JPMorgan Chase & Co., incorporated in Delaware and headquartered in New York City, is a leading multinational financial institution. Holding the titles of the largest bank in the United States and the world's largest by market capitalization as of 2023, it is classified as systemically important by the Financial Stability Board. The bank's significant scale has resulted in increased regulatory scrutiny and the implementation of a robust internal 'Fortress Balance Sheet.' While currently located at 383 Madison Avenue, the firm is scheduled to relocate to the new JPMorgan Chase Building at 270 Park Avenue in 2025.

August 1914: Financing War and Shaping Global Affairs

In August 1914, as World War I erupted, Henry P. Davison, a partner at J.P. Morgan & Co., secured a deal with the Bank of England. This deal made J.P. Morgan & Co. the sole underwriter of war bonds for the UK and France. This move significantly involved the firm in the war effort and global affairs.

1914: A Landmark Headquarters

In 1914, 23 Wall Street was established as the headquarters for J.P. Morgan & Co., marking a significant chapter in the company's history.

September 16, 1920: Terrorist Bombing at 23 Wall Street

On September 16, 1920, tragedy struck the J.P. Morgan & Co. headquarters at 23 Wall Street when a terrorist bomb exploded in front of the building, injuring hundreds and causing multiple fatalities. The case remains unsolved to this day.

1921: Entering the Chinese Market

Expanding into Asia, the Equitable Eastern Banking Corporation, one of J.P. Morgan's predecessors, established a branch in China in 1921, marking the company's entry into the Chinese market.

1924: Expansion into Japan

J.P. Morgan & Co. broadened its global footprint in 1924 by commencing operations in Japan, tapping into a new market and expanding its international presence.

September 16, 1935: The Birth of Morgan Stanley

In 1935, after facing restrictions in the securities business, J.P. Morgan partners took a bold step. On September 16th, they spun off their investment-banking operations and founded Morgan Stanley, marking the beginning of a new era in finance.

1940: Unsolved Terrorist Attack

The FBI officially rendered the 1920 terrorist bombing case inactive in 1940, leaving a cloud of mystery hanging over the event.

1954: Merger with Corn Exchange Bank

Chemical Bank's growth trajectory included a significant merger in 1954 with Corn Exchange Bank, further solidifying its position in the banking industry.

1955: The Birth of Chase Manhattan Bank

The Chase Manhattan Bank came into being in 1955 through the acquisition of Chase National Bank (established 1877) by The Bank of the Manhattan Company (established 1799). The Bank of the Manhattan Company had an intriguing history, having been transformed from a water carrier to a bank by Aaron Burr.

1959: The Formation of Morgan Guaranty Trust Company

J.P. Morgan merged with the Guaranty Trust Company of New York in 1959, creating the Morgan Guaranty Trust Company. This merger solidified their position in the financial landscape and marked a new chapter in their history.

1967: Establishing a Foothold in South Korea

Chase Manhattan Bank continued its global expansion by opening an office in South Korea in 1967, marking its entry into the South Korean market.

September 18, 1968: Chase Manhattan International Limited Founded

On September 18, 1968, the company that would later become JPMorgan Chase was founded as Chase Manhattan International Limited.

1968: Presence in Greece

In 1968, J.P. Morgan & Co. expanded its operations to Greece, further extending its reach in Europe.

1970: Expanding into Taiwan

JPMorgan continued its Asian expansion by opening an office in Taiwan in 1970, capitalizing on the growing Taiwanese economy.

1973: Operations in the Soviet Union

In a significant move during the Cold War, JPMorgan opened an office in the Soviet Union (Russia) in 1973, marking its entry into a new and complex market.

1984: Acquisition of Purdue National Corporation

Expanding its reach, J.P. Morgan & Co. acquired the Purdue National Corporation of Lafayette, Indiana in 1984, further diversifying its portfolio.

1984: Venturing into Private Equity

Recognizing the growing potential of private equity, Chemical Bank established Chemical Venture Partners in 1984. This strategic move allowed the bank to invest in private equity transactions alongside other financial sponsors.

1986: Bernie Madoff Opens Account at Chemical Bank

In 1986, Bernie Madoff opened a business account at Chemical Bank, which would later be acquired by Chase. This account would become a point of contention regarding JPMorgan Chase's alleged failure to prevent Madoff's fraud.

1988: Return to the J.P. Morgan Brand

After operating as Morgan Guaranty Trust, the company decided to return to its roots in 1988. They began operating solely as J.P. Morgan & Co., signifying a return to their legacy and brand recognition.

1991: Merger of Equals

In a historic merger of equals, Chemical Bank merged with Manufacturer's Hanover Trust Company in 1991, marking a significant event in the banking world.

1995: Entering Poland

Following the fall of the Iron Curtain, JPMorgan commenced operations in Poland in 1995, seizing the opportunities presented by the newly opened Eastern European markets.

1996: A Wave of Mergers Shapes JPMorgan Chase

Since 1996, a series of mergers with prominent banking companies like Chase Manhattan Bank, J.P. Morgan & Co., and Bank One shaped JPMorgan Chase into its present form. This period also involved asset acquisitions from entities like Bear Stearns, Washington Mutual, and First Republic.

1998: Formation of Bank One Corporation

In 1998, Bank One Corporation was formed through the merger of Banc One of Columbus, Ohio, and First Chicago NBD. This merger initially struggled until Jamie Dimon reformed the company's practices.

