Goldman Sachs is a multinational investment bank and financial services company founded in 1869, headquartered in New York City. It holds the position of the largest investment bank globally based on revenue and ranked 55th on the Fortune 500 list. Additionally, it secured 23rd place in the Forbes Global 2000 of 2024. It is recognized as a systemically important financial institution by the Financial Stability Board, reflecting its significant influence in the global financial system.

1906: Sears, Roebuck and Company IPO

In 1906, Goldman Sachs entered the initial public offering market by taking Sears, Roebuck and Company public. Also in 1906, Goldman Sachs worked on initial public offerings for General Cigar Company.

1912: F. W. Woolworth Company IPO

In 1912, Goldman Sachs continued its underwriting work for initial public offerings, including F. W. Woolworth Company.

1912: Henry S. Bowers Becomes Partner

In 1912, Henry S. Bowers became the first non-member of the founding family to become a partner of Goldman Sachs and share in its profits.

1917: Henry Goldman Resigns

In 1917, Henry Goldman resigned from Goldman Sachs due to pressure from other partners over his pro-German stance.

1918: San Francisco Office Opened

In 1918, Goldman Sachs opened an office in San Francisco, further expanding its geographical presence.

1918: Waddill Catchings Joins

In 1918, Waddill Catchings joined Goldman Sachs, shifting the balance of power away from the Sachs family.

1919: Acquisition of Merck & Co.

In 1919, Goldman Sachs acquired a major interest in Merck & Co.

1920: Philadelphia and St. Louis Offices Opened

In 1920, Goldman Sachs continued its expansion by opening offices in Philadelphia and St. Louis.

1922: Acquisition of General Foods

In 1922, Goldman Sachs acquired a major interest in General Foods.

December 4, 1928: Launch of Goldman Sachs Trading Corp.Ad

On December 4, 1928, Goldman Sachs launched the Goldman Sachs Trading Corp.Ad, a closed-end fund.

1929: Wall Street Crash

During the Wall Street Crash of 1929, the Goldman Sachs Trading Corp.Ad fund failed, leading to accusations of share price manipulation and insider trading.

1930: Sidney Weinberg Assumes Senior Partner Role

In 1930, during the Great Depression, Sidney Weinberg took over as senior partner, shifting Goldman Sachs' focus from trading to investment banking.

1956: Investment Banking Division Formed

In 1956, due to Weinberg's influence, Goldman Sachs formed an investment banking division to shift focus away from trading.

1956: Ford Motor Company IPO

In 1956, under Weinberg's leadership, Goldman Sachs was the lead advisor on the $657 million initial public offering of Ford Motor Company.

1957: Headquarters Relocation

In 1957, Goldman Sachs relocated its headquarters to 20 Broad Street, New York City.

1958: Sears Roebuck Debenture Offering

In 1958, under Weinberg's leadership, Goldman Sachs was the lead advisor on the $350 million debenture offering by Sears Roebuck.

1969: Levy Takes Over as Senior Partner

In 1969, Gus Levy took over Weinberg's role as Senior Partner and focused on rebuilding Goldman's trading franchise. Also, Weinberg remained a senior partner of the firm and died in July of that year.

1970: Penn Central Bankruptcy

In 1970, the Penn Central Transportation Company went bankrupt with over $80 million in commercial paper outstanding, much of it issued through Goldman Sachs.

1970: London Office Opened

In 1970, under the direction of Senior Partner Stanley R. Miller, Goldman Sachs opened its first international office in London.

1972: Private Wealth Management division created

In 1972, under the direction of Senior Partner Stanley R. Miller, Goldman Sachs created a Private Wealth Management division along with a fixed income division.

1974: "White Knight" Strategy

In 1974, Goldman Sachs pioneered the "white knight" strategy during its attempts to defend Electric Storage Battery against a hostile takeover bid from International Nickel.

1976: Weinberg and Whitehead Assume Co-Senior Partnership

In 1976, John Weinberg and John C. Whitehead became co-senior partners at Goldman Sachs, emphasizing co-leadership. One of their initiatives was the establishment of 14 business principles.

November 16, 1981: Acquisition of J. Aron & Company

On November 16, 1981, Goldman Sachs acquired J. Aron & Company, a commodities trading firm.

1983: Global Headquarters Moved to 85 Broad Street

In 1983, Goldman Sachs moved into a newly constructed global headquarters at 85 Broad Street.

1985: Rockefeller Center Public Offering

In 1985, Goldman Sachs underwrote the public offering of the real estate investment trust that owned Rockefeller Center.

1986: Goldman Sachs Asset Management Formed

In 1986, Goldman Sachs formed Goldman Sachs Asset Management, which manages the majority of its mutual funds and hedge funds. Also, in 1986, the firm also underwrote the IPO of Microsoft, advised General Electric on its acquisition of RCA, and joined the London and Tokyo stock exchanges, where its mergers and acquisitions grew.

1986: David Brown pleads guilty to insider trading

In 1986, Goldman Sachs investment banker David Brown pleaded guilty to charges of passing inside information on a takeover deal that was eventually provided to Ivan Boesky.

1989: Robert M. Freeman pleads guilty to insider trading

In 1989, Robert M. Freeman, a senior partner and head of risk arbitrage at Goldman Sachs, pleaded guilty to insider trading, for his own account and for the firm's account.

