Stagflation is an economic condition characterized by high inflation, slow economic growth, and high unemployment. Popularized in the 1960s and widely recognized in the 1970s, it challenges the conventional inverse relationship between inflation and unemployment. The 1973 oil crisis is a notable example, causing supply chain disruptions, rising prices, and reduced economic activity. Stagflation presents a difficult challenge for policymakers, as measures to combat inflation may worsen unemployment, and vice versa.

1919: Economic conditions in Germany

In 1919, Germany's total expenditure significantly exceeded its tax revenue, exacerbating the risk of inflation.

1919: Keynes describes inflation and economic stagnation

In 1919, John Maynard Keynes described the inflation and economic stagnation gripping Europe in his book The Economic Consequences of the Peace.

1965: Iain Macleod's speech to Parliament

In 1965, British politician Iain Macleod used the term 'stagflation' in a speech to Parliament, during a period of high inflation and unemployment in the United Kingdom.

1967: Rise in expected inflation

Between 1967 and 1970, the Michigan survey indicated that expected inflation rose from 3.8% to 4.9%, reinforcing the view that the Expected Augmented Phillips Curve (EAPC) can explain early, mild stagflation.

1968: Unemployment and inflation rise

Between 1968 and 1970, unemployment rose from 3.6% to 4.9%, while CPI inflation increased from 4.7% to 5.6%, laying the groundwork for stagflation.

1968: Rising inflation and dollar depreciation

From 1968 onwards, rising inflation led to dollar depreciation, which caused commodity producers to demand higher prices, contributing to stagflation.

July 1970: Macleod uses the term again

In July 1970, Iain Macleod used the term stagflation again, contributing to its recognition and usage.

August 1970: The Economist uses the term

In August 1970, the media, including The Economist, began using the term stagflation, signaling its growing acceptance in economic and political discourse.

1970: Rise in expected inflation

Between 1967 and 1970, the Michigan survey indicated that expected inflation rose from 3.8% to 4.9%, reinforcing the view that the Expected Augmented Phillips Curve (EAPC) can explain early, mild stagflation.

1970: Iain Macleod becomes Chancellor of the Exchequer

In 1970, Iain Macleod, a British Conservative Party politician, became Chancellor of the Exchequer.

August 1971: Nixon's wage and price controls

Following Richard Nixon's imposition of wage and price controls on 15 August 1971, an initial wave of cost-push shocks in commodities were blamed for causing spiraling prices.

1971: Ending of the Bretton Woods system

In 1971, the ending of the Bretton Woods system was largely attributed to the US stagflation of the 1970s.

1972: Price controls and wage freeze through 1972

President Nixon's price controls and wage freeze were in effect through 1972, suppressing the underlying stagflation.

March 1973: Newsweek uses the term

In March 1973, Newsweek began using the term stagflation, popularizing it among a wider audience.

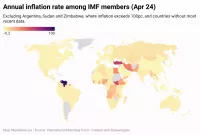

1973: Stagflation prevalent among major market economies

From 1973, stagflation was prevalent among seven major market economies.

1973: 1973 oil crisis

In 1973, the oil crisis significantly contributed to stagflation by disrupting supply chains, leading to rising prices, and slowing economic growth globally.

1979: Volcker increases interest rates

In 1979, Federal Reserve chairman Paul Volcker sharply increased interest rates to combat inflation.

1979: Recurrence of overheated economy and stagflation

In 1979, the pattern of an overheated economy leading to inflation, dollar depreciation, higher oil prices, and another bout of stagflation repeated itself.

1982: Resource scarcity scenario

In 1982, according to the resource scarcity scenario, stagflation results when a restricted supply of raw materials inhibits economic growth.

1982: Shift in economists' focus

In 1982, as inflation rates began to fall, economists shifted their focus from the causes of stagflation to determinants of productivity growth and the effects of real wages on labor demand.

February 1983: Unemployment peaks at 10.4%

In February 1983, the U.S. unemployment rate peaked at 10.4% during the Volcker disinflation.

1984: Jane Jacobs proposes focus on cities

In 1984, Jane Jacobs proposed that the failure of macroeconomic theories to explain stagflation was due to their focus on the nation, rather than the city.

1999: Demand-pull stagflation theory

In 1999, Eduardo Loyo proposed demand-pull stagflation theory, suggesting stagflation can result exclusively from monetary shocks without concurrent supply shocks.

2007: Stagflation appears as a societal crisis

In 2007, stagflation appeared as a societal crisis.

2009: Blanchard's explanation of stagflation

According to Blanchard (2009), adverse supply shocks and "ideas" from economists such as Robert Lucas, Thomas Sargent, and Robert Barro were components of stagflation.

2010: Stagflation appears as a societal crisis

In 2010, stagflation appeared as a societal crisis.

Mentioned in this timeline

Germany officially the Federal Republic of Germany is a Western...

Africa is the second-largest and second-most populous continent comprising of...

Inflation in economics signifies an increase in the average price...

Books are a means of storing information as text or...

The Organization of the Petroleum Exporting Countries OPEC is a...

Paul Adolph Volcker Jr was an influential American economist who...

Trending

Keldon Johnson is an American professional basketball player currently playing for the San Antonio Spurs in the NBA Prior to...

6 months ago Potential NBA Trades: Dillon Brooks, DeMar DeRozan, and the Rockets' Draft Pick

5 months ago Clippers provide update on Kawhi Leonard's condition after injury struggles, future plans.

1 month ago Jason Statham's 'A Working Man' achieves streaming success despite mixed reviews, replacing The Beekeeper.

2 months ago Jamal Murray and Nikola Joki? discussed by David Adelman; Nuggets face Warriors and Suns.

8 months ago Tim Hardaway Jr. aims to continue father's playoff success, reflecting on impressive NBA career.

Popular

Tucker Carlson is an American conservative political commentator known for...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...

Candace Owens is an American conservative political commentator and author...

Ben Shapiro is a prominent American conservative political commentator media...

William Franklin Graham III commonly known as Franklin Graham is...

John F Kennedy JFK was the th U S President...