SoftBank Group is a Japanese multinational investment holding company based in Tokyo. It concentrates on investment management, primarily in technology companies across various sectors like the internet and automation. Its Vision Fund, backed by over $100 billion and Middle Eastern sovereign wealth funds, stands as the world's largest technology-focused venture capital fund, demonstrating SoftBank's significant influence in the tech investment landscape.

September 1981: SoftBank Corp. founded

In September 1981, Masayoshi Son, at the age of 24, founded SOFTBANK Corp as a software distributor.

May 1982: Entry into publishing business

In May 1982, SoftBank entered the publishing business with the launch of "Oh! PC" and "Oh! MZ" magazines, which focused on NEC and Sharp computers, respectively.

1984: Formation of Japan Telecom

In 1984, SoftBank's mobile communications arm began with the formation of Japan Telecom.

1989: Oh! PC magazine circulation

By 1989, Oh! PC magazine reached a circulation of 140,000 copies.

1994: SoftBank goes public

In 1994, SoftBank became a public company with a valuation of $3 billion.

1994: Formation of Digital Phone Group

In 1994, the Digital Phone Group (DPG) mobile phone division was formed.

April 1995: Acquisition of COMDEX

On April 1, 1995, SoftBank acquired COMDEX from The Interface Group for $800 million.

September 1995: Acquisition of Ziff Davis Publishing

In September 1995, SoftBank agreed to acquire US-based Ziff Davis publishing for $2.1 billion.

February 1996: Acquisition of ZDI

On February 29, 1996, SoftBank acquired ZDI.

1996: Acquisition of Kingston Technology stake

In 1996, SoftBank acquired 80% of memory manufacturers Kingston Technology. The company's owners announced plans to distribute $100 million of the $1.5 billion windfall to Kingston employees.

October 1999: SoftBank becomes a holding company

In October 1999, SoftBank transitioned to a holding company structure.

1999: Formation of J-PHONE Co., Ltd.

In 1999, J-PHONE Co., Ltd. was formed by the DGP/ Digital TU-KA Group merger (DTG).

1999: SBI Group Established

In 1999, SBI Group, a Japanese financial services company, began as a branch of SoftBank.

1999: Sale of Kingston Technology stake

In 1999, SoftBank sold its stake in Kingston Technology back to the original owners for about a third of the original price, after the market for memory softened substantially.

February 2000: SoftBank Ventures Asia founded

In February 2000, SoftBank Ventures Asia was founded under the leadership of Masayoshi Son, with a focus on investing in Korean-based Internet companies.

2000: SBVA Founded

In 2000, SoftBank Ventures Asia (SBVA) was founded as SoftBank Ventures Korea and began its focus on South Korean market and its early-stage ventures.

2000: Investment in Alibaba

In 2000, SoftBank made a $20 million investment in Alibaba, a Chinese Internet venture.

October 2001: Vodafone Increases Share in Japan Telecom and J-Phone

In October 2001, Vodafone increased its share to 66.7% of Japan Telecom and 69.7% of J-Phone.

2001: Sale of COMDEX

In 2001, SoftBank sold COMDEX to Key3Media, a spin-off of Ziff Davis.

October 2003: Name Change to Vodafone

On 1 October 2003, Japan Telecom's name and the service brand changed to Vodafone, and the division was called Vodafone K.K. or Vodafone Japan.

January 2005: Acquisition of Fukuoka SoftBank Hawks

In January 2005, SoftBank became the owner of the Fukuoka SoftBank Hawks, a Nippon Professional Baseball team.

February 2005: Vodafone live! Subscriber Numbers in Japan

At the end of February 2005, Vodafone live! had 12.907 million subscribers in Japan.

February 2005: Continued Customer Losses for Vodafone Japan

In February 2005, Vodafone Japan lost 53,200 customers, while competitors gained. Vodafone's 3G service only attracted 527,300 subscribers.

October 2005: Subscriber Decline at Vodafone Japan

By the end of October 2005, Vodafone Japan's number of subscribers had fallen below 15 million, with only 4.8% of Japan's 3G market.

October 2005: Vodafone live! Subscriber Decline

By the end of October 2005, the number of Vodafone live! subscribers had fallen by 138,000.

2005: SoftBank Owns Fukuoka SoftBank Hawks

Since 2005, SoftBank has owned the Fukuoka SoftBank Hawks, a Japanese professional baseball team.

