a free-float market-weighted stock market index of 30 well-established and financially sound companies listed on the Bombay Stock Exchange, was first published.

1989: Sensex Coined

In 1989, the term 'Sensex' was coined by Deepak Mohoni, a stock market analyst, when the BSE Sensitive Index was around 750 points. The name is a portmanteau of 'Sensitive' and 'Index'.

June 1990: Increase in index

From June 1990 to the present, the index has increased by over twenty five times.

July 2001: Launch of DOLLEX

On July 25, 2001, BSE launched DOLLEX, a dollar-linked version of the SENSEX.

May 2004: Trading Suspension

On 17 May 2004, trading was suspended. On 22 May 2006, the SENSEX plunged by 1,100 points during intra-day trading, leading to the suspension of trading for the first time since 17 May 2004.

May 2006: SENSEX Plunges and Trading Suspension

On May 22, 2006, the SENSEX plunged by 1,100 points during intra-day trading, leading to a trading suspension. Investors lost ₹6 lakh crore. The Finance Minister reassured investors. Trading resumed, and the SENSEX recovered, but still finished 457 points down.

August 2006: Manufacturing Sector Growth

In August 2006, India's manufacturing sector grew by 11.1%, contributing to increased confidence in the economy.

October 2006: SENSEX Closes at All-Time High

In October 2006, specifically on the 16th, the SENSEX closed at an all-time high of 12,928.18, with an intra-day high of 12,953.76, driven by increased confidence in the economy.

July 2007: SENSEX Reaches New High and Experiences Decline

On July 23, 2007, the SENSEX touched a new high of 15,733 points. However, on July 27, 2007, it witnessed a significant decline due to selling by Foreign Institutional Investors and global cues, dropping to 15,160 points by noon.

August 2007: SENSEX Falls Due to Global Cues

On August 1, 2007, the BSE SENSEX fell by 615 points in a single day, following global cues and heavy selling in the international markets.

October 2007: SENSEX Tumbles Further

Continuing the volatility, on October 18, 2007, the SENSEX tumbled by 717.43 points (3.83%), and on October 19, 2007, it fell another 438.41 points, ending the week at 17,559.98 after reaching a low of 17,226.18 during the day.

October 2007: SEBI Proposes Curbs on Participatory Notes

On October 16, 2007, SEBI (Securities & Exchange Board of India) proposed curbs on participatory notes (P-notes), which accounted for roughly 50% of FII investment in 2007, due to concerns about the ownership and potential volatility caused by hedge funds.

October 2007: SENSEX Crashes and Recovers

On October 17, 2007, following unclear proposals from SEBI, the SENSEX crashed by 1,744 points (about 9%) shortly after the market opened, leading to a one-hour trading suspension. Finance Minister P. Chidambaram issued clarifications, and the index recovered, ending the day down 336.04 points.

January 2008: SENSEX Experiences Record Loss

In January 2008, specifically on the 21st, the SENSEX saw its highest ever loss of 1,408 points at the end of the session, recovering to close at 17,605.40 after investors panicked due to weak global cues and fears of a US recession.

January 2008: Trading Halted Due to Lower Circuit

On Friday, March 13, trading was halted for 45 minutes for the first time since January 2008 due to a lower circuit. The Sensex touched a low of 29,687.52, down by 3090.62 points (9.43%). However, after the halt, the index saw a significant intra-day recovery, ending up by 1325 points.

February 2008: SENSEX Loses Points After Reliance Power's Debut

On February 11, 2008, the SENSEX lost 833.98 points when Reliance Power fell below its IPO price in its debut trade.

March 2008: SENSEX Sheds Points on Global Economic Fears

The SENSEX ended March 31, 2008, shedding 726.85 points after heavy selling in blue-chip stocks, driven by global economic fears.

March 2008: SENSEX Losses Due to Credit Concerns

The SENSEX experienced a loss of 900.84 points on March 3, 2008, amid concerns about growing credit losses in the US. On March 13, 2008, the SENSEX plummeted another 770.63 points due to global economic jitters.

January 2009: SENSEX Drops on Satyam Fraud Revelation

On January 7, 2009, the SENSEX dropped by 749.05 points following the revelation of the Satyam fraud.

May 2009: SENSEX Surges

On May 18, 2009, the SENSEX surged by 2,110.79 points, closing at 14,285.21, marking its largest single-day rally.

June 2009: SENSEX Crosses 15,000 Mark

On June 4, 2009, the SENSEX crossed the 15,000 mark.

July 2009: SENSEX Plunges on Budget Day

On July 6, 2009, the day of the Union Budget presentation, the SENSEX plunged by 869.65 points due to concerns over the high fiscal deficit, marking the biggest Budget-day loss for the index.

August 2009: SENSEX Experiences Another Loss

On August 17, 2009, the SENSEX lost 626.71 points.

September 2009: SENSEX Crosses 16,000 Mark

On September 7, 2009, the SENSEX crossed the 16,000 mark, closing at 16,016.32 points.

September 2010: SENSEX Crosses 19,000 Mark

By September 13, 2010, the SENSEX had gained 3,000 points over the previous 12 months, closing at 19,208.33 points after crossing the 19,000 mark.

August 2015: SENSEX Plunges

On August 24, 2015, the SENSEX plummeted by over 1,624.51 points, marking its then-worst one-day point plunge in history.

March 2020: Wealth Erased as SENSEX Loses Points

On March 23, 2020, wealth worth ₹14.22 lakh crore ($200 Billion) was erased as the BSE SENSEX lost 3,934.72 points, ending at 25,981.24.

March 2020: Sensex Tumbles Amid Pandemic and Crisis

On March 9, 2020, the Sensex tumbled by 1941.67 points amid fears of the coronavirus pandemic and the Yes Bank crisis, resulting in investors losing ₹6.50 lakh crores ($91 billion). On March 12, 2020, the index plunged by 2919.26 points, ending in red to a 33-month low, wiping off ₹11.2 lakh crores wealth ($160 billion).

January 2021: Sensex Recovers

As of January 21, 2021, the Sensex had recovered to 50,167.71.

Mentioned in this timeline

The stock market is a platform where buyers and sellers...

Coronaviruses are a family of RNA viruses affecting mammals and...

India officially the Republic of India is a South Asian...

Stocks are restraining devices primarily for the feet historically used...

September is the ninth month of the year in the...

A bank is a financial intermediary that plays a crucial...

Trending

22 minutes ago Dmitry Bivol vacates WBC Light Heavyweight Title to pursue Artur Beterbiev fight.

23 minutes ago Stockton: 84-Year-Old Killed in Car Crash, 18-Year-Old Woman Shot

23 minutes ago Ray Dalio warns tariffs mask U.S. decline amid China's rise, potential conflict.

24 days ago Rune vs Medvedev: BNP Paribas Open Semifinal Preview and Betting Odds

1 hour ago Trey Hendrickson's Bengals Future Uncertain Amid Chase, Higgins Deals and Contract Frustration.

1 hour ago Bryce Underwood: Michigan's Game-Changer QB Learns College Rigors, Shocks Alabama and Ohio State

Popular

Bruce Pearl is an American college basketball coach currently head...

The Nintendo Switch is a video game console developed by...

Peter Navarro is an American economist and author known for...

LeBron James nicknamed King James is a highly decorated American...

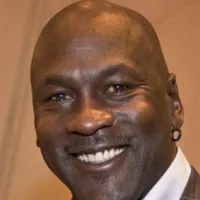

Michael Jordan also known as MJ is a celebrated American...

Facebook is a social media and networking service created in...