Cryptocurrency is a digital currency operating on a decentralized network, independent of central authorities like governments or banks. This design aims for secure and transparent transactions verified by cryptography. Stablecoins, a type of cryptocurrency, may rely on governmental regulations to maintain a stable value. Cryptocurrencies utilize blockchain technology. Bitcoin, launched in 2009, was the first cryptocurrency and remains the most well known. Cryptocurrency's decentralized nature offers potential advantages such as lower transaction fees and increased privacy.

1983: David Chaum conceived ecash

In 1983, David Chaum conceived of ecash, a type of cryptographic electronic money.

1995: Digicash Implementation

In 1995, David Chaum implemented ecash through Digicash, an early form of cryptographic electronic payments requiring user software.

October 1996: NSA paper published in MIT mailing list

In October 1996, the National Security Agency published a paper entitled How to Make a Mint: The Cryptography of Anonymous Electronic Cash in an MIT mailing list, describing a cryptocurrency system.

April 1997: NSA paper published in The American Law Review

In April 1997, the National Security Agency's paper entitled How to Make a Mint: The Cryptography of Anonymous Electronic Cash, describing a cryptocurrency system, was published in The American Law Review.

1998: Description of b-money and bit gold

In 1998, Wei Dai described "b-money," an anonymous, distributed electronic cash system, and Nick Szabo described bit gold.

1999: Comparison to Dot-Com Bubble

In 1999, Cryptocurrencies have been compared to the dot-com bubble, along with Ponzi schemes and pyramid schemes.

2008: Bitcoin's Innovation

After the early innovation of Bitcoin in 2008, tokens, cryptocurrencies, and other digital assets that were not Bitcoin became collectively known as "altcoins".

2008: Satoshi Nakamoto on Cryptocurrency and Libertarianism

In 2008, Bitcoin's founder, Satoshi Nakamoto, expressed the view that cryptocurrencies align well with libertarianism, stating that they could be very attractive to the libertarian viewpoint if properly explained.

January 2009: Bitcoin Creation

In January 2009, Bitcoin was created by pseudonymous developer Satoshi Nakamoto using the SHA-256 cryptographic hash function in its proof-of-work scheme.

2009: Bitcoin's initial release

In 2009, Bitcoin, the first cryptocurrency, was released as open-source software.

2009: Introduction of Bitcoin Mining

Since Bitcoin was introduced in 2009, mining has been the validation of transactions on a blockchain. The rate of generating hashes, which validate any transaction, has been increased by the use of specialized hardware such as FPGAs and ASICs running complex hashing algorithms like SHA-256 and scrypt.

2009: Concerns About Cryptocurrencies as Tools for Web Criminals

Since the inception of bitcoin in 2009, as the popularity and demand for online currencies has increased, so have concerns that the unregulated person to person global economy that cryptocurrencies offer may become a threat to society. Concerns abound that altcoins may become tools for anonymous web criminals.

April 2011: Namecoin Creation

In April 2011, Namecoin was created as an attempt at forming a decentralized DNS.

October 2011: Litecoin Release

In October 2011, Litecoin was released, using scrypt as its hash function instead of SHA-256.

2011: Cryptocurrency Market Retraction

In 2011, the cryptocurrency market experienced a period of retraction.

August 2012: Peercoin Creation

In August 2012, Peercoin was created, using a hybrid of proof-of-work and proof-of-stake.

October 2013: Original Silk Road Shut Down

In October 2013, the original Silk Road was shut down. In the year following the initial shutdown, the number of prominent dark markets increased from four to twelve, while the amount of drug listings increased from 18,000 to 32,000.

2013: Cryptocurrency Bubble

In 2013, the cryptocurrency market experienced a bubble.

February 2014: First Bitcoin ATM in the United States Launched

In February 2014, Jordan Kelley launched the first bitcoin ATM in the United States. The kiosk was installed in Austin, Texas, and it included scanners to read government-issued identification to confirm users' identities.

February 2014: Mt. Gox Declares Bankruptcy After Losing 750,000 Bitcoins

In February 2014, Mt. Gox, the world's largest bitcoin exchange, declared bankruptcy after claiming it had lost nearly 750,000 bitcoins belonging to clients, worth $473 million. The price of a bitcoin fell from a high of about $1,160 in December to under $400 in February.

