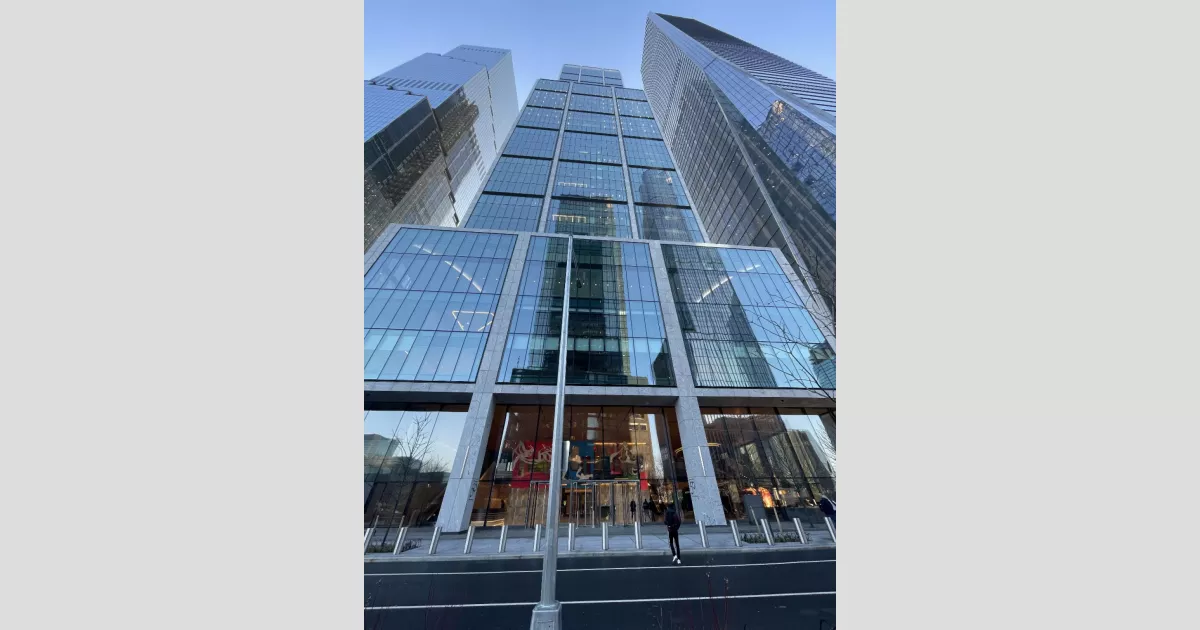

BlackRock, Inc., founded in 1988, is the world's largest asset management firm, overseeing US$10 trillion in assets. Based in New York City, the company operates in 38 countries and serves clients globally. Known for managing the iShares exchange-traded funds, BlackRock is recognized as one of the 'Big Three' index fund managers alongside Vanguard and State Street. The firm's Aladdin software platform is widely used for investment portfolio tracking, while BlackRock Solutions provides risk management services. Ranked 229th on the Fortune 500, BlackRock is a significant player in the global financial market.

1988: Founding of BlackRock

In 1988, Larry Fink, along with seven other partners, founded BlackRock. The firm's initial focus was on providing institutional clients with asset management services through a risk management perspective, drawing from Fink's previous experience at First Boston.

1989: BlackRock's Assets Quadruple

BlackRock demonstrated significant early success, with its assets quadrupling to $2.7 billion by 1989. This growth led to a decrease in Blackstone's stake in the company, reflecting the firm's rapid ascent in the financial world.

1992: BlackRock Adopts Its Name and Reaches $17 Billion in Assets

By 1992, the firm, then known as Blackstone Financial Management, underwent a name change, officially becoming BlackRock. This rebranding coincided with significant growth, as the company's assets under management reached $17 billion.

June 1994: Blackstone Sells Stake in BlackRock

Following an internal dispute between Fink and Schwarzman, Blackstone decided to sell its stake in BlackRock to PNC Financial Services. This strategic move paved the way for Fink to become the Chairman and CEO of BlackRock, solidifying his leadership within the company.

