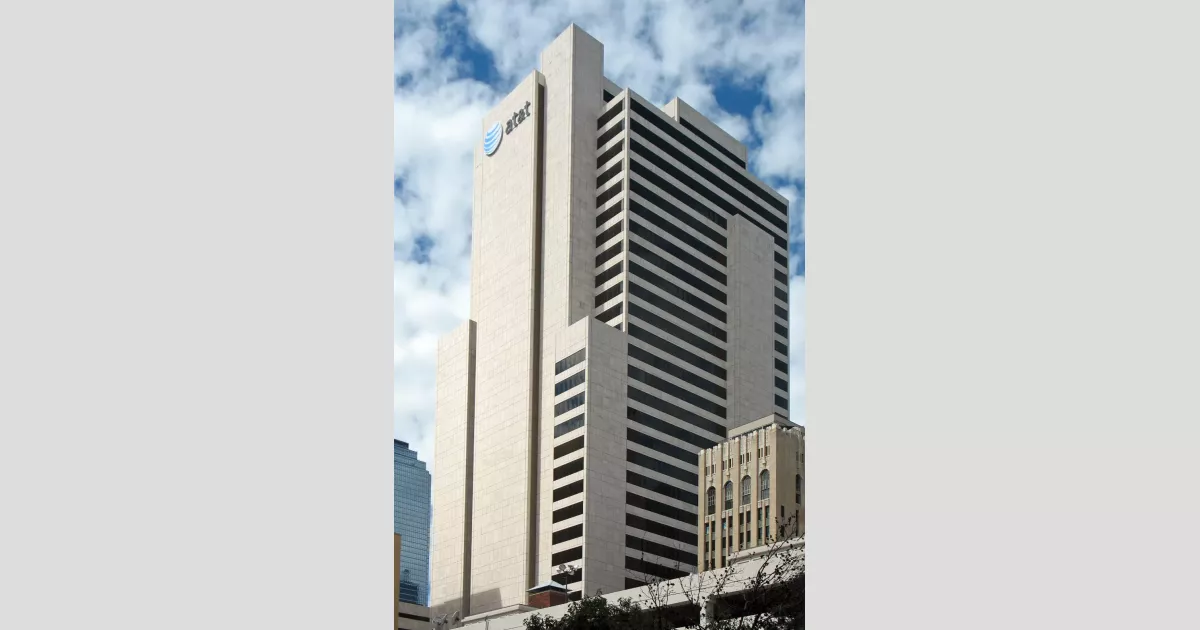

AT&T Inc. is a leading American multinational telecommunications holding company based in Whitacre Tower, Dallas, Texas. It is the world's fourth-largest telecommunications company by revenue and the largest wireless carrier in the United States. In 2023, AT&T was ranked 13th on the Fortune 500 list of the largest U.S. corporations, with revenues amounting to $120.7 billion.

1913: Kingsbury Commitment

In 1913, the Kingsbury Commitment authorized AT&T's monopoly on phone service in the United States, solidifying its dominance throughout most of the 20th century.

1978: Foreign Intelligence Surveillance Act Enacted

The Foreign Intelligence Surveillance Act of 1978 was enacted to outline procedures for the surveillance and collection of foreign intelligence information. The class action lawsuit Hepting v. AT&T alleged that AT&T's actions violated this act.

1982: Breakup of AT&T Monopoly

In 1982, U.S. regulators mandated the breakup of AT&T's monopoly, leading to the creation of seven Regional Bell Operating Companies, also known as Baby Bells.

1982: AT&T Antitrust Lawsuit and Divestiture

In 1982, the United States v. AT&T antitrust lawsuit resulted in the breakup of AT&T's monopoly, leading to the divestiture of its local operating subsidiaries into seven independent companies known as the Baby Bells.

1987: Call Detail Records Database Established

In 1987, AT&T established a database to maintain call detail records of all telephone calls that passed through its network. Employees work at High Intensity Drug Trafficking Area offices to quickly provide data to law enforcement agencies when requested via administrative subpoenas.

