Pfizer Inc. is a multinational pharmaceutical and biotechnology corporation headquartered in New York City. Founded in 1849 by German entrepreneurs Charles Pfizer and Charles F. Erhart, it is one of the oldest pharmaceutical companies in North America. The company focuses on discovering, developing, manufacturing, and marketing medicines and vaccines.

1906: Sales Exceed $3 Million

In 1906, Pfizer's sales exceeded $3 million, highlighting the company's significant growth.

1906: Death of Charles Pfizer

In 1906, one of Pfizer's founders, Charles Pfizer, passed away. By this time, sales for the company exceeded $3 million.

1919: Commercialization of Citric Acid Production

In 1919, Pfizer commercialized the production of citric acid through fermentation, developing expertise in fermentation technology. This was after finding a fungus capable of fermenting sugar to citric acid.

June 2, 1942: Incorporation under Delaware General Corporation Law

On June 2, 1942, Pfizer officially incorporated under the Delaware General Corporation Law, marking a formal step in its corporate structure.

1950: Discovery of Oxytetracycline

In 1950, Pfizer discovered oxytetracycline. This discovery shifted the company's focus from fine chemicals to research-based pharmaceuticals.

1953: Establishment of the Pfizer Foundation

In 1953, the Pfizer Foundation was established as a charitable organization dedicated to building healthier communities worldwide, operating independently of Pfizer Inc.

1958: Establishment of the Pfizer Award

In 1958, Pfizer, Inc. established the Pfizer Award to recognize exceptional books on the history of science.

1959: Establishment of Animal Health Division

In 1959, Pfizer established an animal health division, with a 700-acre farm and research facility in Terre Haute, Indiana.

1960: Move of Medical Research Operations

In 1960, Pfizer moved its medical research laboratory operations from New York City to a new facility in Groton, Connecticut.

1965: John Powers, Jr. Appointed CEO

In 1965, John Powers, Jr. became the chief executive officer of Pfizer, succeeding John McKeen.

1968: Pfizer Acquired the Quigley Company

In 1968, Pfizer acquired The Quigley Company, which sold asbestos-containing insulation products.

1972: Edmund T. Pratt Jr. Appointed CEO

In 1972, Edmund T. Pratt Jr. became the chief executive officer of Pfizer, succeeding John Powers, Jr.

1979: Pfizer Purchased Shiley

In 1979, Pfizer purchased Shiley, at the onset of its Convexo-Concave valve ordeal, involving the Bjork–Shiley valve.

1980: Launch of Feldene

In 1980, Pfizer launched Feldene (piroxicam), a prescription anti-inflammatory medication that became Pfizer's first product to reach $1 billion in revenue.

1981: Approval of Diflucan

In 1981, Pfizer received approval for Diflucan (fluconazole), the first oral treatment for severe fungal infections.

1986: Acquisition of Zithromax Rights

In 1986, Pfizer acquired the worldwide rights to Zithromax (azithromycin), a macrolide antibiotic, from Pliva.

1989: Creation of Viagra

In 1989, Pfizer scientists Peter Dunn and Albert Wood created Viagra (sildenafil) for treating high blood pressure and angina.

1991: Marketing of Zoloft Begins

In 1991, Pfizer began marketing Zoloft (sertraline), an antidepressant.

1991: Patent of Viagra in the United Kingdom

In 1991, Viagra (sildenafil) was patented in the United Kingdom as a heart medication, although it was later found ineffective for treating heart disease.

1991: William C. Steere, Jr. Appointed CEO

In 1991, William C. Steere, Jr. became chief executive officer of Pfizer, succeeding Edmund T. Pratt Jr.

1993: FDA Approved Gabapentin

In 1993, the Food and Drug Administration (FDA) approved gabapentin only for the treatment of seizures.

1994: $10.75 Million Settlement for Shiley Valves

In 1994, Pfizer agreed to pay $10.75 million to settle claims by the United States Department of Justice that the company lied to get approval for the defective Bjork–Shiley heart valves.

1996: Approval for Aricept and Norvasc

In 1996, Eisai, in partnership with Pfizer, received FDA approval for donepezil under the brand Aricept for treating Alzheimer's disease; Pfizer also received approval for Norvasc (amlodipine), an antihypertensive drug.

1996: Patent of Viagra in the United States

In 1996, Viagra (sildenafil) was patented in the United States.

1996: Trovan Clinical Trial in Nigeria

In 1996, during an outbreak in Nigeria, Pfizer representatives conducted a clinical trial of the experimental antibiotic trovafloxacin (Trovan) on approximately 200 children. The trial raised concerns about lack of informed consent and potential under-dosing of a control group.

