Paul Adolph Volcker Jr. was an influential American economist who presided as the 12th chairman of the Federal Reserve from 1979 to 1987. His time as chairman was marked by his successful efforts to curb the rampant inflation that plagued the United States in the 1970s and early 1980s. These measures, known as the Volcker shock, cemented his legacy as an economic giant. Prior to his role as chairman, he served as the president of the Federal Reserve Bank of New York from 1975 to 1979.

1916: Birth of Ruth Volcker

Paul Volcker's sister, Ruth Volcker, was born in 1916.

1918: Birth of Louise Volcker

Paul Volcker's sister, Louise Volcker, was born in 1918.

1922: Birth of Elinor Volcker

Paul Volcker's sister, Elinor Volcker, was born in 1922.

1922: Last Significant Protests Against the Federal Reserve

Prior to Volcker's time, the most recent notable protests against the Federal Reserve took place in 1922.

1923: Death of Elinor Volcker

Paul Volcker's sister, Elinor Volcker, passed away in 1923.

September 5, 1927: Birth of Paul Volcker

Paul Adolph Volcker Jr. was born on September 5, 1927, in Cape May, New Jersey.

1945: Graduation from Teaneck High School

Paul Volcker graduated from Teaneck High School in 1945.

1949: Graduation from Princeton University

Paul Volcker graduated with highest honors from the Woodrow Wilson School of Public and International Affairs at Princeton University in 1949.

1951: Graduation from Harvard University

Paul Volcker obtained an M.A. in political economy from Harvard University's Graduate School of Arts and Sciences and Graduate School of Public Administration in 1951.

1952: Joins Federal Reserve Bank of New York

Paul Volcker commenced his role as a full-time economist at the Federal Reserve Bank of New York in 1952.

1952: Attends London School of Economics

Paul Volcker studied at the London School of Economics as a Rotary Foundation Ambassadorial Fellow in 1952.

September 11, 1954: Marriage to Barbara Bahnson

Paul Volcker married Barbara Bahnson, the daughter of a physician, on September 11, 1954.

1960: Death of Paul Adolph Volcker Sr.

Paul Volcker's father, Paul Adolph Volcker Sr., passed away in 1960.

1962: Director of Financial Analysis at the Treasury Department

In 1962, Paul Volcker was appointed as the Director of Financial Analysis at the Treasury Department.

1963: Deputy Under Secretary for Monetary Affairs

Paul Volcker was promoted to the position of Deputy Under Secretary for Monetary Affairs in 1963.

1966: Death of Louise Volcker

Paul Volcker's sister, Louise Volcker, passed away in 1966.

1969: Under Secretary of the Treasury for International Monetary Affairs

Paul Volcker was appointed as the Under Secretary of the Treasury for International Monetary Affairs in 1969.

August 15, 1971: Nixon Suspends Gold Convertibility of the Dollar

On August 15, 1971, President Richard Nixon made the decision to suspend the dollar's convertibility to gold, a move in which Paul Volcker played a significant role.

1974: End of Term as Under Secretary of the Treasury

Paul Volcker finished his term as the Under Secretary of the Treasury for International Monetary Affairs in 1974.

1975: President of the Federal Reserve Bank of New York

In 1975, Paul Volcker assumed the role of President of the Federal Reserve Bank of New York.

July 25, 1979: Nomination for Federal Reserve Chairman

President Jimmy Carter nominated Paul Volcker to be the chairman of the Board of Governors of the Federal Reserve System on July 25, 1979.

August 2, 1979: Senate Confirmation

The U.S. Senate confirmed Paul Volcker's nomination for Federal Reserve Chairman on August 2, 1979.

August 6, 1979: Assumes Office as Federal Reserve Chairman

Paul Volcker officially took office as the Federal Reserve Chairman on August 6, 1979.

August 1979: Becomes Federal Reserve Chairman

Paul Volcker assumed the role of Federal Reserve Chairman in August 1979.

1979: Appointment as Federal Reserve Chairman

Paul Volcker began his tenure as the 12th chairman of the Federal Reserve in 1979.

1979: Average Federal Funds Rate

The average federal funds rate throughout 1979 was 11.2%.

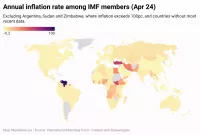

March 1980: US Inflation Peaks

US inflation reached its highest point at 14.8 percent in March 1980.

June 1981: Federal Funds Rate Peaks

The Federal Reserve board, under Volcker's leadership, increased the federal funds rate to its peak of 20% in June 1981.

1982: End of 1980-1982 Recession

The 1980-1982 recession, which saw the national unemployment rate surpass 10%, concluded in 1982.

