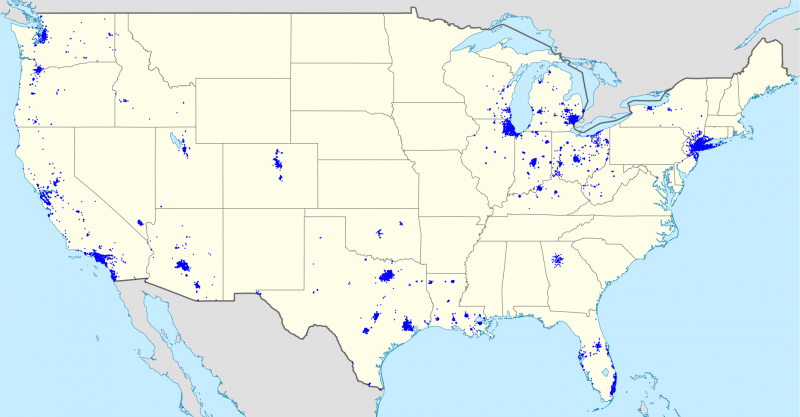

Capital One is a major American bank holding company established in 1994, headquartered in McLean, Virginia. It primarily operates in the United States, and is the ninth-largest bank in the US based on assets. The company specializes in a variety of financial products and services, including credit cards, auto loans, banking, and savings accounts. Capital One holds significant market share as the third-largest issuer of Visa and Mastercard credit cards and is one of the leading auto finance companies in the country.

1987: Customized Credit Card Offers Idea

In 1987, Richard Fairbank and Nigel Morris developed the innovative idea of using information technology and statistical analysis to create customized credit card offers, tailoring terms to individual customer risk profiles.

1988: Signet Bank Collaboration

In 1988, Richard Fairbank and Nigel Morris convinced Signet Bank to establish a credit card division named Signet Financial, where they became employees to implement their innovative approach to credit card offerings.

1991: Successful Mass Mailing Campaign

In 1991, Fairbank and Morris achieved a significant success with a mass mailing campaign that offered balance transfers from other banks' credit cards to Signet's cards at a lower interest rate, significantly boosting Signet's customer base.

1991: Telephone Consumer Protection Act Enacted

The Telephone Consumer Protection Act was enacted in 1991.

July 21, 1994: Capital One Founded

On July 21, 1994, Capital One Financial Corporation, an American bank holding company specializing in credit cards, auto loans, banking, and savings accounts, was founded.

October 1994: Capital One Renamed

In October 1994, OakStone Financial was renamed Capital One after its initial public offering.

February 1995: Spin-off Completion

In February 1995, the spin-off of Signet Financial, initially named OakStone Financial and later renamed Capital One, was officially completed.

1996: International Expansion to the UK and Canada

In 1996, Capital One expanded its business operations internationally to the United Kingdom and Canada, providing access to a larger market for its credit cards.

1996: New Customer Acquisition Techniques

In 1996, Capital One shifted from using teaser rates to more innovative techniques to attract customers, introducing co-branded, secured, and joint account credit cards, and gaining approval to establish Capital One FSB, enabling deposit retention and auto loan issuance.

1997: Growth and Credit Card Receivables

In 1997, Capital One held $12.6 billion in credit card receivables and served more than nine million customers, according to Chief Executive.

July 1998: Acquisition of Summit Acceptance Corporation

In July 1998, Capital One acquired Summit Acceptance Corporation, an auto financing company, marking its expansion into the auto finance sector.

1998: S&P 500 Listing and Stock Price Milestone

In 1998, Capital One was listed in the Standard & Poor's 500, and its stock price reached $100 for the first time, indicating significant growth and recognition.

1999: Expansion Beyond Credit Cards

In 1999, Capital One's CEO Richard Fairbank announced plans to expand beyond credit cards, aiming to leverage consumer data collection expertise to offer loans, insurance, and phone service.

October 2001: Acquisition of PeopleFirst Finance LLC

In October 2001, Capital One acquired PeopleFirst Finance LLC, which was later combined and rebranded as Capital One Auto Finance Corporation in 2003.

2001: Capital One Becomes Principal Sponsor of Florida Citrus Bowl

From 2001, Capital One became the principal sponsor of the college football Florida Citrus Bowl.

2002: Negotiated Services Agreement with USPS Proposed

In 2002, Capital One and the United States Postal Service proposed a negotiated services agreement (NSA) for bulk mailing discounts.

