Taiwan Semiconductor Manufacturing Company (TSMC) is the world's leading semiconductor foundry and Taiwan's largest company. Headquartered in Hsinchu, Taiwan, it operates as a pure-play manufacturer, producing chips for various clients without designing its own branded products. While the Taiwanese government is a shareholder, the majority of the company is owned by foreign investors. TSMC's significance to Taiwan's economy is substantial, contributing significantly to the nation's GDP through integrated circuit exports. Its influence extends to the Taiwan Stock Exchange, constituting a notable percentage of the main index.

2 days ago : TSMC's Q1 Profit Surges 60%, Beating Estimates Amid Trade Policy Concerns

TSMC's first-quarter profit exceeded expectations, climbing 60%. However, growth is threatened by Trump's trade policies and pre-tariff order rushes impacted the results.

1986: Morris Chang invited to lead ITRI and build Taiwan's chip industry

In 1986, Li Kwoh-ting, representing the Executive Yuan, invited Morris Chang to serve as the president of the Industrial Technology Research Institute (ITRI) and tasked him with building Taiwan's chip industry. Philips signed a joint venture to invest $58 million for a 27.5% stake in TSMC.

1987: TSMC founded by Morris Chang

In 1987, TSMC was founded by Morris Chang, marking the establishment of the world's first dedicated semiconductor foundry.

1994: Compound annual growth rate (CAGR) of 17.4 percent in revenue

Since 1994, TSMC has experienced a compound annual growth rate (CAGR) of 17.4 percent in revenue and a CAGR of 16.1 percent in earnings, demonstrating its consistent financial performance.

June 1996: WaferTech Establishment

In June 1996, TSMC Washington (originally known as WaferTech) was established as a joint venture between TSMC, Altera, Analog Devices, and ISSI.

1997: Listed on the New York Stock Exchange

In 1997, TSMC became the first Taiwanese company to be listed on the New York Stock Exchange, expanding its global presence.

2000: TSMC Acquisition of WaferTech

In 2000, TSMC bought out the stake of the other partners in WaferTech, turning the company into a fully-owned subsidiary of TSMC.

2000: Ranked 44th in Forbes Global 2000

In 2000, TSMC ranked 44th in the Forbes Global 2000 list. This highlights TSMC's global standing.

December 2010: TSMC's market capitalization reached a value of NT$1.9 trillion (US$63.4 billion)

In December 2010, TSMC's market capitalization reached a value of NT$1.9 trillion (US$63.4 billion), indicating its growing financial strength.

2010: Fab 15 Investment Announced

In 2010, TSMC announced a US$9.4 billion investment to build its third 300mm wafer fabrication facility, Fab 15, in Central Taiwan Science Park.

January 2011: Land Acquisition for Fab Expansion

On January 12, 2011, TSMC announced the acquisition of land from Powerchip Semiconductor for NT$2.9 billion (US$96 million) to build two additional 300mm fabs (Fab 12B) to meet increasing global demand.

2011: Planned increase in R&D expenditures by almost 39 percent

In 2011, TSMC planned to increase its research and development expenditures by almost 39 percent to NT$50 billion to address growing competition. The company also planned to expand capacity by 30 percent to meet market demand.

2011: Trial production of A5 SoC and A6 SoCs for Apple's iPad and iPhone devices

In 2011, TSMC reportedly began trial production of the A5 SoC and A6 SoCs for Apple's iPad and iPhone devices, entering into a partnership with Apple.

2013: Ranked 70th in the FT Global 500 list

In 2013, TSMC was ranked 70th in the FT Global 500 list of the world's most highly valued companies, with a capitalization of US$86.7 billion.

March 2014: Financial Guidance Raised

In March 2014, TSMC raised its financial guidance due to increased demand for smartphone chips, posting strong first-quarter results.

May 2014: Apple sourced its A8 and A8X SoCs from TSMC

In May 2014, Apple sourced its A8 and A8X SoCs from TSMC, solidifying the partnership between the two companies.

May 2014: Board approved capital appropriations of US$568 million

In May 2014, TSMC's board of directors approved capital appropriations of US$568 million to increase and improve manufacturing capabilities, responding to higher-than-expected demand.

May 2014: Market capitalization reached US$110 billion

In May 2014, TSMC's market capitalization reached US$110 billion, demonstrating its increasing market value.

