The AI bubble is a potential stock market bubble fueled by the rapid advancement of artificial intelligence and its impact on the economy. A key concern is that leading AI tech firms may be engaged in circular investments, creating an artificial inflation of their stock values. This speculative activity raises worries about an unsustainable and overvalued market, characteristic of a bubble.

1999: Morgan Stanley highlights robust cash flow for top US companies in 1999

In 1999, Morgan Stanley pointed out that the median cash flow for the top 500 companies in the US is roughly triple what it was in 1999 and that firms' margin profiles are much more robust now.

2001: IMF draws comparison to dot-com bubble of 2001

In 2001, Kristalina Georgieva, the 12th managing director of the IMF, drew comparisons to the dot-com bubble of 2001, highlighting that a market correction could stunt global growth.

October 2022: Goldman Sachs notes modest valuations compared to the dot-com bubble

A Goldman Sachs chief equity strategist believes the rapid increase in stock valuations is likely justified by powerful and sustained profit growth. Goldman also noted that valuations for the large US growth stocks that led the market higher in the bull market since October 2022 are modest compared to the dot-com bubble.

2023: Nvidia surpasses $1 trillion market value

Since 2023, Nvidia's value quadrupled, surpassing $1 trillion. In July, it became the highest valued company in the world and the first to ever have reached a market value of $4 trillion.

October 2024: Bank of England warns of global market correction risks due to AI overvaluation

In October 2024, the Bank of England warned of the growing risks of a global market correction due to a possible overvaluation of leading AI tech firms, such as OpenAI, which more than tripled its value from $157 billion in October 2024 to $500 billion the following year.

August 2025: MIT report reveals minimal returns on GenAI enterprise investments

In August 2025, a report by the Massachusetts Institute of Technology stated that despite US$30–40bn in enterprise investment into GenAI, 95% of organizations are getting zero return.

September 2025: Australian Financial Review comments on anticipated share-market bubble

In September 2025, the Australian Financial Review noted that "If we really are in another share-market bubble, it's surely the most anticipated example in history."

2025: Sam Altman and Ray Dalio warn of an AI bubble

In 2025, Sam Altman, CEO of OpenAI, stated that he believed an AI bubble is ongoing. Earlier in 2025, Ray Dalio of Bridgewater Associates compared the current levels of investment in AI to the dot-com bubble.

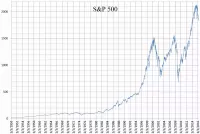

2025: Concentration in S&P 500 and MSCI World index raises concerns

In late 2025, 30% of the US S&P 500 and 20% of the MSCI World index was solely held up by the five largest companies, marking the greatest concentration in half a century. Experts also warned that AI companies were extremely overvalued.

2026: Expected US mega cap spending on AI.

In 2026, US mega caps are expected to start spending on AI, reaching $1.1 trillion between 2026 and 2029.

2029: Expected US mega cap spending on AI.

By 2029, US mega caps are expected to spend $1.1 trillion on AI, between 2026 and 2029, and total AI spending is expected to surpass $1.6 trillion.

Mentioned in this timeline

Nvidia is a technology company based in Santa Clara California...

OpenAI is an American artificial intelligence organization focused on developing...

China officially the People's Republic of China PRC is an...

The S P is a stock market index that tracks...

Ray Dalio is a billionaire hedge fund manager and the...

Sam Altman is an American entrepreneur investor and the current...

Trending

3 months ago McDonald's Employee Shoots Customer After Argument Over Delayed Order in Florida.

3 months ago Spoelstra regrets Ware decision after Heat loss; Knecht as superstar solution?

8 months ago Polio Eradication Efforts Intensify in Pakistan: Focus on Women Heroes and Campaigns

2 months ago Breeze Airways Cancels Redmond, Burbank Flights & Eugene Expansion Before Launch

8 months ago Patrick Reed trending alongside World Cup Soccer and Seahawks Football updates.

7 months ago Hegseth grilled, Defense Secretary testifies on budget, Trump updates: Duckworth impact.

Popular

Thomas Douglas Homan is an American law enforcement officer who...

William Franklin Graham III commonly known as Franklin Graham is...

Jupiter is the fifth and largest planet from the Sun...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...

Kristi Noem is an American politician who has served as...

Instagram is a photo and video-sharing social networking service owned...