2003: Capital One Sponsors Nottingham Forest

From 2003 to 2009, Capital One sponsored English soccer club Nottingham Forest.

2003: Rebranding as Capital One Auto Finance Corporation

In 2003, PeopleFirst Finance LLC, previously acquired by Capital One, was rebranded as Capital One Auto Finance Corporation.

2003: Florida Citrus Bowl Renamed Capital One Bowl

In 2003, the Florida Citrus Bowl was renamed the Capital One Bowl, as part of Capital One's sponsorship.

January 2005: Acquisition of Onyx Acceptance Corporation

In January 2005, Capital One acquired Onyx Acceptance Corporation, an automobile loan financer, further expanding its presence in the auto finance industry.

2005: Acquisition of Hibernia National Bank

In 2005, Capital One became the first monoline credit card issuer to buy a bank, acquiring Hibernia National Bank based in New Orleans, Louisiana, for $4.9 billion in cash and stock, marking its entry into retail banking.

December 2006: Acquisition of GreenPoint Mortgage via North Fork Bancorp

In December 2006, Capital One acquired its GreenPoint Mortgage unit as part of its $13.2 billion acquisition of North Fork Bancorp Inc.

2006: Capital One Sponsors Sheffield United

From 2006 to 2008, Capital One sponsored English soccer club Sheffield United.

2006: Acquisition of North Fork Bank

In 2006, Capital One acquired Melville, New York-based North Fork Bank for $13.2 billion in cash and stock, further reducing its dependency on the credit card business.

2006: Extension of USPS Agreement

In 2006, the three-year negotiated services agreement (NSA) between Capital One and the United States Postal Service for bulk discounts in mailing services was extended.

2007: Closure of GreenPoint Mortgage

During the 2007 subprime mortgage financial crisis, Capital One closed its mortgage platform, GreenPoint Mortgage, due to investor pressures, cutting 1,900 jobs and incurring $860 million in charges.

2007: Consideration of Netspend Acquisition

In 2007, Capital One briefly considered acquiring Netspend, a marketer of prepaid debit cards, for $700 million, but the deal was ultimately not completed.

June 2008: Complaint Filed with USPS

In June 2008, Capital One filed a complaint with the USPS regarding the terms of the next agreement, citing the terms of Bank of America's NSA, but later withdrew the complaint following a settlement.

2008: Capital One Acquired Check-Cashing Businesses

Around 2008, Capital One acquired a now-defunct small portfolio of check-cashing businesses that were subsequently exited from in 2014.

2008: New "Swoosh" Logo and Marketing Campaign

In 2008, Capital One debuted their blue and red "swoosh" logo and launched a $13 billion marketing campaign.

2008: TARP Investment

In 2008, Capital One received an investment of $3.56 billion from the United States Treasury as part of the Troubled Asset Relief Program (TARP).

2008: End of Capital One Sponsorship of Sheffield United

In 2008, Capital One's sponsorship of Sheffield United ended.

February 2009: Acquisition of Chevy Chase Bank

In February 2009, Capital One acquired Chevy Chase Bank for $520 million in cash and stock, expanding its retail banking presence.

June 17, 2009: Repurchase of TARP Stock

On June 17, 2009, Capital One completed the repurchase of the stock the company issued to the U.S. Treasury under the Troubled Asset Relief Program (TARP), paying a total of $3.67 billion, resulting in a profit of over $100 million to the U.S. Treasury.

2009: End of Capital One Sponsorship of Nottingham Forest

In 2009, Capital One's sponsorship of Nottingham Forest ended.

2010: Alec Baldwin Becomes Capital One Spokesperson

In 2010, Alec Baldwin began appearing in a television campaign as the spokesperson for Capital One.

January 2011: Acquisition of Hudson's Bay Company's Credit Card Portfolio

In January 2011, Capital One acquired Canada-based Hudson's Bay Company's private credit card portfolio from Synchrony Financial (then GE Financial), expanding its credit card business in Canada.

April 2011: Deal with Kohl's for Credit Card Program

In April 2011, Capital One signed a seven-year deal with Kohl's to handle Kohl's private label credit card program, previously managed by Chase Bank.

June 2011: Capital One to Acquire ING Direct

In June 2011, ING Group announced the sale of its ING Direct division to Capital One for $9 billion in cash and stock, marking Capital One's re-emergence into the mortgage industry.

August 2011: Agreement to Acquire HSBC's U.S. Credit Card Operations

In August 2011, Capital One reached a deal with HSBC to acquire its U.S. credit card operations for $31.3 billion.