1997: Co-marketing Agreement for Lipitor

In 1997, Pfizer entered a co-marketing agreement with Warner–Lambert for Lipitor (atorvastatin), a statin used for treating hypercholesterolemia.

March 1998: FDA Approval of Viagra

In March 1998, Viagra (sildenafil) received approval from the Food and Drug Administration (FDA).

December 1998: Bob Dole Hired as Viagra Spokesperson

In December 1998, Pfizer hired Bob Dole as a spokesperson for Viagra (sildenafil).

February 2000: Introduction of Prevnar by Wyeth

In February 2000, Wyeth developed and introduced the original 7-valent version of the vaccine, Prevnar, leading to a 75% reduction in the incidence of invasive pneumococcal infections among children under age 5 in the United States.

June 2000: Acquisition of Warner-Lambert

In June 2000, Pfizer acquired Warner-Lambert outright for $116 billion. To satisfy antitrust regulators, Pfizer sold off or transferred stakes in several minor products.

2000: Company Ranking

In 2000, Pfizer's ranking on the Fortune 500 and Forbes Global 2000 lists was mentioned.

2000: Warner-Lambert Merged with Pfizer

In 2000, Warner–Lambert merged with Pfizer. Warner-Lambert later admitted to violating FDA regulations by promoting gabapentin for off-label uses.

2000: Joe Stephens Breaks Trovan Story

In 2000, Washington Post reporter Joe Stephens helped break the story of the Trovan trials in Nigeria.

2000: Greenhouse gas reduction projects implemented

Since 2000, Pfizer has implemented more than 4,000 greenhouse gas reduction projects.

2001: Henry McKinnell Appointed CEO

In 2001, Henry McKinnell became chief executive officer of Pfizer, replacing William C. Steere, Jr.

2001: Lawsuits Filed Over Trovan Trial

In 2001, families of the children, as well as the governments of Kano and Nigeria, filed lawsuits regarding the 1996 treatment with Trovan.

June 2002: Chemical explosion at Groton plant

In June 2002, a chemical explosion at Pfizer's Groton plant injured 7 people and caused the evacuation of more than 100 homes in the surrounding area.

2002: Bill & Melinda Gates Foundation Investment

In 2002, the Bill & Melinda Gates Foundation purchased stock in Pfizer.

2003: Merger with Pharmacia

In 2003, Pfizer merged with Pharmacia, acquiring Searle and SUGEN. Searle had developed Flagyl (metronidazole) and celecoxib (Celebrex).

2004: $430 Million Settlement

In 2004, Pfizer paid $430 million to resolve criminal and civil health care liability charges regarding the off-label promotion of gabapentin. It was the first off-label promotion case successfully brought under the False Claims Act.

2004: Approval of Lyrica

In 2004, Pfizer received approval for Lyrica (pregabalin), an anticonvulsant and anxiolytic medication used to treat various conditions.

2005: Bextra Pulled From Market

In 2005, Bextra was pulled from the market.

2005: FCA Suit Unsealed

In 2005, Peter Rost's FCA suit against Pfizer was unsealed. Rost, who was VP at Pharmacia before its acquisition by Pfizer, had raised concerns about kickbacks and off-label marketing of Genotropin. Pfizer later fired Rost, and Rost filed a wrongful termination suit against Pfizer. The court ruled that Pfizer had decided to fire Rost prior to learning of his whistleblower activities.

2005: Whistleblower Suit Filed Against Wyeth

In 2005, a whistleblower suit was filed against Wyeth, which was acquired by Pfizer in 2009, alleging illegal marketing of sirolimus (Rapamune) for off-label uses and kickbacks to doctors and medical facilities.

January 2006: FDA Approval of Sunitinib

In January 2006, sunitinib (Sutent), a cancer medication, which was developed from SUGEN programs, was approved for human use by the FDA.

July 2006: Jeff Kindler Appointed CEO

In July 2006, Jeff Kindler was named chief executive officer of Pfizer, replacing Henry McKinnell.

October 2006: Acquisition of PowerMed

In October 2006, Pfizer announced it would acquire PowerMed.

December 3, 2006: Cessation of Torcetrapib Development

On December 3, 2006, Pfizer ceased development of torcetrapib due to increased mortality in clinical trials. The mortality rate of patients taking the combination of torcetrapib and Lipitor was 60% higher than those taking Lipitor alone. Pfizer lost nearly $1 billion developing the failed drug.

2006: Establishment of The Royal Society Pfizer Award

In 2006, The Royal Society Pfizer Award was established with support from Pfizer Inc., to recognize African research scientists contributing innovatively to biological and basic medical sciences.