1999: Strategic Acquisition of Hambrecht & Quist

In 1999, Chase Manhattan Bank further strengthened its position by acquiring the San Francisco-based investment bank Hambrecht & Quist for $1.35 billion, bolstering its investment and asset management divisions.

2000: Merger Creates a Financial Giant

In 2000, a significant merger occurred between J.P. Morgan & Co. and Chase Manhattan Company, resulting in the formation of JPMorgan Chase & Co. This merger created a diversified holding entity and a major player in investment banking and asset management.

2001: Enron Corporation Scandal and JPMorgan Chase's Role

JPMorgan Chase faced significant legal and financial repercussions for its role in financing Enron Corporation, which collapsed in 2001 due to a massive accounting scandal. The bank was accused of aiding and abetting Enron's securities fraud.

December 2002: Fines Related to Biased Research

JPMorgan Chase was among ten banks that faced fines totaling $1.4 billion in December 2002 for allegedly deceiving investors with biased research. As part of the settlement, JPMorgan Chase agreed to pay $80 million and implement reforms to separate its investment banking and research divisions, aiming to prevent conflicts of interest and ensure the objectivity of its research reports.

2002: Client Fund Segregation Issues Begin

Following the merger of Chase and J.P. Morgan, issues arose regarding the proper segregation of client funds, as required by the UK Financial Services Authority (FSA). These issues persisted until 2009, eventually resulting in a significant fine for the firm.

2003: JP Morgan Advises Glazer Ownership of Manchester United

In 2003, JP Morgan provided financial advice to the Glazer family during their acquisition of Manchester United, a prominent English football club. This marked an early instance of JP Morgan's involvement in the European football industry.

May 2004: WorldCom Settlement Offer

In May 2004, investors offered JPMorgan Chase $1.37 billion to settle claims related to the bank's underwriting of WorldCom bonds. This offer was later rejected by the bank, which ultimately agreed to a higher settlement amount in March 2005.

2004: Establishment of J.P. Morgan Cazenove

In 2004, J.P. Morgan Cazenove, an advisory and underwriting joint venture, was established with the Cazenove Group.

2004: JPMorgan Chase acquires Bank One

In 2004, JPMorgan Chase completed the acquisition of Bank One in the third quarter. This acquisition was a significant move in the company's expansion and consolidation strategy.

2004: JPMorgan Chase merges with Bank One Corp.

In 2004, JPMorgan Chase merged with Chicago-based Bank One Corp., bringing Jamie Dimon on board as president and COO. This merger included strategic changes and cost-cutting measures led by Dimon.

2004: L.K. Erf Becomes Director of Art Acquisitions

In 2004, L.K. Erf assumed the role of director of acquisitions for JPMorgan Chase's art collection.

2004: Bank One Acquisition and Jamie Dimon's Arrival

The acquisition of Bank One by JPMorgan Chase in 2004 was partly motivated by the desire to bring Jamie Dimon into the company.

March 2005: WorldCom Settlement and Slavery Reparations

In March 2005, JPMorgan Chase agreed to pay $2 billion to settle claims related to its underwriting of WorldCom bonds. The payment was significantly higher than a previous offer from investors. This marked the second-largest settlement in the case. Also in March 2005, the bank acknowledged and apologized for its historical ties to slavery, pledging $5 million in reparations through a scholarship program for Black students.

December 15, 2005: Start of Sanctions Violations

JPMorgan Chase Bank engaged in activities between December 15, 2005, and March 1, 2011, that would later be deemed as violations of various sanctions programs, including the Cuban Assets Control Regulations, Weapons of Mass Destruction Proliferators Sanctions Regulations, and others.

December 2005: Jamie Dimon becomes CEO

In December 2005, Jamie Dimon succeeded William B. Harrison Jr. and became the CEO of JPMorgan Chase. This marked a significant transition in leadership for the company as Dimon brought new strategies and key personnel from Bank One.

2005: Washington Mutual acquires Providian Financial

In 2005, Washington Mutual acquired Providian Financial, a credit card issuer, which later became part of JPMorgan Chase through its acquisition of Washington Mutual.

2005: JPMorgan Chase's Questionable Mortgage-Backed Securities Offerings

JPMorgan Chase allegedly began engaging in questionable practices related to offerings of subprime and Alt-A residential mortgage securities. This period, from 2005 to 2007, would later be scrutinized by the Justice Department in an investigation leading to a $13 billion settlement.

2005: Settlement with Enron Investors

JPMorgan Chase reached a $2.2 billion settlement in 2005 with investors who had sued the bank over its role in the Enron scandal. This settlement highlighted the substantial financial consequences JPMorgan Chase faced for its involvement in the Enron affair.

2005: Jamie Dimon Becomes CEO

Jamie Dimon assumed the role of chief executive officer at JPMorgan Chase at the end of 2005, following the bank's acquisition of Bank One.

2005: Energy Policy Act Passes

The Energy Policy Act of 2005 was passed, granting FERC the authority to detect, prevent, and sanction the gaming of energy markets. This act would later be relevant to FERC's investigation and settlement with JPMVEC for market manipulation.

April 2006: Acquisition of Bank of New York Mellon's retail network

In April 2006, JPMorgan Chase acquired Bank of New York Mellon's retail and small business banking network, adding 339 branches in New York, New Jersey, and Connecticut.

