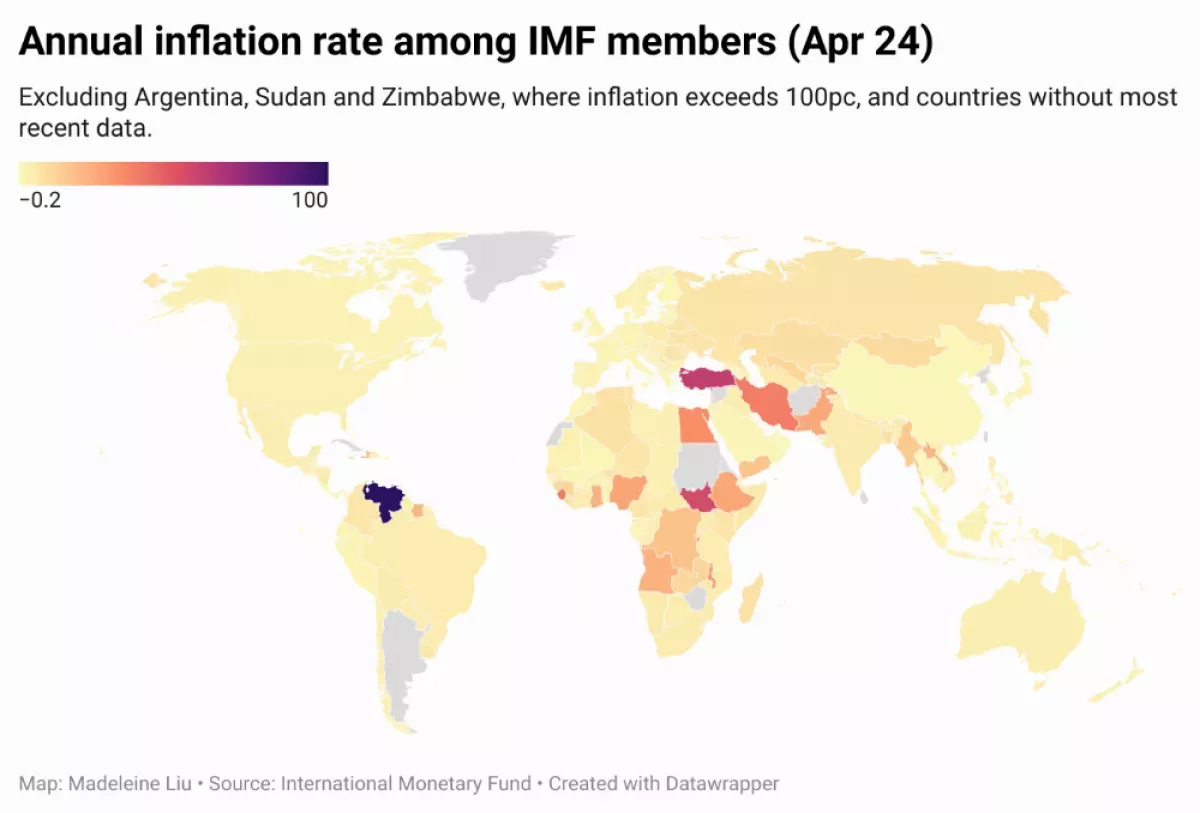

Inflation, in economics, signifies an increase in the average price level of goods and services within an economy, typically measured by the Consumer Price Index (CPI). It erodes the purchasing power of money, meaning each currency unit buys fewer goods and services. The inflation rate, expressed as an annualized percentage change in a general price index like the CPI, quantifies this phenomenon. Deflation, the opposite of inflation, denotes a decrease in the general price level. Because not all household prices increase at the same rate, the CPI is commonly used to measure inflation.

1922: Publication by Thomas M. Humphrey and Richard Timberlake

In 2019, monetary historians Thomas M. Humphrey and Richard Timberlake published "Gold, the Real Bills Doctrine, and the Fed: Sources of Monetary Disorder 1922–1938", analyzing the period from 1922.

1936: John Maynard Keynes' main work

In 1936, John Maynard Keynes published his main work, "The General Theory of Employment, Interest and Money", emphasizing the stickiness of wages and prices in the short run and their gradual response to aggregate demand shocks.

1938: Publication by Thomas M. Humphrey and Richard Timberlake

In 2019, monetary historians Thomas M. Humphrey and Richard Timberlake published "Gold, the Real Bills Doctrine, and the Fed: Sources of Monetary Disorder 1922–1938", analyzing the period up to 1938.

1948: High-inflation episode in Nationalist China

Towards the end of the Nationalist Chinese government in 1948, there was a spectacular high-inflation episode in the country.

1949: High-inflation episode in Nationalist China

In 1949, there was a continuation of the spectacular high-inflation episode that started towards the end of the Nationalist Chinese government.

1958: Publication by Alban William Phillips

In 1958, Alban William Phillips published indirect evidence of a negative relation between inflation and unemployment, confirming the Keynesian emphasis on a positive correlation between increases in real output and rising prices.

