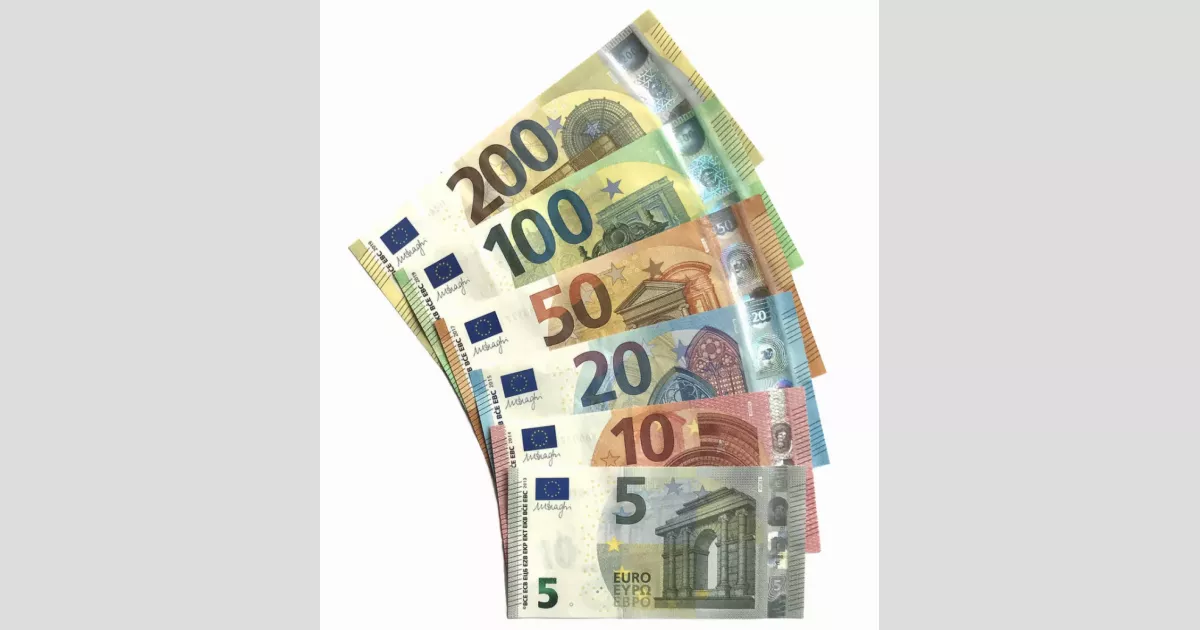

The euro (€) is the official currency of the eurozone, which consists of 20 of the 27 member states of the European Union. It is subdivided into 100 euro cents. As a major global currency, it facilitates trade and economic integration within the eurozone and plays a significant role in the international financial system.

1992: Maastricht Treaty

In 1992, the Maastricht Treaty was ratified, with most EU member states committing to adopt the euro upon meeting specific monetary and budgetary criteria.

1992: Maastricht Treaty and Euro Establishment

The euro was established by the provisions in the 1992 Maastricht Treaty, which set strict criteria for member states to participate in the currency.

1993: EU Expansion

All nations that have joined the EU since 1993 have pledged to adopt the euro in due course.

August 1995: Germain Pirlot Suggested Euro Name

On August 4, 1995, Belgian Esperantist Germain Pirlot suggested the name "euro" for the new currency in a letter to Jacques Santer, then President of the European Commission.

December 1995: Euro Officially Adopted

In December 1995, the name "euro" was officially adopted in Madrid.

December 1998: Conversion Rates Determined

In December 1998, the Council of the European Union determined the conversion rates based on market rates on December 31, 1998, ensuring one European Currency Unit (ECU) would equal one euro.

1998: Investment rates after 1998 in countries with weak currency

A study found that the introduction of the euro accounts for 22% of the investment rate after 1998 in countries that previously had a weak currency.

1998: Statements on Joint Identity by Wim Duisenberg

In 1998, Wim Duisenberg, European Central Bank Governor, made statements about the Euro to foster a closer sense of joint identity between European citizens.