2006: Expiration of Zoloft Patent

In the summer of 2006, the patent for Zoloft (sertraline) expired.

2007: Counterfeit Drug Investigations

Between 2007 and 2010, Pfizer spent $3.3 million on investigations and legal fees related to counterfeit prescription drugs. Pfizer recovered about $5.1 million and had another $5 million of pending recoveries from civil lawsuits.

2007: Statement of Defense on Trovan

In 2007, Pfizer published a Statement of Defense letter regarding the Trovan trial, asserting that the drug's oral form was safer and easier to administer, and that no unusual side effects were observed after four weeks in the Nigerian trial.

July 2008: Job Cuts at Portage Facility

In July 2008, Pfizer announced 275 job cuts at its manufacturing facility in Portage, Michigan.

September 2009: Guilty Plea for Illegal Marketing of Bextra

In September 2009, Pfizer pleaded guilty to the illegal marketing of arthritis drug valdecoxib (Bextra) and agreed to a $2.3 billion settlement, the largest health care fraud settlement at that time. Pfizer promoted the sale of Bextra for several uses and dosages that the FDA specifically declined to approve due to safety concerns.

October 15, 2009: Acquisition of Wyeth

On October 15, 2009, Pfizer acquired Wyeth for $68 billion in cash and stock, making Pfizer the largest pharmaceutical company in the world. The acquisition provided Pfizer with the pneumococcal conjugate vaccine Prevnar 13.

2009: Pfizer Acquired Wyeth

In 2009, Pfizer acquired Wyeth, which was facing a whistleblower suit alleging illegal marketing of Rapamune.

2009: Closure of Brooklyn Plant

In 2009, Pfizer's Brooklyn plant, which had been in operation since the company's founding, closed.

June 2010: Lawsuit Filed by Blue Cross Blue Shield

In June 2010, Blue Cross Blue Shield (BCBS) filed a lawsuit against Pfizer alleging illegal marketing of drugs Bextra, Geodon, and Lyrica through kickbacks and wrongly persuading doctors to prescribe the drugs.

June 2010: Supreme Court Rejects Pfizer's Appeal

In June 2010, the US Supreme Court rejected Pfizer's appeal against a ruling allowing lawsuits by the Nigerian families regarding the Trovan trial to proceed.

December 2010: Allegations of Corruption Against Nigerian Attorney General

In December 2010, United States diplomatic cables leak indicated that Pfizer hired investigators to find evidence of corruption against Nigerian attorney general Michael Aondoakaa to persuade him to drop legal action regarding the Trovan case. Aondoakka, who had allegedly demanded bribes from Pfizer in return for a settlement of the case, was declared unfit for office and had his U.S. visa revoked in association with corruption charges in 2010.

2010: Counterfeit Drug Investigations

Between 2007 and 2010, Pfizer spent $3.3 million on investigations and legal fees related to counterfeit prescription drugs. Pfizer recovered about $5.1 million and had another $5 million of pending recoveries from civil lawsuits.

2010: Ian Read Appointed CEO

In 2010, Ian Read was named chief executive officer of Pfizer.

2010: Introduction of Improved Prevnar Version

In 2010, Pfizer introduced an improved version of the pneumococcal vaccine, Prevnar 13, providing coverage of 13 bacterial variants.

2010: Sponsorship of National Press Foundation program

In 2010, Pfizer sponsored a program for the National Press Foundation (NPF) called "Cancer Issues 2010" to train journalists on cancer research, including the role of pharmaceutical products and vaccines.

February 2011: Closure of UK research and development facility

In February 2011, Pfizer announced the closure of its UK research and development facility in Sandwich, Kent, which employed 2,400 people at the time.

March 2011: Acquisition of King Pharmaceuticals

In March 2011, Pfizer acquired King Pharmaceuticals for $3.6 billion in cash. King produced emergency injectables such as the EpiPen.

2011: Payouts for Trovan Settlement Began

In 2011, payouts began as part of the out-of-court settlement for the Trovan lawsuits. Pfizer committed to paying US$35 million to compensate the families of children in the study, another $30 million to support healthcare initiatives in Kano, and $10 million to cover legal costs.

2011: Lipitor Patent Expiration

Upon its patent expiration in 2011, Lipitor (atorvastatin) was the best-selling drug ever, with approximately $125 billion in sales over 14.5 years.

May 2012: Settlement with Brigham Young University

In May 2012, Pfizer settled allegations with Brigham Young University (BYU) and Dr. Daniel L. Simmons over the development of Celebrex, agreeing to pay $450 million after a six-year battle. BYU had claimed that Pfizer did not give Dr. Simmons credit or compensation for his discovery of an enzyme that led to the development of Celebrex.

