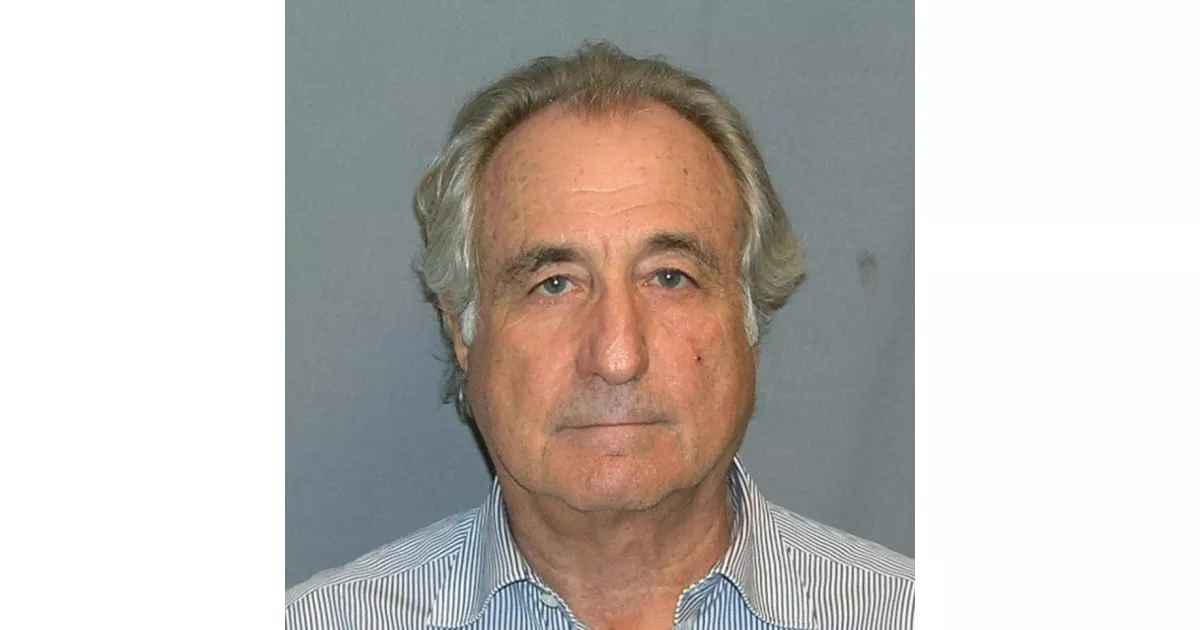

Bernard Madoff was the architect of the largest Ponzi scheme in history, estimated at $65 billion. Once chairman of the NASDAQ, Madoff operated his scheme through his firm's asset management business, promising consistently high returns to investors while using new investor money to pay off existing ones. This fraudulent activity defrauded thousands of individuals, charities, pension funds, and other organizations and led to significant financial losses and widespread repercussions within the financial industry. Madoff's scheme collapsed during the 2008 financial crisis, leading to his arrest and subsequent conviction.

April 29, 1938: Bernard Madoff's Birth

On April 29, 1938, Bernard Lawrence Madoff was born. He later became known as the mastermind of the largest Ponzi scheme in history.

1956: Madoff Graduates High School

In 1956, Bernard Madoff graduated from Far Rockaway High School.

1958: Ruth Alpern graduates high school

In 1958, Ruth Alpern, who would later marry Bernard Madoff, graduated from high school.

November 28, 1959: Madoff Married Ruth Alpern

On November 28, 1959, Bernard Madoff married Ruth Alpern.

1960: Madoff Founded Investment Securities LLC

In 1960, Bernard Madoff founded Bernard L. Madoff Investment Securities LLC, a broker-dealer for penny stocks, using $5,000 he earned as a lifeguard and sprinkler installer, and a $50,000 loan from his father-in-law.

1960: Madoff Founded Brokerage

In 1960, Bernard Madoff founded a penny stock brokerage that eventually grew into Bernard L. Madoff Investment Securities.

1960: Madoff Graduates from Hofstra

In 1960, Bernard Madoff graduated from Hofstra University with a Bachelor of Arts in political science.