October 1, 1999: BlackRock Goes Public

Marking a significant step in its corporate journey, BlackRock went public on October 1, 1999. The initial public offering on the New York Stock Exchange, with shares priced at $14 each, signified BlackRock's growing presence and influence within the financial markets.

2000: Launch of BlackRock Solutions

In a strategic move to diversify its offerings, BlackRock, under the leadership of Charles Hallac, launched BlackRock Solutions in 2000. This new division, focused on analytics and risk management, leveraged the firm's existing technological capabilities, including the Aladdin System and other proprietary tools.

August 2004: BlackRock Acquires State Street Research & Management

BlackRock made its first major acquisition in August 2004, purchasing State Street Research & Management's holding company, SSRM Holdings, Inc. This acquisition, valued at $375 million, significantly increased BlackRock's assets under management, solidifying its position in the industry.

2005: Integration of State Street Research & Management's Mutual-Fund Business

Following the acquisition of SSRM Holdings, Inc., BlackRock further expanded its portfolio in 2005 by integrating State Street Research & Management's mutual-fund business into its operations.

2006: Merger with Merrill Lynch Investment Managers

In a significant strategic move, BlackRock merged with Merrill Lynch's Investment Managers division (MLIM) in 2006. This merger not only diversified BlackRock's offerings but also restructured its ownership, with PNC's ownership being halved and Merrill Lynch acquiring a 49.5% stake in the company.

October 2007: Acquisition of Quellos Capital Management's Fund-of-Funds Business

Continuing its strategic expansion through acquisitions, BlackRock acquired the fund-of-funds business of Quellos Capital Management in October 2007. This acquisition further diversified BlackRock's investment offerings and expanded its client base.

April 2009: Acquisition of R3 Capital Management, LLC

In April 2009, BlackRock acquired R3 Capital Management, LLC, along with the management of its $1.5 billion fund. This acquisition further strengthened BlackRock's position in the investment management industry and broadened its range of investment strategies.

May 2009: BlackRock's Role in the 2007-2008 Financial Crisis

In the wake of the 2007-2008 financial crisis, BlackRock's expertise was called upon by the U.S. Treasury Department. The firm was tasked with analyzing, unwinding, and pricing the toxic assets held by Bear Stearns, American International Group (AIG), and other financial institutions severely impacted by the crisis. BlackRock's role in managing the $130 billion-debt settlement of Bear Stearns and AIG underscored its capabilities in navigating complex financial situations.

February 2010: Acquisition of Barclays Global Investors (BGI)

In February 2010, amidst the financial crisis, BlackRock undertook another significant acquisition by purchasing Barclays Global Investors (BGI) for US$13.5 billion. This acquisition included BGI's exchange-traded fund business, iShares, further solidifying BlackRock's dominance in the ETF market. As part of the deal, Barclays acquired a near-20% stake in BlackRock.

April 1, 2011: Inclusion in the S&P 500 Index

On April 1, 2011, BlackRock achieved a significant milestone by being added as a component of the S&P 500 stock market index. This inclusion reflected BlackRock's substantial size, financial performance, and overall influence in the U.S. stock market.

2013: Recognition by Fortune Magazine

BlackRock's reputation as a leading financial institution was further solidified in 2013 when Fortune magazine included the company on its annual list of the "World's 50 Most Admired Companies." This recognition highlighted BlackRock's strong corporate governance, innovative practices, and overall industry leadership.

2014: BlackRock Becomes World's Biggest Asset Manager

In 2014, BlackRock reached a significant milestone by becoming the world's biggest asset manager, with over $4 trillion in assets under management. This achievement underscored BlackRock's dominance in the global investment management industry.

June 30, 2015: BlackRock's Assets Under Management Reach US$4.721 Trillion

By June 30, 2015, BlackRock's assets under management had grown to US$4.721 trillion, demonstrating the company's continued growth and success in attracting and managing investments.