1990: Co-Senior Partnership and Paperless Trading

In 1990, Robert Rubin and Stephen Friedman assumed the co-senior partnership and pledged to focus on globalization and strengthening the merger & acquisition and trading business lines. In 1990, Goldman Sachs also introduced paperless trading to the New York Stock Exchange.

1991: Start of the problem

According to Joseph P. Kennedy II, the problem of commodity market being influenced by hedge funds and bankers pumping billions of purely speculative dollars into commodity exchanges, chasing a limited number of barrels and driving up the price, started in 1991.

1992: Rubin Leaves for Presidency

In 1992, Robert Rubin left Goldman Sachs to work in the Presidency of Bill Clinton.

November 22, 1994: Admission to Mexican Bolsa

On November 22, 1994, the Mexican Bolsa stock market admitted Goldman Sachs and one other firm to operate on that market.

1994: Financing of Rockefeller Center

In 1994, Goldman Sachs financed Rockefeller Center, which allowed it to take an ownership interest in 1996.

1994: GSCI Launched and Beijing Office Opened

In 1994, Goldman Sachs launched the Goldman Sachs Commodity Index (GSCI) and opened its first office in China in Beijing. That same year, Jon Corzine became CEO.

April 1996: Yahoo! IPO

In April 1996, Goldman Sachs was the lead underwriter of the initial public offering of Yahoo!.

1996: Goldman managed Apple's previous bond offering

In 1996, Goldman Sachs managed Apple's previous bond offerings.

1998: Goldman Sachs establishes presence in Russia

In 1998, Goldman Sachs established its presence in Russia, focusing on investment banking services. This early entry helped the firm navigate complex sanctions later.

1998: NTT DoCoMo IPO

In 1998, Goldman Sachs was the co-lead manager of the ¥2 trillion (yen) NTT DoCoMo IPO.

May 1999: Initial Public Offering

In May 1999, Goldman Sachs became a public company via an initial public offering. Goldman sold 12.6% of the company to the public at $53 per share.

1999: Gramm-Leach-Bliley Act allows banks to diversify

In 1999, the Gramm-Leach-Bliley Act, a financial deregulation law, was enacted, allowing commercial banks to engage in business activities complementary to finance without posing substantial risk to depository institutions or the financial system. Following this, Goldman Sachs and other investment banks expanded into ownership of various enterprises, including raw materials like food products, zinc, copper, tin, nickel, and aluminum.

January 2000: World Bank Internet Bond Offering

In January 2000, Goldman Sachs, along with Lehman Brothers, was the lead manager for the first internet bond offering for the World Bank.

September 2000: Purchase of Spear, Leeds, & Kellogg

In September 2000, Goldman Sachs purchased Spear, Leeds, & Kellogg, one of the largest specialist firms on the New York Stock Exchange, for $6.3 billion.

2000: Financial and employee data

Financial data in billions of US dollars and employee data in thousands. The data is sourced from the company's SEC Form 10-K from 2000 to 2023.

2000: Dragon NaturallySpeaking Sale

In 2000, Goldman Sachs advised Jim and Janet Baker on the sale of Dragon NaturallySpeaking to Lernout & Hauspie.

2000: Sale of Rockefeller Center

In 2000, Goldman Sachs sold Rockefeller Center to Tishman Speyer.

March 2003: Stake in JBWere

In March 2003, Goldman Sachs took a 45% stake in a joint venture with JBWere, the Australian investment bank.

April 2003: Acquisition of The Ayco Company L.P.

In April 2003, Goldman Sachs acquired The Ayco Company L.P., a fee-based financial counseling service.

July 15, 2003: Lawsuit over Artificially Inflating Stock Price of RSL Communications

On July 15, 2003, Goldman Sachs, along with Lehman Brothers and Morgan Stanley, was sued for artificially inflating the stock price of RSL Communications by issuing untrue or materially misleading statements in research analyst reports. The firms paid $3,380,000 for settlement.

July 1, 2004: Start of packaging, selling, and shorting synthetic CDOs

Between July 1, 2004, and May 31, 2007, Goldman Sachs packaged, sold, and shorted a total of 47 synthetic CDOs, with an aggregate face value of $66 billion.

2004: Traders became bearish on the housing boom

Beginning in 2004, some Goldman Sachs traders became "bearish" on the housing boom and developed mortgage-related securities.

May 2006: Paulson Leaves; Blankfein Promoted

In May 2006, Paulson left Goldman Sachs to serve as United States Secretary of the Treasury, and Lloyd Blankfein was promoted to chairman and chief executive officer.

2006: Global Alpha fund success

By 2006, Global Alpha fund, created in the mid-1990s, was described as the "Cadillac of a fleet of alternative investments" that had made millions for Goldman Sachs.

2006: Issuance of the Hudson Mezzanine CDO

In 2006, Goldman Sachs issued the $800 million Hudson Mezzanine CDO, which they bet against and also sold to investors.

2006: Goldman changes stance on mortgage market

In late 2006, Goldman Sachs management changed the firm's overall stance on the mortgage market from positive to negative.