March 2014: IRS Rules Bitcoin as Property for Tax Purposes

On March 25, 2014, the United States Internal Revenue Service (IRS) classified bitcoin as property for tax purposes. This ruling meant virtual currencies are treated as commodities subject to capital gains tax.

August 2014: UK Treasury Commissions Cryptocurrency Study

On 6 August 2014, the UK announced its Treasury had commissioned a study of cryptocurrencies and what role, if any, they could play in the UK economy, as well as considering regulation.

2014: Banks Refusing Virtual Currency Services

In 2014, Gareth Murphy suggested that cryptocurrency adoption could obscure money flows, hindering economic steering. Cryptocurrencies lack consumer protection against fraud, unlike credit cards.

2014: Cryptocurrency Market Crash

In 2014, the cryptocurrency market experienced a crash.

September 2015: Establishment of Ledger Academic Journal

In September 2015, the establishment of the peer-reviewed academic journal Ledger was announced, covering studies of cryptocurrencies and related technologies.

January 2016: Estimated Addition of CO2 to Atmosphere

From 1 January 2016 to 30 June 2017, proof-of-work blockchains added between 3 million and 15 million tons of carbon dioxide to the atmosphere.

2016: Ethereum Largest Altcoin Following

According to the New York Times, Ethereum had the largest "following" of any altcoin in 2016.

June 2017: Estimated Addition of CO2 to Atmosphere

From 1 January 2016 to 30 June 2017, proof-of-work blockchains added between 3 million and 15 million tons of carbon dioxide to the atmosphere.

September 2017: China Banned ICOs

In September 2017, China banned Initial Coin Offerings (ICOs), which caused an abnormal return from cryptocurrency decreasing during the announcement window. The liquidity changes by banning ICOs in China was temporarily negative while the liquidity effect became positive after news.

November 2017: Tether Hacked, Loses $31 Million in USDT

On November 21, 2017, Tether announced it experienced a security breach and lost $31 million in USDT from its core treasury wallet.

December 2017: Youbit Files for Bankruptcy After Hacks

On December 19, 2017, Yapian, the owner of South Korean exchange Youbit, declared bankruptcy after suffering two hacks that year. Customers were still granted access to 75% of their assets.

December 2017: Nicehash Hacked, Over $70 Million Stolen

On December 7, 2017, Slovenian cryptocurrency exchange Nicehash reported that hackers had stolen over $70 million by hijacking a company computer.

2017: Comparisons to Ponzi Schemes and Economic Bubbles

In 2017, Howard Marks compared digital currencies to pyramid schemes and economic bubbles, such as the tulip mania (1637), South Sea Bubble (1720), and dot-com bubble (1999).

2017: Bitcoin Price Inflation Using Tether

In 2017, a paper by John Griffin and Amin Shams found that the price of bitcoin had been substantially inflated using another cryptocurrency, Tether.

2017: Increased Demand for Graphics Cards

In 2017, an increase in cryptocurrency mining increased the demand for graphics cards (GPU).

2017: Cryptocurrency Bubble

In 2017, the cryptocurrency market experienced a bubble.

January 2018: Coincheck Hacked, $530 Million in Cryptocurrency Stolen

In January 2018, Japanese exchange Coincheck reported a massive hack, with $530 million worth of cryptocurrency stolen.

January 2018: Cryptocurrency Market Overview

In January 2018, an overview of the top 10 cryptocurrencies by total value in circulation showed initial market leaders.

February 2018: Chinese Government Halts Trading of Virtual Currency

As of February 2018, the Chinese government has halted trading of virtual currency, banned initial coin offerings, and shut down mining.

March 2018: Plattsburgh Moratorium on Crypto Mining

In March 2018, the city of Plattsburgh, New York put an 18-month moratorium on all cryptocurrency mining.

March 2018: Cryptocurrency Added to Merriam-Webster Dictionary

In March 2018, the word cryptocurrency was added to the Merriam-Webster Dictionary.

May 2018: Bitcoin Gold Suffers Transaction Hijacking and Delisting

In May 2018, Bitcoin Gold had its transactions hijacked, resulting in exchanges losing an estimated $18 million. Bitcoin Gold was subsequently delisted from Bittrex after refusing to cover its share of the damages.

