Wall Street, a street in New York City's Financial District, has become synonymous with the U.S. financial markets, the American financial services industry, and New York-based financial interests. This iconic location serves as the anchor for New York's standing as a leading global financial and fintech hub.

1905: Post office built at 60 Wall Street

In 1905, a post office was built at 60 Wall Street.

1911: Midtown Becomes the Locus of Financial Services Dealings

By 1911, there were indications that midtown Manhattan was becoming the locus of financial services dealings.

1913: $4 stock transfer tax proposed, stock clerks protest

In 1913, authorities proposed a $4 stock transfer tax, prompting protests from stock clerks.

September 16, 1920: Wall Street Bombing

On September 16, 1920, a powerful bomb exploded close to the corner of Wall and Broad Street, killing 38 and seriously injuring 143 people. The perpetrators were never identified, and the explosion helped fuel the Red Scare.

1920: Economy changes to financial and New York maintains leadership

Between 1860 and 1920, the economy changed from "agricultural to industrial to financial" and New York maintained its leadership position despite these changes, according to historian Thomas Kessner.

1920: Wall Street in 1920

Wall Street in 1920.

1921: Bomb threat leads to detectives sealing off area

In 1921, a bomb threat led to detectives sealing off the Wall Street area to "prevent a repetition of the Wall Street bomb explosion".

September 1929: Peak of the stock market

September 1929 was the peak of the stock market.

October 3, 1929: The market started to slip

On October 3, 1929, the market started to slip, and it continued throughout the week of October 14.

October 1929: Stock values plummeted, ushering in the Great Depression

In October 1929, renowned Yale economist Irving Fisher reassured worried investors that their "money was safe" on Wall Street. A few days later, on October 24, stock values plummeted. The stock market crash of 1929 ushered in the Great Depression.

1946: Stocks could not be purchased on margin

From 1946 to 1947, stocks could not be purchased "on margin", meaning that an investor had to pay 100% of a stock's cost without taking on any loans.

1947: Stocks could not be purchased on margin

From 1946 to 1947, stocks could not be purchased "on margin", meaning that an investor had to pay 100% of a stock's cost without taking on any loans.

1960: Federal Reserve reduced margin requirements

Before 1960, the margin requirement was reduced four times, each time stimulating a mini-rally and boosting volume, and when the Federal Reserve reduced the margin requirements from 90% to 70%.

1967: Trading volume hits 7.5 million shares a day

In 1967, volume hit 7.5 million shares a day which caused a "traffic jam" of paper with "batteries of clerks" working overtime to "clear transactions and update customer accounts".

1973: Financial community posts collective loss

In 1973, the financial community posted a collective loss of $245 million, which spurred temporary help from the government.

1975: SEC throws out NYSE's "Rule 394"

In 1975, the SEC threw out the NYSE's "Rule 394" which had required that "most stock transactions take place on the Big Board's floor", in effect freeing up trading for electronic methods.

1976: Banks allowed to buy and sell stocks

In 1976, banks were allowed to buy and sell stocks, which provided more competition for stockbrokers.

1983: Wall Street drug dealer

In 1983, a Wall Street drug dealer was caught selling cocaine from her 1983 Chevrolet Camaro.

September 1985: Hurricane Gloria causes NYSE closure

The NYSE was closed for weather-related reasons due to Hurricane Gloria in September 1985.

1987: Oliver Stone Film Wall Street Released

In 1987, the Oliver Stone film "Wall Street" was released. The film created the iconic character Gordon Gekko, who used the phrase "greed is good".

1987: Stock market plunged

In 1987, the stock market plunged, and the surrounding area lost 100,000 jobs.

1987: Peter Kerr in The New York Times, 1987.

Peter Kerr in The New York Times, 1987.

1995: Sector grew at annual rate of about 6.6%

Between 1995 and 2005, the sector grew at an annual rate of about 6.6% annually.

1998: City offers tax incentives to keep NYSE in Financial District

In 1998, city authorities offered substantial tax incentives to try to keep the NYSE in the Financial District.