January 2007: Acquisition of Alliance Atlantis

In January 2007, Goldman Sachs, along with CanWest Global Communications, acquired Alliance Atlantis, the company with the broadcast rights to the CSI franchise.

February 2007: Agreement on bond portfolio for Abacus 2007-AC1

In late February 2007, Paulson and ACA Management came to an agreement on the portfolio of 90 bonds to be insured in the Abacus 2007-AC1 deal.

April 2007: Issuance of CDOs in the "Abacus" series

Through April 2007, Goldman Sachs issued over 20 CDOs in its "Abacus" series worth a total of $10.9 billion.

May 31, 2007: End of packaging, selling, and shorting synthetic CDOs

Between July 1, 2004, and May 31, 2007, Goldman Sachs packaged, sold, and shorted a total of 47 synthetic CDOs, with an aggregate face value of $66 billion.

October 2007: Criticism for Packaging Risky Mortgages

In October 2007, Goldman Sachs was criticized for packaging risky mortgages and selling them to the public as safe investments.

2007: Profiting from Subprime Mortgage Collapse

During the 2007 subprime mortgage crisis, Goldman Sachs profited from the collapse in subprime mortgage bonds by short-selling subprime mortgage-backed securities. Two Goldman traders, Michael Swenson and Josh Birnbaum, are credited with being responsible for the firm's large profits during the crisis.

2007: Global Alpha peaks

In 2007, Global Alpha, Goldman Sachs' largest hedge fund, reached its peak with over $12 billion in assets under management (AUM).

2007: Unauthorized trade and firing of Matthew Taylor

In 2007, Matthew Marshall Taylor, a former Goldman Sachs trader, was fired after concealing an unauthorized $8.3 billion trade involving derivatives on the S&P 500 index. This was done by making multiple false entries into Goldman's trading system in order to protect his year-end bonus. The trades resulted in a $118 million loss for the company.

2007: Bear Stearns turns down Paulson's CDO proposal

In 2007, Paulson went to Goldman Sachs after being turned down for ethical reasons by another investment bank, Bear Stearns, who he had asked to build a CDO.

2007: LIA investment with Goldman

In 2007, the Libyan Investment Authority (LIA) invested $1.3 billion with Goldman Sachs.

March 2008: Defaults on Hudson Mezzanine CDO

By March 2008, just 18 months after its issue, so many borrowers had defaulted on the $800 million Hudson Mezzanine CDO that holders of the security paid out "about US$310 million to Goldman and others who had bet against it".

March 18, 2008: Goldman Sachs utilizes Federal Reserve loan facilities

Beginning March 18, 2008, during the financial crisis, Goldman Sachs heavily utilized Federal Reserve loan facilities to stabilize markets. Through the Primary Dealer Credit Facility (PDCF), Goldman Sachs borrowed a total of $589 billion. Through the Term Securities Lending Facility (TSLF), Goldman Sachs borrowed a total of $193 billion.

June 2008: Peak oil price and net speculative positions

In June 2008, Goldman Sachs warned investors of a dangerous spike in the price of oil and noted that net speculative positions in petroleum futures were four times as high as they were at that time.

September 2008: Viability Questioned

In September 2008, the firm's viability was called into question as the crisis intensified.

September 21, 2008: Goldman Sachs becomes bank holding company

On September 21, 2008, Goldman Sachs and Morgan Stanley transitioned into traditional bank holding companies after approval from the Federal Reserve. This decision marked the end of the independent securities firm business model, 75 years after Congress separated them from deposit-taking lenders, and occurred after Lehman Brothers filed for bankruptcy and Merrill Lynch was acquired by Bank of America.

September 23, 2008: Berkshire Hathaway invests in Goldman Sachs

On September 23, 2008, Berkshire Hathaway agreed to invest $5 billion in Goldman Sachs' preferred stock and received warrants to purchase an additional $5 billion in Goldman's common stock within five years. Additionally, the company raised $5 billion through a public share offering at $123 per share.

October 2008: Goldman Sachs receives TARP investment

In October 2008, Goldman Sachs received a $10 billion preferred stock investment from the U.S. Treasury as part of the Troubled Asset Relief Program (TARP).

November 11, 2008: Report on Goldman Sachs Underwriting California Bonds

On November 11, 2008, the Los Angeles Times reported that Goldman Sachs had earned $25 million from underwriting California bonds and advised other clients to short those same bonds.

November 2008: TARP Investment

In November 2008, as a result of its involvement in securitization during the subprime mortgage crisis, Goldman Sachs received a $10 billion investment from the United States Department of the Treasury as part of the Troubled Asset Relief Program.

2008: Short selling practices

Between 2008 and 2013, a team of Goldman Sachs employees granted locates by arranging to borrow securities to settle short sales without adequate review.

2008: Investment banks control of oil futures market

By 2008, eight investment banks accounted for 32% of the total oil futures market.

2008: Global Alpha assets decline

By mid-2008, assets under management (AUM) of the Global Alpha fund had declined to $2.5 billion.

2008: Criticism over 'revolving door' relationship

During 2008, Goldman Sachs received criticism for an apparent revolving door relationship, in which its employees and consultants moved in and out of high-level U.S. Government positions, creating potential conflicts of interest, leading to the moniker "Government Sachs".

