Masayoshi Son is a renowned Japanese billionaire known for his contributions to technology, investment, and philanthropy. Born as a third-generation Zainichi Korean, he later became a Japanese citizen. He founded the SoftBank Group Corp., a prominent technology investment company where he holds various leadership roles. He also holds the position of chairman at Arm Holdings, a UK-based company.

August 1957: Birth of Masayoshi Son

Masayoshi Son was born in August 1957.

1979: Marriage and Family Life

Son married Masami Ohno in 1979, and they have two daughters.

1980: Masayoshi Son Graduates from Berkeley and Founds Unison World

Masayoshi Son graduated from Berkeley with a B.A. in Economics in 1980 and started a video game company called Unison World.

1981: SoftBank is Founded

Masayoshi Son founded SoftBank in 1981.

1990: Masayoshi Son Becomes a Japanese Citizen

Masayoshi Son, a third-generation Zainichi Korean, naturalized as a Japanese citizen in 1990.

1995: Masayoshi Son Invests in Yahoo!

Masayoshi Son bought a share of Yahoo! in 1995.

1996: SoftBank Invests in Kingston Technology

SoftBank bought 80% of the shares of Kingston Technology in 1996.

1999: Masayoshi Son Invests in Alibaba

Masayoshi Son invested a $20 million stake into Alibaba in 1999.

2000: Dot Com Crash Impacts Masayoshi Son's Net Worth

During the dot com crash of 2000, Masayoshi Son lost more than $59 billion.

2000: SoftBank Invests in Alibaba Group

In 2000, Masayoshi Son and SoftBank made an initial investment of $20 million in Alibaba Group.

2000: Early Investment in Alibaba

Masayoshi Son invested $20 million in Jack Ma's Alibaba in 2000, marking an early success in his investment career.

September 2001: Yahoo! BroadBand Founded

Masayoshi Son established Yahoo! BroadBand in September 2001 with Yahoo! Japan.

2011: Masayoshi Son Criticizes Nuclear Industry

Masayoshi Son criticized the nuclear industry in response to the Fukushima Daiichi nuclear disaster in 2011.

2013: Masayoshi Son Ranked on Forbes' World's Most Powerful People

Masayoshi Son was ranked 45th on Forbes magazine's list of the World's Most Powerful People in 2013.

2014: Alibaba IPO

The Alibaba IPO took place in 2014.

2015: SoftBank Corp. Becomes SoftBank Group Corp.

The company name of SoftBank Corp. was changed to SoftBank Group Corp. in 2015.

July 2016: SoftBank Announces Plans to Acquire Arm Holdings

SoftBank announced plans to acquire Arm Holdings for £23.4 billion ($31.4 billion) in July 2016.

September 2016: SoftBank Acquires Arm Holdings

In September 2016, SoftBank completed the acquisition of Arm Holdings for approximately £24 billion ($34 billion).

2017: Launch of SoftBank Vision Fund

In 2017, Masayoshi Son established the SoftBank Vision Fund, a $100 billion investment vehicle, to fund emerging technologies.

2017: Rise as a Prominent Stock Investor

Son's global profile as a stock investor grew after establishing the SoftBank Vision Fund in 2017.

2017: First SoftBank Vision Fund Established

The first SoftBank Vision Fund was established in 2017.

March 2018: Masayoshi Son Invests in Saudi Arabian Solar Project

It was announced that Masayoshi Son was investing in a 200GW solar project planned for Saudi Arabia in March 2018.

July 2018: Masayoshi Son Invests in Renewable Energy in India

In July 2018, Masayoshi Son planned to underwrite most of 100 GW of a planned 275 GW of new renewable provision in India.

October 2018: SoftBank's Stake in Alibaba

SoftBank owned 29.5% of Alibaba, which was worth around $108.7 billion as of 23 October 2018.

2018: SoftBank's Stake in Alibaba

By 2018, SoftBank's 27 percent stake in Alibaba was worth $132 billion.

2018: Masayoshi Son Ranked on Forbes' World's Most Powerful People

Masayoshi Son was ranked 55th on Forbes magazine's list of the World's Most Powerful People in 2018.

2019: Expansion of SoftBank's Vision Fund

By 2019, SoftBank's Vision Fund aimed to increase its portfolio of AI companies from 70 to 125. A second Vision Fund was also created with a target of $108 billion.

2019: Second SoftBank Vision Fund Established

The second SoftBank Vision Fund was established in 2019.

