The stock market is where buyers and sellers trade stocks, representing ownership in businesses. This includes publicly listed securities and privately traded shares, like those from equity crowdfunding. Investment strategies guide trading decisions. It serves as a crucial platform for companies to raise capital and for investors to participate in economic growth, but it also comes with inherent risks and requires careful analysis and strategic planning.

October 24, 1929: Black Thursday

On October 24, 1929, also known as Black Thursday, the Dow Jones Industrial Average lost 50%, marking the beginning of the Great Depression.

1929: Regulation of margin requirements

Regulation of margin requirements (by the Federal Reserve) was implemented after the Crash of 1929.

1929: Wall Street Crash

The Wall Street Crash of 1929 led to a massive loss of wealth.

1929: The starting day of the stock market crash in 1929

The names "Black Monday" and "Black Tuesday" are also used for October 28–29, 1929, which followed Terrible Thursday—the starting day of the stock market crash in 1929.

1960: Worker to beneficiary ratio

In 1960 the worker to beneficiary ratio was 5:1

1973: Stock market crash

The stock market crash of 1973–4 led to a massive loss of wealth.

1980: Market capitalization at US$2.5 trillion

In 1980, the total market capitalization of all publicly traded stocks worldwide was US$2.5 trillion.

1986: CATS trading system introduced

In 1986, the CATS trading system was introduced at the Paris Bourse, fully automating the order matching system.

October 19, 1987: Black Monday

On October 19, 1987, Black Monday occurred, with the crash beginning in Hong Kong and spreading globally.

1987: Black Monday

Black Monday of 1987 led to a massive loss of wealth.

1987: Stock market crash

In 1987, the Dow Jones Industrial Average plummeted 22.6 percent—the largest-ever one-day fall in the United States.

1992: Direct ownership of stock by individuals

In 1992, direct ownership of stock by individuals was 17.8%, and indirect participation in the form of retirement accounts was 39.3%.

2000: Dot-com bubble

The dot-com bubble of 2000 led to a massive loss of wealth.

2003: Research concludes that a fixed cost of $200 per year is sufficient to explain why nearly half of all U.S. households do not participate in the market.

A 2003 paper by Annette Vissing-Jørgensen concludes that a fixed cost of $200 per year is sufficient to explain why nearly half of all U.S. households do not participate in the market.

2006: Murray Rothbard in "Making Economic Sense"

Murray Rothbard's "Making Economic Sense" was released in 2006.

October 2007: Beginning of the Great Recession

Starting in October 2007, financial markets experienced one of the sharpest declines in decades, marking the beginning of the Great Recession.

2007: Value of directly owned stock in the bottom quintile of income

As of 2007, the median value of directly owned stock in the bottom quintile of income was $4,000, and $78,600 in the top decile of income.

2007: Slight rise in direct ownership

In 2007, direct ownership of stock by individuals rose slightly to 17.9%, and indirect participation in the form of retirement accounts rose to 52.6%.

2008: Scrutiny of the impact of the structure of stock markets

Events such as the 2008 financial crisis prompted a heightened degree of scrutiny of the impact of the structure of stock markets, in particular to the stability of the financial system and the transmission of systemic risk.

2008: The Great Recession

Since the Great Recession of 2008 households in the bottom half of the income distribution have lessened their participation rate both directly and indirectly from 53.2% in 2007 to 48.8% in 2013, while over the same period households in the top decile of the income distribution slightly increased participation 91.7% to 92.1%.

2008: Financial crisis

The 2008 financial crisis led to a massive loss of wealth.

March 2009: Financial markets experienced one of the sharpest declines in decades

From October 2007 to March 2009, the S&P 500 fell 57%.

2009: Worker to beneficiary ratio

In 2009 the worker to beneficiary ratio was 3:1

2011: Racial composition of stock market ownership

As of 2011, the national rate of direct participation in the stock market was 19.6%, with white households at 24.5%, black households at 6.4%, and Hispanic households at 4.3%.

February 2012: IIROC introduced single-stock circuit breakers

In February 2012, the Investment Industry Regulatory Organization of Canada (IIROC) introduced single-stock circuit breakers.

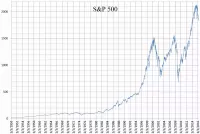

2012: S&P 500 average annual return

In 2012, the S&P 500 index began a period of strong performance, contributing to an average annual return of 14.8% over the subsequent decade.

2012: Stock markets play an essential role in growing industries

Padhi and Naik noted in 2012 that Stock markets play an essential role in growing industries that ultimately affect the economy through transferring available funds from units that have excess funds (savings) to those who are suffering from funds deficit (borrowings).

April 2013: S&P 500 recover to its 2007 levels

From October 2007 to March 2009, the S&P 500 fell 57% and wouldn't recover to its 2007 levels until April 2013.

2013: Households in the bottom half of the income distribution lessened their participation rate

In 2013, households in the bottom half of the income distribution had lessened their participation rate both directly and indirectly from 53.2% in 2007 to 48.8% .

2016: 60 stock exchanges worldwide

As of 2016, there were 60 stock exchanges in the world, with 16 having a market capitalization of $1 trillion or more, accounting for 87% of the global market capitalization.

February 20, 2020: Beginning of the 2020 stock market crash

The 2020 stock market crash began on February 20, 2020, due to the sudden outbreak of the COVID-19 global pandemic.

2021: S&P 500 average annual return

By 2021, the S&P 500 index had achieved an average annual return of 14.8% over the preceding 10 years, although individual annual returns fluctuated significantly.

2021: World stock markets experience an increase

In 2021, the value of world stock markets experienced an increase of 26.5%, amounting to US$22.3 trillion.

January 2022: Largest stock markets by country

As of January 2022, the largest stock markets by country were the United States of America (about 59.9%), followed by Japan (about 6.2%) and the United Kingdom (about 3.9%).

2030: Worker to beneficiary ratio

In 2030 the worker to beneficiary ratio is projected to be 2.2:1.

Mentioned in this timeline

Hong Kong is a densely populated special administrative region of...

Africa is the second-largest and second-most populous continent comprising of...

The S P is a stock market index that tracks...

Japan is an East Asian island country located in the...

The Dow Jones Industrial Average DJIA often called the Dow...

Canada is a North American country the second largest in...

Trending

36 minutes ago Google Maps to fully function in South Korea after data agreement.

2 hours ago CDC Panel to Discuss COVID-19 Vaccine Injuries Following RFK Jr.'s Meeting

37 minutes ago CDC Panel to Discuss COVID Vaccine Injuries Following RFK Jr.'s Meeting

2 hours ago Casey Means' Surgeon General Nomination Faces Scrutiny Over Mainstream Medicine Criticism and Birth Control Views.

3 hours ago Punch, the lonely baby monkey, goes viral and wins hearts worldwide.

4 hours ago Jon Hamm Discovers Viral Dancing Meme; Reacts to Meme-Worthy Status at 54.

Popular

Jesse Jackson is an American civil rights activist politician and...

Barack Obama the th U S President - was the...

Susan Rice is an American diplomat and public official prominent...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...

Michael Joseph Jackson the King of Pop was a highly...

Kashyap Pramod Patel is an American lawyer who became the...