August 2014: Board approved additional capital appropriations of US$3.05 billion

In August 2014, TSMC's board of directors approved additional capital appropriations of US$3.05 billion, further expanding its manufacturing capabilities.

August 2014: Production Capacity Fully Booked

In August 2014, it was reported that TSMC's production capacity for Q4 2014 was almost fully booked due to CPU orders from Apple, a situation unseen for many years.

October 2014: New multi-year agreement for the development of ARM based 10 nm FinFET processors

In October 2014, ARM and TSMC announced a new multi-year agreement for the development of ARM based 10 nm FinFET processors, enhancing their collaboration in processor technology.

2014: Revenue Growth

In 2014, TSMC's revenue grew by 28 percent compared to the previous year.

2015: Revenue Forecast

In 2015, TSMC forecasted a revenue growth of 15 to 20 percent compared to 2014, driven by demand for its 20 nm process, 16 nm FinFET, 28 nm processes, and 200mm fabs.

March 2017: TSMC invested US$3 billion in Nanjing

In March 2017, TSMC invested US$3 billion in Nanjing to develop a manufacturing subsidiary there, despite objections from the Tsai Ing-wen administration.

March 2017: Market capitalization surpassed Intel's

In March 2017, TSMC's market capitalization surpassed that of semiconductor giant Intel for the first time, reaching NT$5.14 trillion (US$168.4 billion).

2018: Morris Chang retires, Mark Liu becomes chairman and C. C. Wei becomes CEO

In 2018, Morris Chang retired after 31 years of leadership at TSMC. Mark Liu succeeded him as chairman, and C. C. Wei became the Chief Executive Officer.

August 2019: GlobalFoundries filed patent infringement lawsuits against TSMC

On 26 August 2019, GlobalFoundries filed several patent infringement lawsuits against TSMC in the US and Germany claiming that TSMC's 7 nm, 10 nm, 12 nm, 16 nm, and 28 nm nodes infringed 16 of their patents.

2019: Leading Edge Technologies

At the beginning of 2019, TSMC was advertising N7+, N7, and N6 as its leading edge technologies.

2019: Net income of US$11.18 billion

In 2019, TSMC reported a net income of US$11.18 billion and consolidated revenue of US$34.63 billion, showing its strong financial performance.

2019: MEMS Ranking

In 2019, TSMC was ranked fourth in the MEMS (Micro-Electro-Mechanical Systems) field, trailing Silex Microsystems.

June 2020: Selected for Apple's 5nm ARM Processors

As of June 2020, TSMC was selected as the manufacturer for Apple's 5 nanometer ARM processors, which will be used as "the company plans to eventually transition the entire Mac lineup to its Arm-based processors, including the priciest desktop computers".

June 2020: Briefly became the world's 10th most valuable company

On 27 June 2020, TSMC briefly became the world's 10th most valuable company, with a market capitalization of US$410 billion.

July 2020: Confirmed halt of shipment of silicon wafers to Huawei

In July 2020, TSMC confirmed it would halt the shipment of silicon wafers to Chinese telecommunications equipment manufacturer Huawei and its subsidiary HiSilicon by 14 September, in response to regulatory pressures.

July 2020: Green Energy Deal Signed

In July 2020, TSMC signed a 20-year deal with Ørsted to purchase the entire production of two offshore wind farms off Taiwan's west coast, marking the world's largest corporate green energy order at the time.

November 2020: Approved plan to build a $12 billion chip plant in Phoenix, Arizona

In November 2020, officials in Phoenix, Arizona, approved TSMC's plan to build a $12 billion chip plant in the city, expanding its operations to the United States.

2020: Global capacity of about thirteen million 300 mm-equivalent wafers per year

As of 2020, TSMC had a global capacity of approximately thirteen million 300 mm-equivalent wafers per year and produced chips with process nodes ranging from 2 microns to 3 nanometres.

2020: Global semiconductor shortage

Due to the 2020-2023 global semiconductor shortage, Taiwanese competitor United Microelectronics raised prices approximately 7-9 percent, and prices for TSMC's more mature processors were raised by about 20 percent.

2020: Arizona Fab Announcement

In 2020, TSMC announced plans to build a fab in Phoenix, Arizona, with production intended to begin by 2024 at a rate of 20,000 wafers per month, utilizing its newest 5 nm process.

