CalPERS is a California state agency managing pension and health benefits for over 1.5 million public employees, retirees, and their families. In fiscal year 2020-21, it disbursed over $27.4 billion in retirement benefits and $9.74 billion in health benefits.

1 day ago : CalPERS Faces Tariff Turmoil: Ohio Pension Systems Down $4 Billion Amid Trade War

Ohio's public pension systems experienced a $4 billion loss due to Trump's tariff war. CalPERS CEO warns that the impact of tariffs could extend. California's retirement system is struggling with Trump's tariff turmoil and faces uncertainties.

1961: Passage of the Meyer-Geddes Hospital and Medical Health Care Act in 1961

In 1961, the Meyer-Geddes Hospital and Medical Health Care Act was passed, leading to SERS offering health insurance for state employees.

1962: SERS Offered Health Insurance in 1962

In 1962, following the passage of the Meyer-Geddes Hospital and Medical Health Care Act, SERS began offering health insurance for state employees.

1973: PERS Deals with HMOs after the HMO Act of 1973

After the Health Maintenance Organization (HMO) Act of 1973, PERS began to deal with HMOs to create more unified and standardized health care benefit rates.

1978: Meyer-Geddes Act Renamed in 1978

In 1978, the Meyer-Geddes Act was renamed the "Public Employees' Medical and Hospital Care Act".

1980: State Law Tying Disability Benefits to Hiring Age in 1980

In 1980, a state law was enacted that tied public safety officers' disability benefits to the age at which they were hired.

1987: CalPERS Established the Focus List in 1987

In 1987, CalPERS established a "Focus List" of companies with concerns about stock and financial underperformance and corporate governance practices, also known as a "name and shame" list.

1990: Passage of California's "Public Employees' Long-Term Care Act" in 1990

California's "Public Employees' Long-Term Care Act," was passed in 1990, leading to CalPERS' administering a Long-Term Care Program.

1992: Age Discrimination Complaint with EEOC in 1992

In 1992, an age discrimination complaint was filed with the Equal Employment Opportunity Commission (EEOC) due to a 1980 state law.

1993: Proposed Clinton Health Care Plan in 1993

In the early 1990s CalPERS was "called a model for the so-called health alliances" proposed in the 1993 Clinton health care plan.

1994: CalPERS Health Plan Contracts in 1994-1995

As of 1994–1995, CalPERS contracted with 24 health plans and reduced health insurance premiums by 1% compared with 1993–1994.

1994: Nesbitt Study on the CalPERS Effect in 1994

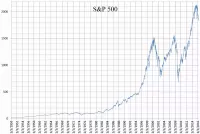

In 1994, Nesbitt published a study that found that companies on the Focus List trailed the S&P 500 prior to being put on the list but outperformed the S&P 500 after being put on the list, naming this phenomenon the "CalPERS effect".

1995: CalPERS Health Plan Contracts in 1994-1995

As of 1994–1995, CalPERS contracted with 24 health plans and reduced health insurance premiums by 1% compared with 1993–1994.

1995: Class Action Lawsuit against CalPERS and Other Agencies in 1995

In 1995, a class action lawsuit was filed against CalPERS and other state and local agencies due to the 1980 state law.

1995: LTC program inception

Since the Long-Term Care (LTC) program's inception in 1995 through June 30, 2013, the total benefits paid have reached approximately $1.3 billion.

1996: Amendment of "Public Employees' Long-Term Care Act" in 1996

California's "Public Employees' Long-Term Care Act," was amended in 1996.

1996: CalPERS Health Insurance Rate Decline in 1996

In 1996, CalPERS health insurance rates continued to decline by 5.3%.

1997: Government Accountability Office Study on CalPERS Premiums (1997-2002)

A 2006 study by the Government Accountability Office determined that from 1997 through 2002 the average annual growth in CalPERS premiums (6.5%) was lower than that of the Federal Employees Health Benefits Program (FEHBP, 8.5%) and of other surveyed employer-sponsored health benefit programs (7.1%).