September 4, 2012: FDA approves Bosulif

On September 4, 2012, the FDA approved bosutinib (Bosulif) for chronic myelogenous leukemia (CML).

November 2012: Lobbying efforts in British Columbia

In November 2012, Pfizer lobbied various officials in the Government of British Columbia, including then-premier Christy Clark, future premier John Horgan, future health minister Adrian Dix, and future deputy premier, minister of public safety and solicitor general Mike Farnworth.

November 2012: FDA approves Xeljanz

In November 2012, Pfizer received approval from the Food and Drug Administration for Xeljanz, a tofacitinib, for rheumatoid arthritis and ulcerative colitis.

2012: Reduction of Invasive Infections Among Children

By 2012, the rate of invasive infections among children under age 5 had been reduced by an additional 50% due to Prevnar 13.

February 1, 2013: Zoetis becomes a public company

On February 1, 2013, Zoetis, the Agriculture Division of Pfizer, became a public company via an initial public offering, raising $2.2 billion.

June 2013: $964 Million Settlement for Asbestos Claims

In June 2013, Pfizer negotiated a settlement for $964 million with asbestos victims related to Quigley Company products. This included payments to existing plaintiffs and a settlement trust for future plaintiffs.

2013: Guilty Plea for Rapamune Mis-branding

In 2013, Wyeth pleaded guilty to criminal mis-branding violations under the Federal Food, Drug, and Cosmetic Act related to Rapamune.

August 2014: Settlement Paid for Rapamune Violations

By August 2014, Pfizer had paid $491 million in civil and criminal penalties related to Rapamune.

September 2014: Acquisition of Innopharma

In September 2014, Pfizer acquired Innopharma for $225 million, plus up to $135 million in milestone payments, expanding Pfizer's range of generic and injectable drugs.

2014: Settlement with Blue Cross Blue Shield

In 2014, Pfizer settled the case with Blue Cross Blue Shield (BCBS) for $325 million regarding the alleged illegal marketing of Bextra, Geodon, and Lyrica.

2014: Lyrica Patent Upheld

In 2014, the United States patent on Lyrica (pregabalin) was challenged but ultimately upheld, extending the expiration date to 2018.

January 5, 2015: Acquisition of Redvax

On January 5, 2015, Pfizer announced it would acquire a controlling interest in Redvax, expanding its vaccine portfolio targeting human cytomegalovirus.

February 2015: FDA approves Ibrance

In February 2015, Pfizer received approval from the Food and Drug Administration for palbociclib (Ibrance) for treatment of certain types of breast cancer.

March 2015: Restart of Tanezumab collaboration with Eli Lilly

In March 2015, Pfizer announced it would restart its collaboration with Eli Lilly and Company surrounding the Phase III trial of Tanezumab.

May 2015: Partnership with Bar-Ilan University

In May 2015, Pfizer and a Bar-Ilan University laboratory announced a partnership based on the development of medical DNA nanotechnology.

June 2015: Acquisition of Nimenrix and Mencevax

In June 2015, Pfizer acquired Nimenrix and Mencevax, meningococcal vaccines, from GlaxoSmithKline for around $130 million.

September 2015: Acquisition of Hospira

In September 2015, Pfizer acquired Hospira for $17 billion, including the assumption of debt. Hospira was the largest producer of generic injectable pharmaceuticals in the world.

November 23, 2015: Merger announcement with Allergan

On November 23, 2015, Pfizer and Allergan announced a planned $160 billion merger, which was the largest pharmaceutical deal ever and the third-largest corporate merger in history.

April 6, 2016: Termination of merger agreement with Allergan

On April 6, 2016, Pfizer and Allergan terminated the merger agreement after the Obama administration and the United States Department of the Treasury introduced new laws intended to limit corporate inversions.

June 2016: Acquisition of Anacor Pharmaceuticals

In June 2016, Pfizer acquired Anacor Pharmaceuticals for $5.2 billion, expanding its portfolio in both inflammation and immunology drugs areas.

August 2016: Acquisition of Bamboo Therapeutics

In August 2016, Pfizer acquired Bamboo Therapeutics for $645 million, expanding its gene therapy offerings.

August 2016: Bid for BIND Therapeutics assets

In August 2016, Pfizer made a $40 million bid for the assets of BIND Therapeutics, which was in bankruptcy.

September 2016: Acquisition of Medivation

In September 2016, Pfizer acquired cancer drug-maker Medivation for $14 billion.

