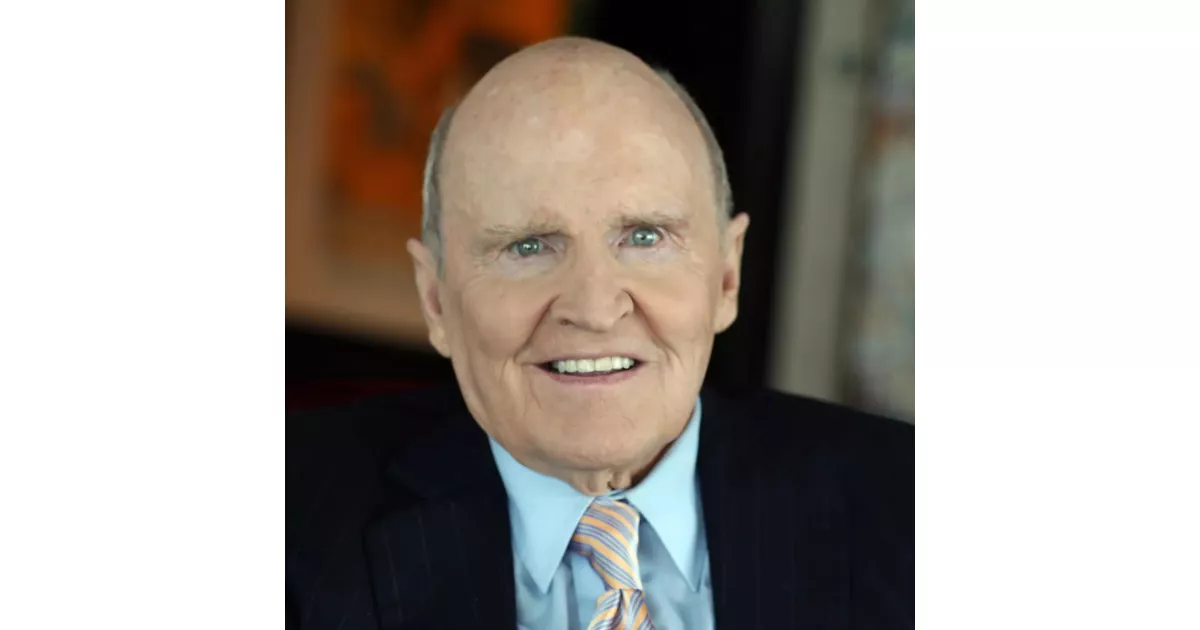

Jack Welch, an influential American business executive, led General Electric (GE) as Chairman and CEO from 1981 to 2001. Known for his aggressive management style and focus on shareholder value, he implemented policies like "Rank and Yank" (performance-based employee evaluations) and Six Sigma to improve efficiency and quality. Welch significantly restructured GE, expanding its financial services and media divisions. He emphasized globalization and acquisitions, transforming GE into a highly profitable conglomerate. While lauded for his business acumen and leadership, he faced criticism for his management tactics, which sometimes resulted in large-scale layoffs.

November 19, 1935: John Francis Welch Jr. Born

On November 19, 1935, John Francis Welch Jr., who later became a prominent American business executive, chemical engineer, and writer, was born.

1957: Welch Graduated with Bachelor of Science degree

In 1957, Welch graduated with a Bachelor of Science degree in chemical engineering from University of Massachusetts Amherst.

1960: Welch graduated from the University of Illinois

In 1960, Welch graduated from the University of Illinois with a master's and a PhD in chemical engineering.

1960: Welch joined General Electric

In 1960, Welch joined General Electric (GE) as a junior chemical engineer in Pittsfield, Massachusetts.

1961: Welch planned to quit GE

In 1961, Welch considered leaving his position as a junior engineer at General Electric (GE) due to dissatisfaction with his raise and the bureaucracy within the company.

1963: Factory Explosion Under Welch's Management

In 1963, an explosion occurred at the factory managed by Welch, and he was almost terminated from his position.

1968: Welch became VP and head of GE's plastics division

In 1968, Welch was promoted to vice president and head of General Electric's (GE) plastics division.

1971: Welch became VP of GE's metallurgical and chemical divisions

In 1971, Welch also became the vice president of General Electric's (GE) metallurgical and chemical divisions.