December 2006: Jamie Dimon becomes Chairman

In December 2006, Jamie Dimon took on the additional role of Chairman of JPMorgan Chase. This move consolidated his leadership position within the company.

2006: Acquisition of Collegiate Funding Services

In 2006, JPMorgan Chase acquired Collegiate Funding Services for $663 million. This acquisition formed the foundation for Chase Student Loans.

2006: JPMorgan Chase Engages in Bribery Scheme

JPMorgan Chase commenced a bribery scheme in 2006, which continued until 2013. The bank secured business deals in Hong Kong by hiring hundreds of individuals connected to Chinese government officials. This scheme, revealed in November 2016, resulted in a $264 million settlement for JPMorgan Chase.

2006: JPMorgan Chase Accused of Mortgage Discrimination

The United States government alleged that JPMorgan Chase began discriminating against black and Hispanic mortgage borrowers in 2006. This alleged discrimination would continue until at least 2009, culminating in a lawsuit filed against the bank in January 2017.

2007: Bear Stearns faces market capitalization issues

In 2007, Bear Stearns, the fifth largest investment bank in the U.S., saw its market capitalization deteriorate significantly, setting the stage for the crisis that unfolded in 2008.

2007: Start of Financial Crisis

The financial crisis of 2007-2008 began, which would later lead to investigations into JPMorgan Chase's practices related to mortgage-backed securities from 2005 to 2007. This resulted in a record $13 billion settlement in November 2013.

March 14, 2008: Bear Stearns market value drops

On March 14, 2008, Bear Stearns lost 47% of its equity market value as rumors spread about clients withdrawing capital. This event marked the beginning of a crisis for the investment bank.

March 15, 2008: Federal Reserve intervenes in Bear Stearns crisis

On March 15, 2008, the Federal Reserve intervened to prevent a wider systemic crisis by engineering a deal to address Bear Stearns' potential insolvency.

March 16, 2008: JPMorgan Chase plans to acquire Bear Stearns

On March 16, 2008, JPMorgan Chase announced plans to acquire Bear Stearns in a stock swap worth $2.00 per share, pending shareholder approval. JPMorgan also agreed to guarantee all Bear Stearns trades and business process flows.

March 18, 2008: Formal acquisition announcement of Bear Stearns

On March 18, 2008, JPMorgan Chase formally announced the acquisition of Bear Stearns for $236 million. The stock swap agreement was signed that night.

March 24, 2008: Revised acquisition offer for Bear Stearns

On March 24, 2008, JPMorgan Chase revised its acquisition offer for Bear Stearns to approximately $10 per share due to public discontent over the initial low price. JPMorgan also acquired a 39.5% stake in Bear Stearns immediately.

May 30, 2008: Completion of Bear Stearns merger

On May 30, 2008, the merger between JPMorgan Chase and Bear Stearns was completed, following sufficient shareholder commitments in favor of the revised deal.

August 2008: JPMorgan Chase Announces Plans for New European Headquarters

In August 2008, JPMorgan Chase revealed plans to build a new European headquarters in Canary Wharf, London. However, these plans were later put on hold.

September 25, 2008: Acquisition of Washington Mutual

On September 25, 2008, JPMorgan Chase acquired the banking operations of Washington Mutual from the FDIC for $1.836 billion, following the largest bank failure in American history.

October 2008: JPMorgan Chase Reports Concerns about Madoff to UK Authorities

After maintaining a business account for Bernie Madoff since 1986, JPMorgan Chase reported concerns about Madoff's performance to the UK Serious Organised Crime Agency in October 2008. However, the bank didn't impose restrictions on Madoff's accounts until his arrest two months later.

October 28, 2008: TARP funds transferred to JPMorgan Chase

On October 28, 2008, $25 billion in funds were transferred from the U.S. Treasury Department to JPMorgan Chase under the Troubled Asset Relief Program (TARP). This was part of efforts to stabilize the financial system during the crisis.

2008: JPMorgan Chase Acquires Bear Stearns and Washington Mutual

In 2008, JPMorgan Chase acquired Bear Stearns and Washington Mutual. Conduct at these firms before their acquisition contributed significantly to the alleged wrongdoing in mortgage-backed securities offerings, leading to a substantial portion of the $13 billion settlement JPMorgan Chase agreed to in 2013.

2008: Acquisition of ClimateCare

In 2008, JPMorgan Chase acquired the UK-based carbon offsetting company ClimateCare. This move was part of the company's efforts to expand its environmental initiatives during the financial crisis.

2008: Dimon's Leadership During Financial Crisis

Jamie Dimon's leadership during the 2008 financial crisis was widely praised as he guided JPMorgan Chase through the turmoil and orchestrated the rescue of two struggling banks.

2008: Lawsuits Regarding Credit Card Practices

Starting in 2008, JPMorgan Chase faced multiple lawsuits from credit card holders claiming the bank violated lending laws by abruptly increasing minimum payments on balances transferred with fixed interest rate promises.

February 1, 2009: Jamie Dimon's statement on TARP funds

During the week of February 1, 2009, Jamie Dimon commented on the lack of government action in enforcing TARP's intent to fund JPMorgan Chase with $25 billion.

February 2009: Plans for using TARP funds

In February 2009, JPMorgan Chase announced it would leverage its capital strength to acquire new businesses, utilizing the funds received under TARP.

