Paul Tudor Jones II is an American billionaire hedge fund manager, conservationist, and philanthropist. He founded Tudor Investment Corporation, a prominent asset management firm, in 1980. Eight years later, he established the Robin Hood Foundation, dedicated to poverty reduction. As of July 2024, his estimated net worth stands at $8.1 billion. He is known for his success in finance and his philanthropic endeavors.

1929: Market precedent

In 1987, Peter Borish, second-in-command to Jones at Tudor Investment Corporation, anticipated the crash by mapping the 1987 market against the market preceding the 1929 crash.

1934: Securities Exchange Act

In 1994, Tudor paid a fine of $800,000 to the SEC to settle allegations of violating the uptick rule, part of the Securities Exchange Act of 1934.

September 28, 1954: Paul Tudor Jones II Born

On September 28, 1954, Paul Tudor Jones II, the future billionaire hedge fund manager, conservationist, and philanthropist, was born.

1976: Earned Bachelor's Degree

In 1976, Paul Tudor Jones earned a bachelor's degree in economics from the University of Virginia.

1976: Began Trading Career

In 1976, after graduating from the University of Virginia, Paul Tudor Jones began his trading career after being introduced to trading by his cousin, eventually being hired and mentored by commodity broker Eli Tullis to trade cotton futures at the New York Cotton Exchange.

1980: Founded Tudor Investment Corporation

In 1980, Paul Tudor Jones founded Tudor Investment Corporation, an asset management firm located in Stamford, Connecticut.

1986: Served as Treasurer of the New York Cotton Exchange

In 1986, Paul Tudor Jones served as treasurer of the New York Cotton Exchange.

1986: Adopted a sixth grade class

In 1986, after watching an episode of CBS News' 60 Minutes, Paul Tudor Jones adopted a sixth grade class in Bedford–Stuyvesant, Brooklyn, guaranteeing college scholarships to students that graduated from high school.

November 1987: PBS documentary 'Trader'

In November 1987, PBS produced a documentary entitled 'Trader' which focused on Paul Tudor Jones's activities. The film shows Jones as a young man predicting the 1987 crash.

1987: Predicted Black Monday

In 1987, Paul Tudor Jones predicted Black Monday, tripling his money due to large short positions.

1987: Developing a reputation for courting models and partying

In 1987, Paul Tudor Jones was reported to be developing a reputation for courting models and partying, and was referred to as Quotron Man in a Wall Street Journal article.

1987: Earned $100 Million

In 1987, Paul Tudor Jones' Tudor firm returned 125.9 percent after fees, earning an estimated $100 million.

1987: Anticipated the crash of 1987

In 1987, Peter Borish, second-in-command to Jones at Tudor Investment Corporation, anticipated the crash by mapping the 1987 market against the market preceding the 1929 crash.

1988: Married Sonia Klein

In 1988, Paul Tudor Jones married Australian-born Sonia Klein, a New York–based yoga entrepreneur, at a wedding in Memphis.

1988: Front-page story

In 1988, at the age of 33, "The Wall Street Journal dedicated a front-page story to Paul Tudor Jones, calling him “the most-watched, most-talked-about man on Wall Street.”

1990: Pleaded Guilty to Destroying Wetlands

In 1990, Paul Tudor Jones pleaded guilty to illegally destroying 86 acres of protected wetlands on his Maryland Eastern Shore hunting estate, resulting in a $1 million fine and $1 million in restitution.

1990: Returned 87.4 percent through shorting the market

In 1990, as the Japanese equities bubble was bursting, Jones returned 87.4 percent through shorting the market.

1991: Closed Tudor Select Fund

In 1991, Jones closed the Tudor Select Fund, a futures fund, and returned investor capital.

August 1992: Chairman of the New York Cotton Exchange

In August 1992, Paul Tudor Jones became the chairman of the New York Cotton Exchange.

1993: Co-founded the Everglades Foundation

In 1993, Paul Tudor Jones co-founded the Everglades Foundation, an organization that advocates for conservation of the Everglades.

1994: SEC Settlement

In 1994, Tudor paid a fine of $800,000 to the SEC to settle allegations of violating the uptick rule (part of the Securities Exchange Act of 1934).

June 1995: End of term as Chairman

In June 1995, Paul Tudor Jones finished his term as chairman of the New York Cotton Exchange.

1997: Maintained Low Profile

In 1997, Paul Tudor Jones maintained a low profile within financial media circles, minimizing interviews with financial reporters. However, he made appearances on Larry King Live to promote his Save Our Everglades campaign and the Robin Hood Foundation.

2000: Regretted not venturing in technology firms

In a 2000 interview, Paul Tudor Jones suggested that he regretted not being more involved with venture investing in technology firms during the 1990s.

2002: Leased Grumeti reserve

In 2002, Paul Tudor Jones leased the Grumeti reserve in Tanzania's western Serengeti.

2004: Founded Excellence Charter School

In 2004, Paul Tudor Jones founded the Excellence Charter School, the country's first all-boys charter school, located in the Bedford–Stuyvesant neighborhood of Brooklyn, New York.

2006: Described as an American conservationist

In 2006, the New York Times described Paul Tudor Jones as an American conservationist, reporting on his leasing of the Grumeti reserve in Tanzania's western Serengeti in 2002.