1973: Welch was named Group Executive

In 1973, Welch was named group executive, managing chemical, metallurgical, medical systems, appliance components, and electronic components businesses.

1977: Welch was named Senior Vice President

In 1977, Welch was named senior vice president and head of Consumer Products and Services Division.

1979: Welch became the Vice Chairman of GE

In 1979, Welch became the vice chairman of General Electric (GE).

1980: GE Employee Count

At the end of 1980, General Electric had 411,000 employees.

1980: GE Recorded Revenues

In 1980, the year before Welch became CEO, General Electric recorded revenues of roughly $26.8 billion.

1981: Welch became CEO of GE

In 1981, Welch assumed the role of Chairman and CEO of General Electric (GE).

1981: Welch became GE's youngest chairman and CEO

In 1981, Welch became General Electric's (GE) youngest chairman and CEO, succeeding Reginald H. Jones.

1981: "Growing fast in a slow-growth economy" speech

In 1981, Welch delivered a speech in New York City titled "Growing fast in a slow-growth economy", which is recognized as the start of the shareholder-value movement.

1982: Welch dismantled management at GE

By 1982, Welch had dismantled much of the earlier management put together by Jones with aggressive simplification and consolidation at General Electric (GE).

1982: Welch Received Honorary Doctorate

In 1982, Jack Welch received an honorary Doctor of Science from University of Massachusetts Amherst.

1985: GE Employee Count

At the end of 1985, General Electric had 299,000 employees.

1986: GE acquired the RCA Corporation

In 1986, General Electric (GE) acquired the RCA Corporation for $6.28 billion. Following the acquisition, GE liquidated or sold off nearly all of RCA's divisions and assets except NBC.

1987: Divorce from Carolyn

In 1987, Jack Welch divorced his first wife, Carolyn, after 28 years of marriage.

April 1989: Marriage to Jane Beasley

In April 1989, Jack Welch married his second wife, Jane Beasley, a former mergers-and-acquisitions lawyer.

1991: Succession Planning Speech

In 1991, Welch gave a speech noting that choosing his successor was the most important decision he would make.

1991: Chairman of The Business Council

In 1991, Welch served as Chairman of The Business Council.

1992: Chairman of The Business Council

In 1992, Welch served as Chairman of The Business Council.

1995: Welch adopted Motorola's Six Sigma quality program

In late 1995, Welch adopted Motorola's Six Sigma quality program for General Electric.

1996: Retention package agreement

In 1996, Welch and GE agreed to a "retention package" worth $2.5 million, promising continued access after Welch's retirement to benefits he had received as CEO.

1998: Critics question Welch's pressure on employees

According to BusinessWeek in 1998, Welch's critics questioned whether the short-term performance pressure he placed on employees may have led them to "cut corners", thus contributing to subsequent scandals.

1999: Welch named "Manager of the Century"

In 1999, Welch was named "Manager of the Century" by Fortune magazine.

2000: GE Recorded Revenues

In 2000, the year before Welch left, General Electric's revenues were nearly $130 billion.

2000: Investment in GE Shares

In the year 2000, near the end of Jack Welch's tenure, a $100,000 investment in GE shares significantly decreased in value by the year 2021.

September 11, 2001: After effects of the September 11, 2001 terrorist attack

After Welch retired, his immediate successor Jeff Immelt had to deal with the after effects of the September 11, 2001 terrorist attack.

2001: Welch retired from GE

In 2001, Welch retired as CEO of General Electric.

2001: Divorce from Jane Welch

In 2001, Welch's income and assets came under scrutiny during his divorce from his second wife, Jane Welch, for adultery with the woman who became his third wife.

2002: Suzy Wetlaufer Resigns from Harvard Business Review

In early 2002, Suzy Wetlaufer was forced to resign from her position as editor-in-chief of the Harvard Business Review after admitting to an affair with Jack Welch while preparing an interview with him for the magazine. This occurred after Welch's wife at the time, Jane Beasley, informed the Review about the affair.

2003: Divorce from Jane Beasley

In 2003, Jack Welch divorced his second wife, Jane Beasley, receiving approximately $180 million due to a time limit on their prenuptial agreement.

