A tariff, also known as an import tax, is a duty imposed by a government on imported goods, paid by the importer. Tariffs serve as a revenue source and regulate foreign trade, protecting domestic industries by increasing the cost of foreign products. They are a key instrument of protectionism, alongside import/export quotas and non-tariff barriers.

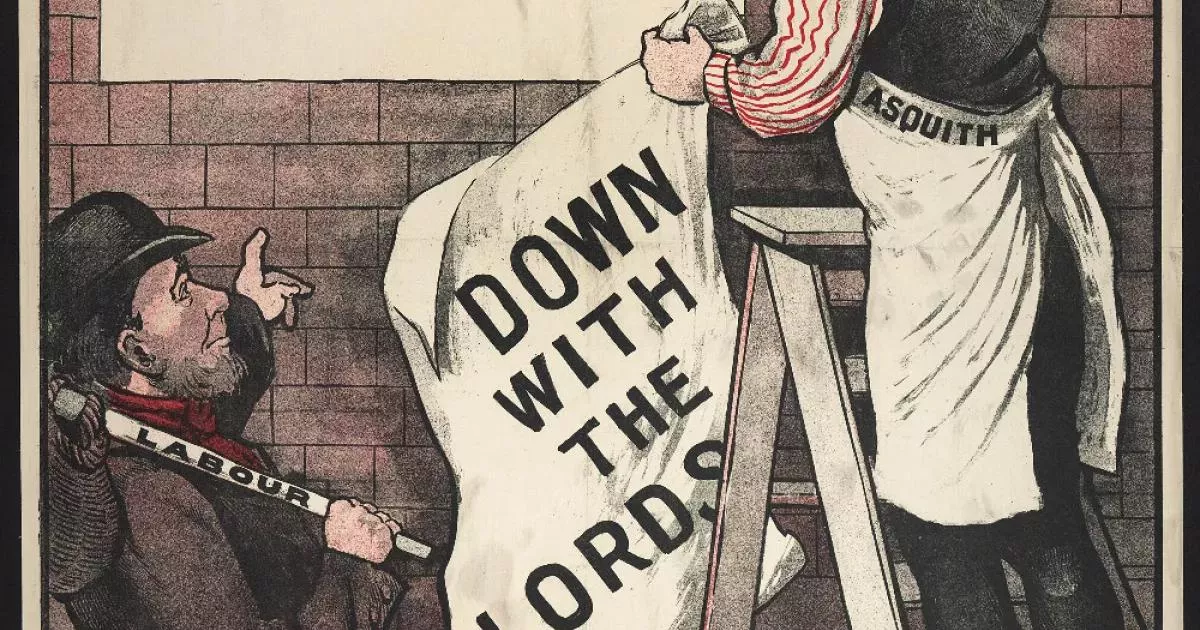

June 15, 1903: Lansdowne advocates fiscal retaliation

On June 15, 1903, Foreign Secretary Henry Petty-Fitzmaurice, 5th Marquess of Lansdowne, advocated in the House of Lords for fiscal retaliation against countries with high tariffs that subsidized products sold in Britain. He suggested threatening duties in response, using the slogan "Big Revolver".

1905: Meat riots in Chile

In 1905, meat riots in Chile developed in protest against tariffs applied to the cattle imports from Argentina.

1912: Democrats win election in 1912

In 1912, the Democrats won the election, leading to tariff reduction.

1913: Weighted average of tariffs remained tendentially the same as in the years preceding the First World War

According to the historian Paul Bairoch, the weighted average of tariffs remained tendentially the same as in the years preceding the First World War: 24.6% in 1913, as against 24.9% in 1927.

1913: Tariff average remained high until 1913

Alfred Eckes Jr. notes that from 1871 to 1913, the average U.S. tariff on dutiable imports never fell below 38 percent, while gross national product (GNP) grew 4.3 percent annually.

1913: British economy lags behind

By 1913, Great Britain's industrial production was growing at an average annual rate of 2.1%, lagging behind the United States and Germany, whose industrial production grew at 4.7% and 4.1% respectively.

1913: US share of global manufacturing

By 1913, the US share of global manufacturing had powered from 23% in 1870 to 36%, during a period of admittedly high tariffs.