1982: Easing of US Monetary Policy

The United States saw a relaxation of its monetary policy in 1982, contributing to the resumption of economic growth.

1983: Inflation Falls Below 3 Percent

By 1983, the inflation rate in the United States decreased to below 3 percent.

1983: Receives the U.S. Senator John Heinz Award

Paul Volcker was honored with the U.S. Senator John Heinz Award for Greatest Public Service by an Elected or Appointed Official in 1983.

1983: Reagan Renominates Volcker

President Ronald Reagan renominated Paul Volcker for a second term as Federal Reserve Chairman in 1983.

1987: Fly-Fishing Anecdote

In 1987, Paul Volcker shared an anecdote about taking his wife on a fly-fishing honeymoon trip to Maine, calling it the "greatest strategic error of my adult life."

1987: Joins Wolfensohn & Co.

Paul Volcker became the chairman of Wolfensohn & Co., a New York-based investment banking firm, in 1987.

1987: End of Tenure as Federal Reserve Chairman

Paul Volcker concluded his service as the chairman of the Federal Reserve in 1987.

1987: Joined the Trust Committee of Rockefeller Group, Inc.

Paul Volcker's connection with the Rockefeller family extended to his 1987 appointment to the trust committee of Rockefeller Group, Inc., an entity that once managed Rockefeller Center.

1990: Death of Alma Louise Volcker

Paul Volcker's mother, Alma Louise Volcker, passed away in 1990.

1991: Death of Ruth Volcker

Paul Volcker's sister, Ruth Volcker, passed away in 1991.

1992: Elected to the American Academy of Arts and Sciences

Paul Volcker was elected to the American Academy of Arts and Sciences in 1992.

1992: Elected to the American Philosophical Society

Paul Volcker was elected to the American Philosophical Society in 1992.

1993: Group of 30 Report on the Derivatives Market

In 1993, Paul Volcker chaired the Group of 30, a consultative group on international economic and monetary affairs, to produce a report titled "Derivatives: Practices and Principles." The report included appendices and a survey on evolving practices in the derivatives market.

1996: Chairman of the Independent Committee of Eminent Persons (Volcker Commission)

In 1996, Paul Volcker was appointed Chair of the Independent Committee of Eminent Persons, also known as the Volcker Commission. The committee's aim was to investigate dormant accounts in Swiss banks belonging to Jewish victims of the Holocaust. The committee oversaw a "massive accounting of Swiss bank records" and, despite a challenging process, reached a $1.25 billion settlement.

June 14, 1998: Barbara Volcker's Death

On June 14, 1998, Paul Volcker's first wife, Barbara, passed away. She had battled lifelong diabetes and rheumatoid arthritis.

1998: Selection of Cotecna for the Oil for Food Program

The Volcker Report examined the 1998 selection of Cotecna, Kojo Annan's employer, for the Oil for Food program.

2000: Director of the United Nations Association of the United States of America

Before leading the Oil for Food program inquiry, Paul Volcker served as a director of the United Nations Association of the United States of America beginning in 2000.

2000: Chairman of the IFRS Trustees

In 2000, Volcker assumed the role of Chairman of the IFRS Trustees. This organization, a not-for-profit based in London, is the funding arm of the International Accounting Standards Board (later the IFRS Foundation) and works toward the development of a unified global accounting model.

2001: Advisory Board at Maxwell School

In 2001, Paul Volcker joined the advisory board of the Maxwell School of Citizenship and Public Affairs at Syracuse University.

April 2004: United Nations Investigation into the Iraqi Oil for Food Program

In April 2004, Paul Volcker was tasked by the United Nations to lead an investigation into potential corruption within the Iraqi Oil for Food program.

March 2005: Release of Report on the Iraqi Oil for Food Program

In March 2005, Volcker released his report on the findings of the Iraqi Oil for Food program. While the report did not find the UN Secretary-General directly involved in any wrongdoing, it did raise concerns about his management of the situation.

October 2006: Leadership Roles in Financial and Policy Organizations

As of October 2006, Paul Volcker held key positions in several influential organizations: chairman of the board of trustees for the Group of Thirty, a member of the Trilateral Commission, and a member of the trust committee of Rockefeller Group, Inc.

January 2008: Endorsement of Barack Obama

In January 2008, Paul Volcker publicly endorsed Barack Obama for the upcoming presidential election.

April 8, 2008: Speaker at The Economic Club of New York

On April 8, 2008, Paul Volcker gave a speech at The Economic Club of New York where he discussed the transfer of mortgage and mortgage-backed securities to the Federal Reserve, and analyzed the connections between the U.S. capital markets, Federal Reserve policies, and the overall economy.