2020: Signed up for the RE100 initiative

In 2020, TSMC became the first semiconductor company in the world to sign up for the RE100 initiative, committing to using 100 percent renewable energy by 2050.

April 2021: Market capitalization over $550 billion

In April 2021, TSMC's market capitalization exceeded $550 billion, reflecting its substantial market value.

June 2021: Taiwan allowed TSMC and Foxconn to jointly negotiate purchasing COVID-19 vaccines

In June 2021, following a year of controversy surrounding vaccine shortages, Taiwan agreed to allow TSMC and Foxconn to jointly negotiate purchasing COVID-19 vaccines on its behalf.

November 2021: TSMC and Sony announced new subsidiary Japan Advanced Semiconductor Manufacturing (JASM)

In November 2021, TSMC and Sony announced that TSMC would be establishing a new subsidiary named Japan Advanced Semiconductor Manufacturing (JASM) in Kumamoto, Japan, to manufacture 22- and 28-nanometer processes.

2021: MEMS Ranking Improvement

In 2021, TSMC improved its ranking to third place in the MEMS (Micro-Electro-Mechanical Systems) field.

2021: Arizona Project Investment Begins

In 2021, TSMC planned to begin spending $12 billion on the Arizona fab project over eight years.

2021: News reports claimed that the facility might be tripled to roughly a $35 billion investment with six factories

In 2021, news reports claimed that the facility in Phoenix, Arizona, might be tripled to roughly a $35 billion investment with six factories, increasing its commitment to US manufacturing.

February 2022: Denso to take equity stake in JASM

In February 2022, TSMC, Sony Semiconductor Solutions, and Denso announced that Denso would take a more than 10 percent equity stake in JASM with a US$0.35 billion investment, amid a scarcity of chips for automobiles. TSMC also enhanced JASM's capabilities with 12/16 nanometer FinFET process technology and increased monthly production capacity.

July 2022: Record profit posted in the second quarter

In July 2022, TSMC announced the company had posted a record profit in the second quarter, with net income up 76.4 percent year-over-year. The company saw steady growth in the automotive and data center sectors.

2022: Taiwan's exports of integrated circuits amounted to $184 billion

In 2022, Taiwan's exports of integrated circuits reached $184 billion, constituting nearly 25 percent of Taiwan's GDP, highlighting the significance of the semiconductor industry to Taiwan's economy.

2022: Construction of fabrication plant started in Kumamoto, Japan

In 2022, construction of the JASM fabrication plant started in Kumamoto, Japan, with production beginning two years later in 2024.

July 2023: US Talent Insufficiency

In July 2023, TSMC warned that US talent was insufficient, so Taiwanese workers would need to be brought in for a limited time, and the chip factory would not be operational until 2025.

August 2023: Germany Factory Investment

In August 2023, TSMC committed €3.5 billion to a €10+ billion factory in Dresden, Germany, with €5 billion in subsidies from the German government and investment from Robert Bosch GmbH, Infineon Technologies, and NXP Semiconductors.

2023: Global semiconductor shortage

Due to the 2020-2023 global semiconductor shortage, Taiwanese competitor United Microelectronics raised prices approximately 7-9 percent, and prices for TSMC's more mature processors were raised by about 20 percent.

2023: Capital expenditures are projected to be pushed up to 2023

In 2023 some of the capital expenditures from the previous period, are projected to be pushed up. This reflects TSMC's long-term investment strategy and adaptability to changing market conditions.

2023: Ranked 44th in Forbes Global 2000

In 2023, TSMC was ranked 44th in the Forbes Global 2000 list, highlighting its global standing.

January 2024: Arizona Plant Faces Worker Shortage

In January 2024, TSMC chairman Liu warned that Arizona lacked workers with specialized skills, and the second Arizona plant was unlikely to start volume production of advanced chips until 2027 or 2028.

February 2024: TSMC shares hit a record high

In February 2024, TSMC shares hit a record high, closing at NT$697 (+8%), influenced by the increase in the price target on chip designer Nvidia.

April 2024: US Funding Agreement

In April 2024, the US Commerce Department agreed to provide $6.6 billion in direct funding and up to $5 billion in loans to TSMC for creating semiconductor manufacturing facilities in Arizona under the CHIPS and Science Act.