2008: Berkshire Hathaway investment in Goldman Sachs

During the 2008 financial crisis, Berkshire Hathaway made a $5 billion investment in Goldman Sachs, which Rajat Gupta allegedly informed Raj Rajaratnam of Galleon Group about.

2008: Goldman Sachs initiates Returnship program

In 2008, Goldman Sachs launched the "Returnship" internship program to offer temporary employment opportunities for workers re-entering the workforce, especially women. Goldman Sachs holds the trademark for the term 'Returnship'.

2008: Executives forgo bonuses after receiving TARP funds

In 2008, after receiving TARP funds, New York Attorney General Andrew Cuomo questioned Goldman's decision to pay 953 employees bonuses of at least $1 million each. CEO Lloyd Blankfein and six other senior executives chose to forgo their bonuses, and Cuomo called the move appropriate and prudent.

2008: Peak in gasoline prices

In 2008, the peak in gasoline prices occurred. Just before the peak, documents showed that 15 of the world's largest banks were betting that crude oil prices would fall.

2008: Role in Financial Crisis

Public protesters were wary of Goldman having an ownership stake due to its role in the 2008 financial crisis.

April 22, 2009: Goldman Sachs repays loans

By April 22, 2009, Goldman Sachs had fully repaid its borrowings, which totaled $782 billion in revolving transactions, in accordance with the terms of the Federal Reserve's loan facilities.

June 2009: TARP Repayment

In June 2009, Goldman Sachs repaid the $10 billion investment from the United States Department of the Treasury with interest.

June 2009: Goldman Sachs repays TARP investment

In June 2009, Goldman Sachs repaid the U.S. Treasury's TARP investment, along with 23% interest, which included $318 million in preferred dividend payments and $1.418 billion in warrant redemptions.

July 2009: Establishment of 1MDB

In July 2009, Prime Minister of Malaysia Najib Razak set up a sovereign wealth fund, 1Malaysia Development Berhad (1MDB).

July 2009: Rolling Stone Article Characterizes Goldman Sachs as a "Great Vampire Squid"

In July 2009, a Rolling Stone article by Matt Taibbi characterized Goldman Sachs as a "great vampire squid" allegedly engineering "every major market manipulation since the Great Depression ... from tech stocks to high gas prices". The firm was being "excoriated by the press and the public".

December 2009: Bonus restrictions for top executives

In December 2009, Goldman Sachs announced that its top 30 executives would receive year-end bonuses in restricted stock that they could not sell for five years. The bonuses included clawback provisions.

2009: Firm's reputation suffers

According to a 2009 BrandAsset Valuator survey, Goldman Sachs' reputation suffered during 2008 and 2009. Rival Morgan Stanley was more respected than Goldman Sachs, a reversal of sentiment from 2006.

April 2010: Performance of CDOs decline in value

By April 2010, at least US$5 billion worth of Goldman Sachs securities either carried "junk" ratings or had defaulted.

April 2010: Rajat Gupta named in insider-trading case

In April 2010, Goldman director Rajat Gupta was named in an insider-trading case for allegedly informing Raj Rajaratnam of Galleon Group about Berkshire Hathaway's $5 billion investment in Goldman during the 2008 financial crisis.

April 2010: SEC charges Goldman Sachs with securities fraud

In April 2010, the U.S. Securities and Exchange Commission (SEC) charged Goldman Sachs and one of its vice-presidents, Fabrice Tourre, with securities fraud related to a synthetic CDO.

June 2010: Defense of commodity investors and oil index-tracking funds

In June 2010, The Economist defended commodity investors and oil index-tracking funds, citing an OECD report that commodities without futures markets and ignored by index-tracking funds also saw price rises during the period.

July 15, 2010: Goldman settles with SEC

On July 15, 2010, Goldman Sachs settled out of court with the SEC and investors, agreeing to pay US$550 million, including $300 million to the U.S. government and $250 million to investors.

July 2010: $550 Million Settlement with SEC

In July 2010, Goldman Sachs paid a $550 million settlement to resolve a lawsuit from the U.S. Securities and Exchange Commission related to the firm's conduct during the 2008 financial crisis. The SEC alleged that Goldman misled investors and profited from the collapse of the mortgage market. Goldman Sachs denied wrongdoing.

July 2010: Settlement doesn't cover charges against Fabrice Tourre

In July 2010, the settlement between Goldman Sachs and the SEC did not cover charges against Goldman vice president and salesman for Abacus, Fabrice Tourre.

2010: Gender discrimination lawsuit filed

In 2010, Cristina Chen-Oster and Shanna Orlich filed a lawsuit against Goldman Sachs alleging gender discrimination, claiming an "uncorrected culture of sexual harassment and assault", cultural and pay discrimination, and a 21% pay gap between male and female vice presidents.

2010: Goldman Sachs Commodity Index and food price speculation

In 2010, Frederick Kaufman argued that Goldman Sachs' creation of the Goldman Sachs Commodity Index (now the S&P GSCI) enabled passive investors, like pension and mutual funds, to speculate on food prices. These financial products disrupted supply and demand, increasing price volatility.