August 26, 2015: Acquisition of FutureAdvisor

On August 26, 2015, BlackRock announced its agreement to acquire FutureAdvisor, a digital wealth management provider. This strategic move reflected BlackRock's focus on expanding its technological capabilities and reaching a wider customer base through digital platforms.

November 2015: Closure of BlackRock Global Ascent Hedge Fund

BlackRock made the decision to wind down its BlackRock Global Ascent hedge fund in November 2015 following losses. This move indicated BlackRock's focus on adapting its investment strategies based on market conditions and performance.

March 2017: Restructuring of Actively-Managed Fund Business

In March 2017, BlackRock initiated a restructuring of its actively-managed fund business. This strategic decision, led by Mark Wiseman, involved replacing certain funds with quantitative investment strategies, reflecting BlackRock's adaptation to evolving market trends and investor preferences.

April 2017: Growth of iShares and Support for Chinese Shares Inclusion

By April 2017, BlackRock's iShares business had grown substantially, accounting for a significant portion of the company's total assets under management and base fee income. This growth highlighted the success of BlackRock's ETF offerings. Additionally, BlackRock demonstrated its support for global market integration by backing the inclusion of mainland Chinese shares in MSCI's global index for the first time.

2017: BlackRock Advocates for Climate Action and Diversity

BlackRock began actively addressing environmental and diversity concerns by sending official letters to CEOs and participating in shareholder votes alongside activist investors and organizations such as the Carbon Disclosure Project. Notably, in 2017, BlackRock supported a shareholder resolution urging ExxonMobil to take action on climate change.

2017: BlackRock Expands ESG Initiatives

BlackRock demonstrated its commitment to environmental, social, and corporate governance (ESG) principles in 2017 by expanding its ESG projects, bringing in new staff, and developing new products.

2017: BlackRock Holds Significant Fossil Fuel Reserves

In 2017, BlackRock held substantial oil, gas, and thermal coal reserves, raising concerns about its environmental impact.

April 5, 2018: BlackRock Introduces Gun-Free ETFs

On April 5, 2018, after engaging in discussions with firearms manufacturers and distributors, BlackRock launched two new exchange-traded funds (ETFs) that excluded stocks from gun makers and major gun retailers, and removed such stocks from seven existing ESG funds.

May 2018: Anti-gun Protesters Demonstrate at BlackRock's Annual Meeting

In May 2018, anti-gun protesters gathered outside BlackRock's annual general meeting in Manhattan to voice their concerns.

September 2018: Environmental Groups Launch "BlackRock's Big Problem" Campaign

In September 2018, environmental groups including the Sierra Club and Amazon Watch launched the "BlackRock's Big Problem" campaign, criticizing BlackRock's environmental impact.

December 2018: BlackRock Identified as a Major Investor in Coal-Fired Power Stations

In December 2018, BlackRock was identified as the world's largest investor in coal-fired power stations, holding shares worth $11 billion.

2018: BlackRock Calls for Improved Gender Diversity on Boards

In 2018, BlackRock urged Russell 1000 companies to prioritize gender diversity on their boards of directors, particularly those with fewer than two women, highlighting its focus on diversity and inclusion.

May 2019: BlackRock Faces Criticism for Environmental Impact of Its Holdings

In May 2019, BlackRock drew criticism for its substantial investments in oil supermajors and major coal producers, raising concerns about its environmental impact.

2019: Climate Activists Protest Outside BlackRock's London Offices

Throughout 2019, climate activists staged protests and glued themselves to the entrance of BlackRock's London offices in response to the company's environmental policies.

January 10, 2020: Climate activists target BlackRock's Paris office

On January 10, 2020, climate activists protested inside BlackRock's Paris office, expressing concerns over the company's role in climate change.

January 14, 2020: BlackRock Announces Shift in Investment Policy to Prioritize Environmental Sustainability

On January 14, 2020, BlackRock CEO Larry Fink declared environmental sustainability as a key factor in investment decisions, and announced the sale of $500 million in coal-related assets and the creation of fossil-fuel-free funds.