1997: CalPERS Health Insurance Rate Decline in 1997

In 1997, CalPERS health insurance rates continued to decline by 1.4%.

1998: CalPERS Health Insurance Rate Increase in 1998

In 1998, CalPERS health insurance rates rose by 2.7%.

1999: CalPERS Health Insurance Rate Increase in 1999

In 1999, CalPERS health insurance rates rose by 5.1%.

2000: NAER Recognition Champion Awards in 2000

In 2000, two CalPERS employees received National Association for Employee Recognition (NAER) Recognition Champion Awards for the employee recognition program.

2002: Government Accountability Office Study on CalPERS Premiums (1997-2002)

A 2006 study by the Government Accountability Office determined that from 1997 through 2002 the average annual growth in CalPERS premiums (6.5%) was lower than that of the Federal Employees Health Benefits Program (FEHBP, 8.5%) and of other surveyed employer-sponsored health benefit programs (7.1%).

2002: Premium Increases and Investment Losses in 2002

During an economic downturn in 2002, premiums for the CalPERS Long-Term Care Program rose an average of 9% and investment losses were $99 million.

2002: CalPERS Won Best Practices Award from NAER in 2002

In 2002, CalPERS itself won a Best Practices award from NAER. The employee recognition program contributed to high employee satisfaction and a low employee turnover rate at CalPERS.

2002: Unfunded Liabilities Increase

In 2002, CalPERS' unfunded liabilities were approximately $22 billion. These liabilities have significantly increased since that time.

January 2003: CalPERS Settled Lawsuit in January 2003

In January 2003, CalPERS settled the suit by agreeing to pay $50 million in retroactive benefits and $200 million in future benefits to 1,700 officers. The settlement was the largest in the EEOC's history.

2003: Government Accountability Office Study on CalPERS Premiums (2003-2006–7)

A 2006 study by the Government Accountability Office determined that between 2003 and 2006–7, the average annual growth rate in CalPERS premiums (14.2%) was higher than that of FEHBP (7.3%) and of other surveyed employer-sponsored health benefit programs (10.5%).

2003: Participating Plans Dropped to Seven as of 2003

The number of participating plans dropped to seven as of 2003.

2004: CalPERS Health Insurance Rate Increases in 2004 and Cities Leaving CalPERS

CalPERS attracted national attention again in the mid-2000s, this time for health maintenance organization rate increases of 25% in 2004 and "more than two dozen cities, counties and school districts" left CalPERS as of 2004 because of high medical insurance rates.

2005: CalPERS Health Insurance Rate Increases in 2005

CalPERS health maintenance organization rate increases of 18% in 2005.

2006: Government Accountability Office Study on CalPERS Premiums (2003-2006–7)

A 2006 study by the Government Accountability Office determined that between 2003 and 2006–7, the average annual growth rate in CalPERS premiums (14.2%) was higher than that of FEHBP (7.3%) and of other surveyed employer-sponsored health benefit programs (10.5%).

2006: Investment Income in 2006-07

Between 1998-99 and 2007-08, the highest investment income was $40.7 billion in 2006-07.

March 2007: Establishment of the California Employers’ Retiree Benefit Trust Fund in March 2007

In March 2007, CalPERS established the California Employers’ Retiree Benefit Trust Fund to provide California public agencies with a cost-efficient, professionally managed investment vehicle for prefunding other post-employment benefits (OPEB) such as retiree health benefits.

2007: Year with no unfunded liabilities

According to the CalPERS chart Historical Factors Impact Funded Status (1993-2018), FY 2007 was the most recent year with no unfunded liabilities.

2007: Financial Crisis of 2007-2008

After the financial crisis of 2007–2008, many cities in California came under financial stress due to a combination of factors, which led to three high-profile municipal bankruptcy filings by Vallejo, Stockton, and San Bernardino that received nationwide attention.

2007: Premium Increase in 2007

Another premium increase of an average of 33.6% occurred in 2007 due to "a projected $600 million shortfall in the program over the next 50 to 60 years".