2010: Goldman Sachs purchased aluminum warehousing company Metro International

In 2010, Goldman Sachs purchased aluminum warehousing company Metro International. Following the purchase, the wait time for warehouse customers for aluminum supplies increased significantly, leading to higher premiums on aluminum sold in the spot market, costing American consumers over $5 billion between 2010 and 2013.

2010: SEC fraud suit

In 2010, the SEC fraud suit charged Goldman Sachs with misleading investors with a particular synthetic CDO called Abacus 2007-AC1.

February 2011: Report on Goldman Sachs raising money for Obama

In February 2011, the Washington Examiner reported that Goldman Sachs was "the company from which Obama raised the most money in 2008", and that its "CEO Lloyd Blankfein has visited the White House 10 times".

March 18, 2011: Federal Reserve approves stock buyback

On March 18, 2011, Goldman Sachs received approval from the Federal Reserve to repurchase Berkshire Hathaway's preferred stock in Goldman.

April 2011: Goldman Sachs warns of oil price spike

In April 2011, Goldman Sachs warned investors of a dangerous spike in the price of oil, stating that the price of oil had grown out of control due to excessive speculation in petroleum futures. Net speculative positions were four times as high as in June 2008, when the price of oil peaked.

June 2011: Global Alpha assets continue to decline

By June 2011, the Global Alpha fund's assets under management (AUM) had decreased to less than $1.7 billion.

August 2011: Accusations of driving up gasoline prices

In August 2011, investment banks, including Goldman Sachs, were accused of driving up gasoline prices by speculating on the oil futures exchange. Confidential documents detailed the banks' positions in the oil futures market just before the peak in gasoline prices in the summer of 2008.

September 2011: Goldman Sachs shuts down Global Alpha Fund

In September 2011, Goldman Sachs announced the closure of Global Alpha Fund LP, its largest hedge fund, managed by Goldman Sachs Asset Management (GSAM). By September 2011, after suffering losses that year, AUM was approximately $1 billion.

2011: Kirill Dmitriev became CEO of the Russian Direct Investment Fund

After working at Goldman Sachs, in 2011 Kirill Dmitriev became CEO of the Russian Direct Investment Fund and, in February 2025, was appointed Special Representative of the Russian President for Investment and Economic Cooperation.

2011: Goldman Sachs takes full control of JBWere

In 2011, Goldman Sachs acquired full control of JBWere in a $1 billion buyout.

March 2012: Greg Smith Resigns and Criticizes Goldman Sachs

In March 2012, Greg Smith, then-head of Goldman Sachs U.S. equity derivatives sales business in EMEA, resigned via an op-ed in The New York Times criticizing the company, and later wrote a book, Why I left Goldman Sachs. Claims made by Smith were alleged to be lacking in evidence.

June 2012: Gupta convicted on insider trading charges

In June 2012, Rajat Gupta was convicted on insider trading charges stemming from the cases on four criminal felony counts of conspiracy and securities fraud.

October 2012: Gupta sentenced to prison

In October 2012, Rajat Gupta was sentenced to two years in prison, an additional year on supervised release, and ordered to pay $5 million in fines for insider trading.

2012: Commodity market influenced by hedge funds and bankers

According to Joseph P. Kennedy II, by 2012, prices on the oil commodity market had become influenced by hedge funds and bankers who were pumping billions of purely speculative dollars into commodity exchanges, chasing a limited number of barrels and driving up the price.

2012: 1MDB bonds arranged and underwritten by Goldman

On December 17, 2018, Malaysia filed criminal charges against subsidiaries of Goldman Sachs and their former employees Leissner and Ng, alleging misleading statements and dishonest misappropriation of US$2.7 billion from the proceeds of 1MDB bonds arranged and underwritten by Goldman in 2012.

January 23, 2013: Federal Jury Sides with Goldman Sachs

On January 23, 2013, a federal jury rejected the Bakers' claims and found Goldman Sachs not liable in the Dragon NaturallySpeaking case.

April 2013: Leads Apple bond offering

In April 2013, Goldman Sachs, along with Deutsche Bank, led a $17 billion bond offering by Apple Inc., making it the largest corporate-bond deal in history and Apple's first since 1996.

June 2013: Goldman Sachs purchases loan portfolio from Suncorp Group

In June 2013, Goldman Sachs acquired a loan portfolio from Brisbane-based Suncorp Group, one of Australia's largest banks and insurance companies, for A$960 million. The face value of the portfolio was A$1.6 billion.

June 30, 2013: Assets under supervision

As of June 30, 2013, Deutsche Asset & Wealth Management had total assets under supervision of $21.6 billion.

July 2013: Accusations of commodity market manipulation

In July 2013, David Kocieniewski of The New York Times accused Goldman Sachs and other Wall Street firms of manipulating commodities markets, particularly aluminum, by capitalizing on loosened federal regulations. After Goldman Sachs purchased aluminum warehousing company Metro International in 2010, delivery delays increased, raising prices for consumers.

August 2013: Goldman Sachs subpoenaed over aluminum price inflation

In August 2013, Goldman Sachs was subpoenaed by the Commodity Futures Trading Commission as part of an investigation into complaints that Goldman-owned metals warehouses intentionally created delays and inflated the price of aluminum.

September 2013: Agreement to acquire stable value business

In September 2013, Goldman Sachs Asset Management agreed to acquire the stable value business of Deutsche Asset & Wealth Management, which had $21.6 billion in assets under supervision as of June 30, 2013.