November 2009: Acquisition of J.P. Morgan Cazenove

In November 2009, J.P. Morgan announced the acquisition of the balance of J.P. Morgan Cazenove, an advisory and underwriting joint venture established in 2004 with the Cazenove Group.

November 2009: Settlement for Derivative Sales

In November 2009, JPMorgan Chase agreed to a $722 million settlement with the U.S. Securities and Exchange Commission (SEC). The settlement resolved an investigation into the bank's sales of derivatives that allegedly contributed to the financial crisis in Jefferson County, Alabama. The SEC alleged that JPMorgan made undisclosed payments to individuals connected to county commissioners in exchange for securing a deal to refinance the county's sewer debt.

2009: Rebranding of Washington Mutual branches

By late 2009, JPMorgan Chase completed the rebranding of Washington Mutual branches to Chase, following its acquisition of the bank the previous year.

2009: Client Fund Segregation Issues End

J.P. Morgan Securities addressed and corrected the errors in its handling of client funds, which had been ongoing since 2002. The firm reported the issue to the FSA and cooperated with the investigation, leading to a reduction in the initial fine.

2009: JPMorgan Chase's Alleged Mortgage Discrimination Continues

JPMorgan Chase's alleged discriminatory practices in mortgage lending, which began in 2006, continued until at least 2009. These practices, targeting black and Hispanic borrowers, led to a lawsuit from the United States government in January 2017.

2009: Lawsuits Regarding Credit Card Practices

Throughout 2009, JPMorgan Chase continued to face lawsuits alleging unfair practices related to credit card minimum payment increases, adding to the legal challenges initiated in 2008.

June 2010: Fine for Client Fund Protection Failure

In June 2010, J.P. Morgan Securities, a subsidiary of JPMorgan Chase, was fined a record £33.32 million (approximately $49.12 million) by the UK Financial Services Authority (FSA). The fine was imposed because the firm failed to properly separate client funds from its own between 2002 and 2009, violating FSA regulations. While no clients suffered losses, their funds would have been at risk if the firm had become insolvent during that period.

September 2010: JPMorgan Ventures Energy Corporation's Market Manipulation

In September 2010, JPMVEC began engaging in manipulative bidding practices in electricity markets that would continue until November 2012, ultimately leading to a FERC investigation and a $410 million settlement.

December 2010: JPMorgan Chase Acquires 25 Bank Street for European Headquarters

In December 2010, JPMorgan Chase decided to purchase an existing office tower at 25 Bank Street in London to serve as the European headquarters for its investment banking division, instead of constructing a new building.

2010: JPMorgan Chase Sued by Madoff Trustee

Irving Picard, the trustee overseeing the liquidation of Madoff's company, sued JPMorgan Chase in 2010. Picard alleged that the bank failed to recognize and act on warning signs of Madoff's fraudulent activities, despite their long-standing business relationship.

January 2011: Mortgage Overcharges and Foreclosures

In January 2011, JPMorgan Chase admitted to wrongly overcharging thousands of military families on their mortgages and improperly foreclosing on over a dozen, violating the Servicemembers Civil Relief Act. The bank pledged to refund up to $2 million and reinstate wrongly foreclosed homes.

March 1, 2011: End of Sanctions Violations

JPMorgan Chase Bank's activities that violated multiple sanctions programs, including those related to Cuba, weapons proliferation, and terrorism financing, ceased on March 1, 2011. These violations, which began in December 2005, eventually resulted in a significant settlement with the U.S. government.

May 2011: Class Action Certification

In May 2011, a class action lawsuit against JPMorgan Chase, alleging unfair credit card practices, was certified by the United States District Court for the Northern District of California.

June 2011: Lending Chief Exits Amid Scandal

Dave Lowman, the lending chief of JPMorgan Chase, was forced out of his position in June 2011 due to the scandal involving the bank's overcharging of military families on mortgages and improper foreclosures.

August 25, 2011: Sanctions Violations Settlement

On August 25, 2011, JPMorgan Chase agreed to pay fines related to violations of sanctions imposed by the Office of Foreign Assets Control (OFAC). The specific details of the violations and the settlement amount were released by the U.S. Department of Treasury.

2011: Risk assessment improvement

In 2011, J.P. Morgan announced that the use of field-programmable gate array-based supercomputers had significantly reduced the time required to assess risk, from hours to minutes.

2011: Market Monitors Refer JPMVEC to FERC

In 2011, market monitors referred JPMVEC to the Federal Energy Regulatory Commission (FERC) due to concerns about the company's bidding practices in electricity markets. This would be one of multiple referrals between 2011 and 2012 that sparked an investigation into JPMVEC.

February 9, 2012: National Mortgage Settlement

On February 9, 2012, JPMorgan Chase and four other major mortgage servicers reached a historic settlement with the federal government and 49 states. The agreement, known as the National Mortgage Settlement (NMS), required the banks to provide $26 billion in relief to struggling homeowners and direct payments to government entities. The NMS aimed to address issues related to mortgage servicing practices and foreclosure abuses that occurred during the financial crisis.

April 2012: Hedge Fund Insiders Detect Market Fluctuations

In April 2012, hedge fund insiders observed unusual activity in the credit default swap market, believed to be linked to the trading positions of Bruno Iksil, a JPMorgan Chase trader known as the "London Whale." Other traders, including some within JPMorgan, reportedly placed bets against Iksil's positions.