March 2006: Agreement to buy Vodafone Japan

In March 2006, SoftBank announced its agreement to acquire Vodafone Japan, giving it a stake in Japan's mobile market.

March 2006: Vodafone Considers Sale of Japan Unit

In March 2006, Vodafone began discussing the sale of the Vodafone Japan unit to SoftBank due to an inability to satisfy customers with its handsets and interfaces.

March 2006: Vodafone Announces Sale to SoftBank

On 17 March 2006, Vodafone Group announced it had agreed to sell Vodafone Japan to SoftBank for about US$15.1 billion.

April 2006: Stake purchase in Betfair

In April 2006, SoftBank purchased a 23% stake in Betfair, an Internet betting exchange.

May 2006: Renaming of Vodafone Japan to SoftBank Mobile Corp.

On 18 May 2006, it was announced that the unit would be renamed "SoftBank Mobile Corp.", effective 1 October 2006.

May 2006: "Otosan" Advertising Campaign Begins

Since May 2006, SoftBank's telecommunications marketing and commercials have principally revolved around "Otosan", the canine patriarch of the Shirato family.

August 2006: Sale of SBI Group shares

In August 2006, SoftBank sold all its shares of SBI Group to a subsidiary of SBI's holding company, making SBI independent.

October 2006: SoftBank Mobile Corp. Effective Date

On 1 October 2006, Vodafone Japan was renamed to "SoftBank Mobile Corp.".

October 2006: Vodafone Japan rebrands to SoftBank Mobile

On October 1, 2006, Vodafone Japan changed its corporate name and service brand name to "SoftBank Mobile" and "SoftBank" respectively.

2007: "Otosan" Advertisements Success

From 2007 to 2012, the Otousan adverts became the most popular in Japan.

January 2008: Collaboration with Tiffany & Co. on phone

On January 28, 2008, SoftBank and Tiffany & Co. collaborated to create a limited edition phone containing over 400 platinum diamonds, costing more than 100,000,000 yen.

February 2010: Acquisition of Ustream stake

On February 3, 2010, SoftBank acquired a 13.7% stake in Ustream.

October 2010: Ayumi Hamasaki becomes commercial spokesperson

On October 1, 2010, Ayumi Hamasaki became the commercial spokesperson for SoftBank.

2010: Wireless City Planning (WCP) Founded

In 2010, SoftBank founded Wireless City Planning (WCP), a subsidiary that planned the development of TD-LTE networks throughout Japan.

2011: Fukuoka SoftBank Hawks Championships

Between 2011 and 2020, the Fukuoka SoftBank Hawks won seven Japan Series championships.

2011: Nexon IPO

In 2011, one of SBVA’s early investments in South Korea included Nexon Co, now a Korean-Japanese gaming publisher that was the largest IPO in Japan.

2011: SBVA Expands Focus

Since 2011, SoftBank Ventures Asia (SBVA) expanded its focus beyond South Korea and made several notable investments in Southeast Asia.

October 2012: Plans to control Sprint Nextel

On October 15, 2012, SoftBank announced plans to take control of American Sprint Nextel by purchasing a 70% stake for $20 billion.

October 2012: Takeover of eAccess announced

On October 3, 2012, SoftBank announced the takeover of its competitor, eAccess.

2012: "Otosan" Advertisements Success

From 2007 to 2012, the Otousan adverts became the most popular in Japan.

July 2013: Willcom becomes wholly owned subsidiary

On July 1, 2013, SoftBank announced that Willcom became a wholly owned subsidiary after the termination of rehabilitation proceedings. eAccess was merged with Willcom, resulting in a new subsidiary and brand from Yahoo! Japan, Ymobile Corporation.

July 2013: FCC approves Sprint acquisition

On July 6, 2013, the United States Federal Communications Commission approved SoftBank's acquisition for $22.2 billion for a 78% ownership interest in Sprint.

August 2013: Increased stake in Sprint Corporation

On August 6, 2013, SoftBank bought 2% more shares of Sprint Corporation, increasing its ownership stake to 80%.

October 2013: Acquisition of Supercell stake

In October 2013, SoftBank acquired a 51% stake in Supercell for a reported $2.1 billion.

2013: Acquisition of Aldebaran Robotics

In 2013, SoftBank bought a controlling stake in French company Aldebaran Robotics, which was rebranded as SoftBank Robotics.