1987: SBC Acquires Metromedia Mobile Business

In 1987, Southwestern Bell Corporation acquired Metromedia's mobile business, marking the beginning of a series of acquisitions.

1989: AT&T ranks as fourteenth-largest donor to US political campaigns

According to OpenSecrets, AT&T was the fourteenth-largest donor to US federal political campaigns and committees from 1989 to 2019, having contributed more than $84.1 million.

1992: AT&T relocates corporate headquarters to San Antonio

In 1992, AT&T, then named Southwestern Bell Corporation, relocated its corporate headquarters from St. Louis, Missouri, to downtown San Antonio.

1994: Rebranding to AT&T Corp.

In 1994, the company formerly known as American Telephone and Telegraph Company rebranded itself as AT&T Corp.

1995: SBC Communications Name Change

In 1995, Southwestern Bell Corporation changed its name to SBC Communications Inc. following its separation from AT&T.

1997: C. Michael Armstrong Named CEO

In early 1997, C. Michael Armstrong was appointed CEO of SBC Communications Inc., with John Zeglis later appointed as president.

1998: Top 15 of Fortune 500

By 1998, SBC Communications Inc. had risen to the top 15 of the Fortune 500 list, reflecting its significant growth and acquisitions.

1998: AT&T Lobbying Effort Begins

In 1998, AT&T began a significant lobbying effort in the United States, focusing on issues such as who would profit from providing broadband internet access. This effort would span over two decades, totaling US$380.1 million by 2019.

1998: Ameritech sells Wisconsin landlines to CenturyTel

Of the Baby Bells, Ameritech sold some of its Wisconsin landlines to CenturyTel in 1998.

1999: Part of Dow Jones Industrial Average

In 1999, AT&T was included in the Dow Jones Industrial Average, a position it held until 2015, signifying its importance in the telecommunications industry.

2001: John Zeglis Resigns as President

In 2001, John Zeglis resigned from his position as president of AT&T, continuing his roles at AT&T Wireless until 2004.

2004: Cingular Wireless Acquires AT&T Wireless

In 2004, Cingular Wireless, a joint venture of SBC and BellSouth, acquired AT&T Wireless, setting the stage for future consolidations under AT&T Inc.

2004: John Zeglis Leaves AT&T Wireless

In 2004, John Zeglis resigned from his positions at AT&T Wireless, marking the end of his tenure with the company.

November 18, 2005: SBC Purchases AT&T Corporation

On November 18, 2005, SBC Communications purchased its former parent, AT&T Corporation, for $16 billion, subsequently adopting the AT&T name and brand.

November 21, 2005: Launch of AT&T Inc.

On November 21, 2005, SBC Communications purchased AT&T Corp. and rebranded itself as AT&T Inc., adopting the latter's branding, history, and stock trading symbol.

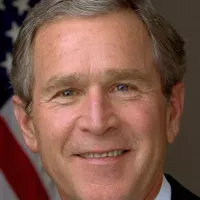

2005: AT&T contributes to President George W. Bush's second inauguration

In 2005, AT&T was among 53 entities that contributed the maximum of $250,000 to the second inauguration of President George W. Bush.

April 2006: Affidavit Filed in Class Action Lawsuit

In April 2006, retired AT&T technician Mark Klein filed an affidavit supporting the allegation that AT&T allowed the NSA to monitor phone and Internet communications without warrants. This was part of the class action lawsuit Hepting v. AT&T, which claimed that such actions violated several laws and constitutional amendments.

May 2006: USA Today Reports on NSA Data Sharing

In May 2006, USA Today reported that AT&T, Verizon, SBC, and BellSouth had handed over all international and domestic calling records to the National Security Agency. This was for the purpose of creating a massive calling database.

June 21, 2006: San Francisco Chronicle Reports on Privacy Policy

On June 21, 2006, the San Francisco Chronicle reported that AT&T had rewritten its privacy policy. The new policy, effective June 23, stated that AT&T, not customers, owned customers' confidential information and could use it to protect its business interests or respond to legal processes.