2013: Tourre trial

In 2013, Fabrice Tourre's case went to trial.

2013: SEC requests about firm's securities lending practices

In 2013, Goldman Sachs gave "incomplete and unclear" responses to information requests from SEC compliance examiners about the firm's securities lending practices.

2013: Matthew Taylor pleads guilty

In 2013, Matthew Marshall Taylor pleaded guilty to charges related to hiding an $8.3 billion unauthorized trade. He was sentenced to 9 months in prison and ordered to repay the $118 million loss.

2013: 1MDB bonds arranged and underwritten by Goldman

On December 17, 2018, Malaysia filed criminal charges against subsidiaries of Goldman Sachs and their former employees Leissner and Ng, alleging misleading statements and dishonest misappropriation of US$2.7 billion from the proceeds of 1MDB bonds arranged and underwritten by Goldman in 2013.

January 2014: LIA files lawsuit against Goldman Sachs

In January 2014, the Libyan Investment Authority (LIA) initiated a $1 billion lawsuit against Goldman Sachs after the firm allegedly lost 98% of the $1.3 billion that the LIA invested with Goldman in 2007. The losses were linked to derivatives trades that earned Goldman $350 million in fees.

December 2014: Goldman Sachs sells aluminum warehousing business

In December 2014, Goldman Sachs sold its aluminum warehousing business to Ruben Brothers.

2014: Acquisition of stake in DONG Energy

In 2014, Goldman Sachs acquired an 18% stake in DONG Energy (now Ørsted A/S), Denmark's largest electric utility, from the Danish government for 8 billion kroner. This acquisition led to protests and political fallout.

March 2015: Dismissal of anti-trust case

In March 2015, the legal case against Goldman Sachs, JPMorgan Chase, Glencore, their warehousing businesses, and the London Metal Exchange for violating U.S. anti-trust laws was dismissed by the United States District Court for the Southern District of New York for lack of evidence.

August 2015: Acquisition of GE Capital Bank on-line deposit platform

In August 2015, Goldman Sachs agreed to acquire General Electric's GE Capital Bank on-line deposit platform, including US$8 billion of on-line deposits and another US$8 billion of brokered certificates of deposit.

2015: U.S. prosecutors examine Goldman's role in 1MDB

In 2015, U.S. prosecutors began examining the role of Goldman Sachs in helping 1MDB raise more than $6 billion. The 1MDB bond deals were said to generate "above-average" commissions and fees for Goldman amounting close to $600 million.

January 2016: Goldman Sachs to pay $15 million over short selling practices

In January 2016, Goldman Sachs agreed to pay $15 million after it was found that a team of Goldman employees, between 2008 and 2013, granted locates by arranging to borrow securities to settle short sales without adequate review. Additionally, Goldman Sachs gave "incomplete and unclear" responses to information requests from SEC compliance examiners in 2013 about the firm's securities lending practices.

January 2016: Gupta released from prison

In January 2016, Rajat Gupta was released from prison to serve his remaining sentence at home.

March 2016: Acquisition of Honest Dollar

In March 2016, Goldman Sachs agreed to acquire Honest Dollar, a financial technology startup offering a digital retirement savings tool, founded by Whurley.

October 2016: Introduction of Marcus by Goldman Sachs

In October 2016, Goldman Sachs Bank USA began offering no-fee unsecured personal loans under the brand Marcus by Goldman Sachs.

October 2016: Judgment in favor of Goldman Sachs

In October 2016, following a trial, Justice Vivien Rose ruled in favor of Goldman Sachs in the lawsuit filed by the LIA. The court stated that the relationship was normal and that Goldman's fees were not excessive.

2016: Protests over DONG Energy IPO

In 2016, additional protests occurred when the initial public offering of DONG Energy resulted in a windfall profit for Goldman Sachs.

May 2017: Goldman Sachs purchases PDVSA 2022 bonds

In May 2017, Goldman Sachs purchased $2.8 billion of PDVSA 2022 bonds from the Central Bank of Venezuela during the 2017 Venezuelan protests. Venezuelan politicians and protesters in New York opposed to President of Venezuela Nicolás Maduro accused Goldman of being complicit in human rights abuses and declared that the financing would fuel hunger in Venezuela, leading the securities to be dubbed "hunger bonds."

2017: Goldman sells stake in utility

In 2017, Goldman Sachs sold just over a 6% stake in DONG Energy for 6.5 billion kroner. Goldman sold its remaining stake in the utility in 2017.

March 2018: Ruling on gender bias lawsuit

In March 2018, a judge ruled that female employees could pursue their claims as a group in a class-action lawsuit against Goldman Sachs on gender bias; however, the class action excludes their claim on sexual harassment.

April 2018: Acquisition of Clarity Money

In April 2018, Goldman Sachs acquired Clarity Money, a personal finance startup.

September 10, 2018: Acquisition of Boyd Corporation

On September 10, 2018, Goldman Sachs acquired Boyd Corporation from Genstar Capital for $3 billion.

