The FTSE 100 Index, colloquially known as the "Footsie", is the primary stock market index in the United Kingdom. It tracks the performance of the 100 largest companies, by market capitalization, listed on the London Stock Exchange. These are typically blue-chip companies, representing a significant portion of the UK economy. The FTSE 100 serves as a key indicator of the UK stock market's health and is closely monitored by investors and financial professionals worldwide.

6 hours ago : FTSE 100 Reacts to Trump's Tariff Stance and US-China Trade Tensions.

The FTSE 100 faces turmoil as Trump dismisses market concerns over tariffs. He insists on resolving the US-China trade deficit, escalating trade war fears. The US is unwilling to negotiate without trade balance.

1935: Establishment of FT 30 Index

The FT 30 Index, also known as the Financial Times Index or FT Ordinary Index (FTOI), was established in 1935 and is now largely obsolete. It is similar to the Dow Jones Industrial Average, with listed companies from industrial and commercial sectors, excluding financial sector companies and government stocks.

January 1984: Index Started

In January 1984, the FTSE 100 Index was initiated by the London Stock Exchange to provide a more accurate representation of market activity, with a public unveiling set for February 14th.

May 1984: Options Contract Launch

In May 1984, the London Traded Options Market (LTOM), owned by the Stock Exchange, launched an options contract based on the FTSE's real-time data. Simultaneously, LIFFE quickly launched its futures contract.

1984: Annual Development

The calculation of the FT 30 Index from 1969 to 1983 and the FTSE 100 since 1984 is shown in the following table.

1985: Low Volume on FTSE Futures Contract

In 1985, the FTSE futures contract experienced low trading volume, with less than 89,000 lots traded annually, significantly lower than the 15 million lots traded on the S&P 500 index contract.

1986: Financial Deregulation and Privatisations

In 1986, Margaret Thatcher's financial deregulation and privatisations, including British Telecom, British Gas, and British Aerospace, culminated in the Big Bang. This, along with the new index, tradable derivatives, and promotion by the Financial Times, led to the FTSE 100 becoming a widely used indicator of the UK stock market's performance.

1987: Privatisations and Black Monday

In 1987, privatisations continued with British Airways and British Petroleum. The latter concluded on the same day as Black Monday, a market crash where the index fell 21.73% in two days, including its worst single-day return of -12.22%.

2007: Delistings from London Market

In 2007, the London market experienced a high number of delistings, with companies switching to NYSE for higher valuations and cheaper costs. Takeovers by private equity further reduced the pool of companies.

2008: Delistings from London Market

In 2008, the London market experienced a high number of delistings, with companies switching to NYSE for higher valuations and cheaper costs. Takeovers by private equity further reduced the pool of companies.

December 2024: Market Capitalisation of Sectors

As of December 2024, the FTSE 100 index comprised 20 ICB sectors, with Banks, Health Care, Industrial Goods and Services, and Energy having market capitalizations exceeding £200 billion each, accounting for about 48% of the index's capitalization. AstraZeneca, Shell, HSBC, and Unilever each exceeded £100 billion in market cap, totaling 28% of the market cap.

2024: Delistings from London Market

In 2024, the London market experienced a high number of delistings, reminiscent of the 2007-2008 financial crisis, with companies like Ashtead Group, CRH, and Flutter, representing almost £120 billion in FTSE 100 market capitalization, switching to NYSE for higher valuations and cheaper costs. Takeovers by private equity further reduced the pool of companies, and speculation arose about the future of index stalwarts like British American Tobacco, Rio Tinto, and Shell.

March 2025: Highest Closing and Intra-Day Value

In March 2025, the FTSE 100 index reached its highest closing value of 8,871.31 and highest intra-day value of 8,908.82, both on March 3, 2025.

March 2025: FTSE 100 Companies After Changes

The FTSE 100 companies following the changes made on March 24, 2025, are listed in the following table.

Mentioned in this timeline

The stock market is a platform where buyers and sellers...

Margaret Hilda Thatcher Baroness Thatcher was a British stateswoman and...

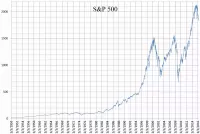

The S P is a stock market index that tracks...

The Dow Jones Industrial Average DJIA often called the Dow...

HSBC Holdings plc is a British multinational universal bank and...

Stocks are restraining devices primarily for the feet historically used...

Trending

34 minutes ago Viola Davis featured in streaming recommendations for shows to watch this week.

35 minutes ago David Foster's Broadway Musical 'BOOP!' Celebrates Opening Night with Family Support.

35 minutes ago Warren Buffett's Berkshire Hathaway Thrives Amid Market Turmoil, Offering Key Investment Advice.

35 minutes ago John Deere Localizes Agricultural Machinery Production in Kazakhstan, Boosting Local Economy.

35 minutes ago Barack Obama confesses struggling to repair relationship with Michelle post-presidency, citing 'deep deficit'.

35 minutes ago Mark Hoppus Reflects on Blink-182, Cancer Battle, and New Memoir 'Fahrenheit 182'

Popular

Bruce Pearl is an American college basketball coach currently head...

The Nintendo Switch is a video game console developed by...

LeBron James nicknamed King James is a highly decorated American...

Michael Jordan also known as MJ is a celebrated American...

Facebook is a social media and networking service created in...

Cristiano Ronaldo nicknamed CR is a Portuguese professional footballer widely...