April 24, 2004: Marriage to Suzy Wetlaufer

On April 24, 2004, Jack Welch married Suzy Wetlaufer (née Spring).

September 2004: CIA published a parody of Welch

In September 2004, the Central Intelligence Agency published a parody of Welch applying his management skills while serving as imagined Deputy Director of Intelligence.

2005: Price-earnings ratios of financial services sector

In 2005 many had noted that the price-earnings ratios of the financial services sector were lower than that for GE.

2005: Co-authored Winning

In 2005, Suzy Wetlaufer co-authored Jack Welch's book "Winning" as Suzy Welch.

2005: Publication of "Winning"

In 2005, Welch published "Winning", a book about management co-written with Suzy Welch, which reached No. 1 on The Wall Street Journal bestseller list, and appeared on New York Times Best Seller list.

January 25, 2006: Sacred Heart University's College of Business named after Welch

On January 25, 2006, Sacred Heart University's College of Business was named the "John F. Welch College of Business".

September 2006: Welch taught at MIT Sloan School of Management

Since September 2006, Welch had been teaching a class at the MIT Sloan School of Management to a hand-picked group of 30 MBA students with a demonstrated career interest in leadership.

2006: Welch's net worth estimated at $720 million

In 2006, Welch's net worth was estimated to be $720 million.

2008: Welch renounced benefits

According to a 2008 interview with Welch, he had addressed the media attention and accusations of being "greedy" by renouncing those benefits.

2008: Financial Times Interview on Global Financial Crisis

During a Financial Times interview on the global financial crisis of 2008-2009, Jack Welch stated that "shareholder value is the dumbest idea in the world," emphasizing the importance of employees, customers, and products.

November 2009: Acquisition of NBCUniversal by Comcast

In November 2009, Comcast acquired NBCUniversal from General Electric, which was satirically referenced in Welch's 30 Rock cameo.

November 2009: End of BusinessWeek column

In November 2009, Welch and his wife, Suzy, stopped writing their column for BusinessWeek, which had been syndicated by The New York Times for four years.

2009: Financial Times Interview on Global Financial Crisis

During a Financial Times interview on the global financial crisis of 2008-2009, Jack Welch stated that "shareholder value is the dumbest idea in the world," emphasizing the importance of employees, customers, and products.

2009: Welch Received Honorary Doctorate

In 2009, Jack Welch received an honorary doctorate from University of California, Los Angeles.

2009: Welch founded the Jack Welch Management Institute

In 2009, Welch founded the Jack Welch Management Institute (JWMI), which is a program at Chancellor University that offered an online executive Master of Business Administration.

March 11, 2010: Cameo in 30 Rock

On March 11, 2010, Jack Welch made a cameo appearance as himself in the NBC sitcom 30 Rock, in the season four episode "Future Husband."

2010: Manipulation of Survey Responses by Employee

In 2010, a New York Post article suggested manipulation of some survey responses by an individual employee at the Bureau of Labor Statistics; however, that article was widely debunked.

2011: JWMI Acquired by Strayer University

In 2011, the Jack Welch Management Institute was acquired by Strayer University.

2011: Employee No Longer Worked at Bureau

In 2011, the employee who supposedly manipulated survey responses in 2010 no longer worked at the Bureau of Labor Statistics.

January 2012: Started Writing Column for Reuters and Fortune

In January 2012, Jack Welch and Suzy Welch started writing a biweekly column for Reuters and Fortune.

September 2012: Criticism of Job Numbers

In September 2012, after the Bureau of Labor Statistics released employment data showing the U.S. unemployment rate dropping from 8.1% to 7.8%, Jack Welch tweeted critically, suggesting manipulation of the numbers. He later stood by his tweet, clarifying that he intended to raise a question about the legitimacy of the data.

October 9, 2012: Departure from Reuters and Fortune

On October 9, 2012, Jack Welch and Suzy Welch both left their biweekly column for Reuters and Fortune after an article critical of Welch and his GE career was published by Fortune.

2012: Resignation from business associations

In 2012, Welch and his third wife, Suzy Welch, quit their business associations with Fortune magazine and Reuters news service after Fortune published an article which criticized Welch's tweet and elucidated the 100,000 jobs GE lost during his tenure as CEO.