1913: Tariffs designed to keep American wages high

From 1860 to 1933, the policy was usually high protective tariffs (apart from 1913 to 1921). The tariffs were designed to keep American wages high, especially after 1890, when the tariff on wool affected an important industry.

1913: Tariff reduction following Democrat victory in 1912

In 1913, following the Democrats' electoral victory in 1912, the average tariff on manufactured goods was significantly reduced from 44% to 25%.

1920: Trade liberalization in Europe

According to the historian Paul Bairoch, the years 1920 to 1929 are generally misdescribed as years in which protectionism increased in Europe. Instead, he says that from a general point of view, the crisis was preceded in Europe by trade liberalisation.

1921: Tariffs designed to keep American wages high

From 1860 to 1933, the policy was usually high protective tariffs (apart from 1913 to 1921). The tariffs were designed to keep American wages high, especially after 1890, when the tariff on wool affected an important industry.

1921: Republicans return to power

In 1921, the Republicans returned to power.

1922: Emergency tariff legislation introduced in 1922

In 1922, after the Republicans returned to power in 1921, new "emergency" tariff legislation was introduced.

1927: Weighted average of tariffs remained tendentially the same as in the years preceding the First World War

According to the historian Paul Bairoch, the weighted average of tariffs remained tendentially the same as in the years preceding the First World War: 24.6% in 1913, as against 24.9% in 1927.

1928: Tariffs lowered in almost all developed countries

According to the historian Paul Bairoch, in 1928 and 1929, tariffs were lowered in almost all developed countries.

1929: Krugman on Protectionism

According to Paul Krugman, the decline in trade between 1929 and 1933 "was almost entirely a consequence of the Depression, not a cause. Trade barriers were a response to the Depression".

1929: Tariffs lowered in almost all developed countries

According to the historian Paul Bairoch, in 1928 and 1929, tariffs were lowered in almost all developed countries.

1930: Friedman on tariffs of 1930

Economist Milton Friedman argued that while the tariffs of 1930 caused harm, they were not responsible by themselves for the Great Depression.

1930: Smoot-Hawley Tariff Act

In 1930, the Smoot-Hawley Tariff Act raised the average level of tariffs on dutiable imports by 15 to 18 percent. This act deteriorated the United States' trade relations with key partners.

1930: Comparison to Smoot–Hawley Tariff Act

The tariff increase in April 2025 was described as the highest level in over a century, including under the Smoot–Hawley Tariff Act of 1930.

1932: Britain abandons free trade in 1932

In 1932, Britain abandoned free trade due to the Great Depression, recognizing its reduced production capacity compared to the protectionist United States and Germany. Large-scale tariffs were reintroduced, but it was too late to regain its dominant economic position. The level of industrialization in the United States was 50% higher than in the United Kingdom in 1932.

1933: Krugman on Protectionism

According to Paul Krugman, the decline in trade between 1929 and 1933 "was almost entirely a consequence of the Depression, not a cause. Trade barriers were a response to the Depression".

1933: Tariffs designed to keep American wages high

From 1860 to 1933, the policy was usually high protective tariffs (apart from 1913 to 1921). The tariffs were designed to keep American wages high, especially after 1890, when the tariff on wool affected an important industry.

1992: Armenia established its custom service

In 1992, Armenia established its custom service after the dissolution of the Soviet Union.

1999: Revised Kyoto Convention defined free zone

According to the 1999 Revised Kyoto Convention, a 'free zone' means a part of the territory of a contracting party where any goods introduced are generally regarded, insofar as import duties and taxes are concerned, as being outside the customs territory.

2001: Chang on Trade Policies

In 2001, economist Ha-Joon Chang argued that most of today's developed countries have developed through policies that are the opposite of free trade and laissez-faire.

2002: United States steel tariff imposed

In 2002, the United States steel tariff imposed a 30% tariff on a variety of imported steel products for a period of three years. American steel producers supported the tariff.

2003: Armenia became a WTO member

In 2003, Armenia became a member of the WTO, resulting in the Most Favored Country (MFC) benefits.

2003: Effects of Free Trade

Studies on the effects of free trade show that the gains induced by WTO rules for developing countries are very small. This has reduced the gain for these countries from an estimated $539 billion in the 2003 LINKAGE model to $22 billion in the 2005 GTAP model.