June 23, 2006: New Privacy Policy Takes Effect

On June 23, 2006, AT&T's new privacy policy took effect, stating that the company owned customers' confidential information and could use it to protect its legitimate business interests or respond to legal processes.

July 2006: Federal Government Motion Rejected

In July 2006, the United States District Court for the Northern District of California rejected a federal government motion to dismiss the class action lawsuit Hepting v. AT&T. The motion had argued that court review of the alleged partnership between the government and AT&T would harm national security.

December 29, 2006: Acquisition of BellSouth Corporation

On December 29, 2006, AT&T acquired BellSouth Corporation following FCC approval, consolidating ownership and management of Cingular Wireless.

2006: Acquisition of BellSouth

In 2006, AT&T Inc. acquired BellSouth Corporation, making it the last independent Baby Bell company and consolidating ownership of Cingular Wireless.

January 2007: Rebranding of Cingular to AT&T

In January 2007, AT&T rebranded its wireless retail stores from Cingular to AT&T following its acquisition of BellSouth Corporation.

August 22, 2007: National Intelligence Director Confirms AT&T's Role

On August 22, 2007, National Intelligence Director Mike McConnell confirmed that AT&T was one of the telecommunications companies assisting with the government's warrantless wire-tapping program on calls between foreign and domestic sources.

September 2007: Legal Policy Change Regarding Service Termination

In September 2007, AT&T changed its legal policy to state that it could terminate or suspend services without notice if it believed the conduct could damage its reputation. This change led to public outcry and a subsequent revision of the policy to support freedom of expression.

October 10, 2007: AT&T Alters Terms for Internet Service

By October 10, 2007, AT&T had altered the terms and conditions for its Internet service to explicitly support freedom of expression by its subscribers. This change came after an outcry over a policy that allowed the company to terminate services that could damage its reputation.

November 8, 2007: Former Technician Reveals NSA Access

On November 8, 2007, former AT&T technician Mark Klein revealed that all Internet traffic passing over AT&T lines was copied into a locked room at the company's San Francisco office, accessible only to employees with National Security Agency clearance.

January 2008: Plans to Filter Internet Traffic Reported

In January 2008, reports emerged that AT&T planned to begin filtering all Internet traffic passing through its network for intellectual property violations. This led to speculation that the move would cause a mass exodus of subscribers and prompted discussions on network neutrality.

June 27, 2008: AT&T moves corporate headquarters to Dallas

On June 27, 2008, AT&T announced it would move its corporate headquarters from downtown San Antonio to One AT&T Plaza in downtown Dallas. The move aimed to gain better access to customers, operations, key technology partners, suppliers, and human resources.

June 3, 2009: Class Action Lawsuit Dismissed

On June 3, 2009, the Ninth Circuit dismissed the class action lawsuit Hepting v. AT&T, citing retroactive legislation in the Foreign Intelligence Surveillance Act. The case had previously been rejected for dismissal by the Northern District of California in July 2006.

2009: Accusations of Discrimination Against PEG Channels

In 2009, AT&T was accused by community media groups of discriminating against local public, educational, and government access (PEG) cable TV channels by imposing conditions that severely restricted their audience.

June 2010: Goatse Security Exposes AT&T Vulnerability

In June 2010, Goatse Security found a flaw in AT&T's system that allowed the extraction of email addresses of AT&T 3G service customers for the Apple iPad without the need for a password. The group collected thousands of emails and disclosed around 114,000 of them to Gawker Media, which published an article about the security issue. The web application exploited was criticized for being poorly designed.

2010: Verizon sells West Virginia operations to Frontier Communications

Verizon sold its West Virginia operations to Frontier Communications in 2010.

2011: AT&T Withdraws T-Mobile Bid

In 2011, AT&T withdrew its $39 billion bid to purchase T-Mobile due to significant regulatory and legal challenges, resulting in T-Mobile receiving $3 billion in cash and access to $1 billion worth of AT&T-held wireless spectrum.