October 2016: Licensing of ONC-392 from OncoImmune

In October 2016, Pfizer licensed the anti-CTLA4 monoclonal antibody, ONC-392, from OncoImmune.

November 2016: Funding of CDC Foundation study for cryptococcal disease

In November 2016, Pfizer funded a $3,435,600 study with the CDC Foundation to research "screen-and-treat" strategies for cryptococcal disease in Botswana.

December 2016: Acquisition of AstraZeneca's antibiotics business

In December 2016, Pfizer acquired AstraZeneca's small-molecule antibiotics business for $1.575 billion.

2016: Last presentation of The Royal Society Pfizer Award

In 2016, The Royal Society Pfizer Award was last presented. It has since been replaced by the Royal Society Africa Prize.

2017: Patent Granted for Prevnar 13 in India

In 2017, Pfizer was granted a patent in India for Prevnar 13.

January 2018: End of Alzheimer's and Parkinsonism research

In January 2018, Pfizer announced that it would end its work on research into treatments for Alzheimer's disease and Parkinsonism, resulting in about 300 researchers losing their jobs.

July 2018: FDA approves enzalutamide

In July 2018, the Food and Drug Administration approved enzalutamide, developed by Pfizer and Astellas Pharma for patients with castration-resistant prostate cancer.

August 2018: Agreement with BioNTech for mRNA-based influenza vaccines

In August 2018, Pfizer signed an agreement with BioNTech to conduct joint research and development activities regarding mRNA-based influenza vaccines.

October 2018: Albert Bourla promoted to CEO

In October 2018, it was announced that effective January 1, 2019, Albert Bourla would be promoted to chief executive officer, succeeding Ian Read.

2018: Lyrica Patent Expiration Extended

In 2014, the United States patent on Lyrica (pregabalin) was upheld, extending the expiration date to 2018.

January 1, 2019: Albert Bourla becomes CEO

On January 1, 2019, Albert Bourla was promoted to chief executive officer of Pfizer, succeeding Ian Read.

January 2019: Xeljanz top drug for direct-to-consumer advertising

In January 2019, Xeljanz was the top drug in the United States for direct-to-consumer advertising, passing adalimumab (Humira).

April 2019: Scott Gottlieb Resigns as FDA commissioner

In April 2019, Scott Gottlieb resigned as FDA commissioner.

July 2019: Acquisition of Array Biopharma

Also in July 2019, Pfizer acquired Array Biopharma for $10.6 billion, boosting its oncology pipeline.

July 2019: Acquisition of Therachon

In July 2019, Pfizer acquired Therachon for up to $810 million, expanding its rare disease portfolio with a compound aimed at treating conditions such as achondroplasia.

July 2019: Scott Gottlieb joins Pfizer board of directors

In July 2019, Scott Gottlieb, who resigned as FDA commissioner in April 2019, joined the Pfizer board of directors.

August 2019: Merger of consumer health business with GlaxoSmithKline

In August 2019, Pfizer merged its consumer health business with that of GlaxoSmithKline, into a joint venture owned 68% by GlaxoSmithKline and 32% by Pfizer, with plans to make it a public company.

September 2019: Initiation of study with CDC Foundation

In September 2019, Pfizer initiated a study with the CDC Foundation to investigate the tracking of healthcare-associated infections, scheduled to run through to June 2023.

December 2019: Additional funding for cryptococcal disease research

In December 2019, Pfizer awarded the CDC Foundation a further $1,948,482 to continue its cryptococcal disease screening and treatment research in nine African countries.

March 2020: Joins COVID-19 Therapeutics Accelerator

In March 2020, Pfizer joined the COVID-19 Therapeutics Accelerator funding vehicle to expedite development of treatments against COVID-19.

May 2020: COVID-19 vaccine testing begins

In May 2020, Pfizer began testing four different COVID-19 vaccine variations using lipid nanoparticle technology. The vaccines were injected into the first human participants in the U.S. in early May.

July 2020: mRNA vaccine candidates receive FDA fast track designation

In July 2020, Pfizer and BioNTech announced that two of the partners' four mRNA vaccine candidates had won fast track designation from the FDA. The company began Phase II-III testing on 30,000 people in the last week of July 2020.

September 2020: Stake in CStone Pharmaceuticals

In September 2020, Pfizer acquired a 9.9% stake in CStone Pharmaceuticals for $200 million (HK$1.55 billion), helping to commercialise its anti-PD-L1 monoclonal antibody, CS1001.

September 2020: Agreement with European Commission for vaccine supply

In September 2020, Pfizer and BioNTech announced that they had completed talks with the European Commission to provide an initial 200 million vaccine doses to the EU, with the option to supply another 100 million doses at a later date.