June 2018: Hydro Quebec Proposed Power Allocation for Crypto Mining

In June 2018, Hydro Quebec proposed to the provincial government to allocate 500 megawatts of power to crypto companies for mining.

June 2018: Coinrail Hacked, Cryptocurrency Selloff Worsens

In June 2018, South Korean exchange Coinrail was hacked, resulting in losses exceeding $37 million in cryptocurrency. The hack contributed to an additional $42 billion selloff in the cryptocurrency market.

July 2018: Bancor Hacked, $23.5 Million in Crypto Stolen

On July 9, 2018, the exchange Bancor experienced a security breach, resulting in the theft of $23.5 million worth of cryptocurrency. The Bancor code and fundraising efforts had been subjects of controversy.

September 2018: Homero Josh Garza Sentenced for Cryptocurrency Pyramid Scheme

On September 13, 2018, Homero Josh Garza was sentenced to 21 months in prison for operating a cryptocurrency pyramid scheme through his companies, GAW Miners and ZenMiner. He was also ordered to pay a judgment of $9.1 million plus $700,000 in interest to the SEC.

2018: Switzerland Issues Legal Guidelines for ICOs

In 2018, a legislative ICO working group in Switzerland began issuing legal guidelines intended to remove uncertainty from cryptocurrency offerings and establish sustainable business practices.

2018: Bitcoin Welfare Loss

In 2018, bitcoin's design caused a 1.4% welfare loss compared to an efficient cash system, with a large mining cost estimated to be US$360 million per year.

2018: Increase in crypto-related suicides noticed after market crash

In 2018, following the cryptocurrency market crash in August, there was an increase in crypto-related suicides, particularly in Korea.

2018: Bank for International Settlements Criticisms of Cryptocurrencies

In 2018, the Bank for International Settlements criticized cryptocurrencies for their price instability, high energy consumption, transaction costs, poor security, fraud at exchanges, vulnerability to debasement, and the influence of miners.

2018: UK Cryptocurrency Study Published

In 2018, the UK published its final report on the cryptocurrency study commissioned by the Treasury.

2018: Cryptocurrency Market Crash

In 2018, the cryptocurrency market experienced a crash.

July 2019: Bitcoin's Electricity Consumption

By July 2019, Bitcoin's electricity consumption was estimated to be approximately 7 gigawatts, around 0.2% of the global total, or equivalent to the energy consumed nationally by Switzerland.

2019: FINMA Issues Guidance to VASPs in Switzerland

In 2019, FINMA, the Swiss regulator, issued its own guidance to VASPs. The guidance followed the FATF's Recommendation 16, however with stricter requirements.

2019: Wash Trading on Cryptocurrency Exchanges

In 2019, a study concluded that up to 80% of trades on unregulated cryptocurrency exchanges could be wash trades and a report by Bitwise Asset Management claimed that 95% of all bitcoin trading volume reported on CoinMarketCap had been artificially generated.

2019: Over a Billion Dollars Worth of Cryptoassets Stolen

In 2019, more than a billion dollars worth of cryptoassets was reported stolen. Stolen assets "typically find their way to illegal markets and are used to fund further criminal activity".

May 2020: Publication of IVMS 101 by the Joint Working Group

In May 2020, the Joint Working Group on interVASP Messaging Standards published "IVMS 101", which is a universal common language for communication of required originator and beneficiary information between VASPs. The FATF and financial regulators were informed as the data model was developed.

June 2020: FATF Updates Guidance to Include Travel Rule

In June 2020, FATF updated its guidance to include the "Travel Rule" for cryptocurrencies, mandating that VASPs obtain, hold, and exchange information about the originators and beneficiaries of virtual asset transfers.

September 2020: European Commission Publishes Digital Finance Strategy

In September 2020, the European Commission published a digital finance strategy. This included a draft regulation on Markets in Crypto-Assets (MiCA), which aimed to provide a comprehensive regulatory framework for digital assets in the EU.

December 2020: IVMS 101 Data Model Still Not Finalized

As of December 2020, the IVMS 101 data model has yet to be finalized and ratified by the three global standard setting bodies that created it.

