Chase Bank is the consumer and commercial banking arm of JPMorgan Chase, a major multinational financial services firm headquartered in New York City. Its history involves numerous mergers and acquisitions, starting with the 1955 combination of Chase National Bank and the Manhattan Company to form Chase Manhattan Bank. Key mergers include Chemical Bank New York in 1996, J.P. Morgan & Co. in 2000, Bank One Corporation in 2004, the acquisition of Washington Mutual's assets in 2008, and First Republic Bank's assets in 2023. These strategic moves have solidified Chase's position as a leading bank in the United States.

1905: ManufacturersTrust Company Established

ManufacturersTrust Company was established in 1905.

1926: Acquisition of Mechanics and Metals National Bank

In 1926, Chase National Bank acquired Mechanics and Metals National Bank through its Chase Securities Corporation.

1930: Acquisition of Equitable Trust Company

In 1930, Chase acquired the Equitable Trust Company of New York, making it the largest bank in the US and the world.

1930: Rescued Rockefeller Center

In 1930, Chase rescued the Rockefeller Center project, having General Electric as a tenant.

1936: Nazi amassed over $20 million

Between 1936 and 1941, the Nazis amassed over $20 million through Chase's Rückwanderer [returnee] Marks, allowing Nazi sympathizers to purchase Marks with dollars at a discounted rate

October 1940: FBI Investigation Begins

In October 1940, the FBI initiated an investigation into German-Americans who purchased Marks. However, Chase National Bank executives avoided federal prosecution when their attorney threatened to reveal sensitive FBI, Army, and Navy "sources and methods" in court.

1941: Nazi amassed over $20 million

Between 1936 and 1941, the Nazis amassed over $20 million through Chase's Rückwanderer [returnee] Marks, allowing Nazi sympathizers to purchase Marks with dollars at a discounted rate

1969: Reorganized as a bank holding company

In 1969, under the leadership of David Rockefeller, Chase Manhattan bank reorganized as a bank holding company, the Chase Manhattan Corporation.

1991: Expanded into Connecticut

In 1991, Chase Manhattan expanded into Connecticut by acquiring two insolvent banks.

1991: Chemical Bank acquisition of Manufacturers Hanover Corporation

In 1991, Chemical Bank acquired Manufacturers Hanover Corporation.

1995: Mergers and acquisitions

The text mentions the company's major mergers and acquisitions and historical predecessors to 1995.

May 1999: Chase Manhattan Reaches Settlement Over Holocaust-related Claims

In May 1999, Chase Manhattan reached a settlement with 20 plaintiffs, including the Claims Conference and the WJC, in an asset reparations lawsuit, becoming the first bank to settle over Holocaust-related claims.

1999: French government commissions report findings to Prime Minister Lionel Jospin

In 1999, the French government formed a commission to report findings to Prime Minister Lionel Jospin, focusing on the actions of French and U.S. banks during the Vichy regime.

December 2000: Acquisition of J.P. Morgan & Co.

In December 2000, Chase Manhattan completed the acquisition of J.P. Morgan & Co. The combined company was renamed JPMorgan Chase.

2004: FBI files declassified

In 2004, A press release from the National Archives and Records Administration (NARA) announced that many of the new Federal Bureau of Investigation (FBI) files had become declassified.

2004: Acquisition of Bank One

In 2004, Chase acquired Bank One, becoming the largest credit card issuer in the United States.

2005: WaMu acquisition of Providian Financial

Through the acquisition, JPMorgan became owner of the former accounts of Providian Financial, a credit card issuer WaMu acquired in 2005.

December 2006: Jamie Dimon became chairman

In December 2006 Jamie Dimon became chairman after William B. Harrison Jr.'s resignation.

2006: Acquisition of Bank of New York's retail banking division

In 2006, Chase bought the retail banking division of the Bank of New York.