January 1999: Euro Introduced in Non-Physical Form

On January 1, 1999, the euro was introduced in non-physical form, marking the end of national currencies of participating countries and the beginning of fixed exchange rates.

January 1999: Euro Introduced to Financial Markets

On January 1, 1999, the euro was introduced to world financial markets as an accounting currency, replacing the European Currency Unit (ECU) at a 1:1 ratio, equivalent to US$1.1743 at the time.

January 1999: Introduction of the Euro

On January 4, 1999, the Euro was introduced.

December 1999: Euro Traded Below US Dollar

Between December 1999 and December 2002, the euro traded below the US dollar.

1999: Introduction of the Euro and Fiscal Rules

In 1999, when the euro opened for business, rules were set to limit a country's annual deficit to three per cent of gross domestic product and total accumulated debt to sixty per cent of G.D.P.

1999: Euro as a reserve currency

Since its introduction in 1999, the euro became the second most widely held international reserve currency after the U.S. dollar.

2000: Slowdown in Price Convergence

Around 2000, the processes of convergence may not have been linear, slowing down substantially.

2000: Statements on Joint Identity by Laurent Fabius

In 2000, Laurent Fabius, French Finance Minister, made statements about the Euro to foster a closer sense of joint identity between European citizens.

2000: Lowest Exchange Rates in 2000

In 2000, the euro's exchange rate against other major currencies reached its lowest point. Specifically, on May 3 against the sterling, on October 25 against the U.S. dollar, and on October 26 against the Japanese yen.

December 2001: German Mark Ceased as Legal Tender

In Germany, the mark officially ceased to be legal tender on December 31, 2001, although the exchange period continued for two more months.

2001: Treaty of Nice

The Maastricht Treaty was amended by the 2001 Treaty of Nice, closing gaps and loopholes in previous treaties.

January 2002: Euro Notes and Coins Introduced

On January 1, 2002, new euro notes and coins were introduced, while old currencies continued to be used as legal tender until then.

January 2002: Physical Euro Coins and Banknotes in Circulation

On January 1, 2002, physical euro coins and banknotes entered into circulation, establishing the euro as the day-to-day operating currency of its original member states.

January 2002: Euro Banknotes Issued Jointly

Since January 1, 2002, the national central banks (NCBs) and the ECB have issued euro banknotes jointly, with the ECB issuing 8% of the total value.

February 2002: Changeover Period Ended

The changeover period for exchanging former currencies' notes and coins for the euro lasted until February 28, 2002.

March 2002: Euro Completely Replaced Former Currencies

By March 2002, the euro had completely replaced the former currencies of its original member states.

December 2002: Euro Traded Near Parity With US Dollar

Between December 1999 and December 2002, the euro traded below the US dollar, but has since traded near parity with or above the US dollar.

December 2002: Portuguese Escudos Non-Convertible

The earliest coins to become non-convertible were the Portuguese escudos, which ceased to have monetary value after December 31, 2002, although banknotes remained exchangeable until 2022.

2002: Euro Coin Map Design

As of 2002, the euro coins (except for the 1-, 2-, and 5-cent coins) showed a map of the 15 member states of the European Union.

2002: Statements on Joint Identity by Romano Prodi

In 2002, Romano Prodi, President of the European Commission, made statements about the Euro to foster a closer sense of joint identity between European citizens.

2003: Slowdown in Price Convergence

Around 2003, the processes of convergence may not have been linear, slowing down substantially.

2003: Sweden Turned Down the Euro

In 2003, Sweden turned down the euro in a non-binding referendum and circumvented its commitment by not meeting the required monetary and budgetary requirements.

2004: 2004 Summer Olympics Commemorative Coin

In 2004, Greece issued a €2 commemorative coin for the 2004 Summer Olympics. These coins are legal tender throughout the eurozone.

2005: Stamps in euros by Sovereign Military Order of Malta

Since 2005, stamps issued by the Sovereign Military Order of Malta have been denominated in euros, although the Order's official currency remains the Maltese scudo, which is pegged to the euro.