2020: EU Report Finds Crypto-asset Losses Due to Security Breaches

A 2020 EU report found that users had lost crypto-assets worth hundreds of millions of US dollars in security breaches at exchanges and storage providers.

2020: Attacks on Privacy in Cryptocurrencies

A recent 2020 study presented different attacks on privacy in cryptocurrencies, demonstrating how the anonymity techniques are not sufficient safeguards.

2020: US Attorney General's Cyber-Digital Task Force Report on Illicit Cryptocurrency Uses

According to a 2020 report produced by the United States Attorney General's Cyber-Digital Task Force, the majority of illicit cryptocurrency uses fall into three categories: financial transactions associated with the commission of crimes; money laundering; and crimes directly implicating the cryptocurrency marketplace itself.

2020: UK National Risk Assessment on Money Laundering and Terrorist Financing

According to the UK 2020 national risk assessment, the risk of using cryptoassets such as bitcoin for money laundering and terrorism financing is assessed as "medium".

2020: Arbitrage Opportunities in Crypto Markets

As of 2020, it was possible to arbitrage to find the difference in price across several cryptocurrency markets, as crypto marketplaces do not guarantee the optimal price.

2020: Altcoins Described

In 2020, Paul Vigna of The Wall Street Journal described altcoins as "alternative versions of Bitcoin". Also, as of early 2020, there were more than 5,000 cryptocurrencies.

2020: Dark Money Flowing into Russia through Hydra

In 2020, more than $1 billion in sales flowed into Russia through Hydra, a dark web marketplace powered by cryptocurrency, which demanded sellers liquidate cryptocurrency through specific regional exchanges.

2020: RenBridge Used for Laundering

Since 2020, RenBridge, an unregulated alternative to exchanges, has been responsible for the laundering of at least $540 million.

January 2021: Cryptocurrency Firms Must Register with FCA in the UK

As of 10 January 2021, all cryptocurrency firms in the United Kingdom must register with the Financial Conduct Authority.

January 2021: Mirror Trading International Disappears with $170 Million in Cryptocurrency

In January 2021, Mirror Trading International disappeared with $170 million worth of cryptocurrency.

January 2021: UK Consultation on Cryptoassets and Stablecoins

In January 2021, the UK issued a consultation on cryptoassets and stablecoins.

February 2021: BNY Mellon to Offer Cryptocurrency Services

On 11 February 2021, BNY Mellon announced that it would begin offering cryptocurrency services to its clients.

March 2021: South Korea Implements New Legislation to Strengthen Oversight of Digital Assets

In March 2021, South Korea implemented new legislation to strengthen their oversight of digital assets. This legislation requires all digital asset managers, providers and exchanges to be registered with the Korea Financial Intelligence Unit in order to operate in South Korea.

March 2021: Morgan Stanley to Offer Bitcoin Funds

On 17 March 2021, Morgan Stanley announced that they will be offering access to bitcoin funds for their wealthy clients through three funds which enable bitcoin ownership for investors with an aggressive risk tolerance.

April 2021: Africrypt Founders Disappear with $3.8 Billion in Bitcoin

In April 2021, the two founders of the African-based cryptocurrency exchange called Africrypt, Raees Cajee and Ameer Cajee, disappeared with $3.8 billion worth of bitcoin.

April 2021: Venmo Adds Support for Cryptocurrencies

On 20 April 2021, Venmo added support to its platform to enable customers to buy, hold and sell cryptocurrencies.

April 2021: Central Bank of the Republic of Turkey Bans Cryptocurrency Payments

On 30 April 2021, the Central Bank of the Republic of Turkey banned the use of cryptocurrencies and cryptoassets for making purchases on the grounds that the use of cryptocurrencies for such payments poses significant transaction risks.

May 2021: Treasury to Require Reporting of Cryptocurrency Transfers Over $10,000

In May 2021, The Department of the Treasury announced that it would require reporting any cryptocurrency transfer of $10,000 or more to the IRS. This measure aimed to combat illegal activities such as tax evasion facilitated by cryptocurrency.

May 2021: Study of Six Largest Proof-of-Stake Networks Concluded

In May 2021, a study of the six largest proof-of-stake networks concluded.

