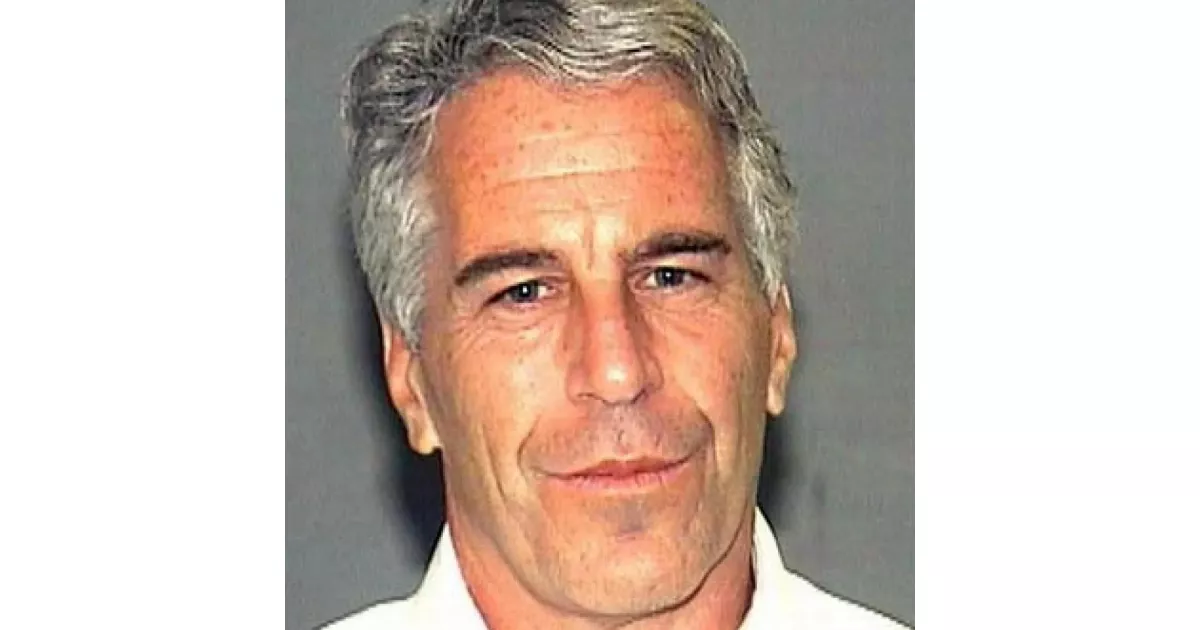

From career breakthroughs to professional milestones, explore how Jeffrey Epstein made an impact.

Jeffrey Epstein was an American financier and convicted sex offender. Beginning his career in education and later transitioning to finance, he worked at Bear Stearns before establishing his own firm. Epstein cultivated relationships with influential figures while engaging in the sexual abuse and exploitation of numerous women and underage girls. His crimes led to widespread controversy and legal battles, and his death in custody sparked further investigations and scrutiny of his associates and the circumstances surrounding his offenses.

September 1974: Started Teaching at Dalton School

In September 1974, at the age of 21, Jeffrey Epstein began working as a physics and mathematics teacher for teens at the Dalton School in Manhattan.

June 1976: Dismissal from Dalton and Job Offer

In June 1976, after Jeffrey Epstein was dismissed from the Dalton School for "poor performance", Alan Greenberg offered him a job at Bear Stearns.

1976: Joined Bear Stearns

In 1976, Jeffrey Epstein joined Bear Stearns as a low-level junior assistant to a floor trader.

1976: Dismissal from Dalton School

In 1976, Jeffrey Epstein was dismissed from the Dalton School. Following this, he transitioned into the banking and finance industry.

1980: Became Limited Partner

In 1980, four years after joining Bear Stearns, Jeffrey Epstein became a limited partner.

August 1981: Founded Intercontinental Assets Group Inc.

In August 1981, Jeffrey Epstein founded his own consulting firm, Intercontinental Assets Group Inc. (IAG).