2006: Acquisition of Collegiate Funding Services and Bank of New York Co.'s retail

In 2006, Chase purchased Collegiate Funding Services for $663 million and acquired the Bank of New York Co.'s retail and small business banking network gaining access to 338 additional branches.

2007: Chase Logo Refuted

In 2007, Ivan Chermayeff refuted the story that the Chase logo was a representation of water pipes laid by the Manhattan Company.

June 30, 2008: Branch Ranking

According to data from SNL Financial as of June 30, 2008, Chase ranked third behind Wells Fargo and Bank of America in terms of total U.S. retail bank branches.

September 25, 2008: Acquisition of Washington Mutual

On September 25, 2008, JPMorgan Chase bought most banking operations of Washington Mutual from the FDIC for $1.888 billion.

2008: Acquisition of Washington Mutual

In 2008, Chase acquired the deposits and most assets of Washington Mutual.

2008: Influence on silver prices

The suits allege that by managing giant positions in silver futures and options, the banks influenced the prices of silver on the Comex Exchange since early 2008.

2009: Consideration of National City branches

Chase previously considered buying National City branches from PNC that were required for divestiture following that bank's acquisition of National City in 2009, but were instead sold to First Niagara Bank.

2009: Bear Stearns and Washington Mutual acquisitions completed

In 2009, JPMorgan Chase completed acquisitions of Bear Stearns and Washington Mutual.

2009: Rebranding of Washington Mutual branches

The company completed the rebranding of Washington Mutual branches to Chase in late 2009.

October 2010: Lawsuits Alleging Silver Market Manipulation

In October 2010, Chase was named in two lawsuits alleging manipulation of the silver market.

2011: Fines and settlements

From 2011 to 2013, JPMorgan Chase paid $16 billion in fines, settlements, and other litigation expenses.

2011: Discrimination Lawsuit

From 2011 to 2017, JP Morgan Chase didn't offer equal benefits to male employees. JP Morgan Chase agreed to pay $5 million to compensate their male employees who did not receive the same paid parental leave as women.

2012: Home purchases analysis in Chicago

From 2012 to 2018, an analysis of home purchases in Chicago showed that JP Morgan Chase loaned 41 times more in Chicago's white neighborhoods than in the city's black neighborhoods.

2013: Account Cancellations of Legal Sex Workers

During 2013 and 2014, Chase and other banks received media attention for cancelling personal and business accounts of legal sex workers and others, citing morality clauses.

2013: Fines and settlements

From 2011 to 2013, JPMorgan Chase paid $16 billion in fines, settlements, and other litigation expenses.

2014: Account Cancellations of Legal Sex Workers

During 2013 and 2014, Chase and other banks received media attention for cancelling personal and business accounts of legal sex workers and others, citing morality clauses.

2016: Dakota Access Pipeline Protests

During 2016 and 2017, Chase and other banks were a target of the Dakota Access Pipeline protests due to their financial ties with Energy Transfer Partners, the pipeline builder.

December 2017: Clarified parental leave policy

In December 2017, JPMorgan Chase "clarified its policy to ensure equal access to men and women looking to be their new child's main caregiver".

2017: Dakota Access Pipeline Protests

During 2016 and 2017, Chase and other banks were a target of the Dakota Access Pipeline protests due to their financial ties with Energy Transfer Partners, the pipeline builder.

2018: Home purchases analysis in Chicago

From 2012 to 2018, an analysis of home purchases in Chicago showed that JP Morgan Chase loaned 41 times more in Chicago's white neighborhoods than in the city's black neighborhoods.

October 2019: Fossil Fuel Investment Criticism

In October 2019, a study indicated that Chase invests more ($75 billion) in fossil fuels than any other bank, leading to criticism and protests.

2019: Chase began opening retail branches in Pittsburgh

In 2019, Chase began opening retail branches in Pittsburgh and other areas within Western Pennsylvania.

2019: Criticism for Targeting Online Personalities' Accounts

In 2019, Chase faced criticism for allegedly targeting the personal accounts of outspoken online personalities such as Martina Markota and Enrique Tarrio.