September 2014: Alibaba goes public

In September 2014, SoftBank's initial $20 million investment in Alibaba turned into $60 billion when Alibaba went public.

October 2014: Investment in OlaCabs and Snapdeal

On 25 and 28 October 2014, SoftBank invested $210 million in OlaCabs and $627 million in Snapdeal for a 30% stake in the company.

November 2014: Investment in Housing.com

In November 2014, SoftBank made a $100 million investment in Housing.com for a 30% stake.

2014: Ymobile Corporation Established

In 2014, Ymobile Corporation, a telecommunications subsidiary of SoftBank, was established.

2014: Co-design of Pepper robot

In 2014, teams from SoftBank and Aldebaran Robotics co-designed Pepper, a humanoid robot.

May 2015: Nikesh Arora appointment

In May 2015, Masayoshi Son announced the appointment of Nikesh Arora, a former Google executive, as Representative Director and President of SoftBank. Arora had been heading SoftBank's investment arm.

June 2015: Acquisition of additional Supercell stake and investment in Coupang

In June 2015, SoftBank acquired an additional 22.7% stake in Supercell, increasing its total stake to 73.2%. Additionally, SoftBank announced a US$1 billion investment in Korean e-commerce website Coupang.

July 2015: Company name change

In July 2015, SoftBank Corp was renamed to SoftBank Group Corp, and SoftBank Mobile was renamed to SoftBank Corp.

July 2015: Merger to form SoftBank Corp.

In July 2015, SoftBank Group merged SoftBank BB Corp., SoftBank Telecom Corp. and Ymobile Corporation to form SoftBank Corp., reflecting its fixed-line and ISP operations. Formerly SoftBank Mobile.

2015: Increased stake in SoftBank Robotics

In 2015, SoftBank increased its stake in SoftBank Robotics to 95%.

2015: Baby Bonus Program

In 2015, SoftBank offered a baby bonus for employees who have children, with payments ranging from 50,000 yen for the first child to 5 million yen for the fifth child.

February 2016: Share repurchase announcement

On February 16, 2016, SoftBank announced a repurchase of 14.2% of shares, valued at $4.4 billion, to boost investor confidence.

March 2016: Sale of Alibaba Group shares

On March 31, 2016, SoftBank announced it would sell shares worth $7.9 billion of their stake in Alibaba Group.

June 2016: Nikesh Arora steps down

In June 2016, Nikesh Arora stepped down from his position amidst pressure from investors. Ron Fisher and Alok Sama took over Arora's overseas investment duties.

June 2016: Sale of Supercell and GungHo Online Entertainment stakes

In June 2016, SoftBank sold its 84% stake in Supercell for a reported US$7.3 billion to Tencent. Also, Softbank agreed to sell most of its stake in GungHo Online Entertainment for about $685 million, which ended Softbank's majority ownership. The offer was completed by June 22.

September 2016: Acquisition of Arm Holdings completed

In September 2016, SoftBank completed its acquisition of British chip designer Arm Holdings for more than US$32 billion, marking the company's largest deal ever. The acquisition was completed on September 5, 2016.

December 2016: Investment pledge in the United States

In December 2016, after meeting with then United States President-elect Donald Trump, chief executive Masayoshi Son announced SoftBank would be investing US$50 billion in the United States toward businesses creating 50,000 new jobs.

January 2017: Potential investment in WeWork

In January 2017, the Wall Street Journal reported that SoftBank Group was considering an investment of well over $1 billion in shared-office space company WeWork.

February 2017: Acquisition of Fortress Investment Group and potential investment in Social Finance Inc.

In February 2017, SoftBank Group agreed to buy Fortress Investment Group LLC for $3.3 billion. Also in February 2017, Social Finance Inc. was close to raising $500 million from an investor group led by Silver Lake, including Softbank.

March 2017: Investment in WeWork and potential investment in Didi Chuxing Technology Co.

On March 20, 2017, SoftBank bought a $300 million stake in WeWork. On March 28, 2017, the Wall Street Journal reported that SoftBank Group Corporation had approached Didi Chuxing Technology Co. about investing $6 billion to help the ride-hailing firm expand in self-driving car technologies.

May 2017: Investment in Paytm

On May 18, 2017, it was reported that Softbank had completed its single largest investment in India to date, investing $1.4 billion in Paytm.

