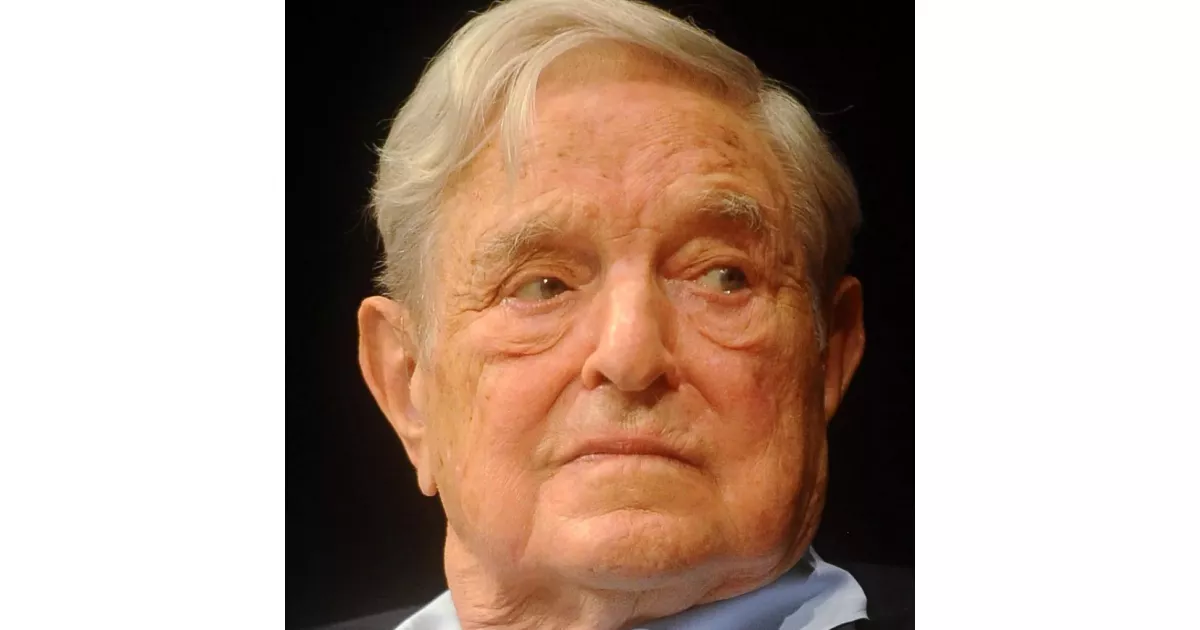

How George Soros built a successful career. Explore key moments that defined the journey.

George Soros is a Hungarian-American investor and philanthropist with a net worth of $7.2 billion as of May 2025. He is known for his significant philanthropic contributions, having donated over $32 billion to the Open Society Foundations. Approximately $15 billion has already been distributed, representing 64% of his initial fortune. Forbes recognized him as the "most generous giver" in 2020 based on the percentage of his net worth donated.

5 hours ago : George Soros Rumors: House Arrest, DOJ Probe, Son's Dubai Flight Fact-Checked

Recent news covers claims of George Soros being under house arrest amid a DOJ probe, also his son Alexander fleeing to Dubai. Soros is also described as Alabama's political target.

1951: Bachelor of Science Degree

In 1951, Soros obtained his Bachelor of Science degree in philosophy from the London School of Economics.

1951: BSc in Philosophy

In 1951, Soros was awarded a Bachelor of Science degree in philosophy from the London School of Economics.

1954: Began financial career

In 1954, George Soros began his financial career at the merchant bank Singer & Friedlander of London.

1954: Master of Science Degree

In 1954, Soros earned a Master of Science degree, also in philosophy, from the London School of Economics.

1956: Moved to New York City

In 1956, George Soros moved to New York City and worked as an arbitrage trader for F. M. Mayer.

1959: Joined Wertheim & Co.

In 1959, Soros moved to Wertheim & Co. as an analyst of European securities.

1963: End of Analyst Role at Wertheim & Co.

In 1963, George Soros concluded his role as an analyst of European securities at Wertheim & Co.

1963: Vice President at Arnhold and S. Bleichroeder

In 1963, Soros became a vice president at Arnhold and S. Bleichroeder.