June 2020: Protests at Chicago Chase Branches

In June 2020, protests occurred at Chicago Chase branches following a report showing disparities in lending practices between white and black neighborhoods. Chase committed to $600 million in new mortgages for Blacks in Chicago.

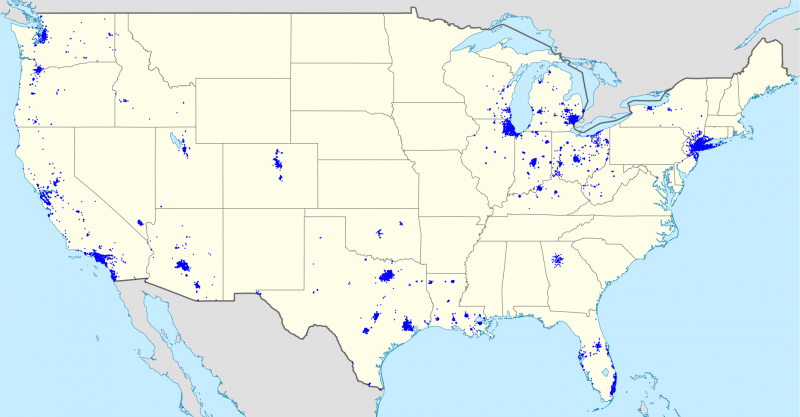

August 2021: Retail Presence in 48 Contiguous States

In August 2021, Chase announced that it was the first bank to have a retail presence in all 48 of the contiguous United States. The last state was Montana.

September 2021: Entry into the United Kingdom Retail Banking Market

In September 2021, JPMorgan Chase entered the United Kingdom retail banking market by launching an app-based current account and Deposit account under the Chase brand.

2022: Asset Size

In 2022, JPMorgan Chase & Co. had assets of $3.31 trillion, making it the largest bank in the United States.

2022: U.S. Government Sues JP Morgan Chase

In 2022, the U.S. government sued JP Morgan Chase Bank, alleging that JP Morgan "facilitated, sustained, and concealed the human trafficking network operated by Jeffrey Epstein."

May 2023: Acquisition of First Republic Bank

In May 2023, Chase acquired the assets of First Republic Bank.

2023: Account Statistics

As of 2023, Chase offers more than 4,700 branches and 15,000 ATMs nationwide and has 18.5 million checking accounts and 25 million debit card users.

2024: ATM Glitch Allows Fraudulent Withdrawals

In 2024, a glitch occurred in Chase's ATMs which allowed users to withdraw money using fraudulent checks, a type of bank fraud known as Check kiting.

Mentioned in this timeline

Bank of America is a multinational investment bank and financial...

Jeffrey Epstein was an American financier and convicted sex offender...

JPMorgan Chase Co incorporated in Delaware and headquartered in New...

Germany officially the Federal Republic of Germany is a nation...

Arizona is a landlocked state in the Southwestern U S...

Pennsylvania is a U S state located in the Mid-Atlantic...

Trending

11 minutes ago Demi Moore debuts dramatic bob haircut at Gucci show, sparking makeover buzz.

1 hour ago Hanfmann Advances in Santiago 2026 After Win, Set to Face Carabelli.

2 hours ago Lesotho: Frontliners help family overcome poverty; South Africa sees tourism boom in 2026.

2 hours ago Sara Eisen on The View: Tense Moments and Financial Expertise Displayed.

1 hour ago Griekspoor to face Medvedev in Dubai final: Highlights and predictions surface.

3 hours ago Ryan Hurst's Kratos Revealed in Prime Video's 'God of War' Series: Cast Updates

Popular

Jesse Jackson is an American civil rights activist politician and...

Barack Obama the th U S President - was the...

Susan Rice is an American diplomat and public official prominent...

Michael Joseph Jackson the King of Pop was a highly...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...

Kashyap Pramod Patel is an American lawyer who became the...