March 2012: U.S. Government Sues AT&T Over False Claims Act Violation

In March 2012, the U.S. federal government sued AT&T for violating the False Claims Act by facilitating fraudulent IP Relay calls from international callers and improperly billing the TRS Fund for these calls.

September 2013: AT&T Expands into Latin America

In September 2013, AT&T announced its expansion into Latin America through a collaboration with América Móvil.

December 2013: AT&T Sells Connecticut Wireline Operations

In December 2013, AT&T announced plans to sell its Connecticut wireline operations to Stamford-based Frontier Communications.

2013: AT&T Settles False Claims Act Violation

In 2013, AT&T entered into a consent decree with the FCC and paid $21.75 million to settle allegations of violating the False Claims Act by facilitating fraudulent IP Relay calls from international callers.

2013: Executives Aware of Aaron Slator's Text Messages

In 2013, AT&T executives were aware of Aaron Slator's racist text messages but had assured him he would not be fired for them.

2013: Support for FCC Process Reform Act

In 2013, AT&T supported the Federal Communications Commission Process Reform Act of 2013 (H.R. 3675; 113th Congress). This bill aimed to increase transparency in the FCC's rulemaking processes and required the agency to accept public input about regulations. AT&T believed this would help modernize regulatory practices.

October 25, 2014: Frontier Communications takes over AT&T landline network in Connecticut

On October 25, 2014, Frontier Communications took over control of the AT&T landline network in Connecticut after being approved by state utility regulators. The deal was worth about $2 billion and included Frontier inheriting about 2,500 of AT&T's employees and many of AT&T's buildings.

November 7, 2014: AT&T announces acquisition of Mexican carrier Iusacell

On November 7, 2014, it was announced that Mexican carrier Iusacell would be acquired by AT&T. The acquisition was approved in January 2015.

2014: AT&T Plans Acquisition of DirecTV

In 2014, AT&T was in the process of organizing a $48.5 billion acquisition of DirecTV, with Aaron Slator being one of the key figures involved in the deal.

2014: AT&T Purchases Iusacell and NII Holdings

In late 2014, AT&T purchased Mexican cellular carrier Iusacell, and two months later, it acquired the Mexican wireless business of NII Holdings, merging the two to create AT&T Mexico.

January 2015: Approval of Iusacell acquisition by AT&T

The acquisition of Mexican carrier Iusacell by AT&T, announced on November 7, 2014, was approved in January 2015.

April 2015: AT&T Fined $25 Million Over Data Breaches

In April 2015, AT&T received a $25 million fine from the Federal Communications Commission (FCC) for data security breaches. An investigation revealed that call centers in Mexico, Colombia, and the Philippines had leaked details of approximately 280,000 people.

April 28, 2015: AT&T Fires President Over Racist Text Messages

On April 28, 2015, AT&T fired Aaron Slator, President of Content and Advertising Sales, for sending racist text messages. This action followed a $100 million defamation lawsuit filed by an African-American employee and protests against AT&T's alleged systemic racial policies.

April 30, 2015: AT&T acquires wireless operations Nextel Mexico

On April 30, 2015, AT&T acquired wireless operations Nextel Mexico from NII Holdings, now AT&T Mexico.

July 2015: AT&T Purchases DirecTV

In July 2015, AT&T purchased DirecTV for $48.5 billion and announced plans to merge its U-verse home internet and IPTV brands with DirecTV to create AT&T Entertainment.

2015: Base Year for Emissions Reduction

AT&T's emissions reduction plan, aiming for a 63% decrease by 2030, uses 2015 as the base year for its targets. This effort is part of the company's commitment to align with the Paris Agreement.

2015: Removed from Dow Jones Industrial Average

In 2015, AT&T was removed from the Dow Jones Industrial Average, marking the end of its 16-year inclusion in the index.

October 22, 2016: AT&T Announces Time Warner Acquisition

On October 22, 2016, AT&T announced a deal to acquire Time Warner for $108.7 billion to increase its media holdings.

