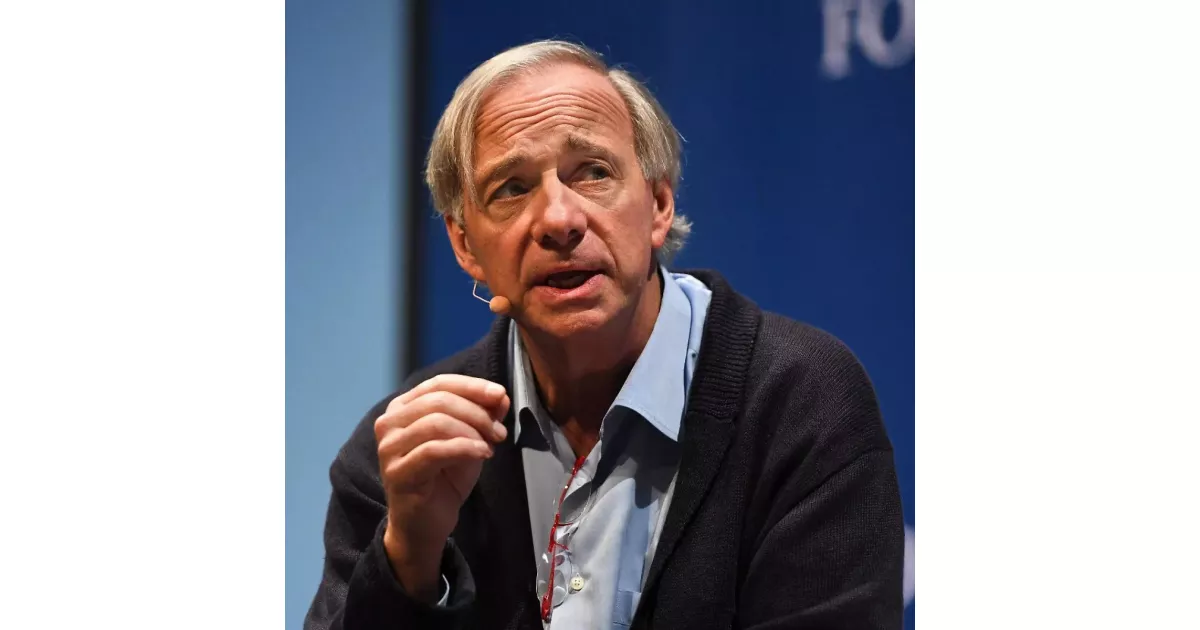

How Ray Dalio built a successful career. Explore key moments that defined the journey.

Ray Dalio is a billionaire hedge fund manager and the co-chief investment officer of Bridgewater Associates, a company he founded in 1975. Dalio is known for his principles-based approach to both life and investing, emphasizing radical transparency and idea meritocracy within Bridgewater. He advocates for a deep understanding of economic and market cycles, using them to inform investment strategies. Dalio's influence extends beyond finance, with his publications on economics, investing, and management gaining widespread recognition.

1974: Fired from Shearson Hayden Stone

In 1974, Ray Dalio was fired from Shearson Hayden Stone after punching his boss in the face at a New Year's Eve party while drunk.

1975: Founded Bridgewater Associates

In 1975, Ray Dalio founded Bridgewater Associates in his two-bedroom New York City apartment.

1981: Opened Office in Westport, Connecticut

In 1981, Bridgewater Associates opened an office in Westport, Connecticut, where Ray Dalio and his wife wanted to start a family.

1985: Co-Chief Investment Officer

In 1985, Ray Dalio became the co-chief investment officer of Bridgewater Associates.

1987: Profit from Stock Market Crash

In 1987, Ray Dalio became well known outside of Wall Street after turning a profit from the stock market crash.

1991: Launched "Pure Alpha" Strategy

In 1991, Ray Dalio launched Bridgewater's flagship strategy, "Pure Alpha," which represents the excess returns a money manager can create in addition to market returns when adjusted for risk.

1996: Launched All Weather Fund

In 1996, Ray Dalio launched All Weather, a fund that pioneered a steady, low-risk strategy known as risk parity.

2005: Bridgewater Becomes Largest Hedge Fund

In 2005, Bridgewater Associates became the world's largest hedge fund.

2007: Bridgewater Predicted Financial Crisis

In 2007, Bridgewater Associates predicted the 2008 financial crisis.

2008: Published "How the Economic Machine Works"

In 2008, Ray Dalio published "How the Economic Machine Works: A Template for Understanding What is Happening Now", an essay assessing the potential of various economies by various criteria.