May 2017: Partnership to create Softbank Vision Fund

On May 27, 2017, Softbank and the Public Investment Fund of Saudi Arabia (PIF) partnered to create the Softbank Vision Fund, the world's largest private equity fund with a capital of $93 billion. Softbank Group contributed $28 billion to the investment fund.

June 2017: Acquisition of Boston Dynamics

On June 8, 2017, Alphabet Inc. announced the sale of Boston Dynamics to SoftBank Group for an undisclosed sum.

August 2017: Investment in Flipkart

On August 10, 2017, Softbank invested $2.5 billion in Flipkart.

August 2017: Investment in WeWork finalized

On August 25, 2017, SoftBank finalized a $4.4 billion investment in WeWork.

October 2017: Collaboration on Neom project

On October 24, 2017, Son announced the group would collaborate with Saudi Arabia to develop Neom, a new high-tech business and industrial city.

November 2017: Investment agreement with Uber

On November 14, 2017, Softbank agreed to invest $10 billion into Uber.

December 2017: SoftBank-led consortium investment in Uber

On December 29, 2017, it was reported that a SoftBank-led consortium had invested $9 billion into Uber.

2017: SoftBank Vision Fund Created

In 2017, SoftBank Investment Advisers oversaw SoftBank's Vision Fund, which invests in emerging technologies. Son also claimed he would make personal connections with the CEOs of all companies funded by Vision Fund in order to boost synergies among them.

2017: SoftBank Team Japan in America's Cup

In 2017, SoftBank Team Japan raced in the America's Cup races held in Bermuda.

2017: SoftBank Sponsor of Japanese National Basketball Team

In 2017, SoftBank was the official jersey sponsor of the Japanese national basketball team at the official Asian Basketball Championship in Lebanon.

January 2018: SoftBank becomes Uber's biggest shareholder

In January 2018, the SoftBank-led consortium's deal with Uber was set to close. The deal left SoftBank as Uber's biggest shareholder, with a 15 percent stake.

2018: SBVA Launches China Venture Fund I

In 2018, SoftBank Ventures Asia (SBVA) launched a $300m venture fund ‘China Venture Fund I’, targeting Chinese start-ups.

July 2019: Creation of Vision Fund 2 announced

In July 2019, SoftBank announced the creation of a "Vision Fund 2", excluding participation from the Saudi Arabia government and including investors Apple, Foxconn, Microsoft and others. The fund is reported to focus on AI-based technology and invest approximately $108 billion, including $38 billion of its own funds.

2019: SoftBank Sponsor of Japanese National Basketball Team

In 2019, SoftBank was the official jersey sponsor of the Japanese national basketball team at the FIBA World Cup.

February 2020: Report on Vision Fund 2 capital

In February 2020, a report from the Wall Street Journal stated the Vision Fund 2 would only end up with less than half of its initialy planned capital.

September 2020: SoftBank Ownership

As of 30 September 2020, information about SoftBank's ownership was recorded.

2020: Fukuoka SoftBank Hawks Championships

Between 2011 and 2020, the Fukuoka SoftBank Hawks won seven Japan Series championships.

March 2021: SBVA Creates Future Innovation Fund

In March 2021, SBVA created $160M ‘future innovation fund’, focusing on AI start-ups and made investment in AI sector including VoyagerX, AI software developer, Upstage AI, AI solution provider, and MarqVision, AI-powered intellectual property (IP) protection platform.

March 2021: SoftBank Corporation subscriber count

In March 2021, SoftBank Corporation, a spun-out affiliate of SoftBank Group and its former flagship business, reported having 45.621 million subscribers, making it the third-largest wireless carrier in Japan.

October 2021: SBVA Investments

By October 2021, SoftBank Ventures Asia (SBVA) had backed more than 250 companies in 10 countries with US$1.3 billion fund under management.

December 2022: Masayoshi Son's stake increase

By December 2022, Masayoshi Son’s stake in SoftBank had risen to 34.2% from 32.2% as of the end of September.

April 2023: Sale of SBVA to The Edgeof

In April 2023, it became known that SoftBank Group would sell its early-stage venture capital arm SoftBank Ventures Asia to The Edgeof, led by Son's youngest brother, Taizo Son.

2023: Dismal Performance of Vision Funds

By 2023, after the launch of Vision Fund 1 and 2, the dismal performance of SoftBank’s funds had cast a shadow over the initial exuberance of both Masayoshi Son and his company regarding its huge, largely unprofitable intercorporate investments that had become the main mission, vision and purpose of the entire SoftBank Group.