1964: Early Suspicions of Madoff's Fraud

An investigator charged with reconstructing Madoff's scheme believes that the fraud was well underway as early as 1964.

1964: Birth of Mark Madoff

In 1964, Mark Madoff, son of Bernard and Ruth Madoff, was born.

1966: Birth of Andrew Madoff

In 1966, Andrew Madoff, son of Bernard and Ruth Madoff, was born.

1973: Carmine Persico becomes boss of the Colombo crime family

In 1973, Carmine Persico became boss of the Colombo crime family, one of New York's five American Mafia families.

1980: Madoff Purchases Oceanfront Home

In 1980, Bernard Madoff purchased an ocean-front residence in Montauk, New York, for $250,000.

1986: Mark Madoff graduates from the University of Michigan

In 1986, Mark Madoff graduated from the University of Michigan.

1988: Andrew Madoff graduates from University of Pennsylvania

In 1988, Andrew Madoff graduated from University of Pennsylvania's Wharton Business School.

1991: Madoffs' Political Contributions Begin

From 1991 to 2008, Bernie and Ruth Madoff contributed approximately $240,000 to federal candidates, parties, and committees.

1991: Ponzi scheme begins

In 1991, Bernie Madoff admitted to starting his Ponzi scheme, falsely claiming he made legitimate investments and instead depositing funds into a Chase Manhattan Bank account, using new deposits to pay existing clients.

1991: Donations to the Democratic party

Since 1991, Madoff and his wife gave over $230,000 to political causes, with the bulk going to the Democratic Party.

1992: First Fraud Investigation

In 1992, Madoff's name first came up in a fraud investigation when two people complained to the SEC about investments they made with Avellino & Bienes.

1992: SEC investigations since 1992

Since 1992, The SEC had six investigations into Madoff that were mishandled due to staff incompetence or ignoring financial experts and whistle-blowers.

1997: Weinstein Leaves Hadassah

As of 1997, when Sheryl Weinstein left Hadassah, Hadassah had invested a total of $40 million with Bernie Madoff.

1999: Markopolos informs SEC about Madoff's impossible gains

In 1999, financial analyst Harry Markopolos informed the SEC that Madoff's claimed gains were legally and mathematically impossible to achieve, suspecting fraud within minutes. He mathematically proved the fraud after four hours.

2000: Madoffs' Donations to SIFMA

From 2000 to 2008, the Madoff brothers donated $56,000 directly to SIFMA.

2000: SEC Ignores Markopolos' Evidence

In 2000, the SEC's Boston office ignored Harry Markopolos' evidence of Madoff's fraud.

2001: Markopolos Discovers Impossibility of Madoff's Strategy

As early as 2001, Harry Markopolos discovered that Madoff's strategy would have required buying more options on the Chicago Board Options Exchange than existed. Suzanne Murphy balked at investing due to insufficient trading volume.

2001: Arvedlund Questions Madoff's Investment Performance

In 2001, Erin Arvedlund publicly questioned Madoff's reported investment performance, suggesting the actual fraud amount might never be known but was likely between $12 and $20 billion.

2001: Madoff's Firm Incorporates

In 2001, after 41 years as a sole proprietorship, the Madoff firm incorporated as a limited liability company, with Madoff as the sole shareholder.

2001: SEC Ignores Markopolos' Evidence Again

In 2001, the SEC's Boston office ignored Harry Markopolos' evidence of Madoff's fraud again.

2001: Madoff's Sons, Brother, and Niece Accused of Negligence

Trustee Picard sued Madoff's sons, Mark and Andrew, his brother Peter, and Peter's daughter, Shana for negligence and breach of fiduciary duty, for $198 million. The defendants had received over $80 million in compensation since 2001.

March 2003: Andrew Madoff Diagnosed with Lymphoma

In March 2003, Andrew Madoff was diagnosed with mantle cell lymphoma.

2003: Swanson Meets Shana Madoff

In 2003, Eric Swanson met Shana Madoff while investigating her uncle Bernie Madoff and his firm.