May 2021: China Bans Financial Institutions from Providing Cryptocurrency Services

On 18 May 2021, China banned financial institutions and payment companies from providing cryptocurrency transaction related services, leading to a sharp fall in the price of major cryptocurrencies.

June 2021: China Forces Out Bitcoin Operations

Before June 2021, China was the primary location for bitcoin mining. However, due to concerns over power usage and other factors, China forced out bitcoin operations, at least temporarily.

June 2021: Cryptocurrency Offered by US Wealth Managers for 401(k)s

By June 2021, cryptocurrency had begun to be offered by some wealth managers in the US for 401(k)s.

June 2021: El Salvador Adopts Bitcoin as Legal Tender

In June 2021, El Salvador became the first country to accept Bitcoin as legal tender, after the Legislative Assembly voted 62–22 to pass a bill submitted by President Nayib Bukele classifying the cryptocurrency as such.

June 2021: Basel Committee Proposes Stricter Capital Requirements for Banks Holding Cryptocurrency

On 10 June 2021, the Basel Committee on Banking Supervision proposed that banks that held cryptocurrency assets must set aside capital to cover all potential losses.

June 2021: Binance Ordered to Cease Regulated Activities in the UK

On 27 June 2021, the UK's Financial Conduct Authority (FCA) demanded that Binance cease all regulated activities in the UK.

July 2021: Senator Warren Demands Answers on Cryptocurrency Regulation

In July 2021, Senator Elizabeth Warren of the Senate Banking Committee, requested answers from the SEC chairman regarding cryptocurrency regulation due to increased cryptocurrency exchange usage and the potential consumer risks involved.

August 2021: Cuba Recognizes and Regulates Cryptocurrencies

In August 2021, Cuba followed El Salvador with Resolution 215 to recognize and regulate cryptocurrencies such as Bitcoin.

August 2021: SEC Chairman Calls for Legislation on Crypto Trading and DeFi Platforms

In August 2021, SEC Chairman Gary Gensler responded to Senator Warren's letter and advocated for legislation focused on "crypto trading, lending and DeFi platforms." Gensler highlighted the vulnerability of investors on crypto trading platforms without brokers and raised concerns about unregistered securities and stablecoins.

September 2021: China Declares All Cryptocurrency Transactions Illegal

In September 2021, the Chinese government declared all cryptocurrency transactions of any kind illegal, completing its crackdown on cryptocurrency.

September 2021: China Bans Cryptocurrency Transactions

In September 2021, the government of China, the single largest market for cryptocurrency, declared all cryptocurrency transactions illegal, completing a crackdown.

October 2021: Mastercard and Bakkt Partner on Cryptocurrency Services

In October 2021, Mastercard announced a partnership with Bakkt on a platform to allow banks and merchants on the Mastercard network to offer cryptocurrency services.

October 2021: First Bitcoin-Linked ETF Starts Trading

In October 2021, ProShares launched the first bitcoin-linked exchange-traded fund (ETF), "BITO", on the NYSE. This event marked a significant endorsement for the crypto industry, potentially opening opportunities for new capital and investors.

October 2021: Systemic Risk in Bitcoin Distribution

In October 2021, a paper by the National Bureau of Economic Research found that bitcoin suffers from systemic risk as the top 10,000 addresses control about one-third of all bitcoin in circulation and less than 2% of anonymous accounts control 95% of all available bitcoin supply.

December 2021: Monkey Kingdom NFT Project Loses US$1.3 Million to Phishing Attack

In December 2021, Monkey Kingdom, a NFT project based in Hong Kong, suffered a loss of US$1.3 million worth of cryptocurrencies due to a phishing link used by hackers.

2021: Chainalysis Report on Cryptocurrency Laundering

According to blockchain data company Chainalysis, criminals laundered US$8,600,000,000 worth of cryptocurrency in 2021, which is a 30% increase from the previous year. Almost $2.2bn worth of cryptocurrencies was embezzled from DeFi protocols in 2021, which represents 72% of all cryptocurrency theft in 2021.

2021: Cryptocurrency market value at $2 trillion

At the end of 2021, the total value of all cryptocurrencies was $2 trillion, but it halved nine months later.