August 26, 2011: Federal Reserve to Hold Public Hearings on Capital One Acquisition of ING Direct

On August 26, 2011, the Federal Reserve Board of Governors announced it would hold public hearings on the Capital One acquisition of ING Direct. They also extended the public comment period to October 12, 2011, amidst rising scrutiny of the deal.

October 12, 2011: Extension of Public Comment Period for ING Direct Acquisition

On October 12, 2011, the Federal Reserve extended the public comment period for the Capital One acquisition of ING Direct. This extension followed rising scrutiny of the deal, focusing on systemic risk, performance under the Community Reinvestment Act, and pending legal challenges.

2011: Criticism of Capital One's Philanthropic Giving

In 2011, the National Committee for Responsive Philanthropy criticized Capital One's charitable giving, noting it was significantly lower than the industry median.

February 2012: Support for Isis Mobile Wallet

In February 2012, Capital One announced support for the Isis Mobile Wallet payment system, along with several other banks.

February 2012: Regulators Approve Capital One Acquisition of ING Direct

In February 2012, regulators approved Capital One's acquisition of ING Direct, paving the way for the completion of the deal.

May 2012: Completion of HSBC Acquisition

In May 2012, Capital One completed the acquisition of HSBC's U.S. credit card operations, including private issued credit cards for companies such as Saks Fifth Avenue, Neiman Marcus, and Lord & Taylor, for $31.3 billion.

July 2012: Capital One Fined for Misleading Customers

In July 2012, Capital One was fined by the Office of the Comptroller of the Currency and the Consumer Financial Protection Bureau for misleading millions of customers, requiring extra payment for payment protection or credit monitoring. The company agreed to pay $210 million to settle the legal action.

October 2012: Capital One Receives Permission to Merge ING into its Business

In October 2012, Capital One received permission to merge ING into its business, furthering the integration of the acquired entity.

November 2012: ING Direct Rebranded as Capital One 360

In November 2012, Capital One rebranded ING Direct as Capital One 360, marking the final step in the integration process.

2012: Capital One Sponsors EFL Cup

From 2012 to 2016, Capital One sponsored the EFL Cup, an English soccer knockout tournament.

2012: Closure of Branch Locations

In 2012, Capital One closed 41 branch locations as part of a strategic adjustment.

2012: DragonForce Featured in Capital One Advertisement

In 2012, Capital One released an advert featuring British power metal band DragonForce playing guitar while using Capital One's mobile app.

2012: Consumer Class Action Lawsuit Filed Against Capital One in Virginia related to its acquisition of ING Direct USA

Two consumer class action lawsuits filed against Capital One in Virginia were reported in July 2024. A suit related to its acquisition of ING Direct USA, in 2012.

February 2013: Lawsuit Claiming Unfair Maintenance of 360 Savings Online Savings Account

In July 2024, two consumer class action lawsuits filed against Capital One in Virginia were reported. A suit related to its acquisition of ING Direct USA, in 2012, claimed that, since February 2013, the company unfairly maintained 360 Savings online savings account as a higher yield rate than was available to its other depositors.

September 2013: Dropped Support for Isis Mobile Wallet

In September 2013, Capital One dropped its support for the Isis Mobile Wallet payment system.

October 2013: Prior Express Written Consent Requirements for Telemarketing Calls

Since October 2013, prior express written consent requirements have been in place for telemarketing calls.

2013: Alec Baldwin's Contract with Capital One Not Renewed

Following a 2013 confrontation with a videographer, Alec Baldwin's contract with Capital One was not renewed, and he was replaced by Jennifer Garner in the campaign.

2013: Settlement with SEC

In 2013, Capital One paid $3.5 million to settle a case with the U.S. Securities and Exchange Commission regarding conduct during the 2007-2008 financial crisis, without admitting wrongdoing.

February 2014: Investment in ClearXchange

In February 2014, Capital One acquired a 25% ownership stake in ClearXchange, a peer-to-peer money transfer service.

May 2014: Extension of Kohl's Contract

In May 2014, Capital One extended its contract with Kohl's to continue handling Kohl's private label credit card program, initially signed in April 2011.

August 2014: Capital One Pays $75.5 Million to Settle TCPA Lawsuit

In August 2014, Capital One and three collection agencies agreed to pay $75.5 million to settle a class action lawsuit alleging violations of the Telephone Consumer Protection Act of 1991 for unauthorized calls to cellphones.

October 2014: Acquisition of Adaptive Path

In October 2014, Capital One acquired Adaptive Path, a San Francisco-based user experience and digital design consultancy, enhancing its capabilities in these areas.

