Thoma Bravo is a prominent American private equity firm specializing in acquiring and growing enterprise software companies. Headquartered in Chicago, Illinois, the firm manages over $130 billion in assets as of 2023. It focuses on long-term value creation through operational improvements and strategic investments within the software sector, establishing itself as a major player in the technology investment landscape.

1980: Establishment of Golder Thoma & Co.

In 1980, Stanley Golder and Carl Thoma established Golder Thoma & Co, which is credited with creating the "consolidation" or "buy and build" investment strategy.

1984: Bryan Cressey Joins the Firm

In 1984, Bryan Cressey was recruited to join Golder Thoma & Co. from First Chicago, and the firm's name was changed to Golder Thoma Cressey.

1998: Firm Split

In 1998, the firm split into two firms: GTCR Golder Rauner and Thoma Cressey Equity Partners.

2002: Acquisition of Prophet 21

In 2002, Thoma Cressey Equity Partners began investing in the enterprise software sector with the acquisition of Prophet 21, a software provider for durable goods distributors.

2003: Software deals and Portfolio

Since 2003, Thoma Bravo has completed over 300 software deals and oversees a portfolio of over 40 software companies.

2008: Renaming to Thoma Bravo

In 2008, Thoma Cressey Bravo was renamed Thoma Bravo after Bryan Cressey left the company.

2014: Acquisition of Riverbed Technology

In 2014, Thoma Bravo acquired Riverbed Technology for $3.6 billion.

September 2016: Closing of 12th Fund

In September 2016, Thoma Bravo closed its 12th fund with $7.6 billion.

2017: Launch of Private Credit Platform

In 2017, Thoma Bravo launched a private credit platform, which focuses on investments in software and technology companies.

2018: Taking Barracuda Networks Private

In 2018, Thoma Bravo took cloud-first security provider Barracuda Networks private for $1.6 billion.

January 2019: Acquisition of Imperva

In January 2019, Thoma Bravo acquired Imperva for $2.1 billion.

January 2019: Announcement of 13th Fund

In January 2019, Thoma Bravo announced that it raised $12.6 billion for its 13th fund.

March 2020: Acquisition of Sophos

In March 2020, Thoma Bravo completed its $3.9 billion acquisition of Sophos.

October 2020: Launch of 14th Fund

In October 2020, Thoma Bravo launched its 14th fund, raising $17.8 billion.

2020: Portfolio of Software Companies

As of 2020, Thoma Bravo oversaw a portfolio of over 70 software companies.

2020: Controversy over Instructure Purchase

In 2020, after Thoma Bravo's purchase of edtech company Instructure, the purchase was criticized as "rushed" and "riddled by conflicts of interest" by a large shareholder.

June 2021: Investment in FTX

In June 2021, Thoma Bravo invested $125 million into FTX.

July 2021: Acquisition of Greenphire LLC

In July 2021, Thoma Bravo acquired clinical payment technology provider, Greenphire LLC.

August 31, 2021: Acquisition of Proofpoint

On August 31, 2021, Thoma Bravo completed its $12.3 billion acquisition of Proofpoint.

September 2021: Acquisition of Stamps.com

In September 2021, Thoma Bravo completed the acquisition of Stamps.com, an e-commerce shipping service provider, for approximately $6.6 billion in cash.

October 2021: Acquisition of Medallia

In October 2021, Thoma Bravo took enterprise software company Medallia private for $6.4 billion.

December 2021: Riverbed Bankruptcy

In December 2021, Riverbed Technology, which Thoma Bravo had acquired in 2014, filed for Chapter 11 Bankruptcy.

2021: Peak Number of Acquisitions

In 2021, Thoma Bravo made the highest number of acquisitions valued at over $58 billion.

March 2022: Acquisition of Anaplan

In March 2022, Thoma Bravo acquired the enterprise cloud software company Anaplan for $10.7 billion (€9.6bn).

April 2022: Sale of Barracuda Networks to KKR

In April 2022, Thoma Bravo sold Barracuda Networks to KKR for about $4 billion, having taken it private in 2018.

May 2022: Acquisition of Bottomline Technologies

In May 2022, Thoma Bravo acquired Bottomline Technologies for $2.6 billion.

June 2022: Completion of Anaplan Acquisition

In June 2022, Thoma Bravo completed the acquisition of Anaplan, after cutting the takeover offer down to $10.4 billion, alleging Anaplan violated acquisition terms by overpaying new hires.

August 2022: Agreement to Buy Nearmap

In August 2022, Thoma Bravo agreed to buy Nearmap, its first Australian acquisition, for A$1.06 billion (US$730 million).

December 2022: Acquisition of Coupa Software

In December 2022, Thoma Bravo outbid Vista Equity Partners to announce its acquisition of Coupa Software for $6.15 billion in cash, with a total enterprise value of $8 billion.