2021: Bitcoin Energy Consumption Equivalent to Greece

By the end of 2021, bitcoin was estimated to produce 65.4 million tons of CO2, as much as Greece, and consume between 91 and 177 terawatt-hours annually.

2021: Chainalysis Report on Illicit Crypto Transactions

In 2021, Blockchain analysis company Chainalysis concluded that illicit activities like cybercrime, money laundering and terrorism financing made up only 0.15% of all crypto transactions conducted, representing a total of $14 billion.

2021: Cryptocurrency Businesses Under Suspicion

In 2021, Federation Tower in Moscow City housed cryptocurrency businesses like Garantex, Eggchange, and Suex, suspected of facilitating money laundering through scams and darknet markets. Suex was sanctioned by the U.S., and Bitzlato's founder was arrested on money-laundering charges.

2021: Kazakhstan Second-Biggest Crypto-Currency Mining Country

In 2021, Kazakhstan became the second-biggest crypto-currency mining country, producing 18.1% of the global exahash rate.

2021: Polytechnic University of Catalonia thesis

In 2021, a Polytechnic University of Catalonia thesis used a broader description, including not only alternative versions of bitcoin but every cryptocurrency other than bitcoin.

2021: Backlash Against Bitcoin Donations

In 2021, a backlash against bitcoin donations arose due to environmental emissions, leading some agencies to halt bitcoin acceptance and seek greener cryptocurrencies, including Greenpeace.

2021: Ransomware Revenue Affiliated with Russia

In 2021, approximately 74% of ransomware revenue, equivalent to over $400 million in cryptocurrency, was directed towards software strains with likely affiliations to Russia.

2021: Regulator Warnings Against Cryptocurrency

In 2021, research by the UK's financial regulator showed that warnings against cryptocurrency were either unheard or ignored, with many crypto users unaware of the lack of protection and falsely assuming regulation.

2021: Cryptocurrency Legal Status and Bans Worldwide

In 2021, the Library of Congress reported that 9 countries had an absolute ban on cryptocurrency trading or usage: Algeria, Bangladesh, Bolivia, China, Egypt, Iraq, Morocco, Nepal, and the United Arab Emirates. 39 other countries or regions had an implicit ban.

2021: Cryptocurrency Bubble

In 2021, the cryptocurrency market experienced a bubble.

January 2022: IMF Seeks Coordinated Approach to Supervising Cryptocurrencies

In a January 2022 interview, Tobias Adrian of the IMF stated that the IMF is seeking a coordinated, consistent and comprehensive approach to supervising cryptocurrencies.

February 2022: Department of Justice Names First Director of Cryptocurrency Enforcement Team

In February 2022, the Department of Justice appointed Eun Young Choi as the first director of a National Cryptocurrency Enforcement Team. This team was formed to address the misuse of cryptocurrencies and other digital assets.

March 2022: Biden Issues Executive Order on Digital Assets

On March 9, 2022, President Biden issued Executive Order 14067, Ensuring Responsible Development of Digital Assets. This order was later revoked on January 23, 2025, by President Trump.

April 2022: Virgil Griffith Sentenced for Pyongyang Presentation

In April 2022, Virgil Griffith received a five-year prison sentence in the US for attending a Pyongyang cryptocurrency conference, where he gave a presentation on blockchains which might be used for sanctions evasion.

May 2022: Cryptocurrency Prices Fall Due to Inflation Warnings

In May 2022, cryptocurrency prices experienced significant volatility, with Bitcoin losing 20% of its value and Ethereum losing 26% in one week. Solana and Cardano also fell 41% and 35% respectively. These declines were attributed to warnings about inflation.

May 2022: Reports of suicidal investors after Luna currency collapse

In May 2022, the collapse of the Luna currency operated by Terra led to reports of suicidal investors in crypto-related subreddits.

May 2022: TerraUSD (UST) Depegging

On 11 May 2022, Terra's stablecoin UST fell from $1 to 26 cents, leading to the failure of Terraform Labs and the loss of nearly $40B invested in the Terra and Luna coins.

June 2022: Bill Gates comments on cryptocurrency

In June 2022, Bill Gates stated that cryptocurrencies are "100% based on greater fool theory".