2009: Engagement to Anke Dening

Over Thanksgiving in 2009, Paul Volcker announced his engagement to Anke Dening, his long-time assistant.

2009: Chairman of the Economic Recovery Advisory Board

Paul Volcker was appointed as the Chairman of the Economic Recovery Advisory Board under President Barack Obama in 2009.

January 21, 2010: President Obama Proposes "The Volcker Rule"

On January 21, 2010, President Obama put forth a proposal for bank regulations that became known as "The Volcker Rule," acknowledging Volcker's strong advocacy for such measures. The proposed rule sought to limit commercial banks' involvement in hedge funds, private equity, and proprietary trading.

February 5, 2010: Profile in The Week

A profile of Paul Volcker published in The Week on February 5, 2010 highlighted his skepticism about the necessity of "financial innovation" for a healthy economy, famously stating that "the only useful banking innovation was the invention of the ATM."

February 2010: Marriage to Anke Dening

Paul Volcker married his long-time assistant, Anke Dening, in February 2010.

April 6, 2010: Comments on National Sales Tax

During the New-York Historical Society's Global Economic Panel on April 6, 2010, Paul Volcker suggested that the U.S. should consider a national sales tax akin to the Value Added Tax (VAT) used in Europe as a way to raise necessary revenue.

February 6, 2011: Departure from President Obama's Economic Recovery Advisory Board

Paul Volcker served as an economic advisor to President Obama and led the President's Economic Recovery Advisory Board until its charter expired on February 6, 2011. He was a vocal critic of banks during the financial crisis, advocating for stronger regulations and a separation of commercial and investment banking activities.

2011: Article on the War on Drugs

In 2011, Paul Volcker and former Secretary of State George Shultz co-authored an article in The Wall Street Journal arguing that the War on Drugs had been unsuccessful. They called for a reassessment of the costs associated with drug prohibition in the United States, stopping short of advocating for legalization.

2011: End of Term on the Economic Recovery Advisory Board

Paul Volcker concluded his term as the Chairman of the Economic Recovery Advisory Board in 2011.

2011: Establishment of the "Paul Volcker Chair"

The Maxwell School of Citizenship and Public Affairs at Syracuse University established the "Paul Volcker Chair" in Behavioral economics in 2011.

2013: Founded the Volcker Alliance

Paul Volcker established the Volcker Alliance in 2013 as a nonprofit organization dedicated to enhancing the effectiveness of public policy execution and restoring public trust in government. This nonpartisan organization collaborates with academic, business, government, and public interest groups to achieve its goals.

2015: Donation of Public Service Papers

In 2015, Paul Volcker donated his collection of public service papers to Princeton University's Seeley G. Mudd Manuscript Library.

2015: Formation of the Band "Volcker"

The political rock band Volcker, hailing from Portland, Oregon, was formed in early 2015 and named in honor of Paul Volcker.

January 27, 2016: Release of Volcker's Debut Album

The band Volcker, named after Paul Volcker, released their self-titled debut album on January 27, 2016.

August 28, 2016: Volcker Featured on BBC Radio 4

On August 28, 2016, the band Volcker was featured on BBC Radio 4's Economics with Subtitles program.

December 8, 2019: Death of Paul Volcker

Paul Volcker passed away on December 8, 2019.

Mentioned in this timeline

Barack Obama the th U S President - was the...

Jimmy Carter the th U S President - was a...

Germany officially the Federal Republic of Germany is a nation...

Inflation in economics signifies an increase in the average price...

Japan is an East Asian island country located in the...

Virginia a state in the Southeastern and Mid-Atlantic US lies...

Trending

31 minutes ago Ameren Prices $400M Senior Notes, $900M Bonds for Grid Investment, Reshaping Debt

2 hours ago Pokemon Celebrates 30 Years: A Cultural Phenomenon with Multimillion-Dollar Cards

2 hours ago Daylight Saving Time 2026: Prepare to set your clocks forward and lose sleep.

2 hours ago Indiana Investigates CenterPoint Energy Amid Bill Concerns and New Utility Law.

2 hours ago Galatasaray's Champions League opponent revealed; Liverpool legend comments on Juventus match; Real Madrid faces Man City.

4 hours ago Google Maps to fully function in South Korea after data agreement.

Popular

Jesse Jackson is an American civil rights activist politician and...

Barack Obama the th U S President - was the...

Susan Rice is an American diplomat and public official prominent...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...

Michael Joseph Jackson the King of Pop was a highly...

Kashyap Pramod Patel is an American lawyer who became the...