January 2020: PNC Financial Services Divests from BlackRock

In January 2020, PNC Financial Services sold its stake in BlackRock for $14.4 billion, marking a significant divestment.

March 2020: BlackRock Selected to Manage Federal Reserve Bond Programs

Amidst the COVID-19 pandemic in March 2020, the Federal Reserve chose BlackRock to oversee two corporate bond-buying programs, the PMCCF and SMCCF, and to purchase CMBS guaranteed by government agencies.

May 2020: European Ombudsman Investigates BlackRock Contract Award

The European Ombudsman launched an inquiry in May 2020 to review the European Commission's decision to grant BlackRock a contract for a study on integrating ESG risks and objectives into EU banking regulations, following concerns raised by members of the European Parliament regarding BlackRock's impartiality due to its investments in the sector.

May 26, 2020: Details of BlackRock's Contract with the Fed Released Publicly

On May 26, 2020, the contract between BlackRock and the Federal Reserve was made public, revealing that BlackRock would earn a maximum of $7.75 million annually for managing the main bond portfolio and would be prohibited from receiving fees on sales of bond-backed exchange-traded funds.

June 2020: BlackRock's Role in COVID-19 Pandemic Response Scrutinized

BlackRock faced scrutiny in June 2020 for its perceived advantages due to its close relationship with the Federal Reserve during the COVID-19 pandemic response. Concerns were raised about potential conflicts of interest and whether BlackRock might leverage its position to influence the Fed's asset purchase program in its favor.

August 2020: BlackRock Granted Approval to Operate in China

In a groundbreaking move in August 2020, BlackRock became the first global asset manager to receive approval from the China Securities Regulatory Commission to establish a mutual fund business in China.

2020: BlackRock Labeled as World's Largest Shadow Bank

BlackRock's substantial financial power and activities led to its characterization as the world's largest shadow bank by prominent publications like The Economist and Basler Zeitung. In response to these concerns, U.S. Representatives Katie Porter and Jesús "Chuy" García introduced a bill in 2020 aiming to impose greater regulation on BlackRock and other shadow banks.

2020: Report Highlights Market Power of BlackRock and Peers

In 2020, the American Economic Liberties Project released a report emphasizing the considerable market power of BlackRock, Vanguard, and State Street, the "Big Three" asset management firms. The report pointed out that these firms collectively managed over $15 trillion in global assets, surpassing three-quarters of the U.S. gross domestic product, and called for structural reforms and enhanced regulation in the financial markets.

March 4, 2021: Senator Warren Proposes "Too Big to Fail" Designation for BlackRock

On March 4, 2021, U.S. Senator Elizabeth Warren put forward a proposal to classify BlackRock as "too big to fail" and subject it to corresponding regulations due to its significant influence and potential systemic risk.

August 2021: BlackRock Launches First Mutual Fund in China

In August 2021, BlackRock established its inaugural mutual fund in China, successfully raising over $1 billion from 111,000 Chinese investors, marking it as the first foreign-owned company granted permission by the Chinese government to operate a wholly-owned entity within China's mutual fund sector.

August 2021: Former Executive Criticizes BlackRock's ESG Investing

In August 2021, a former BlackRock executive, who had previously served as the company's inaugural global chief investment officer for sustainable investing, raised concerns about the firm's ESG investing practices. He argued that ESG investing was a "dangerous placebo" that could harm the public interest and suggested that financial institutions engage in ESG investing primarily for higher fees and increased profits.

October 2021: Consumers' Research Criticizes BlackRock's Ties to China

October 2021 saw the non-profit organization Consumers' Research launch an advertising campaign targeting BlackRock's relationship with the Chinese government.

October 2021: BlackRock's Push for ESG Disclosure Rules Sparks Debate

The Wall Street Journal editorial board reported in October 2021 that BlackRock was advocating for stricter ESG disclosure rules, urging the U.S. Securities and Exchange Commission to mandate that private companies publicly disclose their environmental impact, board diversity, and other ESG metrics. The editorial board expressed concerns that such mandates could deter companies from public markets, negatively impacting stock exchanges, asset managers, and retail investors.

