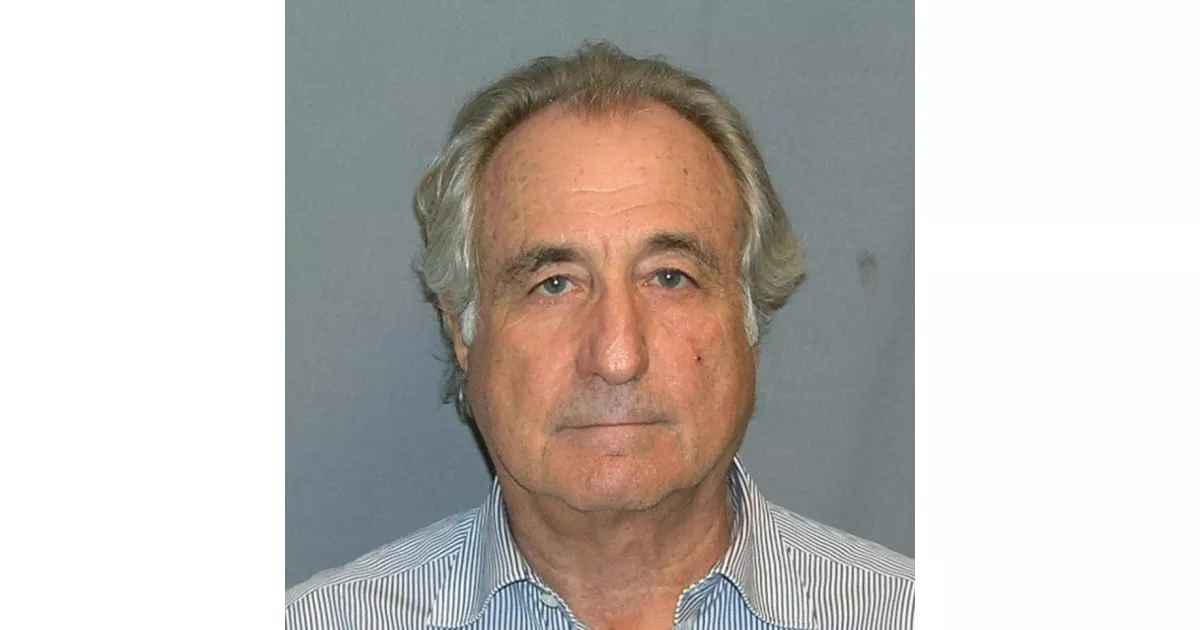

A closer look at the defining struggles that shaped Bernie Madoff's life and career.

Bernard Madoff was the architect of the largest Ponzi scheme in history, estimated at $65 billion. Once chairman of the NASDAQ, Madoff operated his scheme through his firm's asset management business, promising consistently high returns to investors while using new investor money to pay off existing ones. This fraudulent activity defrauded thousands of individuals, charities, pension funds, and other organizations and led to significant financial losses and widespread repercussions within the financial industry. Madoff's scheme collapsed during the 2008 financial crisis, leading to his arrest and subsequent conviction.

1992: SEC investigations since 1992

Since 1992, The SEC had six investigations into Madoff that were mishandled due to staff incompetence or ignoring financial experts and whistle-blowers.

1999: Markopolos informs SEC about Madoff's impossible gains

In 1999, financial analyst Harry Markopolos informed the SEC that Madoff's claimed gains were legally and mathematically impossible to achieve, suspecting fraud within minutes. He mathematically proved the fraud after four hours.

2000: SEC Ignores Markopolos' Evidence

In 2000, the SEC's Boston office ignored Harry Markopolos' evidence of Madoff's fraud.

2001: Markopolos Discovers Impossibility of Madoff's Strategy

As early as 2001, Harry Markopolos discovered that Madoff's strategy would have required buying more options on the Chicago Board Options Exchange than existed. Suzanne Murphy balked at investing due to insufficient trading volume.

2001: Arvedlund Questions Madoff's Investment Performance

In 2001, Erin Arvedlund publicly questioned Madoff's reported investment performance, suggesting the actual fraud amount might never be known but was likely between $12 and $20 billion.

2001: SEC Ignores Markopolos' Evidence Again

In 2001, the SEC's Boston office ignored Harry Markopolos' evidence of Madoff's fraud again.

March 2003: Andrew Madoff Diagnosed with Lymphoma

In March 2003, Andrew Madoff was diagnosed with mantle cell lymphoma.

2003: Madoff Claims He Could Have Been Caught

In 2003, according to Madoff's statements while awaiting sentencing, the SEC's investigators acted like "Lt. Columbo" and never asked the right questions, which allowed him to continue his fraud. He stated that they never looked at his stock records, and it would have been easy to see the Ponzi scheme if they checked with the Depository Trust Company.