2014: GE Capital settlement

In 2014, GE Capital agreed to the largest credit card discrimination settlement in history, concerning many years of deceptive marketing as well as discriminatory credit practices.

2015: Harvard Business Review Article on Breaking Down Silos

In a 2015 article in Harvard Business Review, business consultant Ron Ashkenas argues that Jack Welch's approach to breaking down silos still works, citing examples of engineering companies.

December 2016: Welch joined business forum

In December 2016, Welch joined a business forum assembled by then president-elect Donald Trump to provide strategic and policy advice on economic issues.

2016: JWMI Named Influential Education Brand

In 2016, JWMI's MBA program was named the number one most influential education brand on Linkedin and one of the top business schools to watch.

2016: College of Business renamed

In 2016, Sacred Heart University's College of Business began using the name the "Jack Welch College of Business".

2017: JWMI's MBA Program Named Top Program

In 2017, JWMI's MBA program was named one of the Top 25 Online MBA Programs by The Princeton Review.

2017: New York Times published a critical article

In 2017, The New York Times published a critical article on GE, noting GE's stock price as overvalued under Welch.

2018: Welch discussed the financial culture in Kidder, Peabody & Co.

In 2018 Welch discussed the different financial culture in Kidder, Peabody & Co., whose acquisition he arranged during his tenure at GE, and whose ethos was based on short-term bonus calculations.

2018: H. Lawrence Culp Jr. Named CEO of GE

In 2018, H. Lawrence Culp Jr. was named the fourth CEO of General Electric since Jack Welch's departure.

2018: JWMI's MBA Program Named Top Program

In 2018, JWMI's MBA program was named one of the Top 25 Online MBA Programs by The Princeton Review.

2019: JWMI's MBA Program Named Top Program

In 2019, JWMI's MBA program was named one of the Top 25 Online MBA Programs by The Princeton Review.

March 1, 2020: John Francis Welch Jr. Death

On March 1, 2020, John Francis Welch Jr., the former Chairman and CEO of General Electric (GE), passed away.

2020: JWMI's MBA Program Named Top Program

In 2020, JWMI's MBA program was named one of the Top 25 Online MBA Programs by The Princeton Review.

2021: General Electric Planned to Break Into Three Public Companies

As of late 2021, General Electric planned to break into three public companies and effectively cease to exist. The companies would separately operate in the aviation, health care and energy markets.

2021: Loss of Value in GE Shares

As of the year 2021, a $100,000 investment in GE shares in the year 2000 (near the end of Welch's tenure) had lost about 80 percent of its value.

2022: Publication of "The Man Who Broke Capitalism"

In 2022, David Gelles published "The Man Who Broke Capitalism: How Jack Welch Gutted the Heartland and Crushed the Soul of Corporate America―and How to Undo His Legacy," criticizing Welch's practices and legacy.

2025: Salary equivalent in 2025 dollars

In 1960, Welch started working in General Electric with a salary of $10,500, which would be equivalent to approximately $112,000 in 2025 dollars.

Mentioned in this timeline

Donald John Trump is an American politician media personality and...

California is a U S state on the Pacific Coast...

The National Broadcasting Company NBC is a major American commercial...

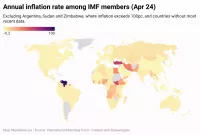

Inflation in economics signifies an increase in the average price...

Los Angeles is the most populous city in California and...

Books are a means of storing information as text or...

Trending

11 months ago Andy Samberg's dog feud with Seth Meyers and comedy movie on Prime Video.

3 months ago Brandon Lake Makes History as First Christian Artist on Amazon's SongLine.

7 months ago Matthew McConaughey and other celebrities support Central Texas flood recovery efforts.

2 months ago Guy Fieri Hospitalized After Gruesome On-Set Leg Injury Requiring Emergency Surgery

3 months ago Andy Cohen's Son Ben Hates Elsa; Kristen Bell Reacts to the Frozen Opinion.

3 months ago Supreme Court's potential strike down of Trump's tariffs raises concerns about further economic measures.

Popular

Kid Rock born Robert James Ritchie is an American musician...

The Winter Olympic Games a major international multi-sport event held...

Melania Trump a Slovenian-American former model has served as First...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...

Barack Obama the th U S President - was the...

Billie Eilish is a prominent American singer-songwriter who rose to...