1998: NYSE strikes deal with city to remain in Financial District

In 1998, the NYSE and the city struck a $900 million deal which kept the NYSE from moving across the river to Jersey City; the deal was described as the "largest in city history to prevent a corporation from leaving town".

September 11, 2001: World Trade Center destroyed

On September 11, 2001, the World Trade Center was destroyed, crippling the communications network and destroying many buildings in the Financial District. The NYSE re-opened on September 17.

2005: Sector grew at annual rate of about 6.6%

Between 1995 and 2005, the sector grew at an annual rate of about 6.6% annually.

2006: Blair Kamin in the Chicago Tribune, 2006

Blair Kamin in the Chicago Tribune, 2006

2006: Financial services industry makes up 9% of city's work force

In 2006, the financial services industry makes up 9% of the city's work force and 31% of the tax base.

2006: Years of economic turmoil begin

The Guardian reporter Andrew Clark described the years of 2006 to 2010 as "tumultuous", in which the heartland of America was "mired in gloom" with high unemployment around 9.6%, with average house prices falling from $230,000 in 2006 to $183,000, and foreboding increases in the national debt to $13.4 trillion, but that despite the setbacks, the American economy was once more "bouncing back".

2007: Start of Financial Services Employment Base Loss Due to Subprime Mortgage Crisis

From 2007 to 2010, New Jersey's financial services sector experienced a 7.9 percent loss in its employment base, following the subprime mortgage crisis.

2007: Financial services industry profits

In 2007, the financial services industry which had a $70 billion profit became 22 percent of the city's revenue.

2007: Subprime Mortgage Crisis Begins

The subprime mortgage crisis began in 2007 and lasted until 2010. Wall Street financing was blamed as one of the causes of the crisis.

2008: Decline in stock market means less taxable income

In 2008, after a downturn in the stock market, the decline meant $18 billion less in taxable income.

2008: Firms in Recession Go Out of Business or Bought Up

In 2008, during the recession, several Wall Street firms faced significant challenges. Lehman Brothers filed for bankruptcy, Bear Stearns was acquired by JPMorgan Chase with U.S. government intervention, and Merrill Lynch was bought by Bank of America. These events resulted in a major downsizing of Wall Street.

2008: "Wall Street West" Employment Contributes to One Third of Private Sector Jobs in Jersey City

In 2008, employment related to "Wall Street West" made up one third of the private sector jobs in Jersey City.

2008: Wall Street firms employed close to 200,000 persons

In 2008, one estimate was that Wall Street firms employed close to 200,000 persons.

2008: Troublesome period for Wall Street

The first months of 2008 was a particularly troublesome period which caused Federal Reserve chairman Ben Bernanke to "work holidays and weekends" and which did an "extraordinary series of moves". It bolstered U.S. banks and allowed Wall Street firms to borrow "directly from the Fed" through a vehicle called the Fed's Discount Window, a sort of lender of last resort.

2009: Oliver Stone Comments on Wall Street Film's Influence

In 2009, Oliver Stone commented on the unexpected cultural influence of his film "Wall Street", noting that it inspired many young people to pursue careers on Wall Street.

2009: Wall Street Reaped Profits and Bonuses After Taxpayer Bailout

In 2009, despite being bailed out by taxpayers, Wall Street firms reaped massive profits and bonuses, leading to public criticism and calls for contrition from banking executives. Goldman Sachs chief executive Lloyd Blankfein was sued by the SEC.

2009: Gloomy Outlook and Job Losses

In 2009, the Boston Consulting Group estimated that 65,000 jobs had been permanently lost due to the economic downturn. However, there were early signs of recovery in Manhattan property prices.

2009: Wall Street Employment Wages Paid in the Amount of Almost $18.5 Billion in New Jersey

In 2009, wages from Wall Street employment in New Jersey totaled nearly $18.5 billion and contributed $39.4 billion to the state's GDP.

2010: Wall Street firms return to engine rooms of wealth

By 2010, Wall Street firms were "getting back to their old selves as engine rooms of wealth, prosperity and excess".

2010: New Jersey Lost 7.9 Percent of its Employment Base in the Financial Services Sector Due to Subprime Mortgage Crisis

From 2007 to 2010, New Jersey's financial services sector experienced a 7.9 percent loss in its employment base, following the subprime mortgage crisis.