November 2021: Blackrock Adjusts Investment Strategy in India and China

In November 2021, Blackrock made strategic investment adjustments, decreasing its investment in India while increasing its investment in China. However, the firm retained its dedicated India Fund, continuing its investments in Indian startups such as Byju's, Paytm, and Pine Labs.

December 2021: BlackRock's Investments in Blacklisted Chinese Companies Scrutinized

In December 2021, reports emerged detailing BlackRock's investments in two companies blacklisted by the US government for alleged human rights abuses against Uyghurs in Xinjiang, with one instance (Hikvision) revealing increased investment by BlackRock following the company's blacklisting.

2021: BlackRock's Assets Under Management Exceed $10 Trillion

BlackRock's assets under management surpassed $10 trillion in 2021, representing a significant portion (approximately 40%) of the United States' nominal GDP, which stood at $25.347 trillion in 2022.

January 2022: Larry Fink Defends BlackRock's ESG Focus

BlackRock founder and CEO Larry Fink addressed criticisms regarding the company's ESG focus in January 2022. Fink defended BlackRock's commitment to ESG investing, rejecting accusations that the firm was promoting a political agenda and stating that ESG "is not woke."

June 2022: West Virginia Bans BlackRock from State Business

In June 2022, West Virginia State Treasurer Riley Moore barred BlackRock and five other financial institutions from conducting business with the state, citing their advocacy against the fossil fuel industry.

October 2022: Louisiana Divests $794 Million from BlackRock

In October 2022, Louisiana withdrew $794 million from BlackRock, citing the company's support for ESG principles and green energy initiatives.

December 2022: Florida Divests $2 Billion from BlackRock Over ESG Policies

In December 2022, Florida's Chief Financial Officer Jimmy Patronis announced the state's divestment of $2 billion from BlackRock, attributing the decision to the firm's emphasis on strengthening ESG standards and policies, a move that BlackRock countered by stating it prioritized politics over investor interests.

December 28, 2022: BlackRock and Zelensky Collaborate on Ukraine's Reconstruction

On December 28, 2022, it was announced that BlackRock and Ukrainian President Volodymyr Zelensky had agreed on a plan for BlackRock to play a role in the reconstruction of Ukraine.

June 2023: BlackRock Applies for Spot Bitcoin ETF

BlackRock made a significant move in the cryptocurrency space by filing an application with the United States Securities and Exchange Commission (SEC) to launch a Spot Bitcoin Exchange-Traded Fund (ETF) in June 2023.

June 2023: Larry Fink Steps Back from "ESG" Terminology

In June 2023, during a talk at the Aspen Ideas Festival, Larry Fink, CEO of BlackRock, revealed his decision to discontinue using the term "ESG." He explained that the term had been "weaponized" and expressed discomfort with the surrounding discourse. While initially reported as feeling "ashamed," Fink clarified that he remained a believer in "conscientious capitalism."

July 2023: Amin H. Nasser Joins BlackRock's Board

In July 2023, BlackRock appointed Amin H. Nasser to its board of directors, strengthening its leadership team.

July 2023: BlackRock to Offer Proxy Voting to Retail Investors in Largest ETF

Responding to criticism from US Republicans about their ESG activities, in July 2023 BlackRock announced plans to grant retail investors proxy voting rights in its largest ETF starting in 2024. Investors in the iShares Core S&P 500 ETF will be able to choose from seven general voting policies, including aligning with BlackRock's management, prioritizing ESG factors, or considering Catholic values. However, investors will not have the ability to vote on specific companies.

August 2023: BlackRock Partners with New Zealand for Renewable Energy Investment

In August 2023, BlackRock signed an agreement with New Zealand to establish a NZ$2 billion investment fund dedicated to solar, wind, green hydrogen, battery storage, and EV charging projects. This partnership reflects BlackRock's commitment to supporting New Zealand's goal of achieving 100% renewable energy by 2030.