2008: Hosted Fundraiser for Barack Obama

During the 2008 presidential election, Paul Tudor Jones hosted a 500-person fundraiser at his Greenwich home for then-candidate Barack Obama.

2008: Inducted into Hedge Fund Manager Hall of Fame

In 2008, Paul Tudor Jones was inducted into Institutional Investors Alpha's Hedge Fund Manager Hall of Fame along with other notable figures.

2009: Delivered commencement speech

In 2009, Paul Tudor Jones delivered a commencement speech at the Buckley School about his experiences with failure and comebacks.

2009: Speech at Buckley School

In 2009, Paul Tudor Jones delivered a commencement speech at the Buckley School about his experiences with failure and comebacks.

April 2012: UVA Contemplative Sciences Center

In April 2012, the University of Virginia announced the creation of a new Contemplative Sciences Center through a $12 million gift from Paul Tudor Jones and his wife, Sonia.

June 2012: Key figure in controversial ousting

In June 2012, Paul Tudor Jones was reportedly a key figure in the controversial ousting of University of Virginia President Teresa A. Sullivan, and penned an editorial supporting her resignation.

June 26, 2012: Sullivan reinstated

On June 26, 2012, the University of Virginia Board of Visitors unanimously voted to reinstate Sullivan.

October 2012: Bought Louis Dreyfus Highbridge Energy

In October 2012, Paul Tudor Jones, along with Glenn Dubin and Timothy Barakett, were among a group of investors buying the merchant energy operation Louis Dreyfus Highbridge Energy from Louis Dreyfus Company and Highbridge Capital Management.

April 2013: Controversial comments at the University of Virginia

In April 2013, at a closed-door investment roundtable at the University of Virginia, Paul Tudor Jones made controversial comments about women in macro trading, suggesting that having a baby hurts their ability to focus.

2014: Returns for Tudor Clients Dimmed

In 2014, the New York Times noted that returns for Tudor clients had "dimmed" over the decade following Jones' "deliberate move to trade more conservatively, fewer big interest-rate and currency moves as central banks kept short-term rates near zero and more competition as the hedge fund universe has mushroomed.

2016: Awarded the Audubon Medal

In 2016, the National Audubon Society awarded Paul Tudor Jones the Audubon Medal in recognition of his contributions to conservation with economic sustainability and habitat protection.

2017: Wrote email to Harvey Weinstein

In 2017, as Harvey Weinstein faced sexual misconduct allegations, Paul Tudor Jones wrote him an email encouraging him and advising him on how to revive his reputation.

November 2019: Estimated net worth

As of November 2019, Forbes Magazine estimated Paul Tudor Jones' net worth to be US$5.3 billion, making him the 343rd richest person on the Forbes 400 and the 7th highest-earning hedge fund manager.

2019: Joined the Giving Pledge

In 2019, Paul Tudor Jones and his wife joined the Giving Pledge, vowing to give most of their wealth to charitable causes.

2019: Received Golden Plate Award

In 2019, Paul Tudor Jones received the Golden Plate Award of the American Academy of Achievement, presented by Awards Council member Dr. Francis Collins during the International Achievement Summit in New York City.

2019: Described as 'One of the Giants'

In 2019, Reuters described Paul Tudor Jones as ‘one of the giants’ and reported that Jones is considered a legend among macro traders.

2020: Weinstein was convicted

In 2020, Harvey Weinstein was convicted and sentenced to 23 years for sexual assault. Paul Tudor Jones distanced himself from Weinstein.

2020: Owns bitcoin as a hedge against inflation

In 2020, Paul Tudor Jones stated that he owns bitcoin as a hedge against inflation.

2022: Eldest daughter joined Zac Brown Band

In 2022, Paul Tudor Jones' eldest daughter, Caroline, a country-pop singer and musician, became a member of the Zac Brown Band.

July 2024: Net Worth Estimated

As of July 2024, Paul Tudor Jones' net worth was estimated to be US$8.1 billion.

Mentioned in this timeline

Barack Obama the th U S President - was the...

CBS Broadcasting Inc CBS is a prominent American commercial broadcast...

Mitt Romney is an American businessman and former politician He...

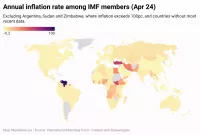

Inflation in economics signifies an increase in the average price...

Connecticut is a state in the New England region of...

Tanzania officially the United Republic of Tanzania is an East...

Trending

39 minutes ago Google Maps to fully function in South Korea after data agreement.

2 hours ago CDC Panel to Discuss COVID-19 Vaccine Injuries Following RFK Jr.'s Meeting

39 minutes ago CDC Panel to Discuss COVID Vaccine Injuries Following RFK Jr.'s Meeting

2 hours ago Casey Means' Surgeon General Nomination Faces Scrutiny Over Mainstream Medicine Criticism and Birth Control Views.

3 hours ago Punch, the lonely baby monkey, goes viral and wins hearts worldwide.

4 hours ago Jon Hamm Discovers Viral Dancing Meme; Reacts to Meme-Worthy Status at 54.

Popular

Jesse Jackson is an American civil rights activist politician and...

Barack Obama the th U S President - was the...

Susan Rice is an American diplomat and public official prominent...

XXXTentacion born Jahseh Dwayne Ricardo Onfroy was a controversial yet...

Michael Joseph Jackson the King of Pop was a highly...

Kashyap Pramod Patel is an American lawyer who became the...