October 2020: Acquisition of Arixa Pharmaceuticals

In October 2020, Pfizer acquired Arixa Pharmaceuticals.

November 9, 2020: COVID-19 vaccine found to be 90% effective

On November 9, 2020, Pfizer announced that BioNTech's COVID-19 vaccine, tested on 43,500 people, was found to be 90% effective at preventing symptomatic COVID-19, later updated to 95%.

November 2020: Merger of Upjohn with Mylan to form Viatris

In November 2020, using a Reverse Morris Trust structure, Pfizer merged its off-patent branded and generic drug business, known as Upjohn, with Mylan to form Viatris, owned 57% by Pfizer shareholders.

December 2020: Vaccine approved for emergency use

In November and December 2020, regulators in various countries approved Pfizer's vaccine for emergency use.

2020: Partnership between Saama and Pfizer

In 2020, Saama and Pfizer started a partnership focused on automating data review processes with the Smart Data Quality (SDQ) platform, which was developed during Pfizer’s COVID-19 vaccine trials.

2020: Expiration of Viagra Patents

In 2020, the patents for Viagra (sildenafil) expired.

January 5, 2021: Introduction of new logo

On January 5, 2021, Pfizer introduced a new logo.

February 2021: Accusations of "high-level bullying" in vaccine negotiations

In February 2021, Pfizer was accused of employing "high-level bullying" against Latin American countries during COVID-19 vaccine negotiations, potentially delaying or preventing agreements.

April 15, 2021: CEO Albert Bourla attends GAVI COVAX AMC 2021 Investment Opportunity Launch Event

On April 15, 2021, Pfizer's CEO Albert Bourla attended the GAVI COVAX AMC 2021 Investment Opportunity Launch Event, also known as One World Protected.

April 2021: Acquisition of Amplyx Pharmaceuticals

In April 2021, Pfizer acquired Amplyx Pharmaceuticals and its anti-fungal compound fosmanogepix (APX001).

November 2021: Launch of Paxlovid

In November 2021, Pfizer launched a new COVID-19 oral antivirus treatment known as Paxlovid.

November 2021: Ventavia whistleblower allegations

In November 2021, The BMJ published an article after obtaining information from a whistleblower from Ventavia Research Group, a research subcontractor for Pfizer, alleging data falsification, unblinding of patients, inadequately trained vaccinators, and slow follow-up on adverse events in Pfizer's phase III trial.

2021: Recognized as a “Best Place to Work” by Glassdoor

In 2021, Pfizer was recognized as a “Best Place to Work” by Glassdoor and a Top Employer by Science for its practices during the pandemic.

2021: Pfizer Award: Eligible Book Details

In 2021, the Pfizer Award recognizes books published in English within the three years preceding the competition year (e.g., for 2024, books from 2021–2023).

January 2022: CEO confirms trial results of fourth dose pending

In January 2022, the Pfizer CEO Albert Bourla confirmed that the trial results of a fourth dose were pending until March 2022. He also mentioned a collaboration to develop an anti-COVID pill treatment and affirmed the COVID vaccine's safety for children.

March 2022: Pending trial results of fourth dose

In January 2022, the Pfizer CEO Albert Bourla confirmed that the trial results of a fourth dose were pending until March 2022.

March 2022: Acquisition of Arena Pharmaceuticals

In March 2022, Pfizer acquired Arena Pharmaceuticals for $6.7 billion in cash.

May 2022: Reports of Paxlovid rebound symptoms

In May 2022, reports emerged of patients experiencing "rebound" symptoms after completing a five-day course of Paxlovid. The FDA decided against changing its recommendations after additional analyses of the drug's clinical trial data.

June 2022: Acquisition of ReViral Ltd

In June 2022, Pfizer acquired ReViral Ltd, for up to $525 million, gaining access to experimental drugs used to combat respiratory syncytial virus infections.

July 2022: UK Fine for Overpriced Epilepsy Drug

In July 2022, UK antitrust authorities fined Pfizer £63 million for unfairly high prices for the epilepsy drug Epanutin. The Competition and Markets Authority stated that Pfizer took advantage of loopholes by de-branding Epanutin, leading to price increases of 780% to 1,600% higher than its standard price over a four-year period.

August 2022: Moderna Sues Pfizer and BioNTech

In August 2022, Moderna announced that it would sue Pfizer and its partner BioNTech for infringing their patent on the mRNA technology.

