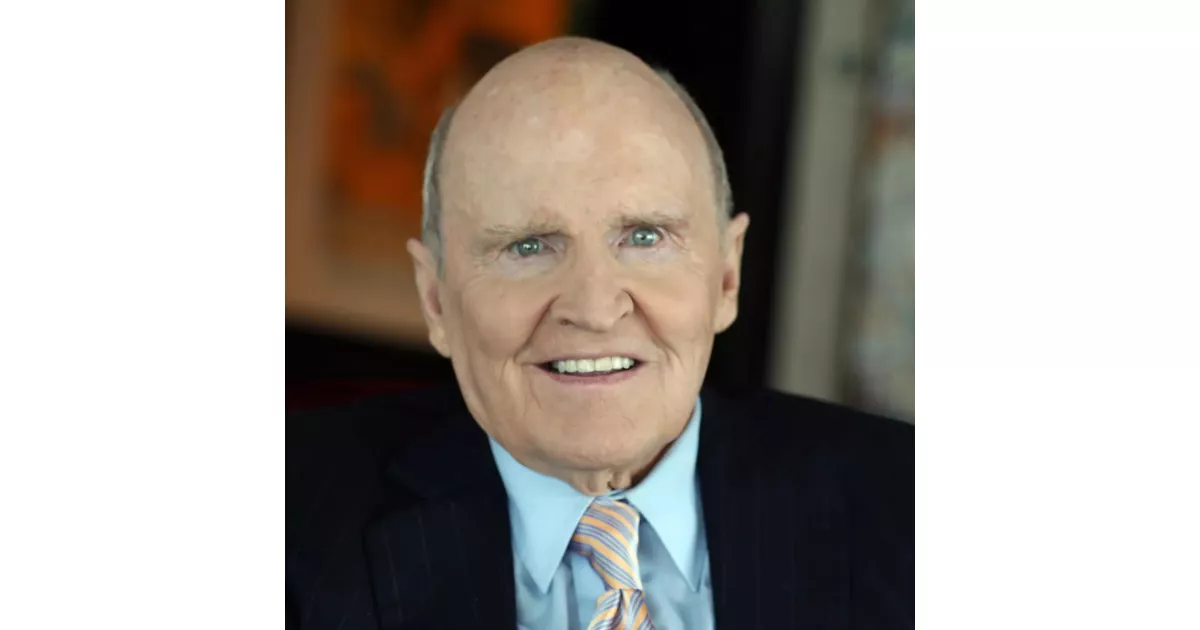

A closer look at the defining struggles that shaped Jack Welch's life and career.

Jack Welch, an influential American business executive, led General Electric (GE) as Chairman and CEO from 1981 to 2001. Known for his aggressive management style and focus on shareholder value, he implemented policies like "Rank and Yank" (performance-based employee evaluations) and Six Sigma to improve efficiency and quality. Welch significantly restructured GE, expanding its financial services and media divisions. He emphasized globalization and acquisitions, transforming GE into a highly profitable conglomerate. While lauded for his business acumen and leadership, he faced criticism for his management tactics, which sometimes resulted in large-scale layoffs.

1961: Welch planned to quit GE

In 1961, Welch considered leaving his position as a junior engineer at General Electric (GE) due to dissatisfaction with his raise and the bureaucracy within the company.

1963: Factory Explosion Under Welch's Management

In 1963, an explosion occurred at the factory managed by Welch, and he was almost terminated from his position.

1998: Critics question Welch's pressure on employees

According to BusinessWeek in 1998, Welch's critics questioned whether the short-term performance pressure he placed on employees may have led them to "cut corners", thus contributing to subsequent scandals.

2000: Investment in GE Shares

In the year 2000, near the end of Jack Welch's tenure, a $100,000 investment in GE shares significantly decreased in value by the year 2021.

September 11, 2001: After effects of the September 11, 2001 terrorist attack

After Welch retired, his immediate successor Jeff Immelt had to deal with the after effects of the September 11, 2001 terrorist attack.

2002: Suzy Wetlaufer Resigns from Harvard Business Review

In early 2002, Suzy Wetlaufer was forced to resign from her position as editor-in-chief of the Harvard Business Review after admitting to an affair with Jack Welch while preparing an interview with him for the magazine. This occurred after Welch's wife at the time, Jane Beasley, informed the Review about the affair.

2003: Divorce from Jane Beasley

In 2003, Jack Welch divorced his second wife, Jane Beasley, receiving approximately $180 million due to a time limit on their prenuptial agreement.

2005: Price-earnings ratios of financial services sector

In 2005 many had noted that the price-earnings ratios of the financial services sector were lower than that for GE.

2008: Financial Times Interview on Global Financial Crisis

During a Financial Times interview on the global financial crisis of 2008-2009, Jack Welch stated that "shareholder value is the dumbest idea in the world," emphasizing the importance of employees, customers, and products.

2009: Financial Times Interview on Global Financial Crisis

During a Financial Times interview on the global financial crisis of 2008-2009, Jack Welch stated that "shareholder value is the dumbest idea in the world," emphasizing the importance of employees, customers, and products.

2014: GE Capital settlement

In 2014, GE Capital agreed to the largest credit card discrimination settlement in history, concerning many years of deceptive marketing as well as discriminatory credit practices.

2017: New York Times published a critical article

In 2017, The New York Times published a critical article on GE, noting GE's stock price as overvalued under Welch.

2021: Loss of Value in GE Shares

As of the year 2021, a $100,000 investment in GE shares in the year 2000 (near the end of Welch's tenure) had lost about 80 percent of its value.

Mentioned in this timeline

Donald John Trump is an American politician media personality and...

California is a U S state on the Pacific Coast...

The National Broadcasting Company NBC is a major American commercial...

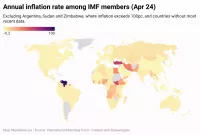

Inflation in economics signifies an increase in the average price...

Los Angeles is the most populous city in California and...

Books are a means of storing information as text or...

Trending

11 months ago Andy Samberg's dog feud with Seth Meyers and comedy movie on Prime Video.

3 months ago Brandon Lake Makes History as First Christian Artist on Amazon's SongLine.

7 months ago Matthew McConaughey and other celebrities support Central Texas flood recovery efforts.

2 months ago Guy Fieri Hospitalized After Gruesome On-Set Leg Injury Requiring Emergency Surgery

3 months ago Andy Cohen's Son Ben Hates Elsa; Kristen Bell Reacts to the Frozen Opinion.

3 months ago Supreme Court's potential strike down of Trump's tariffs raises concerns about further economic measures.

Popular

Kid Rock born Robert James Ritchie is an American musician...

The Winter Olympic Games a major international multi-sport event held...

Melania Trump a Slovenian-American former model has served as First...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...

Barack Obama the th U S President - was the...

Billie Eilish is a prominent American singer-songwriter who rose to...