May 2012: Initial Loss Report from JPMorgan Chase

In May 2012, JPMorgan Chase initially reported losses of $2 billion related to the trading activities of the "London Whale." The firm attempted to downplay the situation in early reports.

June 28, 2012: Ongoing Losses and Potential Impact

As of June 28, 2012, JPMorgan Chase's trading losses related to the "London Whale" incident were ongoing, with estimates suggesting potential losses could reach $9 billion in a worst-case scenario.

July 13, 2012: JPMorgan Chase Reports Increased Losses

On July 13, 2012, JPMorgan Chase disclosed that losses related to the "London Whale" trading incident had increased to $4.4 billion. The disclosure did not provide details about the specific trades involved.

July 23, 2012: Settlement for Credit Card Practices

On July 23, 2012, JPMorgan Chase agreed to pay $100 million to settle a class action lawsuit alleging that the bank unfairly increased minimum monthly payments on credit card balances, despite promising fixed interest rates.

November 2012: JPMorgan Ventures Energy Corporation's Market Manipulation Ends

JPMVEC's manipulative bidding activities in electricity markets, which began in September 2010, ended in November 2012. This period of manipulation would lead to a FERC investigation and a settlement in July 2013.

2012: Art Collection Expands to Over 30,000 Objects

By 2012, the JPMorgan Chase art collection, which began in 1959, grew to encompass over 30,000 pieces, with more than 6,000 being photography-related. The collection notably features a substantial number of works by Middle Eastern and North African artists.

2012: Charges for Misrepresentation

In 2012, JPMorgan Chase & Co faced charges for misrepresenting and failing to disclose information about speculative trades made by its Chief Investment Office (CIO). These trades resulted in significant losses for the bank and raised concerns about risk management practices.

July 2013: JPMorgan Ventures Energy Corporation Settles Market Manipulation Allegations

In July 2013, JPMorgan Ventures Energy Corporation (JPMVEC) agreed to pay $410 million in penalties and disgorgement to settle allegations of market manipulation in electricity markets from September 2010 to November 2012. JPMVEC was accused of engaging in manipulative bidding strategies to inflate payments from California and Midcontinent Independent System Operators.

August 2013: JPMorgan Chase Under Investigation for Mortgage-Backed Securities Offerings

In August 2013, JPMorgan Chase disclosed that it was being investigated by the Department of Justice for its offerings of mortgage-backed securities leading up to the financial crisis of 2007-2008. The investigation focused on potential violations of federal securities laws related to subprime and Alt-A residential mortgage securities from 2005 to 2007.

September 2013: JPMorgan Chase Investigated for Obstruction of Justice

In September 2013, following FERC's investigation into energy market manipulations, JPMorgan Chase faced scrutiny for potential obstruction of justice. The FBI and US Attorney's Office investigated whether employees withheld information or provided false statements during the FERC investigation. This sparked inquiries from senators and a Senate subcommittee.

September 18, 2013: JPMorgan Chase Agrees to $920 Million Settlement

On September 18, 2013, JPMorgan Chase reached a settlement with American and UK regulators, agreeing to pay $920 million in fines and penalties for violations connected to the "London Whale" trading losses and other incidents. The company acknowledged breaches of American securities law. This marked a rare instance of a major American financial institution publicly admitting to such violations.

September 19, 2013: Criminal Proceedings Initiated Against Traders

Following the September 18 settlement, criminal proceedings were initiated against two traders associated with the JPMorgan Chase case on September 19, 2013.

November 19, 2013: JPMorgan Chase Pays $13 Billion to Settle Mortgage-Backed Securities Investigations

On November 19, 2013, JPMorgan Chase agreed to a record $13 billion settlement with the Justice Department. The settlement addressed investigations into the bank's practices related to mortgage-backed securities in the lead-up to the 2007-2008 financial crisis. The settlement included penalties, fines, and consumer relief, with a significant portion attributed to conduct at Bear Stearns and Washington Mutual before their acquisition in 2008.

2013: JPMorgan Chase Holds Largest Credit Derivatives Portfolio Among U.S. Banks

By 2013, JPMorgan Chase had become the leading U.S. bank in terms of the total notional amount of credit default swaps and credit derivatives in its portfolio.

2013: Acquisition of Bloomspot

In 2013, J.P. Morgan acquired Bloomspot, a San Francisco-based startup. However, shortly after the acquisition, the service was shut down, and Bloomspot's talent was left unused.

2013: Launch of Global Health Investment Fund

In 2013, JPMorgan Chase, in collaboration with the Bill and Melinda Gates Foundation, GlaxoSmithKline, and the Children's Investment Fund, launched a $94 million Global Health Investment Fund. The fund aimed to support late-stage healthcare technology trials addressing issues like malaria, tuberculosis, HIV/AIDS, and maternal and infant mortality.

2013: JPMorgan Chase in Talks Over Madoff Scandal Compliance

In the fall of 2013, JPMorgan Chase engaged in discussions with prosecutors and regulators regarding its compliance with anti-money laundering and know-your-customer regulations related to the Madoff scandal.

2013: JPMorgan Chase's Bribery Scheme Ends

JPMorgan Chase's systematic bribery scheme in Hong Kong, which began in 2006, ended in 2013. This scheme involved hiring individuals connected to Chinese officials in exchange for business deals, ultimately leading to a $264 million settlement in November 2016.