1966: Started a Fund

In 1966, Soros started a fund with $100,000 of the firm's money to experiment with his trading strategies.

1967: First Eagle Fund Established

In 1967, Soros and Henry H. Arnhold established the First Eagle fund, an offshoot of Arnhold and S. Bleichroeder.

1969: First Hedge Fund

In 1969, George Soros set up his first hedge fund, Double Eagle.

1969: Double Eagle Hedge Fund Setup

In 1969, Soros set up the Double Eagle hedge fund with $4 million of investors' capital.

1970: Soros Fund Management Founded

In 1970, Soros founded Soros Fund Management and became its chairman, with several notable individuals holding senior positions at various times.

1973: Launch of Quantum Endowment Fund

In 1973, George Soros launched his Quantum Endowment Fund. By January 2014 it had generated almost $42 billion in gains.

1973: Resignation from Double Eagle Fund

In 1973, Soros resigned from the management of the Double Eagle Fund due to perceived conflicts of interest and established the Soros Fund.

1973: End of VP role at Arnhold and S. Bleichroeder

In 1973, Soros's experience as a vice president at Arnhold and S. Bleichroeder ended.

1973: Formation of the Soros Fund

In 1973, the Double Eagle Fund had $12 million and formed the basis of the Soros Fund.

1979: Soros Supports Dissidents in Eastern Europe

From 1979, George Soros began financially supporting dissidents in Eastern Europe, including Poland's Solidarity movement, Charter 77 in Czechoslovakia, and Andrei Sakharov in the Soviet Union, as an advocate of 'open societies'.

1979: Philanthropic Donations Begin

Starting in 1979, George Soros began donating to progressive and liberal political causes through the Open Society Foundations.

1981: Fund Loss and Redemptions

By 1981, the fund had grown to $400m, and then a 22% loss in that year and substantial redemptions by some of the investors reduced it to $200m.

1984: Soros Founds First Open Society Institute in Hungary

In 1984, George Soros founded his first Open Society Institute in Hungary with a budget of $3 million, aiming to promote open societies and a free flow of ideas.

1987: Prediction of disaster in The Alchemy of Finance

In 1987, George Soros predicted disaster in his book "The Alchemy of Finance."

1988: Soros considers investment in Société Générale

In 1988, French financier Georges Pébereau asked Soros to join a group of investors to purchase shares in Société Générale. Ultimately, Soros declined the group effort, opting to accumulate shares in multiple French companies himself, including Société Générale.

1988: Advice to the "No" campaign in Chile

In 1988, George Soros provided advice and support, including crucial data and studies, to the "No" campaign in the Chilean plebiscite, as stated by his friend Máximo Pacheco Matte. This support was instrumental in creating the campaign's influential television program and securing victory.

September 1992: Building Short Position in Pounds Sterling

In the months leading up to September 1992, Soros built a substantial short position in pounds sterling due to recognizing the unfavorable position of the United Kingdom in the European Exchange Rate Mechanism.

September 16, 1992: Black Wednesday Short Sale

On September 16, 1992, also known as Black Wednesday, Soros's fund had sold short more than $10 billion in pounds, profiting from the UK government's reluctance to raise interest rates.

October 26, 1992: Quote in The New York Times

On October 26, 1992, The New York Times quoted Soros stating his fund's position on Black Wednesday was worth almost $10 billion, and they had planned to sell even more.

1994: Speech on assisted suicide and support for Oregon Death with Dignity Act

In 1994, George Soros delivered a speech stating he had offered to help his mother, a member of the Hemlock Society, commit suicide. In the same speech, he also endorsed the Oregon Death with Dignity Act and proceeded to help fund its advertising campaign.

1995: Financial Backer of D.C. United

In 1995, George Soros was a financial backer of Washington Soccer L.P., which owned the operating rights to Major League Soccer club D.C. United.

February 5, 1996: Traded Finnish Markkas

On February 5, 1996, Soros was believed to have traded billions of Finnish markkas in anticipation of selling them short.