2007: Investment Loss in 2007-08

Between 1998-99 and 2007-08, the greatest investment loss was $12.5 billion in 2007-08.

2007: CalPERS Commissioned Studies in 2007-2008

CalPERS commissioned three studies that were released in 2007-2008 about the economic impacts of the following.

October 2008: CalPERS Assets in October 2008

In October 2008, CalPERS had a total of $186.7 billion in assets invested across equities ($104.9 billion), fixed income ($41.0 billion), real estate ($20.9 billion), cash equivalents ($16.2 billion), and inflation-linked assets ($3.7 billion).

2008: Financial Crisis of 2007-2008

After the financial crisis of 2007–2008, many cities in California came under financial stress due to a combination of factors, which led to three high-profile municipal bankruptcy filings by Vallejo, Stockton, and San Bernardino that received nationwide attention.

2008: CalPERS Eliminated Copayments for Preventive Care Visits in 2008

As of 2008, CalPERS eliminated copayments for preventive care visits, raised copayments for other types of office visits, and took other measures in an attempt to reduce costs.

2008: CalPERS Commissioned Studies in 2007-2008

CalPERS commissioned three studies that were released in 2007-2008 about the economic impacts of the following.

2008: CalPERS Warned of Potential Contribution Increases in 2008

In 2008, CalPERS warned that it might ask for more money from the state starting in July 2010 and from local-government employers starting in July 2011 if CalPERS' investments were performing poorly as of June 30, 2009.

June 30, 2009: CalPERS Investment Performance as of June 30, 2009

CalPERS investment performance as of June 30, 2009 affected future contributions.

July 2010: Potential Contribution Increases Warning from CalPERS Starting July 2010

CalPERS warned that it might ask for more money from the state starting in July 2010 if CalPERS' investments were performing poorly as of June 30, 2009.

December 15, 2010: CalPERS Member Home Loan Program Suspension

On December 15, 2010, the CalPERS Board of Administration approved the suspension of the CalPERS Member Home Loan Program, ceasing the acceptance of new applications.

2010: Integrated Health Management Program Initiated in 2010

In 2010, Blue Shield of California, Dignity Health, and Hill Physicians Medical Group initiated an integrated health management program (similar to an Accountable Care Organization) that covered 41,000 CalPERS members.

2010: CalPERS Revised Strategic Asset Allocation Mix in 2010

In 2010, CalPERS revised its strategic asset allocation mix using its Asset Liability Management process.

2010: CalPERS Stopped Publicly Naming Companies on the Focus List in 2010

In 2010, CalPERS stopped publicly naming companies on the Focus List and began dealing with such companies privately.

July 2011: Potential Contribution Increases Warning from CalPERS Starting July 2011

CalPERS warned that it might ask for more money from local-government employers starting in July 2011 if CalPERS' investments were performing poorly as of June 30, 2009.

2011: CalPERS Funding Level in 2011

According to 2011 state figures, the CalPERS system is 78% funded with unfunded future liabilities of $133 billion. Non-government estimates show a larger shortfall.

2011: Governor Brown called CalPERS a Ponzi scheme at a 2011 hearing

At a 2011 legislative hearing, Governor Jerry Brown called CalPERS asserted reliance on bringing in new members "a Ponzi scheme".

June 30, 2012: CalPERS Economic Impacts in California Report for the fiscal year ending June 30, 2012

Key findings of the CalPERS Economic Impacts in California Report for the fiscal year ending June 30, 2012 were released.

2012: CalPERS Initiated a Program to Monetize the Focus List in 2012

In 2012, CalPERS initiated a program to monetize the Focus List, increasing investments in those companies after Board approval each year.

January 1, 2013: Pension Reform Legislation (AB 340) Implementation on January 1, 2013

With the passage of Assembly Bill 340 (AB 340), the pension reform legislation by the California Legislature, CalPERS members hired after January 1, 2013, are expected to pay 50 percent of the Total Normal Cost of the benefit plan in which they participate.