2016: AT&T Acquires Time Warner

In 2016, AT&T announced its acquisition of Time Warner, aiming to expand its media holdings significantly.

2016: AT&T Executives Allegedly Leak Information

In 2016, AT&T executives allegedly began leaking key information to Wall Street analysts to manipulate revenue forecasts, violating the Fair Disclosure Rule.

January 24, 2017: Aaron Slator Sues AT&T for Defamation and Wrongful Termination

On January 24, 2017, Aaron Slator sued AT&T in the Los Angeles Superior Court, accusing the company of defamation and wrongful termination. He claimed he was fired as a scapegoat to protect AT&T's planned acquisition of DirecTV.

July 13, 2017: AT&T to introduce cloud-based DVR streaming service

On July 13, 2017, it was reported that AT&T would introduce a cloud-based DVR streaming service. The company aimed to create a unified platform across DirecTV and its DirecTV Now streaming service, with U-verse to be added shortly afterward.

September 12, 2017: AT&T plans new cable TV-like service

On September 12, 2017, it was reported that AT&T planned to launch a new cable TV-like service for delivery over-the-top over its own or a competitor's broadband network sometime the following year.

November 20, 2017: DOJ Files Lawsuit to Block Time Warner Merger

On November 20, 2017, the U.S. Department of Justice Antitrust Division filed a lawsuit to block AT&T's merger with Time Warner, citing potential harm to competition and higher consumer bills.

December 2017: AT&T Provides Information to Special Counsel

In December 2017, AT&T provided information requested by the Special Counsel investigation led by Robert Mueller regarding payments made to Essential Consultants. These payments were for guidance on the Time Warner merger, tax reforms, and net neutrality policies.

March 7, 2018: AT&T prepares to sell minority stake of DirecTV Latin America

On March 7, 2018, AT&T prepared to sell a minority stake of DirecTV Latin America through an IPO, creating a new holding company for those assets named Vrio Corp. However, the IPO was canceled on April 18, 2018, due to market conditions.

May 2018: Reports on Payments to Essential Consultants

In May 2018, reports emerged that AT&T made 12 monthly payments totaling $600,000 to Essential Consultants, a company set up by President Donald Trump's lawyer Michael Cohen. The payments were made for guidance on the attempted $85 billion merger with Time Warner, tax reforms, and net neutrality policies. AT&T confirmed the reports and stated they had provided information to the Special Counsel investigation led by Robert Mueller.

June 12, 2018: AT&T-Time Warner Merger Approval

On June 12, 2018, U.S. District Court Judge Richard J. Leon approved AT&T's merger with Time Warner, enabling AT&T to become the largest and controlling shareholder of Time Warner, which was subsequently rebranded as WarnerMedia.

September 2019: Elliott Management invests in AT&T

In September 2019, activist investor Elliott Management revealed it had purchased $3.2 billion of AT&T stock, a 1.2% equity interest, and pushed for the company to divest assets to improve its share value.

2019: AT&T becomes world's largest telecommunications company

As of 2019, AT&T is the world's largest telecommunications company. It is also the largest provider of mobile telephone services and the largest provider of fixed telephone (landline) services in the United States.

2019: Culmination of Lobbying Efforts

By 2019, AT&T had expended a total of US$380.1 million on lobbying in the United States over a span of two decades. The company focused on various federal bills and regulations, aiming to influence policies on broadband internet access and other telecommunications issues.

2019: AT&T's contributions to US political campaigns

From 1989 to 2019, AT&T contributed more than $84.1 million to US federal political campaigns and committees, with 42% going to Republicans and 58% to Democrats.

2019: Democratic House Judiciary Requests Merger Records

In 2019, the Democratic House Judiciary requested records related to the AT&T-Time Warner merger from the White House. This request was part of broader scrutiny over the merger and its implications for competition in the media and telecommunications industries.