1997: Soros Fund Management Shorting Currencies and Malaysian accusations

In 1997, Soros Fund Management, noticing the discrepancy between trade and capital accounts, decided to sell short the Thai baht and the Malaysian ringgit. Later in 1997, Prime Minister Mahathir of Malaysia accused Soros of causing the financial crisis, which Soros denied, stating that they were buyers of the currency when it began to decline.

1998: Prediction of disaster in The Crisis of Global Capitalism

In 1998, George Soros predicted disaster in his book "The Crisis of Global Capitalism."

1998: Explanation of Role in Asian Financial Crisis

In 1998, in his book The Crisis of Global Capitalism: Open Society Endangered, Soros explained his role in the Asian financial crisis.

2000: Improving the image of Ricardo Lagos

In 2000, George Soros sought to improve the image of Ricardo Lagos, who was a presidential candidate at the time, among business circles.

2000: Loss of Operating Rights to D.C. United

In 2000, Washington Soccer L.P., the group that George Soros financially backed, lost the operating rights to Major League Soccer club D.C. United.

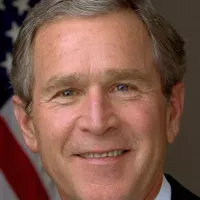

November 11, 2003: Commitment to removing President George W. Bush from office

On November 11, 2003, in an interview with The Washington Post, George Soros said that removing President George W. Bush from office was the "central focus of my life". He would sacrifice his entire fortune to defeat Bush "if someone guaranteed it".

2003: Activity of Project on Death in America

From 1994 to 2003, the Project on Death in America, one of the Open Society Institute's projects, was active in its mission to "understand and transform the culture and experience of dying and bereavement".

2003: Publication of The Bubble of American Supremacy

In 2003, George Soros's book, "The Bubble of American Supremacy", critiqued the Bush administration's "War on Terror" and was a polemic against the re-election of Bush.

2003: Soros Donates to Defeat President Bush

Until the 2003-2004 election cycle, Soros had not been a large donor to U.S. political campaigns. During the 2003-2004 election cycle, he donated $23,581,000 to 527 Groups aimed at defeating President George W. Bush.

September 28, 2004: Multistate tour and speech against re-electing President Bush

On September 28, 2004, George Soros dedicated more money to the campaign against George W. Bush and kicked off his own multistate tour with a speech, "Why We Must Not Re-elect President Bush", delivered at the National Press Club in Washington, D.C.

2004: Soros Donates to Defeat President Bush

Until the 2004 United States presidential election, Soros had not been a large donor to U.S. political campaigns. During the 2003-2004 election cycle, he donated $23,581,000 to 527 Groups aimed at defeating President George W. Bush.

2005: Attempt to Buy Washington Nationals

In 2005, George Soros was a minority partner in a group that attempted to purchase the Washington Nationals, a Major League baseball team. This sparked potential political backlash.

2006: Discussion at Los Angeles World Affairs Council

In 2006, Soros discussed his early career and how he transitioned from an immigrant to a financier at the Los Angeles World Affairs Council.

May 2008: Publication of The New Paradigm for Financial Markets

In May 2008, George Soros's book "The New Paradigm for Financial Markets" described a "superbubble" that had built up over the past 25 years and was ready to collapse.

2008: Increased attention to Soros's theories after the financial crisis

After the 2008 financial crisis, George Soros's theories on reflexivity received more attention, ultimately becoming the focus of an issue of the Journal of Economic Methodology. These theories attempt to explain why markets tend to overshoot or undershoot when moving from one equilibrium state to another.

2008: Reflexivity in modern financial markets

Circa 2008, an example of reflexivity in modern financial markets is the debt and equity of housing markets. Lenders began to make more money available to more people in the 1990s to buy houses. More people bought houses with this larger amount of money, thus increasing the prices of these houses.

2008: Funding for drug policy reform

In 2008, George Soros donated $400,000 to help fund the Massachusetts Sensible Marijuana Policy Initiative, which decriminalized possession of less than 1 oz of marijuana. Soros also funded similar measures in other states and provided funding to drug decriminalization groups such as the Lindesmith Center and Drug Policy Foundation. Additionally, in 2008, he donated $1.4 million to support California's Proposition 5, a failed ballot measure aimed at expanding drug rehabilitation programs.