2010: Federal exertions appear to be the right decisions

From the perspective of 2010, it appeared the Federal exertions in 2008 had been the right decisions.

2010: Anthony Scaramucci Felt Like a Piñata

In 2010, Anthony Scaramucci reportedly told President Barack Obama that he felt like a piñata, being "whacked with a stick" by "hostile politicians".

2010: Manhattan Property Rebounding and Bonuses Being Paid

In 2010, Manhattan property prices began to rebound with a 9% annual increase. Bonuses were also being paid again, with average bonuses exceeding $124,000.

2010: Richard Ramsden Believes Risk Taking is Vital

In 2010, Richard Ramsden of Goldman Sachs expressed the view that risk-taking is vital and sees banks as powering the rest of the economy.

2010: Years of economic turmoil continue

The Guardian reporter Andrew Clark described the years of 2006 to 2010 as "tumultuous", in which the heartland of America was "mired in gloom" with high unemployment around 9.6%, with average house prices falling from $230,000 in 2006 to $183,000, and foreboding increases in the national debt to $13.4 trillion, but that despite the setbacks, the American economy was once more "bouncing back".

2010: The Guardian reporter Andrew Clark, 2010

The Guardian reporter Andrew Clark, 2010.

2010: End of Subprime Mortgage Crisis

The subprime mortgage crisis that started in 2007, ended in 2010. Wall Street financing was blamed as one of the causes of the crisis.

September 2011: Occupy Wall Street movement begins

Beginning in September 2011, the Occupy Wall Street movement, disenchanted with the financial system, protested in parks and plazas around Wall Street.

October 29, 2012: Hurricane Sandy disrupts Wall Street

On October 29, 2012, Wall Street was disrupted when New York and New Jersey were inundated by Hurricane Sandy. The NYSE was closed.

2012: City's securities industry accounts for 5 percent of private sector jobs

In 2012 the city's securities industry accounts for 5 percent of private sector jobs in New York City, 8.5 percent (US$3.8 billion) of the city's tax revenue, and 22 percent of the city's total wages, including an average salary of US$360,700.

August 2013: Securities industry has 163,400 jobs

In August 2013, the city's securities industry, enumerating 163,400 jobs, continues to form the largest segment of the city's financial sector.

June 30, 2018: NYSE market capitalization at US$28.5 trillion

As of June 30, 2018, the New York Stock Exchange is the world's largest stock exchange per market capitalization of its listed companies, at US$28.5 trillion.

Mentioned in this timeline

Barack Obama the th U S President - was the...

Bank of America is a multinational investment bank and financial...

The stock market is where buyers and sellers trade stocks...

JPMorgan Chase Co incorporated in Delaware and headquartered in New...

Bears are carnivoran mammals belonging to the Ursidae family classified...

Stocks were a type of restraining device historically used as...

Trending

33 minutes ago US, Israel launch military operation against Iran, airstrikes kill leader, Gulf earthquake follows.

33 minutes ago Kaitlan Collins covers Bill Clinton's Epstein testimony and calls out Trump allies.

34 minutes ago Adam Levine and Behati Prinsloo: Navigating Cheating Allegations and Maintaining Relationship

34 minutes ago Brandi Carlile Honored as Time's 2026 Woman of the Year, Other News Emerge

Gabe Perreault is a Canadian-born American professional ice hockey player currently playing for the New York Rangers in the NHL...

34 minutes ago Steve Witkoff involved in tense Geneva meeting before US-Iran conflict escalation.

Popular

Jesse Jackson is an American civil rights activist politician and...

Hillary Diane Rodham Clinton is a prominent American politician lawyer...

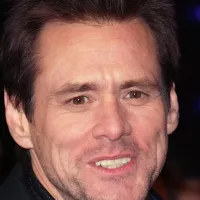

Jim Carrey is a Canadian-American actor and comedian celebrated for...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...

Kashyap Pramod Patel is an American lawyer who became the...

Michael Joseph Jackson the King of Pop was a highly...