February 2009: Dalio Used "d-process" Term

In February 2009, Ray Dalio began using the term "d-process" to describe the deleveraging and deflationary process of the subprime mortgage industry and incorporated it into his investment philosophy.

April 2011: Joined the Giving Pledge

In April 2011, Ray Dalio and his wife joined the Giving Pledge, vowing to donate more than half his fortune to charitable causes within his lifetime.

2011: Self-Published "Principles"

In 2011, Ray Dalio self-published a 123-page volume, Principles, that outlines his philosophy of investment and corporate management.

February 2012: TRS Purchased Stake in Bridgewater

In February 2012, the Teacher Retirement System of Texas (TRS) purchased a stake in Bridgewater Associates Intermediate Holdings, LP, for $250 million.

2013: Bridgewater Listed as Largest Hedge Fund

In 2013, Bridgewater Associates was listed as the largest hedge fund in the world.

March 2017: Stepped down as Co-CEO of Bridgewater

In March 2017, Ray Dalio announced that he would step down as co-CEO of Bridgewater Associates.

2017: Publication of "Principles: Life & Work"

In 2017, Ray Dalio authored the book "Principles: Life & Work," which focuses on corporate management and investment philosophy.

2018: OceanX Commitment

In 2018, OceanX, an initiative of the Dalio family, and Bloomberg Philanthropies committed $185 million over four years to protect the oceans.

2018: Published "Principles for Navigating Big Debt Crises"

In 2018, Ray Dalio published "Principles for Navigating Big Debt Crises".

July 2019: Called for Refinement of Capitalism

In July 2019, Ray Dalio called for the refinement of capitalism and referred to wealth inequality as a national emergency.

2019: Pledge to Connecticut Public Schools

In 2019, Ray Dalio pledged $100 million to Connecticut public schools.

2019: Published "Principles for Success"

In 2019, Ray Dalio published an illustrated version of his book called "Principles for Success."

February 2020: Donation to China's Coronavirus Recovery Efforts

In February 2020, the Dalio Foundation donated $10 million to support China's coronavirus recovery efforts in response to the COVID-19 pandemic.

March 2020: Donation to the State of Connecticut

In March 2020, the Dalio Foundation gave $4 million to the state of Connecticut to fund healthcare and nutrition.

May 2020: Stressed Importance of Reforming Capitalism

In May 2020, Ray Dalio stressed the importance of reforming capitalism, rather than abandoning it.

October 13, 2020: NYP Launched the Dalio Center for Health Justice

On October 13, 2020, NYP launched the Dalio Center for Health Justice with a gift of $50 million.

October 2020: Cautioned About China's Rise

In October 2020, Ray Dalio cautioned people to not be blind to China's rise, arguing that it had continued to emerge as a global superpower.

2021: Published "Principles for Dealing with the Changing World Order"

In 2021, Ray Dalio published "Principles for Dealing with the Changing World Order" and produced a free online personality assessment called PrinciplesYou.

2025: Dalio published How Countries Go Broke: The Big Cycle

In 2025, Dalio published How Countries Go Broke: The Big Cycle, which became a New York Times best seller.

2025: Sold Last Shares

In 2025, Ray Dalio sold his last shares in the hedge fund.

Mentioned in this timeline

Bill Gates an American businessman and philanthropist revolutionized personal computing...

George Soros is a Hungarian-American investor and philanthropist with a...

The stock market is where buyers and sellers trade stocks...

CNBC is an American business news channel owned by Versant...

Coronaviruses are a family of RNA viruses affecting mammals and...

Washington D C is the capital city and federal district...

Trending

34 minutes ago Jafar Panahi faces restrictions, continues filmmaking despite adversity and imprisonment in Iran.

34 minutes ago Joe Rogan Interviews RFK Jr. on Trump's ICE Raids and US Taxpayer Losses.

34 minutes ago Joki? Confronts Dort After Trip, Tempers Flare in Nuggets-Thunder Game

35 minutes ago Arizona Dominates Kansas to Secure Share of Big 12 Title in Basketball Game

35 minutes ago Gui Santos Secures 3-Year, $15M Deal with Warriors; Curry Issues Warning

35 minutes ago Kawhi Leonard potentially playing vs Pelicans; Zach Lowe praises All-NBA caliber.

Popular

Jesse Jackson is an American civil rights activist politician and...

Hillary Diane Rodham Clinton is a prominent American politician lawyer...

Jim Carrey is a Canadian-American actor and comedian celebrated for...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...

Kashyap Pramod Patel is an American lawyer who became the...

Michael Joseph Jackson the King of Pop was a highly...