2005: Effects of Free Trade

Studies on the effects of free trade show that the gains induced by WTO rules for developing countries are very small. This has reduced the gain for these countries from an estimated $539 billion in the 2003 LINKAGE model to $22 billion in the 2005 GTAP model.

2007: Australian Federal election and car tariffs review

In the leadup to the 2007 Australian Federal election, the Australian Labor Party announced it would undertake a review of Australian car tariffs if elected. The Liberal Party made a similar commitment.

2009: Armenia tariff rate

In 2009, Armenia's tariff rate on imports was around three percent. This rate has since increased.

2013: Russia World Leader in Protectionism

In 2013, the Russian Federation adopted more protectionist trade measures than any other country, becoming the world leader in protectionism. The government supported several economic sectors such as agriculture, space, automotive, electronics, chemistry, and energy.

2015: Armenia given access to the Eurasian Customs Union

In 2015, Armenia joined the Eurasian Customs Union upon becoming a member of the EAEU, leading to mostly tariff-free trade with other members but higher import tariffs from outside the union. Armenia also began applying tariffs on its imports at a rate of 0–10 percent.

2016: Swiss government estimated economic benefits of tariff move

Using 2016 trade figures, the Swiss government estimated the move to abolish tariffs on industrial products could have economic benefits of 860 million CHF per year.

2017: Irwin's book review

A review by the Economist of Douglas Irwin's 2017 book Clashing over Commerce: A History of US Trade Policy

2017: India Introduces Tariffs on Electronics

From 2017, India introduced tariffs on several electronic products and "non-essential items" to stimulate domestic manufacturing and combat current account deficits. The national solar energy programme also favors domestic producers.

March 2018: Economists on Tariffs

In March 2018, the University of Chicago surveyed about 40 leading economists asking whether imposing new U.S. tariffs on steel and aluminum will improve Americans' welfare; most disagreed.

2021: Tariff increases impact on output and productivity

A 2021 study found that across 151 countries over the period 1963–2014, tariff increases are associated with persistent declines in domestic output and productivity, as well as higher unemployment and inequality, real exchange rate appreciation, and insignificant changes to the trade balance.

2022: Armenia authorised to apply non-EAEU tariff rates

Until 2022, Armenia was authorised to apply non-EAEU tariff rates, according to Decision No. 113, for specific goods.

November 2024: The Economist observes the effects of the Act

In November 2024, The Economist noted that the Smoot-Hawley Tariff Act, raised average tariffs on imports by around 20% and incited a trade war, led to global trade falling by two-thirds.

2024: Switzerland abolished tariffs on industrial products

In 2024, Switzerland abolished tariffs on industrial products imported into the country.

April 2025: United States announced increase in tariffs on imported products

In April 2025, President Donald Trump of the United States announced a substantial increase in tariffs and a 10% base tariff on all imported products, resulting in the US trade-weighted average tariff rising from 2% to an estimated 24%.

Mentioned in this timeline

The Union of Soviet Socialist Republics USSR existed from to...

India officially the Republic of India is a South Asian...

Germany officially the Federal Republic of Germany is a nation...

China officially the People's Republic of China is an East...

Korea is a peninsular region in East Asia comprised of...

Chicago is the most populous city in Illinois and the...

Trending

19 minutes ago Jack Draper begins Indian Wells title defense with new service motion after comeback.

19 minutes ago Mirra Andreeva Achieves 100th WTA Win at Indian Wells, Blanks Sierra

20 minutes ago Kwity Paye: From Michigan Star to NFL Free Agency Gamble and Overrated Label

21 minutes ago Sarri angry over Mandas sale and Provedel's injury, protests Lazio-Sassuolo penalty.

21 minutes ago Case Keenum Re-Signs with Chicago Bears on a Two-Year Deal

21 minutes ago Rinky Hijikata at Indian Wells: Analysis, Odds, and Alcaraz Match Preview

Popular

Jesse Jackson is an American civil rights activist politician and...

Ken Paxton is an American politician and lawyer serving as...

Markwayne Mullin is an American politician and businessman serving as...

Corey Lewandowski is an American political operative lobbyist commentator and...

Hillary Diane Rodham Clinton is a prominent American politician lawyer...

Kristi Lynn Arnold Noem is an American politician She was...