July 2022: Treasury Releases Framework for International Engagement on Digital Assets

On July 7, 2022, the Department of the Treasury released a Framework for International Engagement on Digital Assets. This framework was later revoked on January 23, 2025, by President Trump.

September 2022: Interpol Red Notice Requested for Do Kwon

In September 2022, South Korean prosecutors requested the issuance of an Interpol Red Notice against Terraform Labs' founder, Do Kwon.

September 2022: Ethereum "The Merge"

On 15 September 2022, Ethereum transitioned its consensus mechanism from proof-of-work (PoW) to proof-of-stake (PoS) in an upgrade process known as "the Merge".

September 2022: Release of Comprehensive Framework for Responsible Development of Digital Assets

On September 16, 2022, the Comprehensive Framework for Responsible Development of Digital Assets was released to support cryptocurrency development and restrict illegal use. It represents a significant milestone in US cryptocurrency regulation history.

November 2022: FTX Trading Ltd. Bankruptcy

On 11 November 2022, FTX Trading Ltd., a cryptocurrency exchange, filed for bankruptcy.

2022: RenBridge Responsible for Laundering of Funds

In 2022, RenBridge was found responsible for laundering at least $540 million since 2020 and was popular with people attempting to launder money from theft.

2022: Ukrainian government raises aid through cryptocurrency

In 2022, following the Russian invasion, the Ukrainian government raised over US$10,000,000 worth of aid through cryptocurrency.

2022: Cryptocurrency Market Overview

In early 2022, only four of the ten leading cryptocurrencies from January 2018 (bitcoin, Ethereum, Cardano and Ripple (XRP)) remained in the top positions.

February 2023: SEC Rules Kraken's Staked Assets as Illegal Securities Seller

In February 2023, the SEC determined that Kraken's staked assets, valued at approximately $42 billion, were operating as an illegal securities seller. Kraken agreed to a $30 million settlement and ceased its staking service in the US, impacting other major crypto exchanges with staking programs.

February 2023: Median Transaction Fees for Ether and Bitcoin

In February 2023, the median transaction fee for Ether corresponded to $2.2845, while for bitcoin it corresponded to $0.659.

March 2023: SEC Issues Alert on Crypto Asset Securities

On March 23, 2023, the SEC issued an alert to investors, cautioning that firms offering crypto asset securities might not be in compliance with U.S. laws, potentially lacking essential information for investors.

June 2023: Cryptocurrency Market Growth

As of June 2023, the cryptocurrency marketplace contained more than 25,000 cryptocurrencies, with over 40 having a market capitalization exceeding $1 billion.

November 2, 2023: Sam Bankman-Fried Found Guilty on Fraud Charges

On November 2, 2023, Sam Bankman-Fried was found guilty on seven counts of fraud related to FTX.

2023: IMF Working Paper on Crypto Mining Emissions

A 2023 IMF working paper found that crypto mining could generate 450 million tons of CO2 emissions by 2027, accounting for 0.7 percent of global emissions, or 1.2 percent of the world total.

2023: Cryptocurrency Market Crash

In 2023, the cryptocurrency market experienced a crash.

2023: Hong Kong Regulatory Framework for Stablecoins

In 2023, the expected regulatory framework for stablecoins in Hong Kong is being shaped and includes a few considerations.

2023: LiteBit Forced to Cease Operations

LiteBit, previously headquartered in the Netherlands, was forced to cease all operations on August 13th, 2023, "due to market changes and regulatory pressure".

March 28, 2024: Sam Bankman-Fried Sentenced to 25 Years in Prison

On March 28, 2024, the court sentenced Sam Bankman-Fried to 25 years in prison.

April 2024: Controversy Surrounds Cook Islands' Proposed Cryptocurrency Recovery Legislation

In April 2024, it was reported that the Cook Islands government was proposing legislation that would allow "recovery agents" to use various means, including hacking, to investigate cryptocurrency used for illegal means. The proposed legislation was criticized by officials for being flawed and potentially unconstitutional.

May 2024: US Congress Advances Bill for Digital Asset Regulatory Clarity

In May 2024, the US Congress advanced a bill called "The Financial Innovation and Technology for the 21st Century Act" to the full House of Representatives to provide regulatory clarity for digital assets, defining responsibilities between the CFTC and SEC.