January 7, 2014: JPMorgan Chase Pays $2.05 Billion in Madoff Scandal Settlement

On January 7, 2014, JPMorgan Chase agreed to pay $2.05 billion in fines and penalties to resolve civil and criminal charges stemming from its involvement in the Madoff scandal. The bank was charged with Bank Secrecy Act violations but agreed to reforms and cooperation with the government. A shareholder lawsuit alleged that JPMorgan Chase ignored warnings about Madoff's fraud, leading to a separate settlement. The bank also reached a settlement with the Office of the Comptroller of the Currency and with the trustee overseeing Madoff's company's liquidation.

July 2014: JPMorgan Chase Data Breach Discovered

JPMorgan Chase's security team discovered the attack in late July 2014, though it wasn't fully contained until mid-August.

September 2014: JPMorgan Chase Data Breach

In September 2014, JPMorgan Chase disclosed that a data breach had compromised the accounts of over 83 million customers.

October 2014: Sale of Commodities Trading Unit

J.P. Morgan sold its commodities trading unit to Mercuria for $800 million in October 2014. The sale price was significantly lower than the initial valuation due to the exclusion of certain assets.

2014: JPMorgan Chase's Political Contributions Favor Republicans

In 2014, JPMorgan Chase's Political Action Committee (PAC) and employees contributed $2.6 million to federal campaigns. The majority of these contributions, 62%, went to Republican candidates and committees.

December 2015: Conviction of Jean-Bernard Lafonta

Jean-Bernard Lafonta, a former executive, was convicted in December 2015 for disseminating false information and engaging in insider trading. Lafonta received a 1.5 million euro fine.

2015: JPMorgan Chase's PAC Supports House Democrats Who Voted for Spending Bill

JPMorgan Chase's PAC provided financial support to 38 House Democrats who voted in favor of a spending bill in 2015. This support came after the PAC had donated to these Democrats' campaigns in the 2014 election cycle.

March 2016: Decision to Halt Financing of Coal Projects

In March 2016, J.P. Morgan decided to stop financing coal mines and power plants in developed countries.

October 2016: Unveiling of Quorum Blockchain Platform

J.P. Morgan launched its permissioned blockchain platform, Quorum, in October 2016. Built on Ethereum's programming language, Quorum was designed for secure and transparent transactions.

November 2016: JPMorgan Chase Settles Bribery Case for $264 Million

In November 2016, JPMorgan Chase agreed to pay $264 million in fines to settle charges related to a bribery scheme that took place between 2006 and 2013. The bank was accused of securing business in Hong Kong by hiring relatives and friends of Chinese officials in exchange for deals, generating over $100 million in revenue.

December 2016: Trial of Former Wendel Executives for Tax Fraud

December 2016 saw the start of a trial involving 14 former executives from investment firm Wendel, who were accused of tax fraud. J.P. Morgan faced scrutiny for its potential role in the alleged scheme.

2016: JPMorgan Chase Criticized for Fossil Fuel Investments Despite Paris Agreement

JPMorgan Chase faced criticism for investing $75 billion in companies expanding fossil fuel projects, including fracking and Arctic exploration, between 2016 and the first half of 2019, despite the Paris climate change agreement.

January 2017: United States Sues JPMorgan Chase for Mortgage Discrimination

In January 2017, the United States government filed a lawsuit against JPMorgan Chase, alleging that the bank discriminated against black and Hispanic mortgage borrowers between 2006 and at least 2009. The lawsuit claimed that thousands of borrowers were affected by the bank's discriminatory practices.

March 2017: Lawrence Obracanik Pleads Guilty to Theft

Lawrence Obracanik, a former employee of J.P. Morgan, pleaded guilty in March 2017 to stealing over $5 million from the company to settle personal debts.

June 2017: Departure of COO Matt Zames

Matt Zames, J.P. Morgan's COO at the time, left the firm in June 2017.

December 2017: Lawsuit by Nigerian Government

The Nigerian government filed a lawsuit against J.P. Morgan in December 2017, seeking $875 million that was allegedly transferred to a corrupt former minister. Nigeria claimed J.P. Morgan was "grossly negligent" in the matter.

2017: JPMorgan Chase Opens Global Operations Center in Warsaw

In late 2017, JPMorgan Chase expanded its global presence by establishing a new global operations center in Warsaw, Poland.

July 2018: Dimon's Criticism of Immigration Policies and JPMorgan Chase's Investment

Despite Jamie Dimon's public criticism of the US government's strict immigration policies, JPMorgan Chase, under his leadership, held $1.6 million worth of stock in Sterling Construction, a company contracted to build a wall on the US-Mexico border, as of July 2018. This apparent contradiction raised concerns about the bank's actions conflicting with its CEO's statements.

December 26, 2018: JPMorgan Chase Pays $135 Million to Settle ADR Charges

On December 26, 2018, JPMorgan Chase agreed to pay over $135 million to settle charges brought by the SEC for mishandling "pre-released" American depositary receipts (ADRs). The settlement included disgorgement of ill-gotten gains, prejudgment interest, and a penalty.

2018: JPMorgan Chase Announces Plans for New Headquarters at 270 Park Avenue

JPMorgan Chase unveiled plans in 2018 to demolish their existing headquarters building at 270 Park Avenue and replace it with a taller, more modern structure. The new headquarters will provide significantly more space for employees.