2005: SEC Ignores Further Evidence Presented by Markopolos

In 2005, Meaghan Cheung at the SEC's New York office ignored Harry Markopolos when he presented further evidence of Madoff's fraud.

2007: SEC Ignores Further Evidence Presented by Markopolos Again

In 2007, Meaghan Cheung at the SEC's New York office ignored Harry Markopolos again when he presented further evidence of Madoff's fraud.

December 2008: Madoff Posts Bail and is Monitored

In December 2008, Madoff posted $10 million bail and remained under 24-hour monitoring and house arrest in his Upper East Side penthouse apartment. Prosecutors filed asset forfeiture pleadings, listing Madoff's valuable properties and financial interests.

December 2008: Madoff Confides in Son About Redemption Struggles

In the first week of December 2008, Madoff confided to a senior employee, one of his sons, that he was struggling to meet $7 billion in redemptions. His Chase account dwindled to $234 million by late November, a fraction of the outstanding requests. He told assistant Frank DiPascali he was finished on December 3rd and informed his brother Peter about the fraud on December 9th.

2008: Irish regulators failed to uncover Madoff's fraud

In 2008, the Central Bank of Ireland failed to spot Madoff's gigantic fraud when he started using Irish funds and had to supply large amounts of information, which would have been enough to enable Irish regulators to uncover the fraud much earlier.

February 2009: Madoff Accepts Lifetime Ban from Securities Industry

In February 2009, Madoff reached an agreement with the SEC, accepting a lifetime ban from the securities industry. Trustee Picard sued Madoff's family for negligence and breach of fiduciary duty.

March 20, 2009: Appeal Denied, Madoff Remains in Jail

On March 20, 2009, an appellate court denied Madoff's request to be released from jail and returned to home confinement until his sentencing.

June 26, 2009: Assets Forfeited, Wife Agrees to Forfeit Assets

On June 26, 2009, Judge Chin ordered forfeiture of $170 million in Madoff's assets. Madoff's wife, Ruth, agreed to forfeit her claim to $85 million in assets, retaining $2.5 million in cash, and Massachusetts regulators accused her of withdrawing $15 million from company-related accounts shortly before his confession.

October 13, 2009: First prison fight

On October 13, 2009, it was reported that Madoff experienced his first prison yard fight with another inmate, also a senior citizen.

December 18, 2009: Hospitalized for facial injuries

On December 18, 2009, Madoff was moved to Duke University Medical Center in Durham, North Carolina, and was treated for several facial injuries, possibly stemming from an altercation with another inmate.

December 24, 2009: Affidavit about his injuries

On December 24, 2009, The Federal Bureau of Prisons said Madoff signed an affidavit indicating that he had not been assaulted and that he had been admitted to the hospital for hypertension.

July 29, 2019: Request for reduced sentence or pardon

On July 29, 2019, Madoff asked Donald Trump for a reduced sentence or pardon, to which the White House and Donald Trump made no comment.

December 2019: Hospitalized for kidney failure

In December 2019, Madoff was hospitalized for chronic kidney failure.

February 2020: Request for compassionate release

In February 2020, Madoff's lawyer filed for compassionate release from prison, claiming he had chronic kidney failure and that the COVID-19 pandemic further threatened his life. The request was denied.

Mentioned in this timeline

CNBC is an American business news channel owned by Versant...

JPMorgan Chase Co incorporated in Delaware and headquartered in New...

Christmas is an annual festival celebrated on December th commemorating...

The S P is a stock market index that tracks...

Pennsylvania is a U S state located in the Mid-Atlantic...

News encompasses information about current events disseminated through various media...

Trending

58 minutes ago Ryan Gosling to Host SNL for the Fourth Time on March 7th

Michael Zheng is an American professional tennis player He reached his highest ATP singles ranking of world No on March...

59 minutes ago Kalshi Offers NBA & College Basketball Predictions with Promo Codes for Bonuses.

59 minutes ago Escalating tensions: Israel strikes near Beirut, Hezbollah warns, officer wounded in Lebanon.

2 hours ago Scott Jennings faces criticism for Iran comments, igniting MAGA civil war.

2 hours ago Tyus Jones joins Denver Nuggets, boosting guard depth for upcoming season.

Popular

Ken Paxton is an American politician and lawyer serving as...

Markwayne Mullin is an American politician and businessman serving as...

Hillary Diane Rodham Clinton is a prominent American politician lawyer...

Jim Carrey is a Canadian-American actor and comedian celebrated for...

Jesse Jackson is an American civil rights activist politician and...

Bill Clinton served as the nd U S President from...