October 2024: Potential breach of export controls reported

In October 2024, TSMC informed the United States Department of Commerce about a potential breach of export controls in which one of its most advanced chips was sent to Huawei via another company with ties to the Chinese government.

October 2024: Halo Vista Development Revealed

In October 2024, it was revealed that the development around the TSMC plants would be called Halo Vista, which would develop 3,500 acres of property with restaurants, hotels, housing, and other mixed-use developments. There will also be a Sonoran Oasis Research and Technology Park.

December 2024: Fab 23 Commercial Operations

The first factory (Fab 23) in Kikuyo, Kumamoto, began commercial operations in December 2024, producing 12-, 22-, and 28-nanometer processes.

2024: Arizona Plant Operational Estimate

As of 2020, it was estimated that the Arizona plant would not be fully operational until 2024, when the 5 nm process is projected to be replaced by TSMC's 3 nm process.

2024: TSMC Washington Operations

As of 2024, the TSMC Washington facility employs 1100 workers and supports node sizes of 0.35, 0.30, 0.25, 0.22, 0.18, and 0.16 micrometers, with an emphasis on embedded flash process technology.

2024: Production beginning in Kumamoto, Japan

In 2024, production is scheduled to begin at the JASM fabrication plant in Kumamoto, Japan.

2024: Shareholder Structure

In early 2024, around 56 percent of TSMC shares were held by the general public, and around 38 percent were held by institutions.

January 2025: Second Factory Construction

As of January 2025, TSMC's second factory is currently under construction adjacent to Fab 23. This factory will produce 6-nanometer and 12-nanometer processes.

2025: Arizona Plant Operational Delay

In July 2023, TSMC warned that the chip factory would not be operational until 2025, due to US talent being insufficient.

2025: Plans to start 2-nanometer mass production

TSMC currently manufactures 3-nanometer chips and plans to start 2-nanometer mass production in 2025, continuing its leadership in advanced semiconductor technology.

2027: Arizona Plant faces further worker shortage delays

In January 2024, TSMC chairman Liu warned that the second Arizona plant was unlikely to start volume production of advanced chips until 2027 or 2028, due to a lack of workers with specialized skills.

2028: Arizona Plant faces further worker shortage delays

In January 2024, TSMC chairman Liu warned that the second Arizona plant was unlikely to start volume production of advanced chips until 2027 or 2028, due to a lack of workers with specialized skills.

2029: Germany Factory Operational

The factory in Dresden, Germany is planned to be fully operational in 2029 with a monthly capacity of 40,000 12-inch wafers.

2050: Pledging to use 100 percent renewable energy by 2050

In 2050, TSMC is committed to use 100 percent renewable energy by 2050, as pledged in the RE100 initiative.

Mentioned in this timeline

Huawei is a Chinese multinational technology corporation founded in by...

Nvidia Corporation founded in by Jensen Huang Chris Malachowsky and...

The United States of America located in North America and...

Sony Group Corporation is a Japanese multinational conglomerate with headquarters...

The iPad is a line of tablet computers designed developed...

Qualcomm is a multinational corporation specializing in semiconductors software and...

Trending

18 minutes ago Ric Flair Predicts Cena's Title Win, Cena Nears Flair's Record, WWE Recognition Explained.

19 minutes ago Suns seek new coach after parting ways with Budenholzer, Durant trade considered.

19 minutes ago Tuomas Iisalo Addresses Ja Morant's Ankle Injury in Grizzlies Press Conference

19 minutes ago Bernadette Peters joins Bonnie Milligan, Lilli Cooper in Jesse Eisenberg's musical comedy.

19 minutes ago Yelich drives in 3 runs, Durbin debuts, Brewers defeat Athletics 5-3.

1 hour ago Zach Edey Dominance: Grizzlies' Draft Pick Exceeds Expectations After Crucial Game

Popular

The Real ID Act of is a US federal law...

Bernard Bernie Sanders is a prominent American politician currently serving...

Michael Jordan also known as MJ is a celebrated American...

Cristiano Ronaldo nicknamed CR is a Portuguese professional footballer widely...

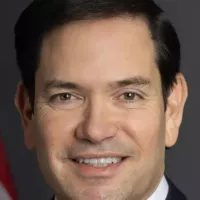

Marco Rubio is an American politician who served as a...

Donald John Trump is an American politician media personality and...