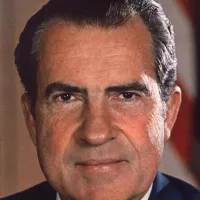

1972: Wage and price controls by Richard Nixon

In 1972, Richard Nixon imposed wage and price controls.

1990: Direct inflation targeting in New Zealand

From its first inception in New Zealand in 1990, direct inflation targeting as a monetary policy strategy has spread to become prevalent among developed countries.

1990: New Zealand adopted an official inflation target

In 1990, New Zealand became the first country to adopt an official inflation target as the basis of its monetary policy, continually adjusting interest rates to steer the country's inflation rate towards its official target.

2000: Common view on inflation

Around the year 2000, a common view on inflation emerged, illustrated by a modern Phillips curve that includes a role for supply shocks and inflation expectations in addition to aggregate demand.

January 2007: U.S. Consumer Price Index

In January 2007, the U.S. Consumer Price Index (CPI) was recorded at 202.416.

2007: Government of Argentina criticised

In 2007, the government of Argentina, during the presidency of Cristina Kirchner, faced criticism for manipulating economic data, including inflation figures.

2007: Inflation rate for the CPI

In 2007, the resulting inflation rate for the CPI was 4.28%, indicating a general rise in price levels for typical U.S. consumers by approximately four percent.

January 2008: U.S. Consumer Price Index

In January 2008, the U.S. Consumer Price Index (CPI) was recorded at 211.080.

2010: M3 money supply increase

From 2010 through 2015, the broadest measure of money supply, M3, increased about 45%, far faster than GDP growth, yet the inflation rate declined during that period.

2015: M3 money supply increase

From 2010 through 2015, the broadest measure of money supply, M3, increased about 45%, far faster than GDP growth, yet the inflation rate declined during that period.

2015: Government of Argentina criticised

In 2015, the government of Argentina, during the presidency of Cristina Kirchner, faced criticism for manipulating economic data, including GDP figures, for political gain and to reduce payments on its inflation-indexed debt.

October 2018: Venezuela hyperinflation

In October 2018, Venezuela experienced the highest hyperinflation in the world, with an annual inflation rate of 833,997%.

2019: Publication by Thomas M. Humphrey and Richard Timberlake

In 2019, monetary historians Thomas M. Humphrey and Richard Timberlake published "Gold, the Real Bills Doctrine, and the Fed: Sources of Monetary Disorder 1922–1938".

December 2021: Statement by Fed chairman Jerome Powell

In December 2021, Fed chairman Jerome Powell stated that the once-strong link between the money supply and inflation "ended about 40 years ago," due to financial innovations and deregulation.

2021: Increase in inflation in most countries

In 2021, most countries experienced a considerable increase in inflation, which is believed to be caused by a mixture of demand and supply shocks.

2022: Peak in inflation in most countries

In 2022, most countries experienced a peak in inflation, which is believed to be caused by a mixture of demand and supply shocks, including the Russian invasion of Ukraine.

May 2023: Inflation expectations remain anchored

As per May 2023, most countries experienced declining inflation rates and inflation expectations generally seem to remain anchored.

2023: Denmark maintains a fixed exchange rate

As of 2023, Denmark is the only OECD country which maintains a fixed exchange rate (against the euro).

2023: Central banks following an inflation target

As of 2023, the central banks of all G7 member countries can be said to follow an inflation target.

2023: Inflation surge linked to M2 money supply growth

During the COVID pandemic and its immediate aftermath, the M2 money supply increased at the fastest rate in decades, leading some to link the growth to the 2021-2023 inflation surge.

Mentioned in this timeline

Venezuela officially the Bolivarian Republic of Venezuela is located on...

New Zealand is an island country in the southwestern Pacific...

Jerome Hayden Jay Powell is an American investment banker and...

Argentina officially the Argentine Republic is located in the southern...

Richard Nixon the th U S President served from until...

The euro is the official currency of the eurozone which...

Trending

41 minutes ago Kyle Anderson's Injury Status: Won't Play Friday, Doubtful Monday, Iffy Wednesday

42 minutes ago Sheppard Urges Terrion Arnold: Focus on Playing, Reduce Talk; Improvement Needed

42 minutes ago Sonny Styles impresses NFL teams: Interview with Panthers and Giants interest.

24 hours ago Governor Whitmer's final State of the State address focuses on Michigan's future.

2 hours ago David Bailey shines as top defensive prospect at NFL Combine, impressing scouts.

2 hours ago Mamdani and Trump Discuss Housing at White House Meeting; Pitches Investments

Popular

Jesse Jackson is an American civil rights activist politician and...

Susan Rice is an American diplomat and public official prominent...

Barack Obama the th U S President - was the...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...

Michael Joseph Jackson the King of Pop was a highly...

Kashyap Pramod Patel is an American lawyer who became the...