February 2019: Launch of JPM Coin

J.P. Morgan announced the launch of JPM Coin in February 2019, a digital token designed to settle transactions between clients of its wholesale payments business. This marked the first cryptocurrency issued by a U.S. bank.

January 2020: Leaked JPMorgan Chase Report Warns of "Catastrophic Outcomes" from Climate Change

In early 2020, an internal JPMorgan Chase study titled "Risky business: the climate and macroeconomy" was leaked. The report, authored by bank economists and dated January 14, 2020, cautioned about the potential for catastrophic consequences from climate change. Despite the report's origins, JPMorgan Chase distanced itself from its findings.

May 14, 2020: JPMorgan Chase Accused of Insufficient Action on Human Rights Violations

On May 14, 2020, the Financial Times reported that JPMorgan Chase, along with other financial institutions, was accused of not doing enough to address human rights violations within its investments. The report highlighted concerns about companies' treatment of employees, supply chains, and stakeholders during the COVID-19 pandemic. JPMorgan Chase responded by stating that it takes human rights violations very seriously and may scrutinize or divest from companies with alleged or proven violations.

September 2020: JPMorgan Chase Settles Market Manipulation Charges

In September 2020, JPMorgan Chase admitted to manipulating precious metals futures and government bond markets over eight years. They settled with U.S. authorities for $920 million, entered a deferred prosecution agreement for three years, and avoided criminal charges.

April 19, 2021: JP Morgan's Involvement in the European Super League

On April 19, 2021, JP Morgan pledged $5 billion to finance the European Super League, a controversial plan to form a breakaway group of top European football clubs. The plan was met with widespread backlash from fans and stakeholders, who criticized it as an attempt to create a closed and elitist competition. JP Morgan eventually apologized for its role in the failed project.

June 2021: Investment in Brazilian Digital Bank C6

JPMorgan Chase made a significant investment in the Brazilian digital bank C6 in June 2021, acquiring a 40% stake in the company. The exact amount of the investment was not publicly disclosed.

September 2021: Entry into UK Retail Banking Market

JPMorgan Chase launched an app-based current account under the Chase brand in September 2021, marking its entry into the UK retail banking market and its first retail banking operation outside of the United States.

October 21, 2021: JPMorgan Chase Joins Net-Zero Banking Alliance

On October 21, 2021, JPMorgan Chase announced its commitment to supporting the global transition to net-zero emissions by joining the Net-Zero Banking Alliance.

November 2021: Acquisition of The Infatuation

JPMorgan Chase acquired The Infatuation, the restaurant recommendation website and owner of Zagat, in November 2021.

2021: C6 Bank's Growth Since 2021

Since 2021, C6 Bank has grown its customer base from 8 million to 25 million and expanded its loan portfolio from R$9.5 billion (approximately $2 billion) to R$40 billion (approximately $8.2 billion). This growth demonstrates the rapid expansion of digital banking in Brazil.

2021: Demolition of JPMorgan Chase's Former Headquarters Completed

The demolition of JPMorgan Chase's old headquarters at 270 Park Avenue was finalized in the spring of 2021, paving the way for the construction of their new headquarters building.

March 2022: Acquisition of Global Shares

In March 2022, JPMorgan Chase announced its plan to acquire Global Shares, a cloud-based provider of share plan software management.

May 20, 2022: Use of Blockchain for Collateral Settlements

JPMorgan Chase conducted collateral settlements using blockchain technology on May 20, 2022, representing a significant step in the adoption of blockchain technology within traditional financial markets.

September 2022: Acquisition of Renovite Technologies

JPMorgan Chase acquired Renovite Technologies, a California-based payments technology company, in September 2022. This strategic acquisition was part of JPMorgan's efforts to strengthen its position in the rapidly growing payments processing sector and compete more effectively with fintech companies.

November 2022: Attendance at Global Financial Leaders' Investment Summit in Hong Kong

Daniel Pinto, JPMorgan Chase's COO, attended the Global Financial Leaders' Investment Summit in Hong Kong in November 2022, despite criticism from some US lawmakers who urged American financial executives to boycott the event due to political concerns related to Hong Kong.

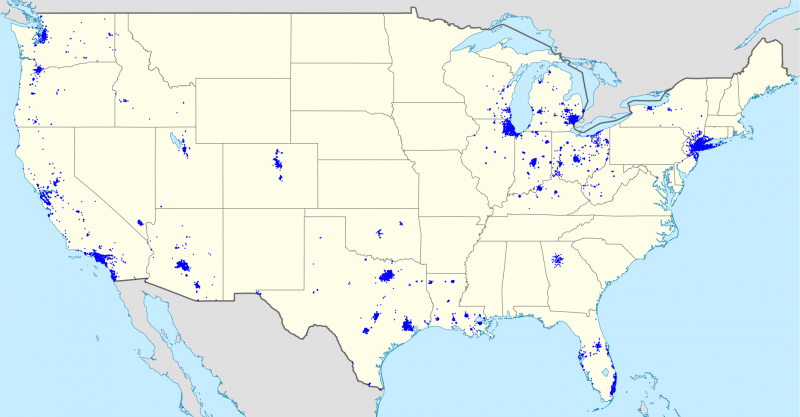

November 24, 2022: JPMorgan Chase Sued for Allegedly Benefiting from Jeffrey Epstein's Sex Trafficking

On November 24, 2022, JPMorgan Chase and Deutsche Bank were sued by two women who accused Jeffrey Epstein of sex trafficking. The lawsuit alleged that the banks knowingly benefited from and ignored Epstein's illegal activities by allowing him to use his accounts to finance them.