2003: Madoff Claims He Could Have Been Caught

In 2003, according to Madoff's statements while awaiting sentencing, the SEC's investigators acted like "Lt. Columbo" and never asked the right questions, which allowed him to continue his fraud. He stated that they never looked at his stock records, and it would have been easy to see the Ponzi scheme if they checked with the Depository Trust Company.

2004: SEC Investigation of Madoff

In 2004, Genevievette Walker-Lightfoot, a lawyer in the SEC, found inconsistencies in Madoff's business but was told to stop the investigation.

2005: Madoffs' Contributions to DSCC

From 2005 through 2008, the Madoffs contributed $25,000 a year to the Democratic Senatorial Campaign Committee.

2005: SEC Ignores Further Evidence Presented by Markopolos

In 2005, Meaghan Cheung at the SEC's New York office ignored Harry Markopolos when he presented further evidence of Madoff's fraud.

2005: SEC Investigation Concluded

In 2005, the SEC investigation on Madoff's firm was concluded.

2006: Swanson Leaves SEC

In 2006, Eric Swanson left the SEC.

2007: Swanson and Shana Madoff Marry

In 2007, Eric Swanson and Shana Madoff married.

2007: SEC Ignores Further Evidence Presented by Markopolos Again

In 2007, Meaghan Cheung at the SEC's New York office ignored Harry Markopolos again when he presented further evidence of Madoff's fraud.

January 2008: Andrew Madoff Chairs Lymphoma Research Foundation

In January 2008, Andrew Madoff was named chairman of the Lymphoma Research Foundation.

December 10, 2008: Madoff's Sons Expose Ponzi Scheme

On December 10, 2008, Madoff's sons, Mark and Andrew, informed authorities about their father's confession of the asset management unit being a massive Ponzi scheme.

December 11, 2008: Madoff's Arrest

On December 11, 2008, Bernard Madoff was arrested, marking the end of his tenure as chairman of Bernard L. Madoff Investment Securities.

December 2008: Madoff Posts Bail and is Monitored

In December 2008, Madoff posted $10 million bail and remained under 24-hour monitoring and house arrest in his Upper East Side penthouse apartment. Prosecutors filed asset forfeiture pleadings, listing Madoff's valuable properties and financial interests.

December 2008: Peter Madoff Resigns from SIFMA

In December 2008, Peter Madoff resigned from the board of directors of SIFMA as news of the Ponzi scheme broke.

December 2008: Madoff Confides in Son About Redemption Struggles

In the first week of December 2008, Madoff confided to a senior employee, one of his sons, that he was struggling to meet $7 billion in redemptions. His Chase account dwindled to $234 million by late November, a fraction of the outstanding requests. He told assistant Frank DiPascali he was finished on December 3rd and informed his brother Peter about the fraud on December 9th.

2008: Hadassah Withdraws Funds

By the end of 2008, Hadassah had withdrawn more than $130 million from its Madoff accounts.

2008: Madoffs' Political Contributions End

From 1991 to 2008, Bernie and Ruth Madoff contributed approximately $240,000 to federal candidates, parties, and committees.

2008: Bongiorno's testimony about Madoff's fraud

In 2008, Bongiorno, who spent over 40 years with Madoff, told investigators that she was doing "the same things she was doing in 2008" when she first joined the firm.

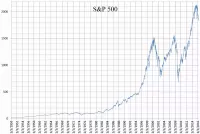

2008: Madoff Securities Ranking

In 2008, Madoff Securities was the sixth-largest market maker in S&P 500 stocks.

2008: Irish regulators failed to uncover Madoff's fraud

In 2008, the Central Bank of Ireland failed to spot Madoff's gigantic fraud when he started using Irish funds and had to supply large amounts of information, which would have been enough to enable Irish regulators to uncover the fraud much earlier.

2008: Madoff's Suicide Attempt

On Christmas Eve 2008, Ruth Madoff claimed that she and Bernard attempted suicide after his fraud was exposed, both taking a bunch of pills in a suicide pact.

February 2009: Madoff Accepts Lifetime Ban from Securities Industry

In February 2009, Madoff reached an agreement with the SEC, accepting a lifetime ban from the securities industry. Trustee Picard sued Madoff's family for negligence and breach of fiduciary duty.