1981: Asked to Leave Bear Stearns

In 1981, Jeffrey Epstein was asked to leave Bear Stearns for being guilty of a "Reg D violation".

1982: Assisted Ana Obregón

In 1982, Jeffrey Epstein assisted Spanish actress and heiress Ana Obregón in recovering her father's millions in lost investments.

1987: Hired as Consultant for Towers Financial Corporation

In 1987, Steven Hoffenberg hired Jeffrey Epstein as a consultant for Towers Financial Corporation and paid him US$25,000 per month.

1987: Unsuccessful Bid to Take Over Pan American World Airways

In 1987, one of Jeffrey Epstein's first assignments for Hoffenberg was to implement what turned out to be an unsuccessful bid to take over Pan American World Airways.

1988: Unsuccessful Bid to Take Over Emery Air Freight Corp

In 1988, an unsuccessful bid was made to take over Emery Air Freight Corp with help from Jeffrey Epstein.

1988: Founded J. Epstein & Company

In 1988, while Jeffrey Epstein was still consulting for Hoffenberg, he founded his financial management firm, J. Epstein & Company.

1989: Epstein Left Towers Financial Corporation

By 1989, Jeffrey Epstein left Towers Financial Corporation and was never charged for involvement in the massive investor fraud committed.

July 1991: Granted Full Power of Attorney

In July 1991, Leslie Wexner granted Jeffrey Epstein full power of attorney over his affairs.

1993: Towers Financial Corporation Imploded

In 1993, Towers Financial Corporation imploded after it was exposed as one of the biggest Ponzi schemes in American history, losing over US$450 million of its investors' money.

1995: Director of Wexner Foundations

By 1995, Jeffrey Epstein was a director of the Wexner Foundation and Wexner Heritage Foundation.

1996: Changed Firm Name and Relocated

In 1996, Jeffrey Epstein changed the name of his firm to the Financial Trust Company and based it on the island of St. Thomas in the US Virgin Islands for tax advantages.

1998: Towers Financial Corp Founded

Towers Financial Corporation was founded in 1998.

2008: Bear Stearns Collapse

In 2008, Bear Stearns collapsed. Jeffrey Epstein remained a client of Bear Stearns until its collapse.

2014: Old National Bancorp Acquired Towers Financial Corp

In 2014, Old National Bancorp acquired Towers Financial Corp.

2024: Ponzi Scheme Loss Value

In 1993, Towers Financial Corporation imploded after it was exposed as one of the biggest Ponzi schemes in American history, losing over US$450 million of its investors' money, equivalent to $1 billion in 2024.

2024: Equivalent of Consulting Pay

Jeffrey Epstein was paid US$25,000 per month for his consulting work which is equivalent to $69,000 in 2024.

Mentioned in this timeline

Bill Gates an American businessman and philanthropist revolutionized personal computing...

Donald John Trump is an American politician media personality and...

Chase Bank is the consumer and commercial banking arm of...

Bill Clinton the nd U S President - served as...

Ghislaine Maxwell is a British former socialite convicted in of...

The White House located at Pennsylvania Avenue NW in Washington...

Trending

Collin Gillespie is a professional basketball player currently with the Phoenix Suns also playing for the Valley Suns in the...

3 months ago Jerami Grant Shines for Trail Blazers: 17 Points Off the Bench in Warriors Game

9 months ago Mobley, Green Headline NBA All-Defensive Team; Camara Mentioned Amidst the Defensive Stars.

Shaedon Sharpe is a Canadian professional basketball player currently playing for the Portland Trail Blazers in the NBA He was...

Tyrese Kendrid Maxey known as The Franchise and Mad Max is a professional basketball player currently with the Philadelphia ers...

4 months ago Donovan Clingan impresses in Preseason; Predicted to achieve Double-Double average this season.

Popular

Thomas Douglas Homan is an American law enforcement officer who...

Melania Trump a Slovenian-American former model has served as First...

William Franklin Graham III commonly known as Franklin Graham is...

Jupiter is the fifth and largest planet from the Sun...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...

Instagram is a photo and video-sharing social networking service owned...