2014: Capital One Exited Check-Cashing Businesses

Capital One exited from a portfolio of check-cashing businesses in 2014.

2014: Terms of Use Amended

In 2014, Capital One amended its terms of use to allow it to contact customers in any manner, including personal visits and modifying caller ID, although the company stated personal visits would only occur as a last resort for vehicle repossession.

2014: End of Capital One's Sponsorship of Capital One Bowl

In 2014, Capital One's sponsorship of the Capital One Bowl ended. From 2003 to 2014 it was called the Capital One Bowl.

January 2015: Acquisition of Level Money

In January 2015, Capital One acquired Level Money, a budgeting app for consumers, expanding its offerings in the financial management tools space.

July 2015: Acquisition of Monsoon

In July 2015, Capital One acquired Monsoon, a design studio, development shop, marketing house, and strategic consultancy, further strengthening its design and marketing capabilities.

2015: Acquisition of GE's Healthcare Financial Services Unit

In 2015, Capital One acquired General Electric's Healthcare Financial Services unit, which included $8.5 billion in loans made to businesses in the healthcare industry, for $9 billion.

2015: Branch Closures in D.C. Metro Area

In 2015, Capital One closed several branch locations in the D.C. metro area, resulting in 174 operating branches in the region.

2015: Capital One Under Federal Investigation

In 2015, Capital One disclosed that it was under federal investigation for bank fraud, money laundering, and possible racketeering charges.

2015: Name of Bowl Game Changed to Buffalo Wild Wings Citrus Bowl

In 2015, the name of the Capital One Bowl game was changed to the Buffalo Wild Wings Citrus Bowl.

2015: Capital One Becomes Title Sponsor of the Orange Bowl

Since 2015, Capital One is the title sponsor of the Orange Bowl.

October 2016: Acquisition of Paribus

In October 2016, Capital One acquired Paribus, a price tracking service, for an undisclosed amount, adding to its portfolio of consumer-focused technology services.

2016: End of Capital One Sponsorship of EFL Cup

Capital One's sponsorship of the EFL Cup, an English soccer knockout tournament, ended in 2016.

2016: Sale of ClearXchange

In 2016, ClearXchange, in which Capital One held a 25% ownership, was sold to Early Warning.

November 7, 2017: Capital One Exits Mortgage Origination Business

On November 7, 2017, Capital One exited the mortgage origination business, resulting in the layoff of 1,100 employees.

November 2017: Mortgage Market Too Competitive for Capital One

In November 2017, Sanjiv Yajnik, President of Financial Services, announced that the mortgage market was too competitive for Capital One to make money in the business, leading to their exit from mortgage origination.

2017: Capital One Becomes Sponsor of Capital One Arena

In 2017, Capital One became the sponsor of the Capital One Arena in Washington D.C.

May 2018: Capital One Acquires Confyrm

In May 2018, Capital One acquired Confyrm, a digital identity and fraud alert service.

November 2018: Capital One Acquires Wikibuy

In November 2018, Capital One acquired Wikibuy, a shopping comparison app and browser extension. Wikibuy continues to operate the service which is now named Capital One Shopping.

2018: Capital One Temporarily Changes Logo for Capitals' Stanley Cup Appearance

In 2018, Capital One temporarily altered its logo to celebrate the Washington Capitals' Stanley Cup Finals appearance.

2018: Capital One Fined for Failure to Monitor Money Laundering

In 2018, Capital One was fined $100 million for failure to monitor, detect, and prevent money laundering.

July 2019: Contradictory Statements Regarding Capital One Data Breach

In July 2019, Capital One issued a press statement regarding the data breach which was mocked for containing contradictory statements about the compromise of bank account and Social Security numbers.

July 2019: Deal with Walmart for Credit Card Programs

In July 2019, Capital One signed a deal with Walmart to handle Walmart's private label and co-branded credit card programs, previously serviced by Synchrony Financial.

July 17, 2019: Capital One Alerted to Data Breach

On July 17, 2019, Capital One was alerted to the data breach that would later be publicly acknowledged. Several customers reported that they first learned of the breach through the media.

July 29, 2019: Capital One Announces Data Breach

On July 29, 2019, Capital One publicly acknowledged a data breach that had occurred ten days earlier, compromising the data of 106 million people in the United States and Canada. The breach involved personal information like Social Security numbers and bank account numbers.