June 30, 2013: CalPERS Assets as of June 30, 2013

By June 30, 2013, CalPERS had a total of $257.9 billion in assets invested as follows: $166.3 billion in equities, $40.2 billion in fixed income, $25.8 billion in real assets, $10.6 billion in cash equivalents, $9.2 billion in inflation-linked assets, $5.2 billion in hedge funds, and $0.5 billion in multi-asset class and other.

July 1, 2013: Long-Term Care Program Premiums from July 1, 2013

From July 1, 2013, through December 31, 2013, participants in the LTC program paid annual premiums of more than $168 million.

December 31, 2013: Long-Term Care Program Premiums through December 31, 2013

From July 1, 2013, through December 31, 2013, participants in the LTC program paid annual premiums of more than $168 million.

December 2014: CalPERS Deferred Compensation Retirement Plan (457 plan) as of December 2014

As of December 2014, CalPERS is responsible for a deferred compensation retirement plan (457 plan) and two other plans to supplement income after retirement or permanent separation from State employment.

December 2014: LTC Program Enrolled Participants as of December 2014

As of December 2014, the LTC program had 144,936 enrolled participants.

2014: Wilshire Associates Study on CalPERS Engagements in 2014

In 2014, a study by Wilshire Associates showed that companies engaged by CalPERS significantly outperformed the Russell 1000.

2018: Retiree Statistics

In 2018, CalPERS faced criticism regarding the number of retirees (26,000) collecting over $100,000 annually in pension, representing less than 4% of total retirees but receiving 17% of total pension payouts.

2019: CalPERS Health Benefits Provision in 2019

In 2019, CalPERS provided more than $9.2 billion in health benefits for 1.5 million active and retired state, public agency, and school workers and their dependents.

2019: CalPERS Benefit Payments in 2019-20

In the fiscal year 2019-20, CalPERS paid $25.8 billion in benefits.

2020: CalPERS Provided Monthly Allowances as of 2020

As of 2020, CalPERS paid monthly allowances to 732,529 retirees, survivors, and beneficiaries.

2020: LTC Program Statistics as of 2020

As of 2020, the LTC program had 116,832 members who paid annual premiums of $278.5 million and who collectively received $337.3 million in benefits annually.

2020: Pension Rate of Return Lowered to 7 Percent

In 2020, the California Public Employees' Retirement System board voted to lower the pension plan's expected rate of return from investment to 7 percent. This decision puts a greater financial burden on the state's cities, counties and other local government agencies across California that rely on CalPERS pensions.

Mentioned in this timeline

California is the most populous US state located on the...

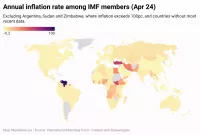

Inflation in economics signifies a rise in the average price...

The S P is a stock market index that tracks...

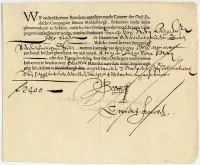

Money is any item or verifiable record that's widely accepted...

Stocks represent fractional ownership of a corporation granting shareholders a...

Trending

17 minutes ago Michelle McCool's Impending WWE Hall of Fame Induction Sparks Excitement and Debate

18 minutes ago Tiffany Stratton Eyes Olympic Debut, Addresses Charlotte Flair's Rookie Comment, and WrestleMania.

18 minutes ago Rory McCann Revealed as Baylan Skoll in Ahsoka at Star Wars Celebration.

18 minutes ago Jey Uso's Unexpected Rise, Gunther's Antagonism, and WrestleMania Night 1 Predictions Explored.

19 minutes ago Ludwig Kaiser Impresses WWE, Discusses Fan DMs, and Joins Show with Gable and Cargill.

1 hour ago Fuego Del Sol Unmasks at Spring Break, Leaves Boots, Appears to Retire

Popular

The Real ID Act of is a US federal law...

Bernard Bernie Sanders is a prominent American politician currently serving...

Michael Jordan also known as MJ is a celebrated American...

Cristiano Ronaldo nicknamed CR is a Portuguese professional footballer widely...

Marco Rubio is an American politician who served as a...

Donald John Trump is an American politician media personality and...