October 2022: Acquisition of Biohaven Pharma and Global Blood Therapeutics

In October 2022, Pfizer acquired Biohaven Pharma and its calcitonin gene-related peptide programs for $11.6 billion, and also acquired Global Blood Therapeutics for $5.4 billion, boosting Pfizer's rare disease business.

October 2022: Pfizer executive admits no transmission reduction evaluation

On 10 October 2022, during a session of the European Parliament's Special Committee on the COVID-19 Pandemic, Pfizer executive Janine Small testified that the company had not evaluated the Pfizer–BioNTech COVID-19 vaccine for its ability to reduce transmission of the SARS-CoV-2 virus prior to its release to the general public.

2022: Sponsor of the 2022 Oscars ceremony

In 2022, Pfizer was a prominent sponsor of the Oscars ceremony alongside BioNTech.

2022: Listed as a Top Employer for Diversity and Best Employer for Women by Forbes

In 2022, Pfizer was listed as a Top Employer for Diversity and Best Employer for Women by Forbes

April 2023: Move to Hudson Yards

In April 2023, Pfizer moved its world headquarters from 42nd Street in Midtown Manhattan to the Spiral at Hudson Yards.

June 2023: Completion of CDC Foundation study

In September 2019, Pfizer initiated a study with the CDC Foundation to investigate the tracking of healthcare-associated infections, scheduled to run through to June 2023. In June 2023 the study was completed.

December 2023: Acquisition of Seagen

In December 2023, Pfizer acquired Seagen, a pioneer of antibody–drug conjugates for the treatment of cancer, for $43 billion.

2023: Named one of "America's Greatest Workplaces" by Newsweek

In 2023, Pfizer was named one of "America's Greatest Workplaces" by Newsweek, received Clinical Trials Arena Excellence Awards, inclusion in the top 10 of the “World’s Most Admired Companies” by Fortune

2023: Affordability and Access Programs

In 2023, Pfizer’s affordability and access programs reached 45 million patients in the MERA region, supported by the IUdo app, which was launched in Egypt, Qatar, and Lebanon to facilitate patient access to care.

2023: Xeljanz price increase flagged by ICER

In 2023, the Institute for Clinical and Economic Review (ICER) identified Xeljanz (tofacitinib) as one of five high-expenditure drugs that experienced significant net price increases without new clinical evidence to justify the hikes. Specifically, Xeljanz's wholesale acquisition cost rose by 6%, leading to an additional $72 million in costs to U.S. payers.

2023: Pfizer Award: Eligible Book Details

In 2023, the Pfizer Award recognizes books published in English within the three years preceding the competition year (e.g., for 2024, books from 2021–2023).

May 2024: European Patent Office Upholds Moderna's Patent

In May 2024, the European Patent Office upheld the validity of Moderna's EP949 patent, one of the two patents asserted against Pfizer and BioNTech.

July 2024: Innovation Supply Chain partnership with Flagship Pioneering

In July 2024, Pfizer and Flagship Pioneering announced an "Innovation Supply Chain" partnership to co-develop 10 drug candidates. Each party committed $50 million upfront, with potential success milestones and royalties reaching up to $700 million per commercialized drug.

October 2024: Partnership with Ignition AI Accelerator

In October 2024, Pfizer announced a partnership with the Ignition AI Accelerator to expedite drug discovery and development processes, improve operational efficiency, and streamline stakeholder engagement.

December 2024: Company's board of directors

As of December 2024, the company's board consisted of the following directors:

2024: Focus on AI and Gene Therapy

In 2024, Pfizer is focused on integrating AI and gene therapy in the Middle East, Russia, and Africa (MERA) region, with its headquarters in Dubai. Key initiatives are being undertaken to address healthcare challenges.

2024: Ranked highly in the Hispanic Association on Corporate Responsibility (HACR) Corporate Inclusion Index

In 2024, Pfizer ranked highly in the Hispanic Association on Corporate Responsibility (HACR) Corporate Inclusion Index. Pfizer was named a “Best Place to Work for Disability Inclusion” in the Disability Equality Index and received awards such as Top Diverse Employer, Top Hispanic Employer, and Top Disability-Friendly Company by DiversityComm, Inc.

2024: Revenue from Top Products

In 2024, Pfizer's top-selling products included Eliquis, Prevnar, Paxlovid, Vyndaqel, Comirnaty, and Ibrance. 61% of the company's revenues came from the United States, 4% from China, and 35% from other countries.

2024: Expanded Agreement with Saama

In 2024, Saama and Pfizer reached an expanded multi-year agreement to integrate AI-driven solutions across Pfizer's R&D portfolio. This scaled their 2020 partnership to streamline data review and accelerate regulatory submissions across global studies, introducing Saama’s Biometrics Research and Analysis Information Network for faster statistical programming and biostatistics workflows.