2008: Induction into Hedge Fund Manager Hall of Fame

In 2008, George Soros was inducted into Institutional Investors Alpha's Hedge Fund Manager Hall of Fame.

2008: Association with AS Roma

In 2008, George Soros's name was associated with AS Roma, an Italian association football team, but the club was not sold.

February 2009: Comments on the world financial system disintegration

In February 2009, George Soros stated that the world financial system had effectively disintegrated and saw no near-term resolution to the crisis.

June 2009: Soros Donates to Central and Eastern Europe

In June 2009, George Soros donated $100 million to Central Europe and Eastern Europe to counter the impact of the Great Recession on the poor, voluntary groups, and non-government organizations.

August 2009: Soros Donates to New York for Underprivileged Children

In August 2009, Soros donated $35 million to the state of New York to be earmarked for underprivileged children, providing $200 per child aged 3 through 17 to parents with benefit cards.

October 2009: Remarks on marijuana and funding of Drug Policy Alliance

In October 2009, George Soros stated in an interview that he believes marijuana is less addictive but not appropriate for use by children and students, noting he hasn't used it for years. He has been a major financier of the Drug Policy Alliance, an organization that promotes cannabis legalization, with approximately $5 million in annual contributions from one of his foundations.

October 2009: Soros founded the Institute for New Economic Thinking

In October 2009, in response to the Great Recession, George Soros founded the Institute for New Economic Thinking, a think tank composed of international economic, business, and financial experts tasked with investigating radical new approaches to organizing the international economic and financial system.

October 2010: Donation to support California's Proposition 19

In October 2010, George Soros donated $1 million to support California's Proposition 19.

July 2011: Funds Returned to Outside Investors

In July 2011, Soros announced he had returned funds from outside investors' money, valued at $1 billion, and instead invested funds from his $24.5 billion family fortune.

2011: Quantum Fund's Assets

As of 2011, the Quantum Fund had $25 billion in assets under management.

2011: $11 Billion in Donations

By 2011, Soros had donated more than $11 billion to various philanthropic causes.

August 21, 2012: Acquisition of Manchester United Shares

On August 21, 2012, it was reported that George Soros acquired roughly a 2% stake in English football club Manchester United through the purchase of 3 million of the club's Class-A shares.

September 27, 2012: Soros Donates to Priorities USA Action

On September 27, 2012, Soros donated $1 million to Priorities USA Action, a super PAC supporting President Barack Obama's reelection.

October 2013: Soros Joins Ready for Hillary Finance Committee

In October 2013, Soros donated $25,000 to Ready for Hillary, becoming a co-chairman of the super PAC's national finance committee.

2013: Quantum Fund's Success

In 2013, the Quantum Fund made $5.5 billion, making it the most successful hedge fund in history.

January 2014: Ranked Number 1 by LCH Investments

In January 2014, George Soros was ranked number 1 in LCH Investments list of top 20 managers, having posted gains of almost $42 billion since the launch of his Quantum Endowment Fund in 1973.

June 2015: Soros Donates to Priorities USA Action Supporting Hillary Clinton

In June 2015, Soros donated $1 million to the Super PAC Priorities USA Action, which supported Hillary Clinton in the 2016 presidential race.

December 2015: Soros Donates $6 Million to Priorities USA Action

In December 2015, Soros donated $6 million to the Super PAC Priorities USA Action, supporting Hillary Clinton in the 2016 presidential race.

2015: Investment in Fen Hotels

In 2015, the Quantum Fund announced it would inject $300 million to help finance the expansion of Fen Hotels, an Argentine hotel company, to develop 5,000 rooms.

January 2016: Prediction of financial crisis akin to 2008

In January 2016, at an economic forum in Sri Lanka, George Soros predicted a financial crisis akin to the 2008 financial crisis, based on the state of global currency, stock, and commodity markets as well as the sinking Chinese yuan.

August 2016: Soros Donates $2.5 Million to Priorities USA Action

In August 2016, Soros donated $2.5 million to the Super PAC Priorities USA Action, which supported Hillary Clinton in the 2016 presidential race.

2016: Soros Donates to Criminal Justice Reform Proponents

Since 2016, George Soros has donated sums exceeding $1 million to the campaigns of progressive criminal justice reform proponents through the Safety and Justice PAC in local district attorney elections.