December 2022: Raising of 15th Fund

In December 2022, Thoma Bravo raised $24.3 billion for its 15th fund, which Preqin called the largest tech-focused buyout fund raised by an independent private-equity firm.

2022: Market Correction

In 2022 the market faced correction after tech valuations peaked in 2021.

2022: Series of Security Related Investments

In 2022, Thoma Bravo made a series of security related investments, including the acquisition of SailPoint for $6.9 billion in April, an agreement to buy Ping Identity for $2.8 billion in August, and an agreement to buy ForgeRock for $2.3 billion in October.

February 2023: Lawsuit Following FTX Collapse

Following the collapse of FTX, in February 2023, Thoma Bravo, Paradigm Operations and Sequoia Capital were sued for allegedly making “materially false and misleading statements" while promoting FTX and "aided and abetted the misconduct that led to the collapse of the FTX Entities.”

June 2023: PEI 300 Ranking

In June 2023, Private Equity International placed Thoma Bravo fourth on the PEI 300 ranking of the largest private equity firms.

June 2023: Agreement to Divest Adenza to Nasdaq, Inc.

In June 2023, Thoma Bravo agreed to divest Adenza to Nasdaq, Inc. for $10.5 billion in a cash-and-stock deal, acquiring a 15 percent stake in Nasdaq.

July 2023: Sale of Imperva to Thales Group

In July 2023, Thoma Bravo sold Imperva to Thales Group for $3.6 billion, after acquiring it in January 2019.

July 2023: Software Deals

As of July 2023, Thoma Bravo had completed over 440 software deals.

September 2023: Sale of Exostar to Arlington Capital Partners

In September 2023, Arlington Capital Partners announced it had bought Exostar, a software company, from Thoma Bravo for an undisclosed amount.

November 2023: Acquisition of NextGen Healthcare

In November 2023, Thoma Bravo acquired health-records software company NextGen Healthcare for a total enterprise value of $1.8 billion.

2023: Assets under management

As of 2023, Thoma Bravo has over $130 billion in assets under management.

2023: Acquisition of Magnet Forensics and Merger with Grayshift

In 2023, Thoma Bravo acquired Canada-based digital investigation software maker Magnet Forensics for CA$1.8 billion (US$1.34bn) and merged it with Grayshift, a digital forensics firm in its existing portfolio.

February 2024: Fortune Analysis of Top Private Equity Investors in Tech

In February 2024, Fortune published an analysis of the top ten private equity investors in tech of 2021, highlighting that Thoma Bravo made the highest number of acquisitions valued at over $58 billion during that year. Additionally, it was mentioned that Thoma Bravo's 14th and 15th funds had lower performance, while the 13th fund saw some big exits.

March 2024: Agreement to Take Everbridge Private

In March 2024, Thoma Bravo agreed to take Everbridge, a provider of critical event management software, private for approximately $1.8 billion.

April 2024: Agreement to Acquire Darktrace

In April 2024, Thoma Bravo agreed to acquire Darktrace, a UK-based cybersecurity company, in a private transaction valued at $5.3 billion.

June 2024: PEI 300 Ranking

In June 2024, Thoma Bravo was ranked seventh on Private Equity International's PEI 300 ranking.

December 2024: Acquisition of Majority Stake in USU Product Business

In December 2024, Thoma Bravo completed the acquisition of a majority stake in USU Product Business, an IT management solutions provider, planning to invest additionally in the company.

2024: Cessation of Cryptocurrency Investments

In 2024, Orlando Bravo stated that the firm would cease making further cryptocurrency investments due to the fallout from FTX.

Mentioned in this timeline

Cryptocurrency is a digital currency operating on a decentralized network...

Florida a state in the Southeastern United States is largely...

Miami is a major coastal city located in Florida United...

Chicago is the most populous city in Illinois and the...

Canada is a North American country the second largest in...

The Nasdaq Stock Market is a major American stock exchange...

Trending

6 minutes ago ASU defeats Utah, court rejects Trump tariff refund slowdown attempt.

6 minutes ago The Office stars reunited at the 2026 Actor Awards in Los Angeles.

7 minutes ago Anthony Edwards Shines as Timberwolves Defeat Grizzlies; Named NBA Player of Week

7 minutes ago Wembanyama's plea aids in finding missing Elijah Hoard at O'Hare airport.

7 minutes ago Lindsey Graham Predicts Cuba Next After Iran Strikes, Regime Collapse Imminent

7 minutes ago Ja Morant's potential return this season as he continues to battle injuries.

Popular

Hillary Diane Rodham Clinton is a prominent American politician lawyer...

Jesse Jackson is an American civil rights activist politician and...

Ken Paxton is an American politician and lawyer serving as...

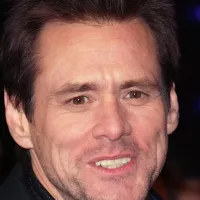

Jim Carrey is a Canadian-American actor and comedian celebrated for...

Bill Clinton served as the nd U S President from...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...