2024: Pfizer Award: Eligible Book Details

In 2024, the Pfizer Award recognizes books published in English within the three years preceding the competition year (e.g., for 2024, books from 2021–2023).

2024: Dose Optimization Trials Planned

In late 2024, dose optimization trials are planned to support large-scale registration studies.

February 2025: Trump considers exemptions to reciprocal tariffs

In February 2025, Donald Trump said that he was considering four exemptions to reciprocal tariffs, including pharmaceutical industries.

February 2025: Pfizer CEO Emphasizes Ability to Mitigate Tariffs

In February 2025, Pfizer’s CEO Albert Bourla emphasized the company’s ability to mitigate potential future tariffs by shifting manufacturing to its 13 U.S. facilities.

March 2025: Sale of Haleon stake

In March 2025, Pfizer sold its entire stake in Haleon for $3.24 billion to institutional investors.

2025: 100% score from the Human Rights Campaign

In 2025, Pfizer earned a 100% score from the Human Rights Campaign on the Corporate Equality Index for LGBTQ workplace equality

Mentioned in this timeline

Nigeria is a West African nation the most populous in...

India officially the Republic of India is a South Asian...

Africa is the second-largest and second-most populous continent comprising of...

Japan is an East Asian island country located in the...

Connecticut is a state in the New England region of...

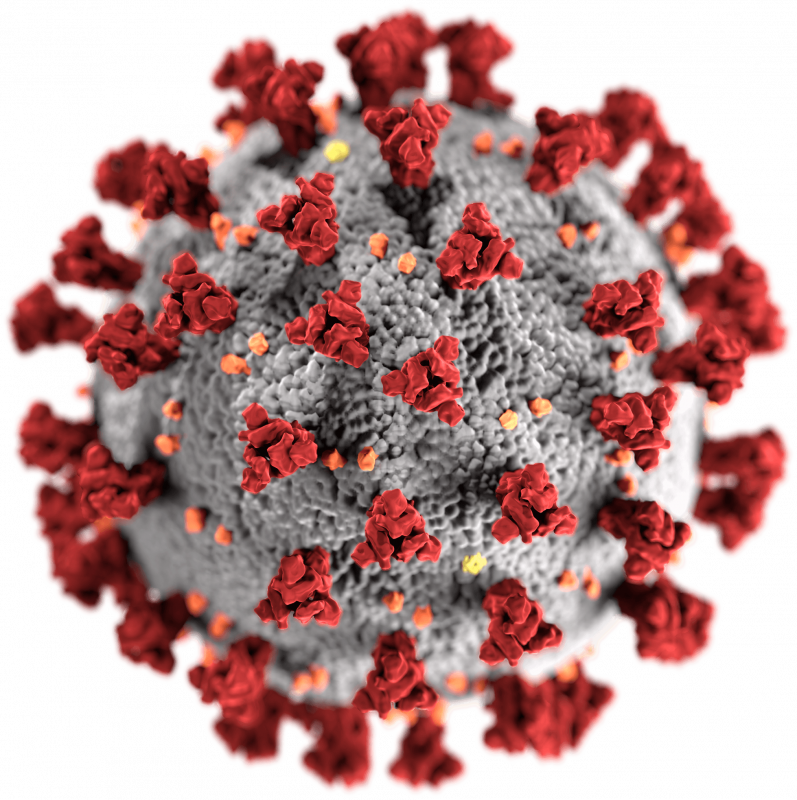

COVID- vaccines are designed to provide immunity against SARS-CoV- the...

Trending

39 minutes ago Six Flags to Open World's Tallest Vertical-Loop Roller Coaster in Texas by 2026

39 minutes ago Bill Nye Visiting Lehigh Valley, Winter Weather, ICE Protest in Pennsylvania.

39 minutes ago Cadillac Names First F1 Car After Mario Andretti, Honoring Racing Icon's Legacy

2 hours ago Kenya Moore Denies Hair Salon Rent Issues Amidst 'RHOA' Alum Rumors

2 hours ago Rep. Jason Crow Campaigns in Wisconsin and Against Van Orden; Trump's Iran Attack

3 hours ago Burnley Mounts Incredible Comeback from 3-0 to Draw with Brentford in Thrilling Match.

Popular

Jesse Jackson is an American civil rights activist politician and...

Hillary Diane Rodham Clinton is a prominent American politician lawyer...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...

Michael Joseph Jackson the King of Pop was a highly...

Barack Obama the th U S President - was the...

Kashyap Pramod Patel is an American lawyer who became the...