November 2018: Admission of funds misappropriation

In November 2018, Goldman's former chairman of Southeast Asia, Tim Leissner, admitted that more than US$200 million in proceeds from 1MDB bonds went into accounts controlled by him and a relative, bypassing the company's compliance rules. Leissner, another former Goldman banker Roger Ng, and Malaysian financier Jho Low were charged with money laundering.

December 17, 2018: Malaysia files criminal charges against Goldman subsidiaries

On December 17, 2018, Malaysia filed criminal charges against subsidiaries of Goldman Sachs and their former employees Leissner and Ng, alleging misleading statements and dishonest misappropriation of US$2.7 billion from the proceeds of 1MDB bonds arranged and underwritten by Goldman in 2012 and 2013.

2018: Women partners at Goldman Sachs

At the end of 2018, roughly two-thirds of the women who were partners at Goldman Sachs have since left the firm or no longer have the title.

March 2019: Partnership with Apple for Apple Card launch

In March 2019, Apple, Inc. announced a partnership with Goldman Sachs to launch the Apple Card, the bank's first credit card offering.

March 2019: Fine for transaction misreporting

In March 2019, Goldman Sachs was fined £34.4 million by the London regulator for misreporting millions of transactions over a decade.

May 16, 2019: Acquisition of United Capital Financial Advisers, LLC

On May 16, 2019, Goldman Sachs acquired United Capital Financial Advisers, LLC for $750 million.

December 2019: Pledge for climate transition projects

In December 2019, Goldman Sachs pledged to invest and finance $750 billion in climate transition projects and to stop financing oil exploration in the Arctic and some projects related to coal.

2019: Gupta's conviction upheld

In 2019, Rajat Gupta's insider trading conviction was upheld through the courts.

2019: Revival of lawsuit

In 2019, the lawsuit against Goldman Sachs, JPMorgan Chase, Glencore, their warehousing businesses, and the London Metal Exchange of violating U.S. anti-trust laws was revived after the 2nd U.S. Circuit Court of Appeals in Manhattan said the previous decision was in error.

June 2020: Introduction of Goldman Sans typeface

In June 2020, Goldman Sachs introduced Goldman Sans, a new corporate typeface, and made it freely available. The initial license terms, which prohibited disparagement of Goldman Sachs, led to online mockery, eventually causing the bank to switch to the SIL Open Font License.

July 2020: Settlement in Malaysia for 1MDB scandal

In July 2020, Goldman Sachs agreed to a $3.9 billion settlement in Malaysia regarding criminal charges related to the 1MDB scandal.

July 24, 2020: Settlement between Malaysian government and Goldman Sachs

On July 24, 2020, the Malaysian government announced it would receive US$2.5 billion in cash from Goldman Sachs, along with a guarantee for the return of US$1.4 billion in assets linked to 1MDB bonds. In return, the Malaysian government agreed to drop all criminal charges against the bank and cease legal proceedings against 17 current and former Goldman directors.

October 2020: Goldman Sachs subsidiary admits to auditing mistakes and pays fines

In October 2020, the Malaysian subsidiary of Goldman Sachs admitted to mistakes in auditing its subsidiary and agreed to pay more than $2.9 billion in fines, equivalent to $3.36 billion in 2023.

August 2021: Agreement to acquire NN Investment Partners

In August 2021, Goldman Sachs announced an agreement to acquire NN Investment Partners, with US$335 billion in assets under management, for €1.7 billion from NN Group.

September 2021: Agreement to acquire GreenSky

In September 2021, Goldman Sachs announced its agreement to acquire GreenSky for approximately $2.24 billion.

2021: Case dismissed again

In 2021, the lawsuit against Goldman Sachs, JPMorgan Chase, Glencore, their warehousing businesses, and the London Metal Exchange of violating U.S. anti-trust laws was dismissed by judge Paul A. Engelmayer. However, Reynolds Consumer Products and two other plaintiffs that had directly transacted with the defendants were allowed to pursue the case.

March 2022: Completion of GreenSky acquisition

In March 2022, Goldman Sachs completed its acquisition of GreenSky.

May 2022: Flexible Vacation Policy Implementation

In May 2022, Goldman Sachs implemented a more flexible vacation policy to help their employees "rest and recharge" whereby senior bankers get unlimited vacation days, and all employees are expected to take a minimum of 15 days vacation every year.

June 2022: Derivatives product linked to Ether (ETH) and Partnership with McLaren

In June 2022, Goldman Sachs offered its first derivatives product linked to Ether (ETH). Additionally, Goldman Sachs was announced as an official partner of McLaren.

September 2022: Layoffs announced

In September 2022, Goldman Sachs announced layoffs of hundreds of employees across the company, reportedly due to a significant reduction in earnings from July of the same year.

2022: Plans to exit Russia

After Russia’s 2022 invasion of Ukraine, Goldman Sachs announced plans to exit Russia, finalizing the sale of its business to Armenian firm Balchug Capital in April 2025, following a decree by President Vladimir Putin.

2022: Political Contributions in 2022

In 2022, Goldman Sachs and its employees contributed $3.3 million to various political entities in the United States, with David McCormick, former CEO of Bridgewater Associates, receiving the largest share at $336,000.

2022: Settlement with purchasers

In 2022, Reynolds Consumer Products and two other plaintiffs, who had directly transacted with the defendants, settled with Goldman Sachs and JPMorgan Chase regarding their lawsuit.

