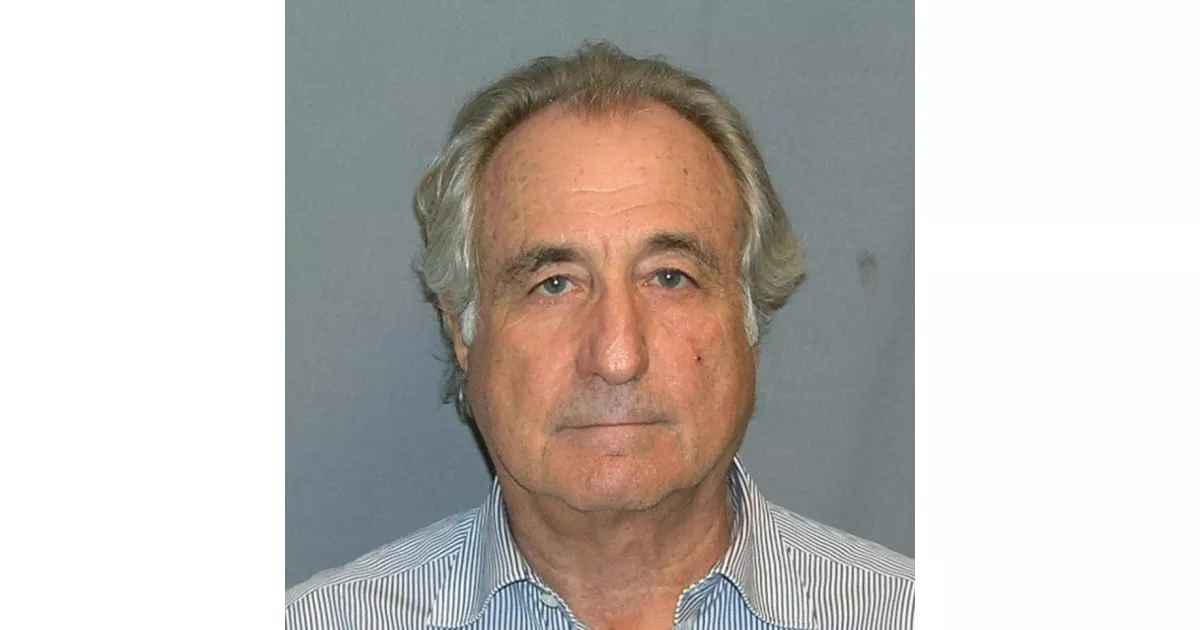

Discover the career path of Bernie Madoff, from the first major opportunity to industry-changing achievements.

Bernard Madoff was the architect of the largest Ponzi scheme in history, estimated at $65 billion. Once chairman of the NASDAQ, Madoff operated his scheme through his firm's asset management business, promising consistently high returns to investors while using new investor money to pay off existing ones. This fraudulent activity defrauded thousands of individuals, charities, pension funds, and other organizations and led to significant financial losses and widespread repercussions within the financial industry. Madoff's scheme collapsed during the 2008 financial crisis, leading to his arrest and subsequent conviction.

1960: Madoff Founded Investment Securities LLC

In 1960, Bernard Madoff founded Bernard L. Madoff Investment Securities LLC, a broker-dealer for penny stocks, using $5,000 he earned as a lifeguard and sprinkler installer, and a $50,000 loan from his father-in-law.

1960: Madoff Founded Brokerage

In 1960, Bernard Madoff founded a penny stock brokerage that eventually grew into Bernard L. Madoff Investment Securities.

1991: Ponzi scheme begins

In 1991, Bernie Madoff admitted to starting his Ponzi scheme, falsely claiming he made legitimate investments and instead depositing funds into a Chase Manhattan Bank account, using new deposits to pay existing clients.

1991: Donations to the Democratic party

Since 1991, Madoff and his wife gave over $230,000 to political causes, with the bulk going to the Democratic Party.

1999: Markopolos informs SEC about Madoff's impossible gains

In 1999, financial analyst Harry Markopolos informed the SEC that Madoff's claimed gains were legally and mathematically impossible to achieve, suspecting fraud within minutes. He mathematically proved the fraud after four hours.

2001: Markopolos Discovers Impossibility of Madoff's Strategy

As early as 2001, Harry Markopolos discovered that Madoff's strategy would have required buying more options on the Chicago Board Options Exchange than existed. Suzanne Murphy balked at investing due to insufficient trading volume.

2001: Madoff's Firm Incorporates

In 2001, after 41 years as a sole proprietorship, the Madoff firm incorporated as a limited liability company, with Madoff as the sole shareholder.

January 2008: Andrew Madoff Chairs Lymphoma Research Foundation

In January 2008, Andrew Madoff was named chairman of the Lymphoma Research Foundation.

December 11, 2008: Madoff's Arrest

On December 11, 2008, Bernard Madoff was arrested, marking the end of his tenure as chairman of Bernard L. Madoff Investment Securities.

2008: Madoff Securities Ranking

In 2008, Madoff Securities was the sixth-largest market maker in S&P 500 stocks.

February 2009: Madoff Accepts Lifetime Ban from Securities Industry

In February 2009, Madoff reached an agreement with the SEC, accepting a lifetime ban from the securities industry. Trustee Picard sued Madoff's family for negligence and breach of fiduciary duty.

Mentioned in this timeline

CNBC is an American business news channel owned by Versant...

JPMorgan Chase Co incorporated in Delaware and headquartered in New...

Christmas is an annual festival celebrated on December th commemorating...

The S P is a stock market index that tracks...

Pennsylvania is a U S state located in the Mid-Atlantic...

News encompasses information about current events disseminated through various media...

Trending

22 minutes ago Oklahoma Braces as Tornado and Severe Thunderstorm Warnings Sweep Through the State

22 minutes ago Severe Tornadoes Threaten Plains, Texas, and Iowa; Flash Floods Possible in North Texas.

22 minutes ago John Carlson Traded: Ducks Acquire Veteran Defenseman From Capitals in NHL Deal

23 minutes ago Ted Season 2 premieres on Peacock, continuing Seth MacFarlane's comedic legacy.

1 hour ago Rui Hachimura's performance, Lakers' tiebreakers, and his demand after wins examined.

1 hour ago Suns defeat Kings 114-103; Booker and Green seek chemistry in victory.

Popular

Ken Paxton is an American politician and lawyer serving as...

Markwayne Mullin is an American politician and businessman serving as...

Hillary Diane Rodham Clinton is a prominent American politician lawyer...

Jim Carrey is a Canadian-American actor and comedian celebrated for...

Jesse Jackson is an American civil rights activist politician and...

Bill Clinton served as the nd U S President from...