March 4, 2020: AT&T announces major cost-cutting moves

On March 4, 2020, AT&T announced its intent to perform major cost-cutting moves, including cuts to capital investment and plans to promote AT&T TV, which officially launched nationally on March 2, 2020, as its primary pay television service offering.

April 24, 2020: John Stankey to replace Randall L. Stephenson as CEO of AT&T

On April 24, 2020, AT&T announced that effective July 1, 2020, company COO John Stankey would replace Randall L. Stephenson as CEO of AT&T. It was acknowledged that AT&T's acquisitions of DirecTV and Time Warner had resulted in a $200 billion debt burden for the company by this point.

May 2020: Launch of HBO Max

HBO Max, a cloud-based DVR streaming service by AT&T, launched in May 2020. The service aimed to unify platforms across DirecTV and DirecTV Now, with U-verse to be added shortly afterward.

July 1, 2020: John Stankey becomes CEO of AT&T

Effective July 1, 2020, John Stankey replaced Randall L. Stephenson as CEO of AT&T, a move announced on April 24, 2020.

December 2020: Crunchyroll sold to Sony's Funimation

Crunchyroll was sold to Sony's Funimation for $1.175 billion in December 2020, with the acquisition closing in August 2021.

December 2020: AT&T Reports CO2e Emissions

In December 2020, AT&T reported its total CO2e emissions for the year ending December 31, 2020, at 5,788 Kt, a reduction of 737 Kt or 11.3% year-over-year. The company also announced plans to reduce emissions by 63% by 2030 from a 2015 base year, in alignment with the Paris Agreement.

2020: AT&T Settles Lawsuit with Government Entities

In 2020, AT&T paid $48 million to settle a lawsuit with 30 government entities under the California False Claims Act. The suit was related to AT&T's contractual obligations to provide services at the lowest cost available. AT&T denied any wrongdoing.

2020: OAN Revenue Primarily from AT&T

In 2020, sworn testimony by an OAN accountant indicated that 90% of OAN's revenue came from AT&T. Court documents showed that OAN promised to cast a positive light on AT&T during newscasts.

February 25, 2021: AT&T to spin-off DirecTV, U-Verse TV, and DirecTV Stream

On February 25, 2021, AT&T announced it would spin-off DirecTV, U-Verse TV, and DirecTV Stream into a separate entity, selling a 30% stake to TPG Capital while retaining a 70% stake in the new standalone company. The deal was closed on August 2, 2021.

March 2021: SEC Sues AT&T for Selective Disclosures

In March 2021, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against AT&T and three of its executives for violating the Fair Disclosure Rule. The SEC alleged that starting in 2016, these executives leaked key information to Wall Street analysts to manipulate revenue forecasts.

May 17, 2021: AT&T plans to merge WarnerMedia with Discovery, Inc.

On May 17, 2021, AT&T announced plans to relinquish its equity interest in WarnerMedia and have it merge with Discovery, Inc. in a $43 billion deal to establish a new media company.

June 2021: Electronic Arts purchases Playdemic from WBIE

Electronic Arts, a bidder in the proposed sale of Warner Bros Interactive Entertainment, purchased the mobile gaming studio Playdemic from WBIE for $1.4 billion in June 2021.

August 2, 2021: Deal closed for AT&T's spin-off of DirecTV, U-Verse TV, and DirecTV Stream

The deal to spin-off DirecTV, U-Verse TV, and DirecTV Stream into a separate entity was closed on August 2, 2021, with AT&T retaining a 70% stake and selling a 30% stake to TPG Capital.

August 2021: Closing of Crunchyroll acquisition by Sony's Funimation

The acquisition of Crunchyroll by Sony's Funimation, announced in December 2020, closed in August 2021 for $1.175 billion.

September 2021: Fox Corporation acquires TMZ from WarnerMedia

In September 2021, Fox Corporation acquired TMZ from WarnerMedia in a deal worth about $50 million, with TMZ being operated under the Fox Entertainment division.