June 2024: EU's Markets in Crypto-Assets (MiCA) Regulation Comes Into Force

On 30 June 2024, the EU regulation Markets in Crypto-Assets (MiCA) covering asset-referenced tokens (ARTs) and electronic money tokens (EMTs) (also known as stablecoins) came into force.

November 2024: Labour Government Confirms Proceeding with Cryptoasset Regulation

In November 2024, the incoming Labour government confirmed it will proceed with the regulation of cryptoassets, with new UK requirements expected to come into force in 2026.

December 2024: The Rest of MiCA Comes Into Force

As of 30 December 2024, the rest of MiCA came into force, covering crypto-assets other than ART and EMT and CASPs.

2024: Dogecoin Value Plunge

By mid-2024, the record-high value for Dogecoin of 73 cents had plunged to 13 cents.

January 2025: ESMA Issues Guidance to Crypto-Asset Service Providers

As of 17 January 2025, the European Securities and Markets Authority (ESMA) issued guidance to crypto-asset service providers (CASPs) allowing them to maintain crypto-asset services for non-compliant ARTs and EMTs until the end of March 2025.

January 2025: President Trump Revokes Order 14067 and Prohibits Central Bank Digital Currency

On January 23, 2025, President Donald Trump signed Executive Order 14178, which revoked Executive Order 14067 of March 9, 2022, and the Department of the Treasury's Framework for International Engagement on Digital Assets of July 7, 2022. The order also prohibits the establishment, issuance, or promotion of a Central Bank Digital Currency.

March 2025: CASPs Allowed to Maintain Crypto-Asset Services for Non-Compliant ARTs and EMTs

The European Securities and Markets Authority (ESMA) issued guidance to crypto-asset service providers (CASPs) allowing them to maintain crypto-asset services for non-compliant ARTs and EMTs until the end of March 2025.

April 2025: Cryptocurrency Market Cap

As of April 2025, the cryptocurrency market capitalization was estimated at $2.76 trillion.

2026: New UK Cryptoasset Requirements Expected to Come Into Force

In 2026, new cryptoasset requirements in the UK are expected to come into force, as the Labour government confirmed its commitment to regulating cryptoassets in November 2024.

2027: Projected CO2 Emissions from Crypto Mining

A 2023 IMF working paper projected that by 2027, crypto mining could generate 450 million tons of CO2 emissions, accounting for 0.7 percent of global emissions, or 1.2 percent of the world total.

Mentioned in this timeline

Bill Gates an American businessman and philanthropist revolutionized personal computing...

Ukraine is a country in Eastern Europe the second-largest on...

Elizabeth Warren is a prominent American politician and the senior...

Ethereum is a decentralized open-source blockchain platform notable for its...

India officially the Republic of India is a South Asian...

Hong Kong is a densely populated special administrative region of...

Trending

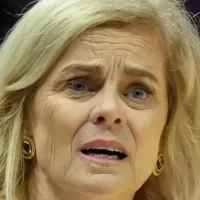

56 minutes ago Kim Mulkey's LSU Tigers: NCAA Tournament Seeding Possibilities and AP Poll Ranking

56 minutes ago Tyrese Maxey's Dunk of the Year Potential and 76ers' Free Agency Task.

57 minutes ago Jeremy Roenick defends Team USA hockey amidst criticism, political controversy.

5 days ago Tyler Herro Returns to Heat with a Flak Jacket, Hawks Defeated

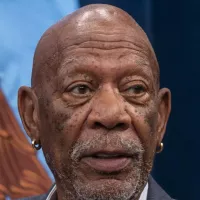

57 minutes ago Morgan Freeman shares life advice, reveals secret to staying young, and talks voice.

2 hours ago Kyle Anderson's Injury Status: Won't Play Friday, Doubtful Monday, Iffy Wednesday

Popular

Jesse Jackson is an American civil rights activist politician and...

Susan Rice is an American diplomat and public official prominent...

Barack Obama the th U S President - was the...

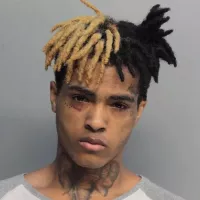

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...

Michael Joseph Jackson the King of Pop was a highly...

Kashyap Pramod Patel is an American lawyer who became the...