January 2025: SoftBank Group establishes The Stargate Project for AI infrastructure

In January 2025, SoftBank Group, along with Oracle Corporation, MGX, OpenAI, and other partners, established The Stargate Project. This cooperative venture aims to build AI infrastructure in the US, with an estimated $500 billion investment and the goal of generating 100,000 new jobs by 2029.

January 21, 2025: Stargate AI infrastructure launch

On January 21, 2025, Softbank, OpenAI, MGX, and Oracle announced the launch of Stargate, an artificial intelligence infrastructure system in conjunction with the U.S. government, estimated to cost $500 billion and funded over four years. According to U.S. president Donald Trump, the project was developed to have American-made AI in the United States.

February 2025: SoftBank announces joint venture with OpenAI

In February 2025, SoftBank announced a joint venture with OpenAI called SB OpenAI Japan, which will develop "Advanced Enterprise AI" called "Cristal intelligence." SoftBank will spend $3 billion annually to deploy OpenAI solutions across SoftBank companies. OpenAI and SoftBank also agreed to establish a joint venture with 50:50 ownership called SB OpenAI Japan which would "serve as a springboard for introducing AI agents tailored to the unique needs of Japanese enterprises."

March 2025: SoftBank to acquire Ampere Computing

In March 2025, SoftBank entered into an agreement to acquire Ampere Computing, a company that produces energy-efficient and high-performance processors meant to enable next-generation cloud computing and artificial intelligence (AI). This was a $6.5 billion transaction meant to be closed in the latter half of 2025.

March 31, 2025: Top Shareholders

As of March 31, 2025 Softbank's top shareholders were recorded.

April 23, 2025: SoftBank acquires stake in Twenty One

On April 23, 2025, Cantor Equity Partners, a SPAC announced a merger with Twenty One (XXI), a bitcoin acquisition company. SoftBank will own a 25% stake in the business led by stablecoin issuer Tether and bitcoin exchange Bitfinex. XXI's stated mission is "to accumulate Bitcoin and grow ownership per share." The newly formed company is targeting to go public with 42,000 bitcoin on its balance sheet contributed by its investors.

October 2025: Agreement to acquire ABB Robotics division

In October 2025, SoftBank Group announced an agreement to acquire the ABB Robotics division from ABB for US$5.375 billion, replacing ABB’s earlier plan to spin off the unit, as part of its strategy to expand into Physical AI, combining robotics with SoftBank’s AI and computing expertise.

October 2025: Second Installment of Investment in OpenAI

In October 2025, SoftBank Group approved a second installment of $22.5 billion to complete its $30 billion investment in OpenAI, contingent on OpenAI completing corporate restructuring. If restructuring fails, the investment would drop to $20 billion.

2025: Forbes Global 2000 rank

In 2025, SoftBank was ranked as the 130th largest public company in the world on the Forbes Global 2000 list.

Mentioned in this timeline

Basketball is a team sport played on a rectangular court...

Tencent is a Chinese multinational technology conglomerate headquartered in Shenzhen...

Donald John Trump is an American politician media personality and...

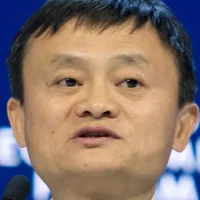

Jack Ma Yun is a prominent Chinese businessman and philanthropist...

WeWork is a company that provides shared workspace including physical...

Facebook is a social media and networking service created in...

Trending

26 minutes ago Lehkonen's OT heroics send Finland to semifinals; Father misses goal broadcasting other game.

26 minutes ago Carlos Alcaraz Advances to Semifinals in Qatar Open After Khachanov Rematch

26 minutes ago SeatGeek and Spotify Partner for Concert Ticket Sales Integration on Music Platform.

27 minutes ago Hilary Duff returns to music after 11 years with 'Luck... Or Something'

1 hour ago Juuse Saros saves Finland in semi-final; Leijonat's opportunity, controversial referee choice.

1 hour ago Finnish Players Shine at Olympics: Saros Leads Finland, Haula & Forsberg Aim for Gold

Popular

Jesse Jackson is an American civil rights activist politician and...

Randall Adam Fine is an American politician a Republican who...

Pam Bondi is an American attorney lobbyist and politician currently...

Barack Obama the th U S President - was the...

Bernie Sanders is a prominent American politician currently serving as...

Ken Paxton is an American politician and lawyer serving as...