June 2020: Masayoshi Son Steps Down from Alibaba Board

Masayoshi Son stepped down from the Alibaba board in June 2020.

September 2020: SoftBank Group Agrees to Sell Arm Limited to Nvidia

SoftBank Group agreed to sell Arm Limited to Nvidia in a cash and stock deal initially worth $40 billion in September 2020.

2020: Challenges and Fallout from the COVID-19 Pandemic

By 2020, SoftBank Vision Fund's portfolio experienced challenges due to the COVID-19 pandemic and a Chinese regulatory crackdown.

2020: Sprint and T-Mobile US Merge

Sprint and T-Mobile US merged in 2020 in an all shares deal for $26 billion.

October 2021: Increased Investment Pace and Declining Investment Amount

By October 2021, Son had increased his startup investments, with the average investment per company in Vision Fund 2 decreasing compared to Vision Fund 1.

2021: SoftBank Group Corp. Acquires Stake in Deutsche Telekom AG

By 2021, SoftBank Group Corp. had acquired 4.5% of Deutsche Telekom AG.

2021: Masayoshi Son Steps Down as CEO of SoftBank Mobile

Masayoshi Son relinquished his position as CEO of SoftBank Mobile in 2021.

March 2022: Record Loss for SoftBank Vision Fund

SoftBank Vision Fund recorded a $27.4 billion loss for the financial year ending March 2022, attributed to a decline in its stock portfolio valuation.

August 2022: Public Apology and Criticism of SoftBank Vision Fund

In August 2022, Son expressed remorse over his management of the SoftBank Vision Fund, which faced criticism from financial publications.

November 2022: Personal Debt and Controversy Over Investment Losses

By November 2022, Son reportedly owed SoftBank $4.7 billion due to losses in tech investments, sparking controversy over corporate governance.

December 2022: Masayoshi Son's Stake in SoftBank

As of December 2022, Masayoshi Son had a 34.2% stake in SoftBank.

February 2023: Growing Personal Debt and Scrutiny Over Margin Loans

By February 2023, Son's personal debt had risen to $5.1 billion, and concerns arose over his use of SoftBank shares as collateral for margin loans.

2023: Arm Files for U.S. Stock Market Listing

After the collapse of the deal with Nvidia, SoftBank Group Corp's chip maker Arm filed in 2023 with regulators confidentially for a U.S. stock market listing.

2023: SoftBank Sells Most of its Stake in Alibaba

SoftBank had sold most of its Alibaba stake by 2023.

July 2024: Masayoshi Son Ranked on Forbes' World's Billionaires List

As of July 2024, Masayoshi Son ranks 49th on Forbes's list of The World's Billionaires.

2027: Renewable Energy in India

Masayoshi Son's investment is for a planned 275 GW of new renewable provision in India by 2027.

2030: Saudi Arabia's Vision 2030

Masayoshi Son's solar project is part of Saudi Arabia's Vision 2030.

Mentioned in this timeline

Jack Ma Yun is a prominent Chinese businessman and philanthropist...

SoftBank Group is a Japanese multinational investment holding company based...

Nvidia is a prominent American technology company specializing in the...

The stock market is where buyers and sellers trade stocks...

Saudi Arabia officially the Kingdom of Saudi Arabia KSA is...

India officially the Republic of India is a South Asian...

Trending

55 minutes ago Turkey's economic growth slows in 2025; faces major shocks, expert warns.

56 minutes ago Teodora Kostovi?, 18, Dominates in Antalya, Achieving Career-Best Ranking After defeating Bulgarian player.

2 hours ago Prediction Market Revenue Potential and Ethical Concerns Highlighted in Recent Reports.

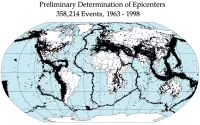

2 hours ago Earthquake Shakes Southeast Nebraska and Kansas Border; Community Reacts to Seismic Activity

4 hours ago Dan Bongino Unleashes R-Rated Rant Against Trump Voter's Complaint: Heated Exchange Erupts.

4 hours ago UAE Supports Stranded Tourists with Hotels and Meals After Iran Flight Disruptions

Popular

Jesse Jackson is an American civil rights activist politician and...

Hillary Diane Rodham Clinton is a prominent American politician lawyer...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...

Jim Carrey is a Canadian-American actor and comedian celebrated for...

Kashyap Pramod Patel is an American lawyer who became the...

Michael Joseph Jackson the King of Pop was a highly...