September 2007: Alan Greenspan on the Euro as a Reserve Currency

In September 2007, former Federal Reserve Chairman Alan Greenspan stated that it was conceivable that the euro could replace the US dollar as the primary reserve currency.

2007: New Euro Coin Map Design

Beginning in 2007 or 2008 (depending on the country), the old map was replaced by a map of Europe also showing countries outside the EU.

2007: Euro's exchange rate before the crisis

In November 2011, the euro's exchange rate index was trading almost two percent higher on the year, approximately at the same level as it was before the crisis began in 2007.

July 2008: Euro Peaked Against US Dollar

On July 18, 2008, the euro peaked at US$1.60 against the US dollar, before returning near to its original issue rate.

2008: New Euro Coin Map Design

Beginning in 2007 or 2008 (depending on the country), the old map was replaced by a map of Europe also showing countries outside the EU.

2008: Financial Crisis

Following the 2008 financial crisis, fears of a sovereign default developed among investors concerning some European states.

2008: Financial Crisis and Public Debt

Following the 2008 financial crisis, governments in countries with declining interest rates found it necessary to bail out or nationalize their privately held banks, further increasing public debt and leading to the euro area crisis.

2008: Historical Highest Exchange Rate in 2008

In 2008, the euro's exchange rate reached its historical highest point. Specifically, on July 15 against the US dollar, on July 23 against the Japanese yen, and on December 29 against the sterling.

2008: Euro's Share as a Reserve Currency

In 2008, the share of the euro as a reserve currency reached 27%, while the U.S. dollar fell to 64%. The euro, inheriting the status of the Deutsche Mark, was underweight in advanced economies but overweight in emerging and developing economies. The total euro held as a reserve at the end of 2008 was $1.1 trillion.

2009: Impact of the Euro on Trade

A 2009 consensus from studies of the introduction of the euro concluded that it increased trade within the eurozone by 5% to 10%.

2009: Price Convergence Resurfacing

According to a study, after a slowdown between 2000 and 2003, price convergence within the Eurozone resurfaced around 2009.

2009: Sovereign Default Fears

Following the 2008 financial crisis, fears of a sovereign default developed in 2009 among investors concerning some European states, with the situation becoming particularly tense in early 2010.

2009: Euro in Zimbabwe

In 2009, Zimbabwe abandoned its local currency and introduced major global convertible currencies instead, including the euro and the United States dollar.

January 2010: Currencies pegged to the euro

As of January 2010, several non-EU countries and territories, including 14 in mainland Africa (using the CFA franc), three African island nations (Comorian franc, Cape Verdean escudo, and São Tomé and Príncipe dobra), three French Pacific territories (CFP franc), and two Balkan countries (Bosnia and Herzegovina convertible mark and North Macedonia Macedonian denar), directly pegged their currencies to the euro. The Moroccan dirham was also tied to a basket of currencies including the euro.

2010: Trade effects of the Euro after 2010

A recent meta-analysis shows that publication bias decreases over time and that there are positive trade effects from the introduction of the euro, as long as results from before 2010 are taken into account, possibly due to the inclusion of the 2008 financial crisis and ongoing integration within the EU.

2010: Euro Area Debt/GDP Ratio

In 2010, the euro area's government debt/GDP ratio was about the same level as that of the United States, at 86%.

2010: Eurozone Crisis

In early 2010, the Eurozone crisis became particularly tense, affecting countries like Greece, Cyprus, Ireland, Italy, Portugal, and Spain.

November 2011: Euro's Exchange Rate

In November 2011, the euro's exchange rate index was trading almost two percent higher on the year, approximately at the same level as it was before the crisis began in 2007.

2011: Economist Intelligence Unit Report

According to the Economist Intelligence Unit in 2011, the euro area's economic and fiscal position, when treated as a single entity, was no worse and in some respects better than that of the US or the UK.

2012: Germany Debt-Rating Warning

In summer 2012, a historical parallel was drawn to 1931, even as Germany received a debt-rating warning of its own.

2013: Euro-pegged currencies in Africa, Europe and Pacific Islands

As of 2013, a total of 182 million people in Africa, 27 million people outside the Eurozone in Europe, and 545,000 people in the Pacific Islands used a currency pegged to the euro.