December 21, 2021: AT&T to sell Xandr to Microsoft

On December 21, 2021, AT&T announced that it had agreed to sell Xandr (and AppNexus) to Microsoft for an undisclosed price. The deal was completed in June 2022.

2021: AT&T Data Leak

In 2021, AT&T experienced a significant data leak affecting over 7.6 million current users and 65 million former users. Sensitive information including full names, email addresses, and social security numbers was compromised.

2021: AT&T Involved in Funding OAN

In 2021, a Reuters report revealed AT&T's significant role in funding One America News Network (OAN), a far-right TV network known for promoting conspiracy theories. OAN's founder claimed AT&T wanted to create a conservative network to compete with Fox News. AT&T denied these allegations.

April 8, 2022: Completion of WarnerMedia spin-off and merger with Discovery, Inc.

On April 8, 2022, the spin-off of WarnerMedia and its subsequent merger with Discovery, Inc. to form Warner Bros. Discovery was completed. As a result of this merger, HBO Max and other video services were dropped from AT&T's unlimited plan offering.

June 2022: Completion of Xandr sale to Microsoft

The sale of Xandr and AppNexus by AT&T to Microsoft, announced on December 21, 2021, was completed in June 2022.

December 2022: AT&T Agrees to Pay Fines to Settle SEC Lawsuit

In December 2022, AT&T agreed to pay $6.25 million in fines to settle a lawsuit with the SEC without acknowledging guilt. The individual executives involved were fined $25,000 each.

2022: AT&T Withdraws from WarnerMedia

In 2022, AT&T withdrew its equity stake in WarnerMedia, merging it with Discovery, Inc. to create Warner Bros. Discovery and divesting itself of its media arm.

2023: AT&T ranks 13th on Fortune 500

In 2023, AT&T was ranked 13th on the Fortune 500 list, highlighting its status as one of the largest corporations in the United States with revenues of $120.7 billion.

February 22, 2024: AT&T Cellular Service Disruption

On February 22, 2024, a cellular service disruption affected millions of AT&T users in the United States, making it impossible for some to call emergency services. The FBI and Department of Homeland Security investigated the outage, which AT&T later attributed to a poorly timed server update. Users were compensated for the disruption.

March 2024: AT&T Confirms 2021 Data Leak

In March 2024, AT&T confirmed a 2021 leak of contact information for over 7.6 million current users and 65 million former users. The leaked data included sensitive information such as full names, email addresses, and social security numbers, leading to multiple class-action lawsuits.

2030: Future Emissions Reduction Target

AT&T plans to reduce its CO2e emissions by 63% by 2030 from a 2015 base year. This target is aligned with the Paris Agreement to limit global warming to 1.5°C above pre-industrial levels.

Mentioned in this timeline

Donald John Trump is an American politician media personality and...

Home Box Office HBO is an American pay television service...

Fox News Channel FNC is a conservative American news and...

George W Bush the rd U S President - is...

The White House located at Pennsylvania Avenue NW in Washington...

Frontier Communications is an American telecommunications company providing broadband internet...

Trending

3 months ago RBA Holds Rates Steady Amid Inflation Concerns and Economic Uncertainty: A Detailed Analysis

3 months ago Quentin Tarantino's 'Kill Bill: The Whole Bloody Affair' Arrives in Theaters!

2 months ago JoJo Siwa Hospitalized with Excruciating Pain Before Performance: Shares Health Update

7 months ago Margaret Qualley & Patrick Schwarzenegger Star in Amazon's Heartbreaking Romance, 'Love Of Your Life'

3 months ago ACA Subsidies Expiration Fuels Premium Fears Amid Government Shutdown, Impacting Covered California

10 months ago Will Arnett sells Beverly Hills mansion for $20.2 million to Paris Hilton's relative.

Popular

Thomas Douglas Homan is an American law enforcement officer who...

William Franklin Graham III commonly known as Franklin Graham is...

Jupiter is the fifth and largest planet from the Sun...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...

Kristi Noem is an American politician who has served as...

Instagram is a photo and video-sharing social networking service owned...