2017: Study Finds Soros Funding Boosted Science in Former Soviet Republics

A 2017 study found that a grant program by George Soros, which awarded funding to over 28,000 scientists in the former Soviet republics, significantly increased scientific publications and encouraged scientists to remain in the science sector after the end of the Soviet Union.

2017: $12 Billion in Donations

By 2017, George Soros's donations totaled $12 billion "on civil initiatives to reduce poverty and increase transparency, and on scholarships and universities around the world".

2017: Soros Funds Larry Krasner's Campaign

In 2017, Larry Krasner was elected as the District Attorney of Philadelphia with the help of a $1.5 million ad campaign funded by George Soros.

April 2019: Awarded Ridenhour Prize for Courage

In April 2019, George Soros was awarded the Ridenhour Prize for Courage and donated the prize money to the Hungarian Spectrum, an online English-language publication.

July 2019: Soros Donates to Democracy PAC

By July 2019, Soros had donated $5.1 million to Democracy PAC for the 2020 election cycle.

July 2020: Donation to Bard College

In July 2020, George Soros donated $100 million to Bard College to support the Center for Civic Engagement initiatives and the Open Society University Network.

2020: "Most Generous Giver"

In 2020, Forbes recognized Soros as the "most generous giver" based on the percentage of his net worth donated to philanthropic causes.

2020: Soros Supports George Gascón and Kim Foxx Campaigns

In 2020, George Soros was the largest donor supporting George Gascón for Los Angeles County District Attorney and gave $2 million to a PAC supporting Kim Foxx's campaign for Cook County State's Attorney.

2020: Soros Donates to Joe Biden's Presidential Campaign

In the second quarter of 2020, George Soros donated at least $500,000 to presumptive Democratic presidential nominee Joe Biden, becoming one of the campaign's largest donors.

2020: Soros Launches Democracy PAC

Soros launched a new super PAC called Democracy PAC for the 2020 election cycle, donating $5.1 million to it by July 2019.

April 2021: Pledge to Bard College Endowment

In April 2021, George Soros pledged $500 million to the endowment of Bard College, marking one of the largest donations ever made to higher education in the United States.

August 2021: Donation to the Center for Curatorial Studies at Bard College

In August 2021, George Soros donated $25 million to the Center for Curatorial Studies at Bard College.

September 2022: Additional Donation to Bard College

In September 2022, George Soros made an additional $25 million donation to Bard College.

2022: Soros was the largest donor to the Democratic Party in the election cycle

For the 2022 United States elections, Soros was the country's largest donor. He donated $128.5 million to support the Democratic Party in the election cycle.

May 2025: Net Worth and Philanthropy Update

As of May 2025, George Soros's net worth is US$7.2 billion, and he has donated more than $32 billion to the Open Society Foundations.

Mentioned in this timeline

Huawei is a Chinese multinational technology corporation headquartered in Shenzhen...

Donald John Trump is an American politician media personality and...

Barack Obama the th U S President - was the...

Hillary Diane Rodham Clinton is a prominent American politician lawyer...

Ukraine is a country in Eastern Europe the second-largest on...

George W Bush the rd U S President - is...

Trending

37 minutes ago Sabalenka Dominates, Eyes First Indian Wells Title After 100th Match Win

2 hours ago Byron Buxton's Value, Twins' Future, and Top-10 Player Status Explored.

2 hours ago Predictions surface for the 2026 World Baseball Classic, focusing on Team USA's chances.

2 hours ago José Contreras' sons shine as MLB scouts eye young talent in World Baseball Classic.

2 hours ago Max Christie NBA Prop Bets, Fantasy Picks, and Betting Tips for March 6, 2026

2 hours ago Kip Moore Releases 'Levee', Announces 'Reason To Believe' World Tour, Returns to Australia

Popular

Ken Paxton is an American politician and lawyer serving as...

Markwayne Mullin is an American politician and businessman serving as...

Jesse Jackson is an American civil rights activist politician and...

Hillary Diane Rodham Clinton is a prominent American politician lawyer...

Jim Carrey is a Canadian-American actor and comedian celebrated for...

Corey Lewandowski is an American political operative lobbyist commentator and...