August 2023: US House Committee Investigates BlackRock's China Investments

The US House of Representatives' Select Committee on the Chinese Communist Party launched an investigation in August 2023 into BlackRock's investments in Chinese companies accused of human rights violations and supporting the People's Liberation Army.

November 2023: BlackRock Seeks Approval for Spot Ethereum ETF

Expanding its presence in the cryptocurrency market, BlackRock filed another application in November 2023 for a Spot Ethereum ETF, further diversifying its offerings.

December 31, 2023: BlackRock Reaches US$10 Trillion in Assets Under Management

By December 31, 2023, BlackRock, already recognized as the world's largest asset manager, achieved a significant milestone by reaching US$10 trillion in assets under management.

January 10, 2024: BlackRock's Spot Bitcoin ETF Approved

BlackRock's application for a spot Bitcoin Exchange-Traded Fund (ETF) was approved on January 10, 2024, along with ten other applications, marking a significant development in the cryptocurrency market.

January 2024: BlackRock Acquires Global Infrastructure Partners

BlackRock announced in January 2024 its acquisition of the investment fund Global Infrastructure Partners for $12.5 billion, demonstrating its strategic expansion in the infrastructure investment sector. The deal involved a payment of $3 billion in cash and 12 million BlackRock shares.

January 19, 2024: iShares Bitcoin Trust ETF Achieves $1 Billion in Volume

On January 19, 2024, the iShares Bitcoin Trust ETF (IBIT), the first spot bitcoin ETF, reached $1 billion in volume, demonstrating its rapid growth and market acceptance.

March 2024: BlackRock Launches First Tokenized Fund on Ethereum

In March 2024, BlackRock marked its entry into the tokenized fund market by launching the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) on the Ethereum blockchain. The fund focuses on investments in U.S. Treasury bills and repo agreements and quickly gained traction, securing $245 million in assets within its first week.

2024: BlackRock Operates World's Largest Bitcoin Fund

As of 2024, BlackRock manages the world's largest bitcoin fund.

2024: BlackRock's Board of Directors

As of 2024, BlackRock's board of directors consists of 17 members.

2024: BlackRock Implements Proxy Voting for Retail Investors

Starting in 2024 Blackrock will implement a new policy allowing investors in BlackRock's iShares Core S&P 500 ETF to make choices from seven different general policies. These range from voting generally with BlackRock's management, to environmental, social and governance factors or prioritizing Catholic values.

Mentioned in this timeline

Ukraine is a country in Eastern Europe the second-largest on...

Elizabeth Warren is a prominent American politician and the senior...

Ethereum is a decentralized open-source blockchain platform notable for its...

The stock market is where buyers and sellers trade stocks...

India officially the Republic of India is a South Asian...

New Zealand is an island country in the southwestern Pacific...

Trending

43 minutes ago Noah Fant: Patriots might target the tight end; forecast for 2026 free agency.

43 minutes ago Fort Polk Lockdown Lifted After Investigation; Army Exercise Cancellation Sparks Deployment Speculation.

44 minutes ago Broncos Release Dre Greenlaw, Citing Injury Concerns and Salary Cap Savings

44 minutes ago Austin Schlottmann Joins Tennessee Titans on One-Year Deal: Contract Details

44 minutes ago Breece Hall seemingly critiques Jets' free agency; jokes about future contracts.

44 minutes ago Dee Alford joins Buffalo Bills with a lucrative three-year, $21M free agency deal.

Popular

Jesse Jackson is an American civil rights activist politician and...

Ken Paxton is an American politician and lawyer serving as...

Markwayne Mullin is an American politician and businessman serving as...

Corey Lewandowski is an American political operative lobbyist commentator and...

Hillary Diane Rodham Clinton is a prominent American politician lawyer...

Kristi Lynn Arnold Noem is an American politician She was...