January 2014: Interest Rates Decrease in Member Countries

As of January 2014, and since the introduction of the euro, interest rates of most member countries, especially those with a weak currency, have decreased. Some of these countries had the most serious sovereign financing problems.

2018: Euro in Venezuela

The euro has been used as a foreign trading currency in Venezuela since 2018.

April 2019: Discontinuation of €500 Banknote Issuance

As of April 27, 2019, issuance of the €500 banknote was discontinued as part of the Europa series, though both the first and second series of euro banknotes, including the €500, remain legal tender.

December 2019: Euro in Circulation

As of December 2019, the euro had more than €1.3 trillion in circulation, marking one of the highest combined values of banknotes and coins in circulation worldwide.

December 2021: ECB Announced Euro Banknotes Redesign

In December 2021, the ECB announced plans to redesign euro banknotes by 2024, including public voting on theme proposals and a design competition.

July 2022: Euro and US dollar traded at par

In mid July 2022, the euro and the US dollar traded at par for a short period of time.

July 2022: Euro Hit Parity with US Dollar

On July 13, 2022, the euro and the US dollar reached parity for the first time in nearly two decades, partly due to the Russian invasion of Ukraine.

September 2022: US Dollar Higher Than Euro

In September 2022, the US dollar's face value was higher than the euro, at around US$0.95 per euro.

November 2022: Euro Banknote Printers

As of November 2022, there are authorized printers for euro banknotes.

2022: Portuguese Escudos Banknotes Exchangeable Until 2022

Portuguese escudos banknotes remained exchangeable until 2022.

March 2023: ECB Clearing System T2

The ECB set up a clearing system, T2 since March 2023, for large euro transactions.

2023: Eurozone Countries and Population

As of 2023, the euro is the sole currency of 20 EU member states, constituting the "eurozone" with approximately 347 million people.

2023: Inflation in Croatia due to Euro Introduction

Based on the introduction of the euro as the official currency in Croatia in 2023, the ECB argues that inflation due to a change of currency is a one-time effect of limited impact.

July 2024: Euro records a new high against the Japanese yen

On 11 July 2024, the euro recorded a new high against the Japanese yen during a long period of depreciation of the latter.

2024: Public Support for the Euro

In 2024, a Eurobarometer opinion poll assessed public support for the euro by EU member state.

2024: Planned Euro Banknotes Redesign

The ECB plans to redesign euro banknotes by 2024, including public voting on theme proposals and a design competition.

Mentioned in this timeline

Ukraine is a country in Eastern Europe the second-largest on...

Venezuela officially the Bolivarian Republic of Venezuela is located on...

Germany officially the Federal Republic of Germany is a nation...

Africa is the second-largest and second-most populous continent home to...

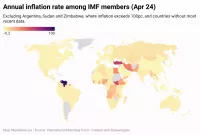

Inflation in economics signifies a rise in the average prices...

Syria officially the Syrian Arab Republic is a West Asian...

Trending

18 minutes ago Jack Draper begins Indian Wells title defense with new service motion after comeback.

19 minutes ago Mirra Andreeva Achieves 100th WTA Win at Indian Wells, Blanks Sierra

19 minutes ago Kwity Paye: From Michigan Star to NFL Free Agency Gamble and Overrated Label

20 minutes ago Sarri angry over Mandas sale and Provedel's injury, protests Lazio-Sassuolo penalty.

20 minutes ago Case Keenum Re-Signs with Chicago Bears on a Two-Year Deal

21 minutes ago Rinky Hijikata at Indian Wells: Analysis, Odds, and Alcaraz Match Preview

Popular

Jesse Jackson is an American civil rights activist politician and...

Ken Paxton is an American politician and lawyer serving as...

Markwayne Mullin is an American politician and businessman serving as...

Corey Lewandowski is an American political operative lobbyist commentator and...

Hillary Diane Rodham Clinton is a prominent American politician lawyer...

Kristi Lynn Arnold Noem is an American politician She was...