August 6, 2020: Federal Reserve Issues Cease and Desist Order Against Capital One

On August 6, 2020, the Federal Reserve Board of Governors announced a cease and desist order against Capital One because of the data breach. The order mandated improvements in governance, risk management, and compliance practices.

January 2021: Capital One Fined by FINCEN for Anti-Money Laundering Control Failure

In January 2021, Capital One was fined $390 million by FINCEN for anti-money laundering control failure concerning a now-defunct small portfolio of check-cashing businesses.

November 2021: Introduction of Venture X Credit Card

In November 2021, Capital One introduced Venture X, a travel rewards credit card with a $395 annual fee, expanding its credit card product line.

March 2022: Capital One Partners with Vivid Seats Inc. to Launch Capital One Entertainment

In March 2022, Capital One announced a partnership with Vivid Seats Inc. to launch Capital One Entertainment, a rewards program for cardholders.

March 2022: Capital One Becomes Official Bank and Credit Card Sponsor of World Series

In March 2022, Major League Baseball announced Capital One as the official bank and credit card and presenting sponsor of the World Series.

2022: Naming Rights Deal for Capital One Field at Maryland Stadium Ends

From 2009 to 2022, the University of Maryland Terrapins football team played at Capital One Field at Maryland Stadium. The naming-rights deal ended in 2022.

2022: Paige Thompson Convicted and Sentenced in Capital One Data Breach Case

In 2022, Paige Thompson was convicted of five felonies and two misdemeanors related to the Capital One data breach. She was sentenced to time served and five years of probation.

2022: Capital One Venture X Sponsors Rose Bowl Game

Since 2022, Capital One Venture X is the presenting sponsor of the Rose Bowl Game.

December 31, 2022: Loan Portfolio Size

As of December 31, 2022, Capital One's loan portfolio included $114 billion in credit card loans, $75 billion in auto loans, and $85 billion in commercial loans.

2023: Federal Reserve Ends Enforcement Action Against Capital One

In 2023, the Federal Reserve ended the enforcement action against Capital One related to the 2020 cease and desist order, which was issued following the data breach.

February 2024: Capital One to Acquire Discover Financial

In February 2024, Capital One announced an agreement to acquire Discover Financial in an all-stock deal valued at $35.3 billion. The deal is subject to regulatory approval.

April 2024: Walmart Terminates Deal

In April 2024, Walmart terminated its deal with Capital One due to customer service failures by Capital One, ending the agreement for Capital One to handle Walmart's private label and co-branded credit card programs.

July 2024: Consumer Class Action Lawsuit Filed Against Capital One

In July 2024, a proposed consumer class action lawsuit was filed in Virginia, claiming that the company's takeover of Discover would violate federal antitrust laws.

September 30, 2024: Capital One Ninth Largest Bank

As of September 30, 2024, Capital One is the ninth largest bank in the United States by total assets, a leading issuer of Visa and Mastercard credit cards, and a major car finance company.

January 2025: CFPB Sues Capital One

In January 2025, the Consumer Financial Protection Bureau sued Capital One for cheating savings account holders out of $2 billion.

February 2025: CFPB Drops Lawsuit Against Capital One

In February 2025, the CFPB dropped its lawsuit against Capital One.

Mentioned in this timeline

Chase Bank is the consumer and commercial banking arm of...

Bank of America is a multinational investment bank and financial...

Walmart Inc is a multinational retail corporation operating hypermarkets discount...

College football is a popular amateur sport in the United...

JPMorgan Chase Co incorporated in Delaware and headquartered in New...

San Francisco is the fourth-most populous city in California and...

Trending

41 minutes ago Harvey Weinstein Interview, Paltrow Claims, and Rikers Inmate Fight Revealed.

41 minutes ago Kalif Raymond signs one-year deal with Chicago Bears, filling need as returner.

41 minutes ago Shooting at US Consulate in Toronto: Suspect vehicle image released by police.

41 minutes ago Brad Marchand Possibly Out for Season: Panthers Consider Shutting Down Star Player

2 hours ago Dawson Knox secures future with Bills, signing a 3-year contract extension.

2 hours ago Sheryl Underwood Guest Hosts 'The View', Revives Radio Show: A Career Milestone

Popular

Jesse Jackson is an American civil rights activist politician and...

Markwayne Mullin is an American politician and businessman serving as...

Ken Paxton is an American politician and lawyer serving as...

Corey Lewandowski is an American political operative lobbyist commentator and...

Kristi Lynn Arnold Noem is an American politician She was...

Hillary Diane Rodham Clinton is a prominent American politician lawyer...