March 12, 2009: Madoff Pleads Guilty

On March 12, 2009, Bernard Madoff pleaded guilty to 11 federal felonies, admitting to turning his wealth management business into a Ponzi scheme.

March 13, 2009: Madoff's Net Worth Filing

According to a March 13, 2009, filing by Bernard Madoff, he and his wife were worth up to $126 million, plus an estimated $700 million for the value of his business interest in Bernard L. Madoff Investment Securities LLC.

March 2009: Madoff Admits to Ponzi Scheme

During his guilty plea in March 2009, Madoff admitted that the essence of his scheme was depositing client money into a bank account instead of investing it, using funds from other clients to pay those requesting redemptions.

March 20, 2009: Appeal Denied, Madoff Remains in Jail

On March 20, 2009, an appellate court denied Madoff's request to be released from jail and returned to home confinement until his sentencing.

June 17, 2009: Madoff Claims Friendship with SEC Officials

In an interview on June 17, 2009, Madoff stated that SEC Chairman Mary Schapiro was a "dear friend" and SEC Commissioner Elisse Walter was a "terrific lady" whom he knew "pretty well".

June 22, 2009: Defense Requests 12-Year Sentence

On June 22, 2009, Madoff's lawyer hand-delivered a pre-sentencing letter to the judge requesting a sentence of 12 years, based on life expectancy tables.

June 26, 2009: Assets Forfeited, Wife Agrees to Forfeit Assets

On June 26, 2009, Judge Chin ordered forfeiture of $170 million in Madoff's assets. Madoff's wife, Ruth, agreed to forfeit her claim to $85 million in assets, retaining $2.5 million in cash, and Massachusetts regulators accused her of withdrawing $15 million from company-related accounts shortly before his confession.

June 29, 2009: Madoff Sentenced to Prison

On June 29, 2009, Bernard Madoff was sentenced to 150 years in prison, the maximum sentence allowed for his crimes.

September 2009: Homes Auctioned by U.S. Marshals

In September 2009, all three of Bernard Madoff's homes were auctioned by the U.S. Marshals Service.

September 27, 2009: Sheehan States Amounts Invested and Missing

On September 27, 2009, David Sheehan, chief counsel to trustee Picard, stated that about $36 billion was invested, with $18 billion returned and $18 billion missing.

October 13, 2009: First prison fight

On October 13, 2009, it was reported that Madoff experienced his first prison yard fight with another inmate, also a senior citizen.

October 2009: Civil Lawsuit Filed Against Madoff Family

In October 2009, a civil lawsuit was filed alleging that Peter Madoff deposited $32,146 into his Madoff accounts and withdrew over $16 million, Andrew deposited almost $1 million and withdrew $17 million, and Mark deposited $745,482 and withdrew $18.1 million.

November 2009: Accounting Front Man Pleads Guilty

In November 2009, David G. Friehling, Madoff's accounting front man, pleaded guilty to multiple charges, admitting to rubber-stamping Madoff's filings. He cooperated extensively with prosecutors. Frank DiPascali pleaded guilty to 10 federal charges.

December 18, 2009: Hospitalized for facial injuries

On December 18, 2009, Madoff was moved to Duke University Medical Center in Durham, North Carolina, and was treated for several facial injuries, possibly stemming from an altercation with another inmate.

December 24, 2009: Affidavit about his injuries

On December 24, 2009, The Federal Bureau of Prisons said Madoff signed an affidavit indicating that he had not been assaulted and that he had been admitted to the hospital for hypertension.

December 11, 2010: Mark Madoff Suicide

On the morning of December 11, 2010, exactly two years after Bernard Madoff's arrest, his son Mark was found dead in his New York City apartment, with the cause of death ruled as suicide by hanging.

2010: Mark Madoff's Death

In 2010, Mark Madoff passed away.

May 4, 2011: Picard Updates on Amounts Owed and Recovered

In a statement on May 4, 2011, trustee Picard said that the total amount owed to customers was $57 billion, with $17.3 billion actually invested. $7.6 billion had been recovered, but only $2.6 billion was available to repay victims. The IRS ruled that investors' capital losses would be treated as business losses for tax deduction purposes.