May 1, 2023: Acquisition of First Republic Bank

On May 1, 2023, JPMorgan Chase acquired the substantial majority of assets and deposits of First Republic Bank, marking the second largest bank failure in U.S. history. The deal included a $10.6 billion payment to the FDIC and the return of $25 billion in funds deposited by other banks.

May 2023: Development of IndexGPT AI Tool

CNBC reported in May 2023 that JPMorgan Chase was developing an AI-powered tool called IndexGPT for investment advisors. This tool would utilize artificial intelligence and cloud computing to provide investment recommendations to clients, showcasing the bank's commitment to integrating AI into its services.

May 2023: JPMorgan Chase Invests $200 Million in Carbon Credits for Carbon Dioxide Removal

In May 2023, JPMorgan Chase announced a $200 million investment in carbon credits, representing 800,000 metric tons of carbon dioxide removal. This investment supports multiple companies involved in carbon capture technology. This move follows JPMorgan Chase's previous commitment to the Frontier CDR initiative, aiming to advance the carbon dioxide removal industry.

June 2023: JPMorgan Chase Settles Class-Action Lawsuit Related to Jeffrey Epstein

In June 2023, JPMorgan Chase agreed to a $290 million settlement in a class-action lawsuit alleging their involvement in Jeffrey Epstein's sex trafficking operation. The lawsuit claimed the bank turned a blind eye to Epstein's activities.

September 2023: JPMorgan Chase Settles with U.S. Virgin Islands over Jeffrey Epstein Ties

JPMorgan Chase reached a $75 million settlement in September 2023 with the United States Virgin Islands Department of Justice. The settlement resolves allegations that the bank facilitated and failed to report Jeffrey Epstein's illegal activities.

December 2023: Institutional Investors Hold Majority Stake in JPMorgan Chase

As of December 2023, over 70% of JPMorgan Chase's shares were owned by institutional investors, indicating their significant influence on the bank.

2023: JPMorgan Chase & Co.: A Financial Powerhouse

As of 2023, JPMorgan Chase & Co. secured its position as the largest bank in the United States and globally based on market capitalization. Its significant influence led to its recognition as systemically important by the Financial Stability Board.

2023: Increased Stake in Brazilian Digital Bank C6

JPMorgan Chase increased its ownership stake in the Brazilian digital bank C6 to 46% in 2023. Since JPMorgan's initial investment in 2021, C6 experienced significant growth, expanding its customer base from 8 million to 25 million and growing its loan portfolio substantially.

2023: JPMorgan Chase Tops the Charts

JPMorgan Chase secured the top spot on the Forbes Global 2000 ranking in 2023. Despite its success, it has faced criticism for its risk management, financing activities, and legal settlements.

April 24, 2024: Russian Court Orders Seizure of JPMorgan Chase Assets

On April 24, 2024, a Russian court ordered the seizure of $439.5 million of JPMorgan Chase's funds. This action was taken in response to a lawsuit by VTB Bank, a Russian state-owned bank, seeking to reclaim assets frozen under international sanctions imposed due to the conflict in Ukraine. JPMorgan Chase counter-sued, citing their inability to access VTB's assets in the U.S.

2025: Relocation to a New Headquarters

JPMorgan Chase is scheduled to relocate its headquarters to the currently under-construction JPMorgan Chase Building at 270 Park Avenue in 2025.

2025: JPMorgan Chase's New Headquarters at 270 Park Avenue Slated for Completion

The construction of JPMorgan Chase's new headquarters at 270 Park Avenue in New York City is expected to be completed in 2025. Once finished, the building will house a large portion of the company's workforce.

Mentioned in this timeline

Chase Bank is the consumer and commercial banking arm of...

Ukraine is a country in Eastern Europe the second-largest on...

Jeffrey Epstein was an American financier and convicted sex offender...

Nigeria is a West African nation the most populous in...

California is a U S state on the Pacific Coast...

Ethereum is a decentralized open-source blockchain platform notable for its...

Trending

12 minutes ago Oklahoma Sooners Honor Buddy Hield and 2016 Final Four Team.

13 minutes ago Moldova's Veterinary Education to modernize through the EDUVET European Project for enhancement.

13 minutes ago Brendan Fraser as Eisenhower in 'Pressure': D-Day drama unfolds with weather worries.

13 minutes ago Cade Cunningham's 42 Points Leads Pistons Over Knicks; Brunson's Performance Notable.

13 minutes ago Usha Vance's diaper request sparks controversy during pregnancy: A novel approach?

1 hour ago Learner Tien at Delray Beach Open: Fritz ousted, Paul advances, Korda previewed.

Popular

Jesse Jackson is an American civil rights activist politician and...

Barack Obama the th U S President - was the...

Bernie Sanders is a prominent American politician currently serving as...

Ken Paxton is an American politician and lawyer serving as...

Michael Joseph Jackson the King of Pop was a highly...

Randall Adam Fine is an American politician a Republican who...