2022: PDVSA bonds 2022

In May 2017, Goldman Sachs purchased $2.8 billion of PDVSA 2022 bonds from the Central Bank of Venezuela during the 2017 Venezuelan protests. Venezuelan politicians and protesters in New York opposed to President of Venezuela Nicolás Maduro accused Goldman of being complicit in human rights abuses and declared that the financing would fuel hunger in Venezuela, leading the securities to be dubbed "hunger bonds."

May 2023: Goldman Sachs agrees to pay $215 million to settle gender discrimination claims

In May 2023, Goldman Sachs agreed to pay $215 million to resolve claims made by nearly 2800 female staff, settling accusations of discriminatory practices that allegedly provided women with lower salaries and lesser opportunities. Government records revealed that female employees earned 20% less than their male counterparts.

September 2023: Unfair settlement

In September 2023, the Malaysian prime minister called the Goldman Sachs settlement unfair to the country as the settled amount was not sufficient.

2023: Financial and employee data

Financial data in billions of US dollars and employee data in thousands. The data is sourced from the company's SEC Form 10-K from 2000 to 2023.

2023: Value of 1MDB bonds in 2023

In 2015, U.S. prosecutors began examining the role of Goldman in helping 1MDB raise more than $6 billion, equivalent to about $7.54 billion in 2023.

2023: Value of $10.9 billion in 2023 USD

In 2023, the $10.9 billion from the Abacus series in April 2007 was worth approximately $15.4 billion.

January 2024: Investment in Medi Assist Healthcare

In January 2024, Goldman Sachs invested ₹72 crore (₹720 000 000) for 15 lakh (1 500 000) shares in Medi Assist Healthcare debuting in India.

March 13, 2024: Report on women partners leaving the firm

On March 13, 2024, WSJ reported that roughly two-thirds of the women who were partners at Goldman Sachs at the end of 2018 have left the firm or no longer have the title. Furthermore, no woman runs a major division or is seen as a credible candidate to succeed Solomon.

August 2024: Largest shareholders of Goldman Sachs

As of August 2024, this entry refers to the 10 largest shareholders of Goldman Sachs.

2024: Forbes Global 2000 Rank

In 2024, Goldman Sachs ranked 23rd in the Forbes Global 2000 list.

January 2025: Possible End to Apple Credit Card Partnership

In January 2025, Goldman Sachs CEO David Solomon stated that the credit-card partnership with Apple may end before its contract runs out in 2030.

February 11, 2025: Termination of DEI Commitment for IPO Boards

On February 11, 2025, Goldman Sachs confirmed the decision to end its commitment to ensuring that companies it takes through the IPO process have at least two board members who are not white men, marking another rollback of DEI initiatives.

February 2025: Announcement of DEI Commitment Termination

In February 2025, Goldman Sachs announced the termination of its commitment to diversity on the boards of companies it assists with going public. This decision reflects broader shifts in corporate DEI strategies amidst political and societal debates.

February 2025: Dmitriev appointed Special Representative

In February 2025, Kirill Dmitriev was appointed Special Representative of the Russian President for Investment and Economic Cooperation, after having worked at Goldman Sachs and becoming CEO of the Russian Direct Investment Fund in 2011.

February 2025: Resumption of NDFs linked to the Russian ruble

In February 2025, despite plans to exit Russia, Goldman Sachs resumed offering clients non-deliverable forwards (NDFs) linked to the Russian ruble.

April 2025: Finalizing the sale of business to Armenian firm Balchug Capital

After Russia’s 2022 invasion of Ukraine, Goldman Sachs announced plans to exit Russia, finalizing the sale of its business to Armenian firm Balchug Capital in April 2025, following a decree by President Vladimir Putin.

Mentioned in this timeline

Apple Inc founded in and headquartered in Cupertino California is...

Vladimir Vladimirovich Putin is a Russian politician and former intelligence...

Bill Clinton served as the nd U S President from...

Ukraine is a country in Eastern Europe the second-largest on...

Bank of America is a multinational investment bank and financial...

The United States of America is a federal republic located...

Trending

41 minutes ago Scottie Scheffler Navigates Masters Champions Dinner Protocol, Seating, and Traditions.

41 minutes ago Greg Abel on Insurance, Berkshire Hathaway Share Repurchase, and Shareholder Letter

42 minutes ago Severe Weather Outbreak Forecast: Tornadoes, Hail, and Storms Threaten Texas and Midwest

42 minutes ago Jordan Spieth's DIY swing aid & Arnold Palmer Invitational betting tips.

42 minutes ago McIlroy regrets Rahm's DP World Tour rejection; Rahm accuses tour of extortion.

43 minutes ago Rain returns to Austin, Texas, ending drought with milder temperatures this week.

Popular

Ken Paxton is an American politician and lawyer serving as...

Hillary Diane Rodham Clinton is a prominent American politician lawyer...

Jesse Jackson is an American civil rights activist politician and...

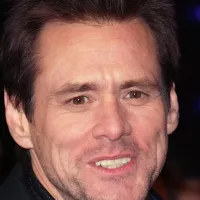

Jim Carrey is a Canadian-American actor and comedian celebrated for...

Bill Clinton served as the nd U S President from...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...