November 2011: Kugel Pleads Guilty

In November 2011, former Madoff employee David Kugel pleaded guilty to charges related to creating a phony paper trail for Madoff's scheme.

2012: Peter Madoff Sentenced

In 2012, Peter Madoff, Bernard Madoff's brother, was sentenced to 10 years in prison for his involvement in the Ponzi scheme.

December 2013: Madoff Suffers Heart Attack

In December 2013, Bernard Madoff had a heart attack and reportedly had end-stage renal disease (ESRD).

January 2014: Madoff claims to have kidney cancer

In January 2014, Bernard Madoff claimed in an email to CNBC that he had kidney cancer, but this was unconfirmed.

September 3, 2014: Andrew Madoff's Death

On September 3, 2014, Andrew Madoff, Bernard Madoff's son, died of lymphoma.

2014: Andrew Madoff's Death

In 2014, Andrew Madoff passed away.

May 2015: Friehling Sentenced; DiPascali Dies

In May 2015, David Friehling was sentenced to one year of home detention and one year of supervised release due to his cooperation. Frank DiPascali died of lung cancer before he could be sentenced.

November 9, 2017: U.S. Government Begins Paying Madoff Victims

On November 9, 2017, the U.S. government announced that it would begin paying out $772.5 million from the Madoff Victim Fund to over 24,000 victims. The Madoff Recovery Initiative reported $14.418 billion in total recoveries and settlement agreements.

July 29, 2019: Request for reduced sentence or pardon

On July 29, 2019, Madoff asked Donald Trump for a reduced sentence or pardon, to which the White House and Donald Trump made no comment.

December 2019: Hospitalized for kidney failure

In December 2019, Madoff was hospitalized for chronic kidney failure.

February 2020: Request for compassionate release

In February 2020, Madoff's lawyer filed for compassionate release from prison, claiming he had chronic kidney failure and that the COVID-19 pandemic further threatened his life. The request was denied.

February 2020: Madoff had chronic kidney failure

In February 2020, it was revealed that Madoff had chronic kidney failure.

April 14, 2021: Bernard Madoff's Death

On April 14, 2021, Bernard Madoff, the infamous financial criminal behind a $65 billion Ponzi scheme and former chairman of the Nasdaq, died.

February 17, 2022: Madoff's Sister and Husband Found Dead

On February 17, 2022, Bernard Madoff's sister, Sondra Weiner, and her husband, Marvin, were found dead in their home with gun wounds, labeled as a potential murder-suicide.

2024: $5,000 equivalent to $53,000

In 1960, Madoff used $5,000 to found a firm, which is equivalent to $53,000 in 2024.

Mentioned in this timeline

CNBC is an American business news channel owned by Versant...

JPMorgan Chase Co incorporated in Delaware and headquartered in New...

Christmas is an annual festival celebrated on December th commemorating...

The S P is a stock market index that tracks...

Pennsylvania is a U S state located in the Mid-Atlantic...

News encompasses information about current events disseminated through various media...

Trending

55 minutes ago Ryan Gosling to Host SNL for the Fourth Time on March 7th

Michael Zheng is an American professional tennis player He reached his highest ATP singles ranking of world No on March...

56 minutes ago Kalshi Offers NBA & College Basketball Predictions with Promo Codes for Bonuses.

56 minutes ago Escalating tensions: Israel strikes near Beirut, Hezbollah warns, officer wounded in Lebanon.

2 hours ago Scott Jennings faces criticism for Iran comments, igniting MAGA civil war.

2 hours ago Tyus Jones joins Denver Nuggets, boosting guard depth for upcoming season.

Popular

Ken Paxton is an American politician and lawyer serving as...

Markwayne Mullin is an American politician and businessman serving as...

Hillary Diane Rodham Clinton is a prominent American politician lawyer...

Jim Carrey is a Canadian-American actor and comedian celebrated for...

Jesse Jackson is an American civil rights activist politician and...

Bill Clinton served as the nd U S President from...